9.3

8.064 reviews

English

EN

Since the beginning of March, precious metals such as silver and gold have experienced remarkable increases in value, with the Silver price by 26% and the Gold price increased by 16%. These significant gains are especially striking given the short period in which they occurred and the traditional role of these metals as safe havens. Although gold has reached new all-time highs, silver has not yet surpassed its peak prices from previous years, but it shows potential for significant upward movements, as Jesse Colombo describes in his Final Analysis from silverseek.com.

The demand for silver is not limited to the traditional applications in jewelry, silverware or Silver bars. The highest demand comes from industrial applications due to its unique physical and electrical properties. It is extensively used in electronics, solar panels, automobiles, and other sectors. The recent report of the Silver Institute highlighted an 11% increase in industrial demand for silver in 2023, setting a new record of 654.4 million ounces. This increase is significantly driven by the increase in photovoltaic applications, which alone saw a 64% increase.

Demand for silver by industry. Source: GFMS Definitive, Metals Focus, The Silver Institute, UBS

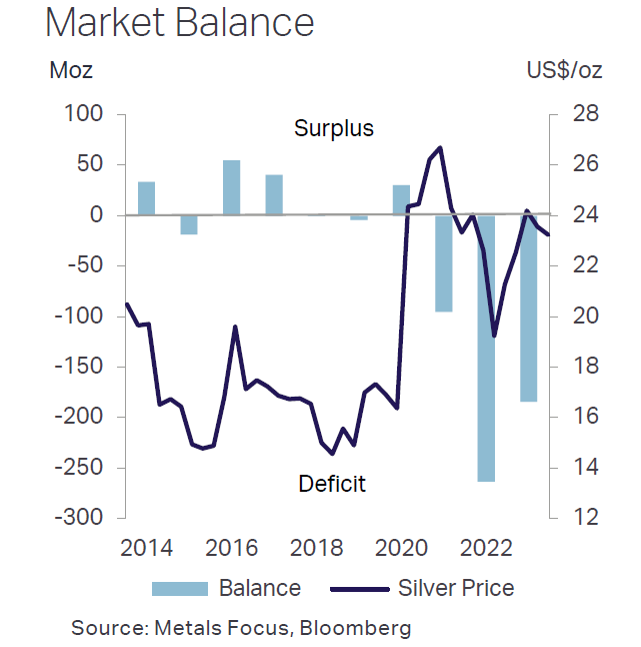

The silver market is experiencing a Consistent deficit, where demand exceeds supply. This has been the case since 2021 and is contributing to price increases. In 2023, the deficit reached 184.3 million ounces and is expected to worsen further in 2024. This ongoing shortage is the direct result of robust demand combined with modest increases in supply, which has been relatively stable for more than a decade. It is striking that the Global Mine Production of silver has been declining for a decade, adding to the pressure on supply.

Shortage of silver. Source: Metal Focus, Bloomberg

The consistent shortages of recent years have significantly depleted available silver supplies. Stocks on major global exchanges such as the London Bullion Market Association and COMEX in the U.S. have seen sharp declines. Notably, inventories on China's Shanghai Gold Exchange have fallen by an astounding 73%.

Recent market movements have shown that silver is breaking out of a long-term consolidation pattern, indicating the potential for a new bull market. This breakout is supported by gold's recent surge above key resistance levels, which is typically good for silver. Despite some pullbacks from silver ETFs, likely diverted to emerging markets such as cryptocurrencies, the fundamental indicators suggest a return of investor interest in silver if current trends continue.

Silver remains relatively cheap compared to historical standards, especially when compared to gold. The current Gold-to-silver price ratio is significantly higher than historical averages, suggesting that silver is undervalued. Adjusted for inflation, silver is priced well below its historical peaks, indicating room for significant appreciation.

Silver and gold prices rise despite a strong U.S. dollar and Rising Interest Rates, which typically move inversely with the prices of precious metals. This indicates underlying strength and investor confidence in these metals as a hedge against inflation and economic uncertainty. Stubbornly high inflation, as indicated by recent CPI data, further supports demand for silver and gold as protective investments.

Economic problems in China, including a significant economic slowdown and losses in the real estate and stock markets, have prompted Chinese investors to looking at gold more and more, which indirectly supports silver prices. In addition, geopolitical tensions, such as those arising from conflicts related to Israel, Iran and Ongoing Issues in Ukraine, also plays a role in the increased attractiveness of precious metals as safe havens.

There is increasing talk of a potential "Silversqueeze", where concentrated buying can expose and undermine large short positions in the market, potentially leading to dramatic price increases. This movement, encouraged by communities such as r/WallStreetBets, aims to mimic the short squeeze dynamics previously seen in other markets.

Silver's recent price movements and the economic forces at play suggest a robust start to what could be one of the most significant bull markets in its history. For investors, this makes a compelling case for viewing silver not only as a hedge against macroeconomic and geopolitical uncertainty, but also as a potentially lucrative investment. In these uncertain times, the tangible security that physical silver provides becomes even more appealing, underscoring its timeless value in maintaining prosperity.

Do you want to Buy silver by means of Silver bars and Silver Coins? We are happy to help you with your order.

On Thursday 16 May 2024, Holland Gold will host a event on Gold and world politics in the Georg Kessler Lounge at the AFAS AZ Stadium.

The event consists of three parts: one interview, one presentation and a Q&A session for the audience. For example, the gold rush is discussed in World Politics, the geopolitical tensions that are rising every day; in Ukraine, the Middle East, in West Africa and around Taiwan. What impact does this have on the financial system? Central banks seem to be caught in a gold rush. The yellow metal achieves a Record price. How long will the US dollar remain dominant?

Buy your tickets here: https://www.hollandgold.nl/evenement/

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink and Joris Beemsterboer interview various economists and experts in the field of macroeconomics. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.