9.3

8.064 reviews

English

EN

Gold is still doing very well and the outlook for precious metals is still very strong, according to the new Gold Compass from In Gold We Trust (IGWT). Because where the Gold price A year ago, the price of the precious metal has risen sharply this year. In addition, an analysis by Jan Nieuwenhuijs shows that global gold reserves have reached a record high. How is gold doing so far in 2023 and why is gold such a good asset?

Gold prices have had a tailwind over the past year after US banks started to falter in March, as can be seen in the chart below. In the space of a week, the price of gold rose significantly. Although the storm has subsided somewhat, it remains to be seen whether the turmoil in the banking sector is completely over. Banks are still vulnerable due to the rise in interest rates and the fierce competition that money market funds in America offer.

The geopolitical tensions are far from over either. The world is increasingly decaying into different power blocs and the BRICS countries seemed to be exploring a scenario in which a coin backed by bullion is introduced. The chance that such a currency will actually be introduced in the short term is small, as such a currency also requires far-reaching cooperation, he said Frank Knopers in a podcast with Holland Gold. We can see in the euro area how difficult it is to have a single currency. The BRICS countries will also have to make good agreements about what a possible BRICS currency will look like. And that while the countries of the BRICS are very different from each other. 'For the time being, the BRICS currency is still a long way off,' said Knopers.

Nevertheless, central banks of emerging economies are signalling with their policies that gold is still of strategic importance. In recent months, Multiple Central Banks in the news after they replenished their gold reserves. In doing so, they are responding to geopolitical uncertainty. This has done the gold price well over the past year.

The gold price then came under some pressure in June and July, as central bank policy rates were raised further. If interest rates rise, other assets become more attractive. Gold offers security and has no counterparty risk, but no interest is paid on precious metals. Rising interest rates will therefore initially cause a downward trend in the gold price. Nevertheless, the real interest rate is particularly important for the gold price, which is still negative due to high inflation. Official inflation figures according to the new methodology point to a relatively low inflation rate of 3 percent year-on-year for August, but economists such as Han de Jong arrived at relatively higher price increases.

That's because the New calculation method better captures the price increase that households will actually face. Given that many households only feel the effects of expensive energy through energy contracts after a number of months, last year's very high inflation rate was probably exaggerated, but the actual inflation rate is now higher. If one assumes the 8.1 percent inflation calculated by Han de Jong, then the real interest rate is still negative.

Thus, several factors cause a high gold price; panic in the banking sector, fears of a recession, geopolitical tensions and still high inflation. Expressed in different currencies, the price of gold is not far below the all time high, as shown in the following graph.

In addition to the new capabilities of the device, the price of a new iPhone is often the topic of conversation when Apple presents a new model. Where people paid 499 dollars for the first iPhone, last year there was 799 dollars at the bottom of the receipt of the cheapest model of the new iPhone 14. The price of the more expensive versions with more storage even approached $2,000.

The interesting thing is that the price of the new iPhone actually dropped when compared to the prices in gold. The new iPhone 15 Pro now changes hands for 0.78 ounces of gold, according to calculations IGWT in a special on the website. Last year, the iPhone 14 Pro cost 0.87 ounces of gold. The first iPhone Steve Jobs held in his hands in 2007 cost even more in terms of gold; Buyers then had to put down 0.92 ounces of gold. Buyers who would pay in gold have therefore started to pay less gold for the latest iPhone over the years.

This is a simple outline of why gold has been considered a solid asset for so long. While fiat depreciates in value almost every year, the value of gold has remained constant for centuries due to scarcity. Vincent Kersten, co-founder of Holland Gold, also explained this aspect of gold at our previous event. He was referring to an English proverb; 'For one troy ounce of gold, a man can buy a suit'. For about 31.1 grams of gold, you can always buy a tailor-made suit, whether someone lives in the year 1900 or in the year 2023. Thus, gold does not lose its value, unlike fiat money.

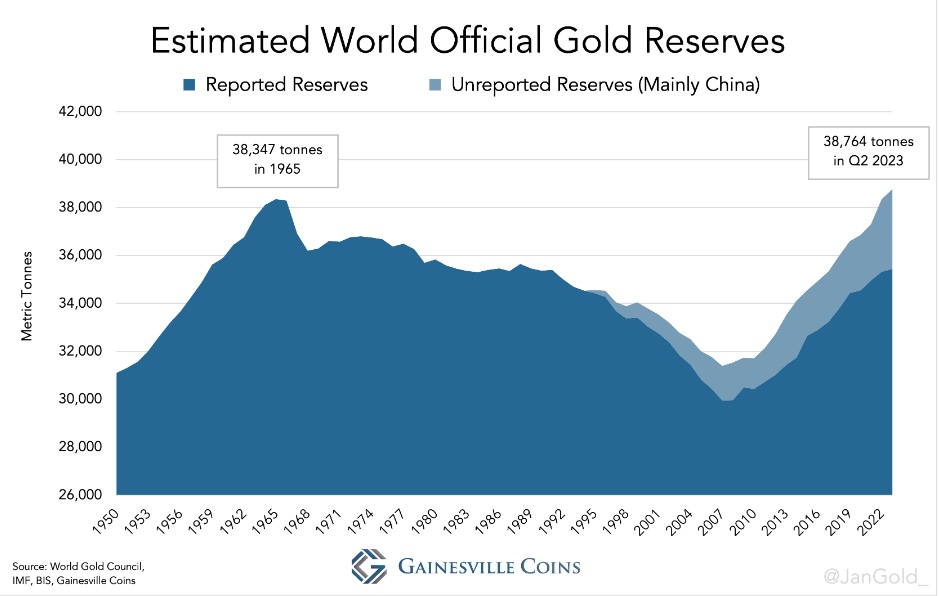

It also showed that global gold reserves have reached a record amount, according to the Jan Nieuwenhuijs. According to the analyst's estimate, the total global gold reserves come in at 38,764 tonnes of gold. It is important to note that these are estimates, as the reserves of various central banks are not known. For example, the analyst thinks that China's reserves are actually much higher than what the country has declared to the IMF. If the analyst's estimates are correct, more gold is held as a reserve now than in 1965.

It is also interesting that gold mainly takes the place of the dollar. The dollar's share of reserves has declined since 2008. Since then, central banks have bought 7,000 tonnes of gold. Although the dollar is still absolute master of the financial system, an interesting development is visible. In the coming years, more will become clear about the role of the dollar, the Chinese renminbi, other currencies, a possible BRICS currency and gold. Nevertheless, the outlook for precious metals is strong, as Jan Nieuwenhuijs also expects.