9.3

8.064 reviews

English

EN

This article has been automatically translated from Dutch. Click here to see the orginal article including all links to sources.

In this week's selection, we explore why the influential Russell Napier advises investors to avoid not only government bonds but also the S&P 500. According to him, fundamental changes are unfolding in the global financial system, signaling a transition to a new system of national capitalism. Additionally, we see evidence that Javier Milei's reforms in Argentina are beginning to pay off, as the economy emerges from a recession. Meanwhile, Germany's next chancellor claims that Milei is ruining his country. Lastly, we discuss the Federal Reserve's interest rate decision and its impact on financial markets. The dollar is rising, while the euro has seen a significant decline in value.

This week, Swiss outlet The Market NZZ published a highly insightful interview with Russell Napier, a well-known independent market strategist, researcher, and author. Napier is convinced that the global financial system is undergoing fundamental changes and is on the verge of collapse. He envisions a future where governments increasingly dictate where investors should allocate their capital.

Governments, he says, will increasingly steer investments toward strategic national objectives such as infrastructure, energy, and defense. He also predicts more proposals requiring a portion of pension funds to be invested domestically. Concrete examples of mounting pressure on institutional investors like insurers and pension funds have become increasingly evident in recent times.

Global Liquidity (source: Daniel Lacalle)

Napier foresees a long-term rise in inflation but believes a period of deflation is likely first. While governments have fueled inflation in recent years through money creation, central banks have now slammed on the brakes. Money supply growth has slowed dramatically, which he believes will hit economic growth. Napier expects governments to respond by forcing banks to lend more, suppressing interest rates, and using national savings (such as pensions) to invest in their priorities.

In this context, he advises against investing in government bonds and the S&P 500. Europeans send hundreds of billions of euros annually to the U.S. to fund American companies and the government. Napier interprets recent speeches by Macron and reports by Draghi as signaling a shift. The money currently flowing to the U.S., he argues, should be redirected to serve national interests. Under the new system of national capitalism, governments will increasingly direct investments. Institutions like pension funds will be compelled to repatriate assets, liquidating their positions in the S&P 500. This makes the S&P 500 a poor investment, as it is significantly overvalued and overly represented in the portfolios of foreign investors.

Napier also expects governments to address debt through inflation, making bonds a poor investment for the coming years. “In the long term, you could lose a fortune in real terms. So: no bonds. Period.”

Napier remains highly bullish on gold, expecting its price to rise further as the global monetary system collapses. He notes that fund managers have minimal exposure to the precious metal. He also advises holding stocks that are not heavily liquidated because they are not overrepresented in institutional investors' portfolios. His advice: “Buy stocks nobody wants today and hold much more gold.” Read the full interview here.

Argentina emerged from a severe recession in Q3 2024, marking a significant milestone for libertarian president Javier Milei, reports the Financial Times. GDP grew by 3.9% during this period, the first economic growth since late 2023. This recovery comes precisely one year after Milei took office and dramatically cut through bureaucracy. Previously, he managed to halt inflation, which had exceeded 100%.

Javier Milei, Davos 2024 (source: World Economic Forum)

The growth was driven in part by a surge in consumer spending and capital investment. JPMorgan expects Argentina's economy to grow by 5.2% in 2025, a figure likely to outpace Germany's, which is in the midst of an existential crisis. Sander Boon highlighted in a recent podcast episode that Europe is in dire need of reform. This could happen via leaders like Milei, Trump, and Musk or through the EU’s approach of more debt, bureaucracy, and government intervention. Milei's successes are therefore a thorn in the side of established political factions seeking to maintain the status quo. This was evident in Germany this week.

Germany's political crisis over the budget deficit and increased borrowing has led to the coalition's collapse, prompting new elections in February. The campaign has already begun. Liberal FDP leader Christian Lindner criticized Germany's excessive regulations, expanding bureaucracy, and oversized government as the country's most pressing issues. He remarked that Germany “could use a touch of Milei and Musk.” Lindner urged Germans not to be arrogant and to analyze and learn from these examples.

Christian Lindner, Davos 2023 (source: World Economic Forum)

However, Friedrich Merz (CDU) expressed his disdain for Lindner’s remarks in a televised statement, calling Milei's presidency a disaster: "This president is ruining the country and trampling on its people." As Merz is likely to become the next chancellor, doubts linger over whether Germany will genuinely reform. Lindner responded in an op-ed: "It is concerning that Friedrich Merz, likely the next chancellor, is 'shocked' when I call for a touch of disruption, referencing Milei and Musk." To be continued!

