9.3

8.064 reviews

English

EN

The outcome of the Dutch elections has sparked uncertainty among investors. What do the plans of the winning parties mean for taxation, public finances, and the value of your wealth? In this week’s selection, we analyze the implications of the Dutch parliamentary elections for investors, discuss the risks of rising debt levels across the West, and examine the growing global demand for gold. We also review the latest interest rate decisions by the FED and ECB, explore the progress toward a digital euro, and highlight Ray Dalio’s view of gold as the world’s safest form of money.

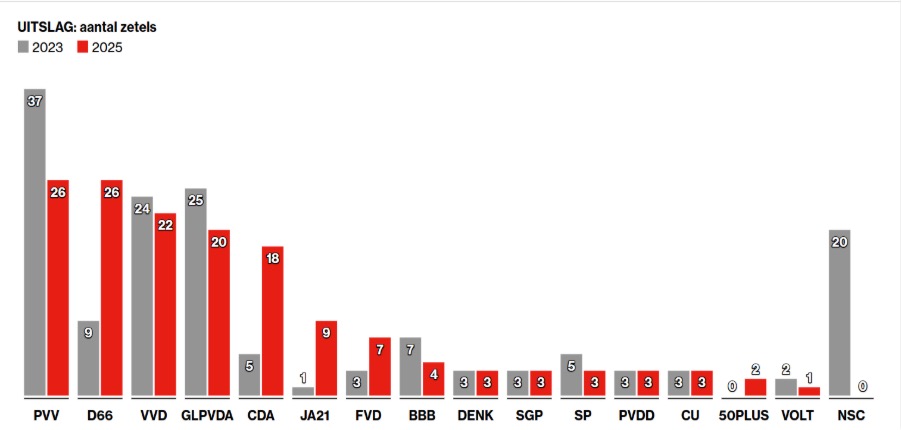

With the Dutch parliamentary elections now behind us, investors can take stock. Was the outcome favorable for investors, or should they brace for higher taxes? And what will happen to public finances if the various party programs are implemented?

Source: ANP forecast

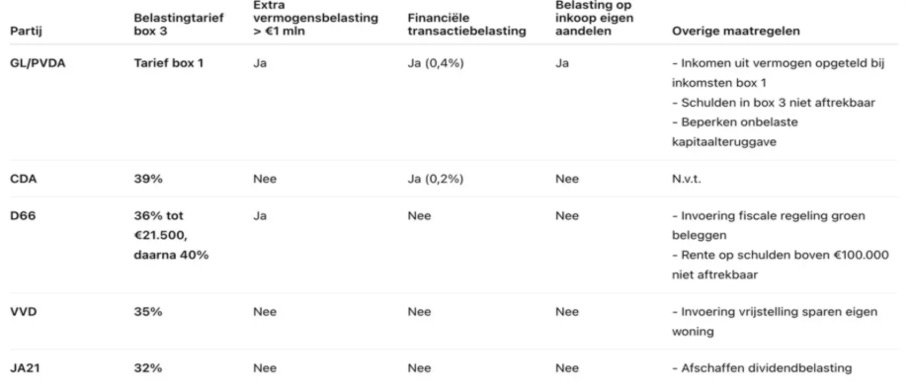

According to Stockwatch.nl, among the winning parties only JA21 plans a meaningful reduction in the wealth tax (box 3), proposing to lower the rate from 36% to 32%. CDA and D66 favor increasing the rate, while the VVD intends to leave it unchanged at 35%. The other parties’ positions on investor-related tax policy are summarized in the table below:

