9.3

8.064 reviews

English

EN

This week saw a new battle in the 'war on cash', it became clear that France is the eurozone's new problem child, the first major victim in the German car industry fell, the Chinese stock market had its best week in 16 years, and we look at predictions for the gold and silver prices. In short, a jam-packed weekly selection!

Last week we read on Alfonso Peccatiello's substack another Interesting article about the Chinese real estate market with the title 'China is Imploding'. This week, the Chinese stock market experienced its Best Week in 16 years. The CSI 300, a Chinese stock index of the 300 largest A-shares traded on the Shanghai Stock Exchange and the Shenzhen Stock Exchange, rose 15.7 percent this week. This comes after the Chinese government announced several stimulus measures. China is facing strong deflationary pressures from a sharp downturn in the property market and weak consumer confidence.

CSI 300 vs. SP500 (source: Holger Zschaepitz)

China's central bank has actually cut interest rates and injected liquidity into the banking system today, and there are also lake Fiscal measures expected. With this, the Chinese hope to boost their ailing economy and bring economic growth back to the target of about 5%. As part of this, special government bonds worth about $284 billion will be issued this year. The capital injection into banks has a value of $142 billion. The pressure on these banks is increasing as they are urged to support the economy by providing cheaper loans to risky borrowers, such as property developers and local governments with financial difficulties while profit margins in the sector continue to shrink.

This move is very significant and is already becoming Beijing's "whatever it takes" moment said, as a reference to Mario Draghi during the euro crisis. Investors' exposure to Chinese equities previously reached a nadir But sentiment seems to have changed after the announcement. On Tuesday bought the largest number of Chinese stocks in a single day since 2021. U.S. hedge fund manager and billionaire David Tepper said at CNBC now to buy "everything" in China. Jeroen Blokland said the following on X in response to the Chinese announcement about Incentives: "This is downright bullish for all risky, liquidity-sensitive asset classes such as quality stocks, gold and Bitcoin."

An interesting perspective to pay attention to is that in China the stock market is much less important than in the US. In Alfonso's article we already read that Chinese households have 60% of their wealth in Chinese real estate, while in the US this figure is 23%. A telling quote from a Interesting video on the differences between the U.S. and China: "only a small fraction of Chinese, 10%, own stocks compared to 70% of Americans: So if the U.S. stock market falls by two-thirds tomorrow, 70% of people will feel very poor. In China, if the stock market falls by two-thirds, 90% of people don't care."

The people who care about cash payments and privacy have lost a battle in the 'war on cash' this week. A majority in the House of Representatives voted in favor of a legal ban on cash payments of 3000 euros or more. At the moment, consumers are still allowed to unlimited pay in cash. A limit on cash payments would help to prevent money laundering by criminals.

At first, NSC considered this to be an unnecessary Suspicion of cash as a legitimate means and proposed to raise the limit to 10,000 euros. They received support from coalition parties PVV and BBB, but not from the VVD. The support of small opposition parties for this milder proposal fell just two seats short of a majority. In the end, NSC voted in favor of the ban on cash payments for goods from 3000 euros. Below is a handy overview of the parties that voted for and against the ban. Good to know, as this also affects your cash purchases at Holland Gold.

Who voted for the ban on cash payments from €3000 (source: DebateDirect)

The Netherlands was not the only country this week with news about restricting cash. We received from multiple readers This article of the Jerusalem Post. Israeli Prime Minister Benjamin Netanyahu is said to have ordered the possibility of abolishing the 200-shekel banknote (about €50), the largest in circulation, to be examined. It would also look at restricting private ownership of large amounts of alternatives to cash, such as gold and silver.

Just like in the Netherlands, this would be a measure against black money and money laundering. Israel has a huge 'black market', according to estimates about 20% of the country's GDP. Economists predict that by fighting dirty money, Israel could increase its tax revenues by $24-31 billion by 2030.

The message apparently caused so much unrest that the Bank of Israel felt compelled yesterday to respond with a reassuring statement to come. They indicate that the issue has been raised, but that not enough substantiated professional justification has been presented to the governor of the bank to abolish any banknote. "We emphasize that the NIS 200 banknote in circulation, like the other banknotes and coins, will continue to be used."

