9.4

7.521 Reviews

English

EN

The outlook for precious metals remains good, according to the monthly report from In Gold We Trust. Gold still appears to score well compared to fiat money, although the dollar has also been strong in the past year. What's in the report and what can we expect in the near future?

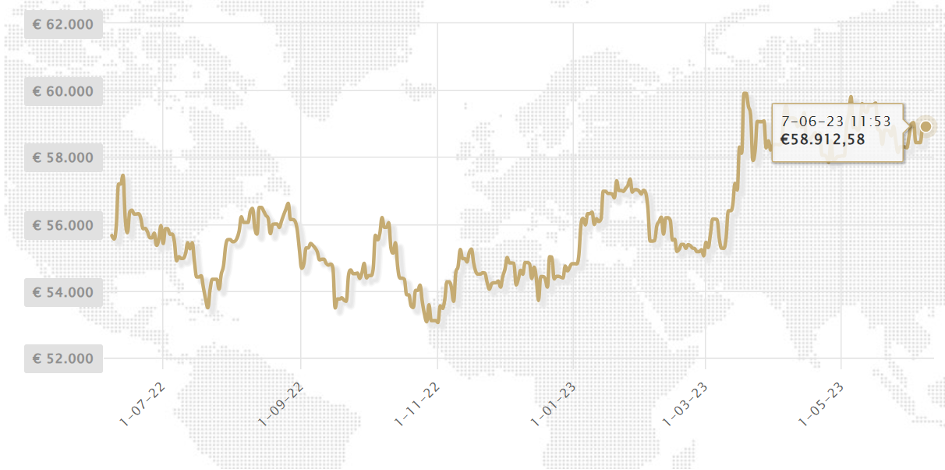

Last year, the Gold price in euros up about six percent. Especially after March, the price of gold came in Upward pressure due to the turmoil in the banking sector. In euros, the precious metal even reached a record level of more than €61,000 per kilo. Gold is a refuge for investors in times of uncertainty, and it was seen when banks began to falter. No new banks have collapsed in recent weeks, but the turmoil has been visible in the share price of several regional banks in the U.S. Stock prices fell, even after the chairman of the U.S. central bank assured that banks were solid.

The price of gold also rose because central banks bought a lot of gold. In particular, central banks of emerging economies replenished their gold reserves, including in Poland, Czech Republic, Singapore and China. Central banks seem to be responding to the increasing geopolitical turmoil. IGWT previously wrote already about the geopolitical and monetary showdowns that could affect the gold price in the near future. For example, there is the war in Ukraine and since the war, the world seems to be splitting into two different power blocs, with the Western countries of the G7 on the one hand and an increasing group of BRICS countries in the rest of the world on the other. In addition, according to IGWT, the end of the dollar's hegemony is in sight. These are all factors that could push the price of gold higher.

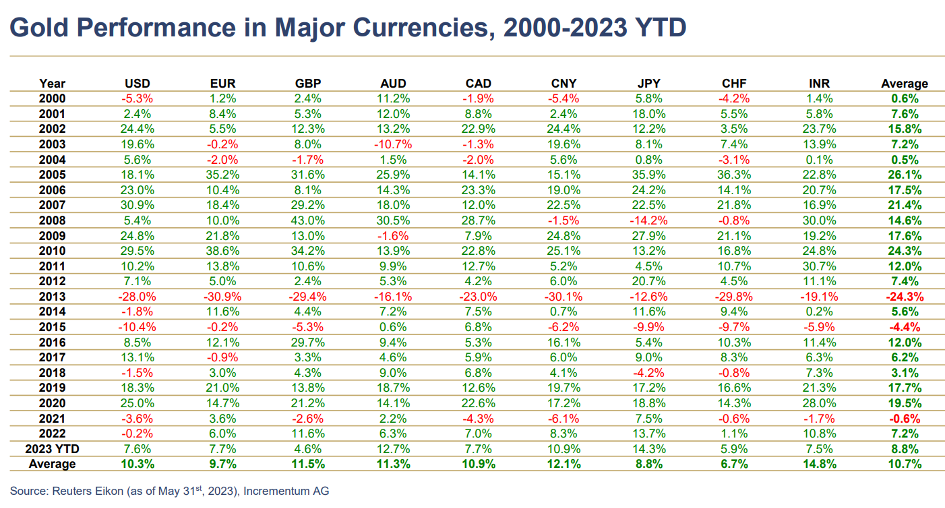

The return on gold in different currencies in different years (Source; IGWT)

In dollar terms, the price of gold did not perform as strongly in 2022 as might be expected from a year in which the war in Ukraine broke out and there was high inflation. The price of the precious metal peaked last year at $2,070 per troy ounce in March, before sinking to $1,650 per troy ounce in October. Since then, the gold price has risen significantly again, but the return for the whole of 2022 was lower as a result.

The combination of high inflation and geopolitical turmoil should normally do gold, known as a safe haven, good. This was not the case last year due to the aggressive interest rate policy of the FED, the US central bank. Because interest rates in the U.S. rose very quickly, the dollar was an attractive currency. As a result, the dollar had a strong year in 2022 and also rose against the euro. In Europe, they were relatively late with interest rate hikes. The first interest rate hike only came in July 2022, while the Fed had already raised rates in March. The development of the gold price in dollars was therefore largely determined by the dollar.

