9.3

8.064 reviews

English

EN

The price of silver has risen sharply in a short period of time. At the beginning of this month, the price was just under €800 per kilo, but this week the price of the precious metal even touched €960. That's an increase of about 20 percent in three weeks and about 40 percent since the beginning of this year. This makes it one of the best-performing commodities this year. What does this say about the silver market?

Gold and silver are often mentioned in the same breath, because they are both precious metals and because both fulfilled the role of money in the past. Yet, they are two different types of precious metals. Gold is primarily purchased as a means of storing wealth, while silver also has an important industrial component. Due to its properties, silver is a particularly useful and versatile raw material for numerous products, from solar panels to electronics and from water filters to RFID chips.

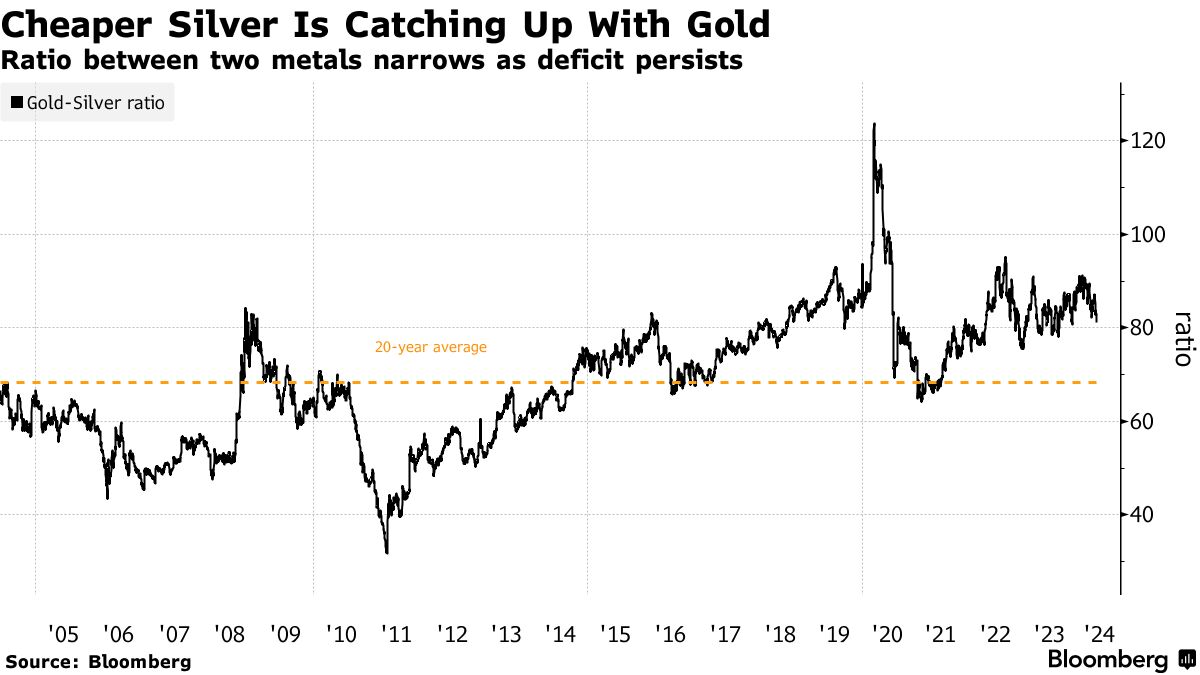

Often the prices of these precious metals move in the same direction, but from time to time the price movements can also vary greatly. Over the past twenty years, the so-called gold/silver ratio has shown a slight upward trend and has averaged a level of 68 troy ounces of silver for one troy ounce of gold. However, there were major outliers during this period. For example, silver was relatively expensive at the previous peak in 2011 with a ratio of 32:1, while the price was exceptionally low at 120:1 after the outbreak of the corona crisis.

Based on this ratio, silver has been undervalued for the last two years. Even after this month's increase, the ratio stands at 76:1, still higher than the average of the past two decades. That suggests that silver price could rise even further.

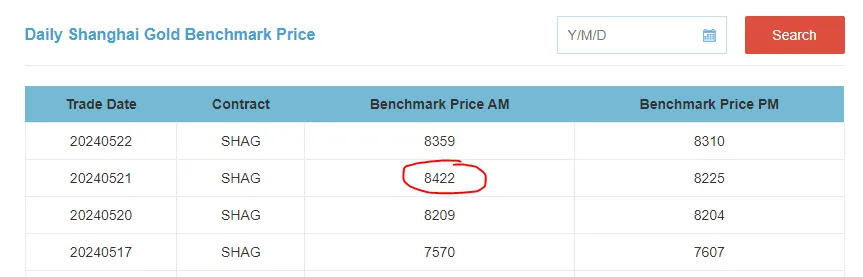

Of course, this sudden price increase raises questions, because who is suddenly buying so much silver? There are indications that there is a lot of demand for the precious metal in China, because if we compare the silver price fixing in London with that of Shanghai, we come to a remarkably large difference. On Tuesday 21 May, the silver price fixing in London This is €935.88 per kilo, while the Shanghai Silver Fix was trading at 8,422 yuan per kilo on the same day, or €1,079.63 per kilo. That's a difference of more than €100 per kilo, making it lucrative to export silver from Western markets to China.