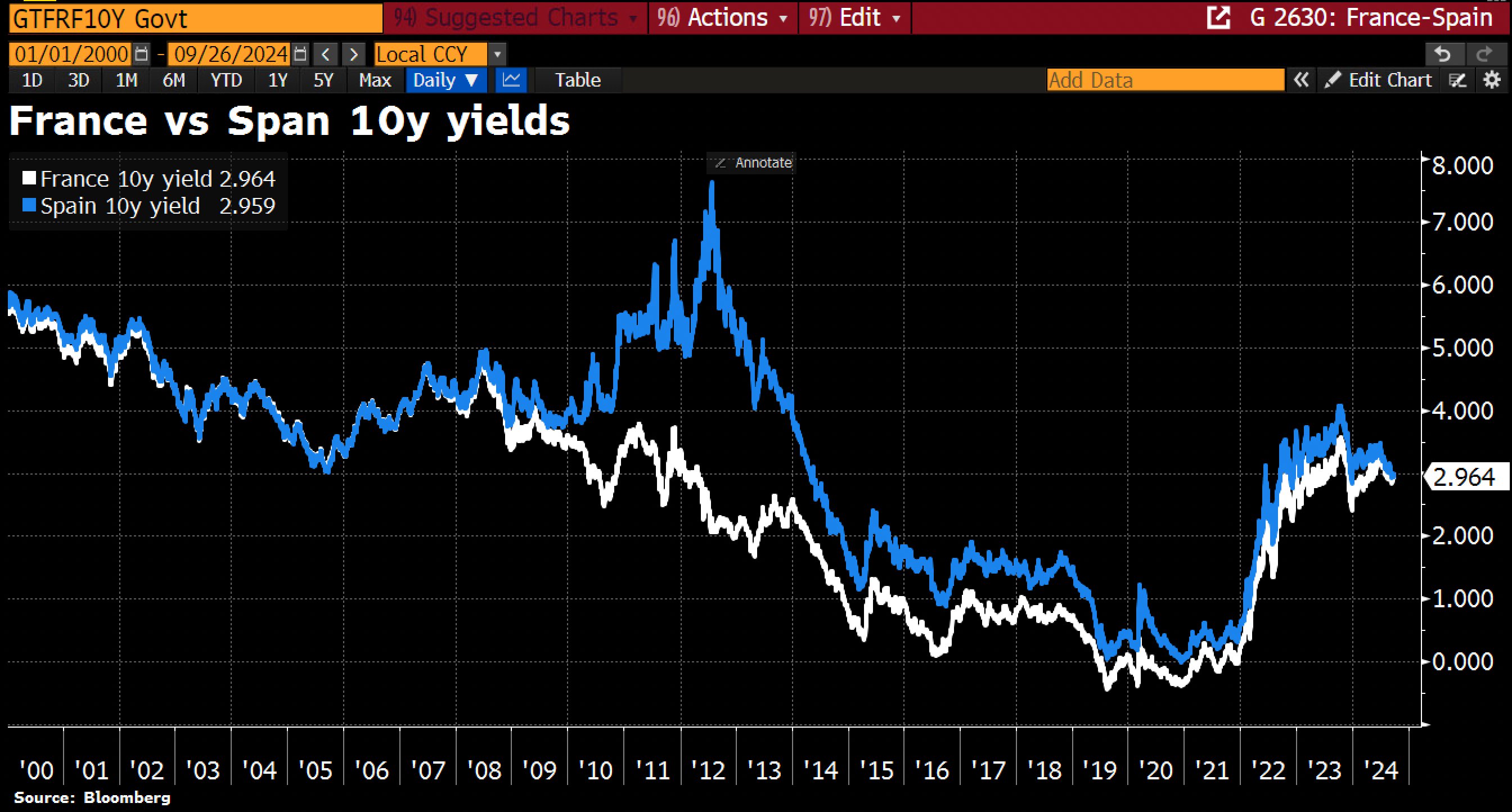

The word "child" may not be appropriate for a country of this size, but there are certainly concerns. The problems with France's huge budget deficit are now so great that investors are Returns on their loans to France than to Spain. In fact, political and economic risks are increasing to such an extent that Greece may soon pay a lower interest rate than France. Portugal, which had to be rescued during the euro crisis, has had lower interest rates than France since June.

10-year government bond yields, France vs. France Spain (source: Holger Zschaepitz)

The gap between French and German interest rates has almost doubled since the beginning of June. Then President Emmanuel Macron called early parliamentary elections, which caused months of political instability as the country grappled with deteriorating public finances. European rules state that budget deficits may not exceed 3 percent and public debt may not exceed 60 percent of GDP. Interest rates rose further as the new government of Prime Minister Michel Barnier on Monday again asked the European Commission for a delay in submitting plans to comply with these EU fiscal rules. France's public debt has now risen to 111 percent of GDP and its budget deficit is at least 5.6 percent of GDP.

Investors are becoming increasingly skeptical about whether France will implement the cuts. It will be very difficult for Brussels to enforce it and the internal political situation does not really allow it. The Reduced inflation in France, at least, the ECB will give more room to reduce the pressure on debt and the budget deficit, but this will certainly not solve the structural problems. "If France is unable to address structural problems, it will join Italy on the periphery of the eurozone..." an investor told the Financial Times. Edin Mujagic put it in BNR "France is in the process of being relegated from the Eredivisie of the eurozone to the Keuken Kampioen Divisie of the union."