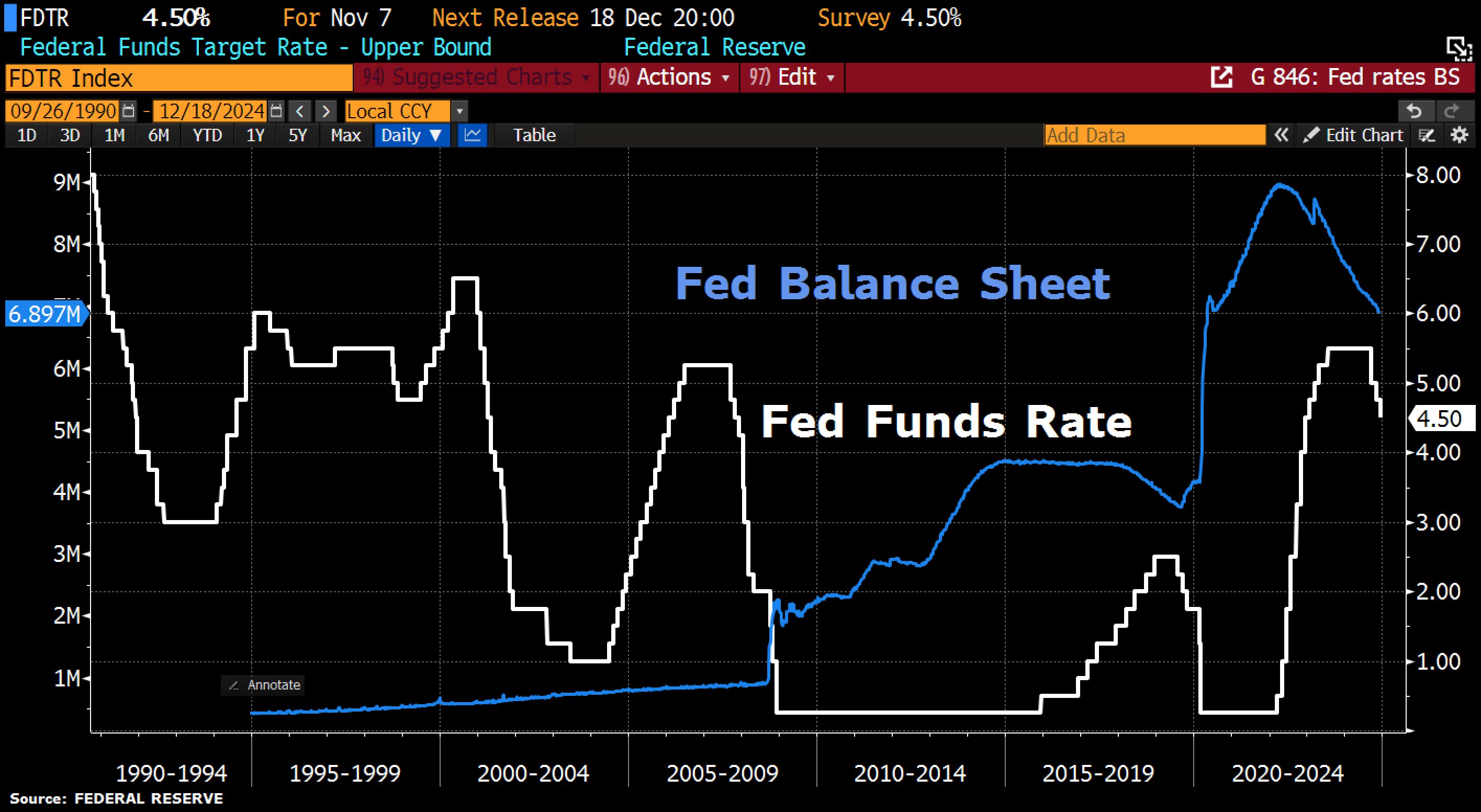

The Federal Reserve lowered interest rates by another quarter percentage point on Wednesday, bringing the target to 4.25%-4.5%. Despite the rate cut, the dollar rose against other currencies, while U.S. stocks lost value. This reaction stems from the Fed's signal that rate cuts would slow next year. Officials justified this stance by noting that an overly rapid reduction could undermine efforts to control inflation. Inflation forecasts had to be revised upward.

Federal Funds Target Rate (source: Holger Zschaepitz)

Remarkably, the decision was not unanimous, with one policymaker voting against further cuts. Officials now expect rates to fall by only half a percentage point next year, rather than the full percentage point predicted in September. Four policymakers foresee no additional cuts in 2025, according to the Fed Dot Plot. The S&P 500 dropped 2.95% following the announcement, while the Nasdaq lost 3.65%. Before Wednesday, traders hoped for more aggressive rate cuts in 2025 to fuel the bull market. Volatility also surged.

EURUSD (source: Robin Brooks)

The dollar climbed by 1% against a basket of currencies on Wednesday, reaching its highest level in over two years. A straightforward explanation for this trend is that when markets expect U.S. interest rates to remain higher for longer, demand for dollars increases compared to other currencies, thereby driving up the dollar’s price.

The euro, however, has seen a sharp decline in value against the dollar since October. Just a few months ago, one euro was worth $1.12, but it now trades at a mere $1.04. According to analyst Jeroen Blokland, this drop is partially due to Germany’s ongoing crisis. He even suggests that further turmoil could push the euro below parity (1 euro = 1 dollar) with the U.S. dollar. Robin Brooks shared a similar perspective on X, stating: “A key theme for 2025 will be the euro falling below parity, where it should have remained since Russia's invasion of Ukraine. Europe faces prolonged stagnation and urgently needs a weaker currency...”

Although bitcoin reached a new all-time high of over $108,000 earlier this week, its price fell following the Fed's announcement, briefly dropping below $93,000. This decline aligns with bitcoin’s historical pattern of tracking global money supply (M2) growth with a lag of approximately 70 days. Previously, it was observed that the global money supply has been decreasing in recent months, which could explain bitcoin’s recent downward movement. The coming weeks will be pivotal in determining whether bitcoin continues to follow M2 trends or begins to decouple from this pattern.

For enthusiasts: curious about central banks' expectations for 2025 following this Fed move? CNBC just published a comprehensive overview.