However, this table does show why gold is an attractive option for investors. Gold doesn't have a spectacular price increase every year. There has even been a year when gold in every currency fell in value, such as in 2013. Yet, compared to fiat money, gold does provide much more certainty that it retains value, since the supply of gold is limited. The money we use today, on the other hand, can be created from nothing.

A similar conclusion could be seen in the article we wrote about the IGWT report in May; 'It's not that the value of gold increases every year, but gold is reasonably stable in value in the long term. The precious metal is therefore a very good weapon against inflation. The purchasing power of a banknote, on the other hand, decreases every year due to currency depreciation. So it's not so much that the price of gold is doing very well every year, but rather that fiat money is losing purchasing power every year.".

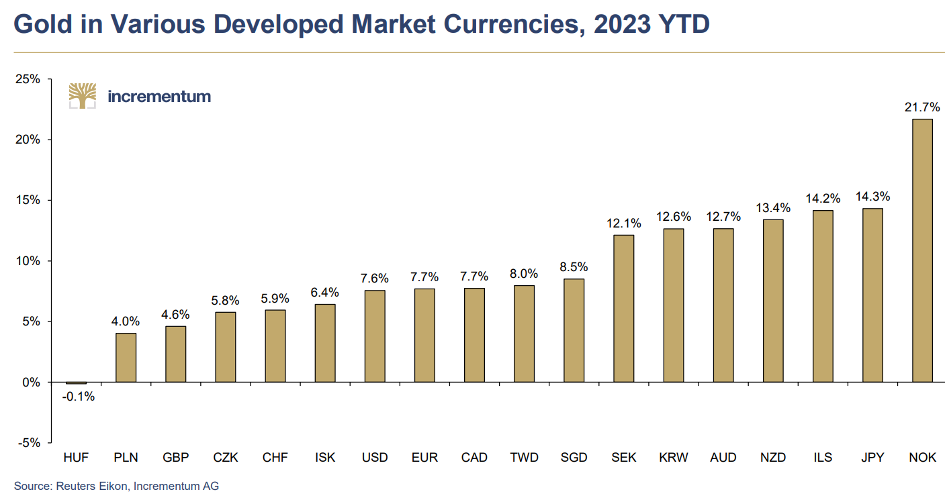

Return on gold in 2023, expressed in different currencies (Source; IGWT)

As we have written before, the prospects of gold are certainly not bad. The geopolitical turmoil is by no means over, which means that gold remains attractive as a safe haven. There is also the question of how long central banks will continue to raise interest rates. The Fed recently raised interest rates by a quarter of a percentage point, but economists consider it likely big that interest rates will not be raised at the next interest rate decision on 14 June. Inflation has been falling in the U.S. for some time. In April, the price increase was 4,9 percent, while in June 2022 9,1 percent. By not raising interest rates further, it is hoped that a recession will be avoided in America.

In Europe, the ECB is still slightly behind the FED. It is therefore quite possible that the ECB will raise interest rates again at the next interest rate decision. We see that inflation is still too high. In the Eurozone, prices rose by an average of 6.1 percent. As a result, inflation in the euro countries fell slightly, from 7 percent in April. In the Netherlands rose the c in May to 6.1 percent, while in April it was 5.2 percent. Inflation excluding fuels also rose and now stands at 7.9 percent. ABN-AMRO wrote last month that it expects higher inflation in 2024 as well. Rabobank wrote on Thursday that the Dutch economy is cooling only slightly and is still overheated is. Klaas Knot indicated that inflation is unlikely to return to normal levels until 2025 and that further rate hikes are therefore needed to tame inflation.

On the other hand, the ECB wants to prevent a possible recession. We can already see that the demand for credit sharply decreases. Banks are now setting stricter standards for loans and charging higher interest rates. As a result, not only have house prices fallen, but this can also have an impact on economic activity, as companies make fewer investments. Because the effect of interest rate hikes is always felt with a delay, it is quite conceivable that these developments will continue in the coming months.

You may therefore wonder how far interest rates should be raised. Klaas Knot is known as one of the hawks within the ECB. Other economists within the ECB may be less positive about further interest rate hikes. Should inflation fall in the course of this year while the economy is contracting, the ECB could even start thinking about the Lowering interest rates.

Policymakers can argue that the effect of interest rate hikes is still felt after the eventual recession has already set in. That's because the effect of rate hikes is felt with a lag. There are also doubts about the effectiveness of interest rate hikes, as part of the price increase is due to a supply-side problem of products, such as last summer's high energy prices followed by rising labour costs this year. However, interest rates have an effect on the demand side of products.

The real interest rate, i.e. the interest rate adjusted for inflation, plays an important role in the outlook for the gold price. In recent years, real interest rates have been negative, which makes gold attractive as an investment. Should inflation remain high, precious metals would be a good Hedge can be. If there is indeed a recession later this year, this could also mean a rise in the price of gold, as well as the Incrementum Recession Phase Model showed. In such a situation, policymakers will cut interest rates, which could also be positive for assets such as stocks, bonds and precious metals. Time will tell which asset titles will do well in the near future. Although the price of gold depends on many factors, the outlook for the precious metal is certainly not bad.

![]() Have a look at us YouTube channel

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink and Joris Beemsterboer interview various economists and experts in the field of macroeconomics. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.