The Gold price broke through €77,000 per kilo for the first time this week, and also the Silver price is doing well and is getting close to the high of earlier this year. Early August Wrote We also mentioned JP Morgan, who predicted a silver price of $36 per ounce by 2025. That was an increase of over $10 at the time of writing. They seem to be slowly getting right because at the time of writing the price is $32 per ounce. Citibank indicated this week that it is 'bullish' and expects a price of up to $40 dollars per ounce in 2025. expect. Willem Middelkoop says they may even expect a return to the all-time high of $50.

Silver price (source: Otavio Costa)

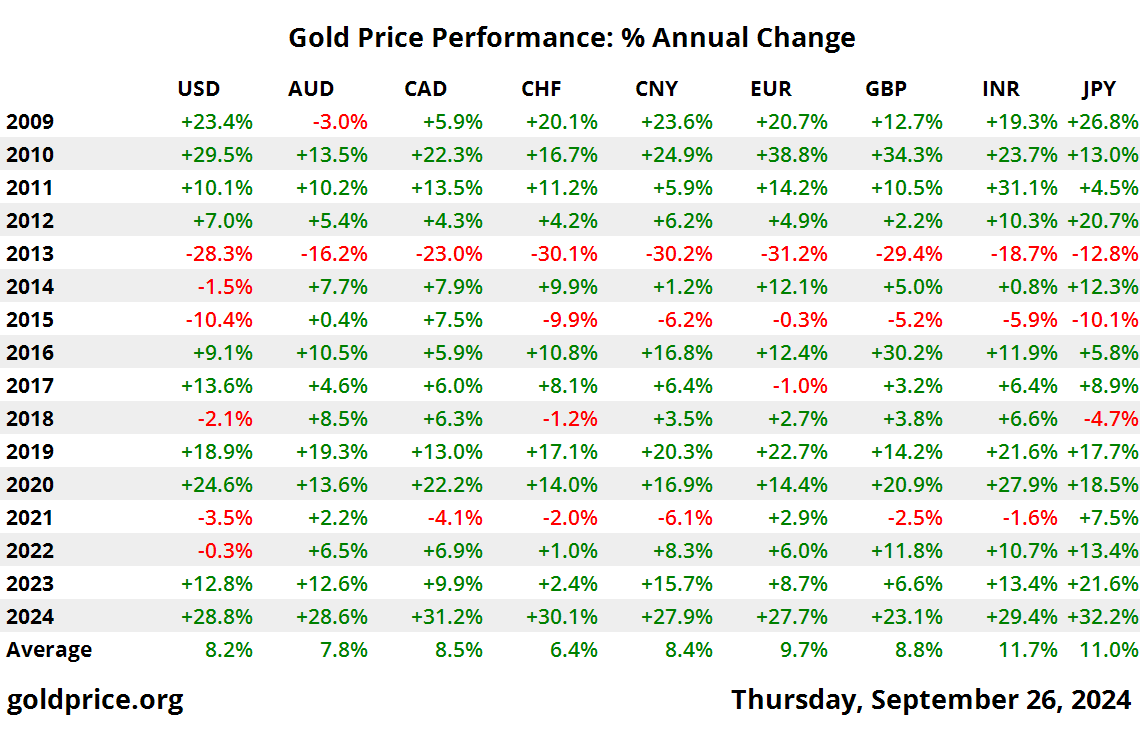

The fact that the gold price is doing extremely well this year is of course no secret to regular readers of Holland Gold. The table below gives a nice overview of the performance of recent years against different currencies. Gold has already gained 27 percent against the euro this year and has averaged 9.7 percent per year since 2009. For a prognosis, we look at the makers of the IGWT report. When she turned a 10-year-old in 2020, forecast the price of gold was at $1500 per ounce. The current price is right on track and is predicted to reach $4821 by 2030. So it's a good time to go to a Savings plan if you haven't already. The Holland Gold Savings Plan allows you to automatically buy bullion periodically while retaining the flexibility to adjust or stop your deposit at any time.

Performance gold price since 2009 (source: Ronnie Stoeferle)

Finally, a short message about the poor state of the German car industry, which we have already discussed over the past month. Talked and Wrote. The first major casualty seems to have fallen. According to Bild WKW, a supplier of automotive parts, is insolvent and has the right to bankruptcy Requested. WKW Automotive supplied Components for Volkswagen, Mercedes and BMW and has about 3800 employees. The company had been in trouble for some time.

Photo by Macron (Source: France Diplomacy)

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink interviews various economists and experts in the macroeconomic field. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.