A trend that we have already observed in the gold market is now also occurring in silver, namely that the price is increasingly determined by China. They want value for money and buy large amounts of gold and silver, which they increasingly get from Western countries. We could draw a parallel here with the London Gold Pool, but with both institutional players (central banks and sovereign wealth funds) and private investors.

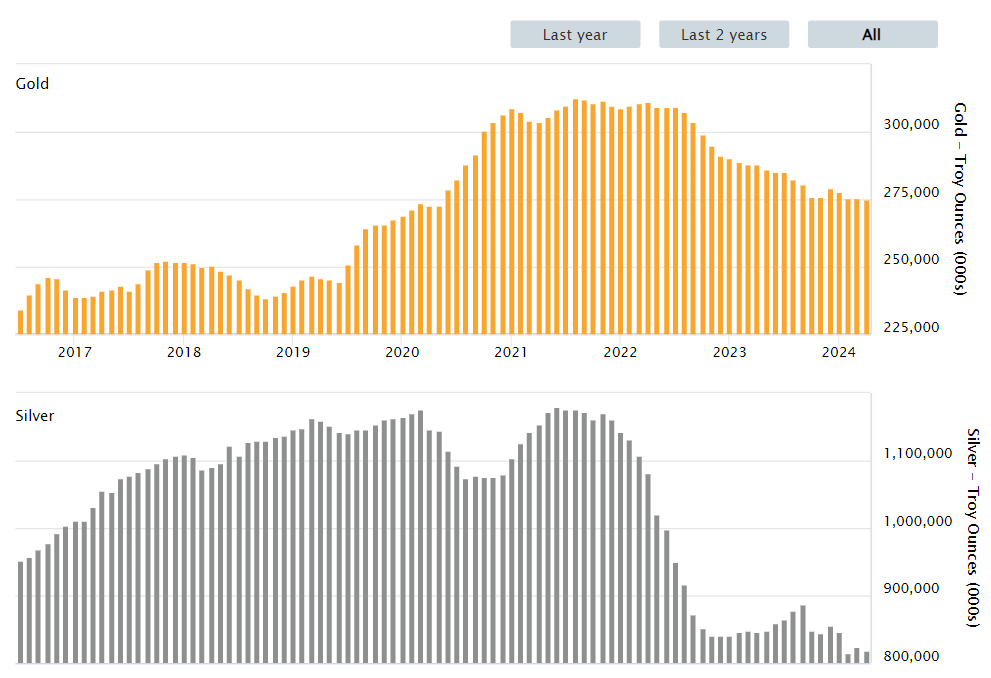

As long as the prices of gold and silver in China remain higher than in London and New York, the precious metal will continue to flow eastwards. The longer prices in 'east' and 'west' continue to diverge, the more significant this trend becomes. The graph below shows that since 2022, a substantial amount of gold (yellow) and silver (grey) has already disappeared from the vaults of the LBMA. This is partly due to a decline in the stocks of ETFs (which usually hold their stock in London), but most likely also to increasing demand for both precious metals from Asia.

In the Geotrendlines Model portfolio we definitely hold a position in silver, as it is an interesting precious metal with unique fundamentals. With increasing demand (industry and investors) and mining production barely increasing due to lack of investment, silver certainly has upside potential. Just like copper, which this week has a New record reached through a combination of increasing demand, limited supply and, of course, speculation.

Gold, however, is a completely different story. The upside potential of gold does not lie in any new industrial applications, but in a revaluation of all the gold present above ground compared to the money bubble and debt bubble that has inflated worldwide in recent decades. We consider this upside potential to be many times greater and is also the reason why we hold a lot of gold - only physical gold, no gold mines - in our model portfolio.

This column also appears in today's Boon & Knopers On this page, Sander Boon and Frank Knopers of Geotrendlines share a weekly market commentary containing their views on the most important trends and events in the field of money, gold and geopolitics.

Would you like to read these comments as well? Then click here to read the first four editions of the Boon & Knopers update for free.

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink interviews various economists and experts in the macroeconomic field. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.