Source: Stockwatch.nl

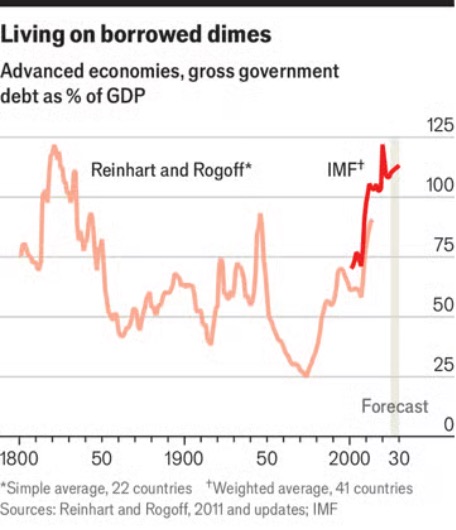

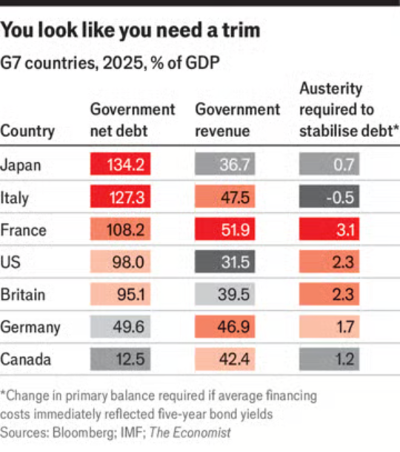

The Netherlands continues to impose relatively high taxes on capital. But will the fiscal policies of the new coalition parties contribute to sound public finances? At Holland Gold, we have long warned of the risks posed by excessive government debt. Whereas sovereign debt crises were once mainly a problem for developing nations, today it is the wealthy economies that are burdened with record debt levels. Public debt in advanced economies now stands at 110% of GDP—near an all-time high, according to The Economist.

Source: The Economist

This debt build-up can partly be explained by a series of crises: the 2007–2009 financial crisis, the Covid-19 pandemic, and Russia’s invasion of Ukraine. Yet politically, there is little appetite anywhere to cut spending or reduce deficits. Every attempt to rein in government borrowing seems to be short-lived.

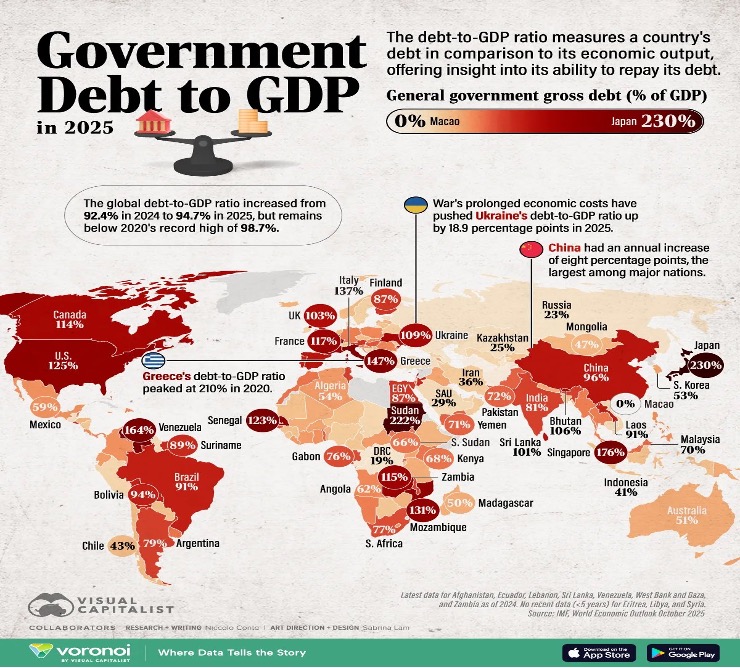

France, for example, faces recurring political turmoil whenever austerity is proposed — a topic we have covered before at Holland Gold. Japan, too, shows no sign of fiscal restraint. Newly appointed Prime Minister Sanae Takaichi has announced plans for higher public spending and lower taxes, despite Japan’s debt already standing at 230% of GDP.

Source: Barchart

To stabilize debt ratios in countries such as the UK, France, and the United States, budget cuts equivalent to 2–3% of GDP would be required. Yet taxes in Europe are already high, leaving little room to raise them further without stifling economic growth. Combined with rising spending needs for aging populations, defense, and climate policy, this leaves governments in a difficult position.

Moreover, existing debt must be refinanced at higher interest rates. Unsurprisingly, bond markets are showing growing concern. Investors are demanding higher yields on long-term government bonds across most major economies — even though none are currently in recession.

