9.3

8.064 reviews

English

EN

Governments must take steps to reduce the debt burden, the International Monetary Fund says in a blog on the website. A review of tax policy is particularly important in this regard. The debacle of the euro crisis, which caused problems for governments, is still fresh in many people's minds. Now interest rates are rising, while governments have only taken on more debt in previous years. Can governments get into trouble again, or is the situation different now?

Yesterday it was announced that the interest rate of the Federal Reserve, the US central bank, was not increased. As a result, the policy rate remains in a range between 5.25% and 5.50%. U.S. policymakers left interest rates unchanged for the second time and want to see if the current interest rate hikes are enough to get inflation under control. U.S. inflation was 3.7 percent year-on-year in August. One year previously, the inflation rate was 8.3 percent.

Central bankers should also be careful not to Raise too much, which means that interest rate hikes now will exacerbate a later recession. This is because the effect of interest rate hikes is always noticeable with a delay. Officially, the Netherlands is in recession as the economy contracted for two quarters in a row. In America, there is still growth, but there is still danger in high interest rates. In March, several banks already ran into problems. Banks in America face stiff competition from money market funds that often offer higher interest rates than banks. If customers withdraw their money from the bank en masse, the bank can get into trouble as a result.

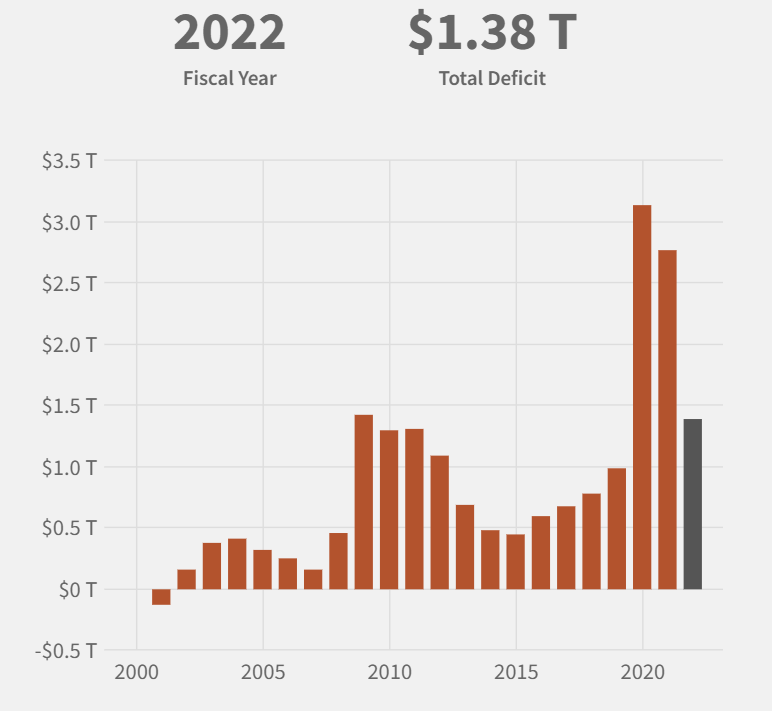

Governments around the world had deficits in recent years, causing public debt to rise. The United States is the most conspicuous; the last time the Americans had a budget surplus was in 2001. Other countries, such as Italy, have also had to contend with a year after year lack. The corona crisis in particular caused public debts to rise. Many governments came up with large support packages, while revenues declined. The result was a big hole in the budget. As a result, the Netherlands also had a deficit. Here, the gap in the budget in 2020 amounted to 3,7 percent.

As can be seen in the figure, the US has always had a budget deficit in recent years. (Source: U.S. treasury)

A government deficit does not have to be a problem for a country, as public debt is always expressed as a percentage of its Total Economy. If the economy grows faster than the mountain of debt, the national debt as a percentage will still decrease. Now, governments are also being "helped" by high inflation rates, which are causing nominal GDP to rise sharply and reduce the debt burden. For example, the Dutch public debt is expected to fall to 46,9 percentage of GDP, while there is a budget deficit.

Although public debt is falling, the world's total debt remains at a high level, the IMF wrote. Although the total global public debt has fallen by eight percent in the past two years, the debt is still significantly higher than before the corona pandemic. Total private debt fell more sharply, by twelve percent, but even this was not enough to cancel out the sharp increase in debt during the pandemic.

The total amount of debt in the world, while decreasing, is still above pre-2020 levels. (Source: IMF)

Last month, a study by the Rabobank, The which examined whether higher interest rates cause problems for European governments. The bank's economists compared Germany, France, Spain, the Netherlands, Belgium and Greece. This shows that there is quite a difference between countries. For example, the Netherlands can bear higher interest rates much more easily than Italy. Not only is the national debt of the Netherlands much lower, but the interest costs as a percentage of government revenues are also much lower than those of the Italians.

The Dutch national debt is lower than the Italian national debt. The Netherlands also spends relatively little on interest charges. (Source: Raboresearch)

Not only is the level of the national debt important in these comparisons, but the structure of the debt also says a lot about its portability. For example, Austria took advantage of the low interest rates by issuing bonds with a maturity of one hundred years at that time. Countries such as Greece and Spain, as well as Cyprus and Portugal, are still benefiting from the European Union's support measures dating back to the time of the euro crisis. As a result, interest charges in Greece are relatively favourable, given the level of public debt of around 171 percent.

Italy, with a public debt of about 145 percent, did not receive this support and issued bonds on its own account. Therefore, Italy's interest charges are relatively high. If interest rates remain high for a long time, interest charges will increase further. In the long run, more than ten percent of the annual budget would have to be spent on interest payments. This can be problematic, as it would require either spending cuts or tax increases.

The study also provides forecasts for the coming years. Interestingly, forecasts vary from country to country. This is because the forecast depends, among other things, on the growth of the economy, which varies from country to country. Some countries also have a larger budget deficit than others. Countries with a larger public debt will also be hit harder by the current interest rates, although Portugal is an exception. That's because in the years between 2006 and 2010, Portugal issued bonds with high interest rates. When those bonds mature, interest charges decrease, even if new bonds are issued at current rates.

The country-by-country forecast in the event that interest rates rise even further. (Source: Rabobank)

According to Rabobank, if interest rates rise even further, this does not necessarily mean that the national debt will increase further. According to the bank, GDP is much more important than the level of interest rates. Also, due to the debt structure, it takes a while for high interest rates to translate into higher government debt. In addition, interest rates are now high due to increased inflation. If interest rates bounce up because of market turmoil and investors consider bonds riskier, the effect on government debt is also greater. The debt burden will then no longer decrease due to high inflation. On the other hand, according to Rabobank, it is also the case that lower interest rates do not necessarily mean that the national debt is falling sharply. This is because in this scenario, inflation and nominal economic growth are also lower.

That is why, according to Rabobank, a new debt crisis like the one we had in the euro crisis is not likely. Although high interest rates may cause problems in the long term, they do not yet have major effects on public debt in the short term. Nevertheless, it is wise for many countries to reduce public debt, in case interest rates remain high for a longer period of time. If there is an acute need for government to step in, such as during a banking crisis, a high debt hampers governments. However, for such cases, governments do have the option of absorbing blows with the gold supply. For example, Russia sold gold this year to cover the government deficit. At the beginning of this year, revenues from the sale of oil and gas were lower, resulting in a deficit of 25 billion. The country then sold gold to fill the gap. At the beginning of August, Russia announced that he wanted to start buying gold again. Gold therefore still offers security in times of uncertainty.

Finally, it is possible that the European Central Bank's policy rate will be lowered again at a later date, slowly reducing the possibility of a debt crisis. Economists such as Jeroen Blokland predict a recession later this year. Therefore, the ECB will start stimulating again if inflation allows. The coming period will show how factors such as inflation, GDP and interest rates will develop.