Source: The Economist

With a debt-to-GDP ratio of 43%, the Netherlands remains among Europe’s most fiscally disciplined nations. Yet projections by the CPB show that even here, public debt is set to rise sharply under most party proposals. The VVD performs “best” on paper with an expected debt ratio of 107% by 2060. These figures do not account for potential European debt issuance or Eurobonds — an idea criticized by economist Han de Jong in our podcast. Nonetheless, major parties such as D66 are not opposed to the concept.

Source: Stockwatch

What remains after coalition talks and what policies will actually be implemented is anyone’s guess. In politics, one thing is certain — uncertainty itself.

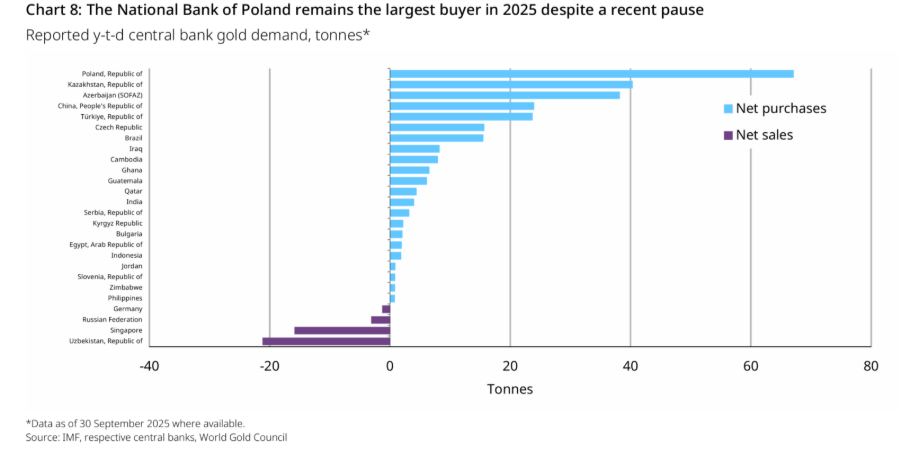

According to the World Gold Council, global gold demand reached a new record of 1,313 tonnes in the third quarter, worth a total of USD 146 billion. Central banks increased their net purchases to 220 tonnes — up 28% from Q2 — despite the record-high gold price. During the quarter, gold set 13 new all-time highs.

Source: World Gold Council – Central bank purchases year-to-date

For the first time since 2021, Brazil’s central bank increased its gold reserves by 15 tonnes. The largest buyer was Kazakhstan, adding 18 tonnes. For the year as a whole, Poland remains the leading gold buyer among central banks, aiming to raise its gold reserves from 20% to 30% of total reserves — currently at 24%. This suggests that Poland’s accumulation is far from over.

The Bank of Korea also announced intentions to resume gold purchases, as stated by Heung-Soon Jun during the LBMA/LPPM Global Precious Metals Conference in Kyoto — its first potential move since 2013. The World Gold Council expects continued strong central bank demand into the fourth quarter.

Fed Chair Jerome Powell surprised markets by signaling that a December rate cut — widely expected by investors — is “far from certain.” A growing number of Fed officials believe the pause on rate reductions should be extended, pointing to persistent inflation and a weakening labor market. Markets responded by sharply reducing the probability of another rate cut at the December 9–10 meeting, as shown on Polymarket.

The European Central Bank left its benchmark rate unchanged at 2% and reiterated that monetary policy is “in a good place.” Still, investors expect that the ECB could lower rates later this year.

The European Central Bank is pressing forward with its digital euro project, set for launch in 2029, at an estimated cost of €1.3 billion. The ECB announced on Thursday that the initiative is entering its next phase. Holland Gold previously discussed the rationale and risks of the digital euro with Menno Broos, project manager at De Nederlandsche Bank — that interview can be viewed here.

Economist and Bridgewater Associates founder Ray Dalio recently called gold “the safest form of money.” He outlines several reasons to support this claim:

Dalio advises investors to hold around 15% of their wealth in gold.