9.3

8.064 reviews

English

EN

(This article has been automatically translated from Dutch. Click here to see the orginal article including all links to sources)

It will have escaped no one’s attention that Donald Trump has won the race for the U.S. presidency. In this week’s high-profile podcast, Kees de Kort gives his unfiltered view on the results, the role of the media, and the (geo)political consequences for Ukraine, Israel, Europe, and NATO. In this week’s selection, we look at the impact of his election on financial markets, so you are fully up-to-date. The price of bitcoin and stocks is rising, as are the dollar and interest rates, but will gold continue to rise as well?

Bitcoin

As it became increasingly clear that Trump would be the 47th president of the United States, we saw a strong reaction in the markets. Bitcoin experienced a significant rise, as we had predicted in the monthly update. For the first time in history, a bitcoin exceeded $75,000. Trump previously promised in a speech at the Bitcoin conference in Nashville to make the U.S. "the bitcoin superpower of the world." We discussed his speech earlier; watch it here.

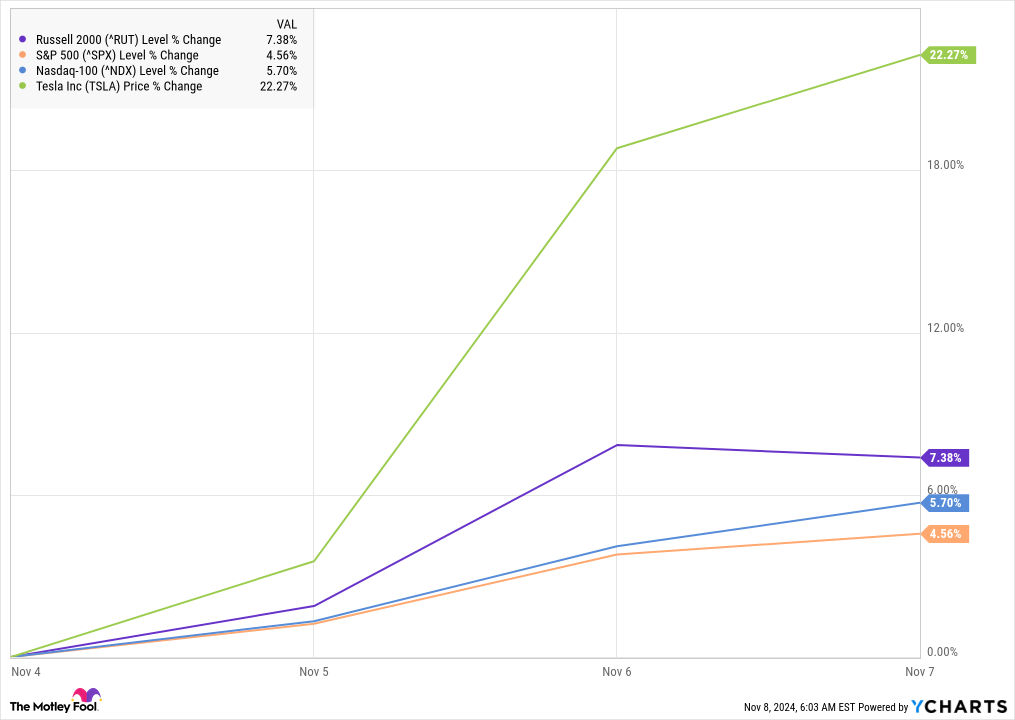

Stocks

The U.S. stock market also reacted positively. The S&P 500 is now up more than 4.5 percent from the beginning of the week, at 5,973 points, marking another all-time high. Stock analyst Nico Inberg had previously predicted this, attributing it to Trump's plan to reduce corporate taxes. The Russell 2000, an index of smaller U.S. companies, rose even more sharply and is up more than 7 percent since the beginning of the week. Investors seem to expect that Trump's policies, like trade tariffs, will be relatively favorable for these companies. Tesla, the company of Trump supporter Elon Musk, saw perhaps the most notable increase, with the stock up more than 22 percent since the start of the week.

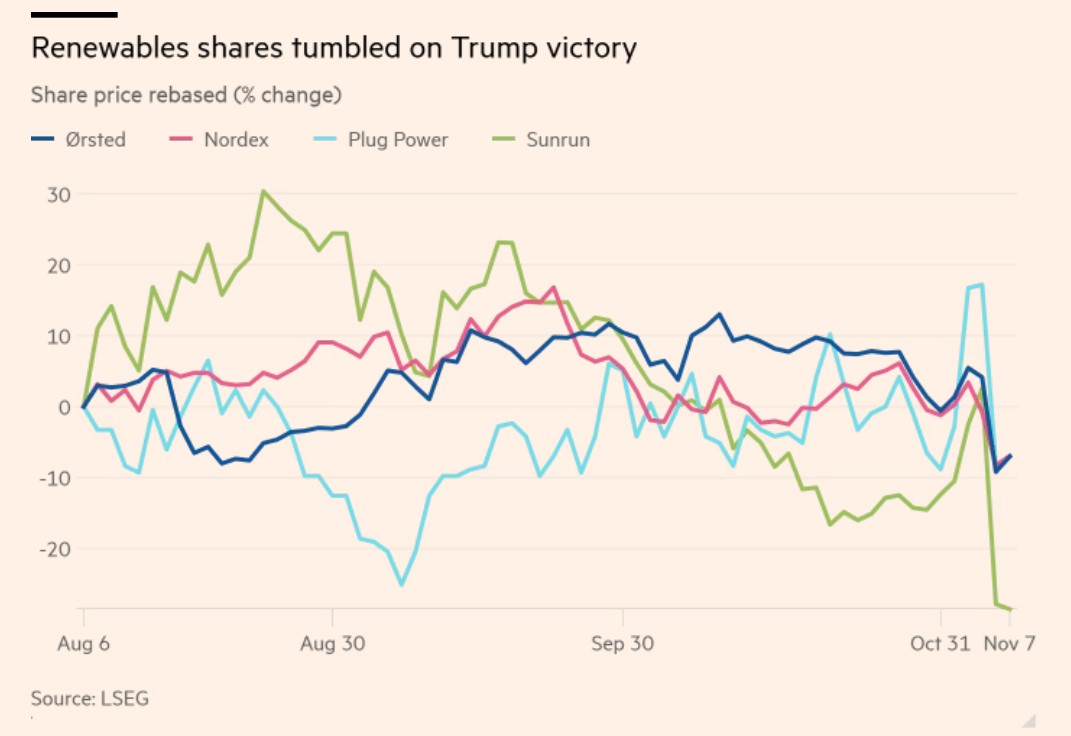

However, it wasn't all celebrations on the stock market. Companies focused on the energy transition took a hit, as seen in the graph above, due to concerns that Trump will end President Joe Biden's "Inflation Reduction Act." This would mean the end of tax benefits for renewable energy and halt the development of offshore wind energy. According to the Financial Times, some hedge funds capitalized on this and made over $1.2 billion in profits from short positions on companies like Nordex, a German wind turbine producer.

The Dollar

The U.S. dollar appreciated on Wednesday. The dollar index, a measure of the currency against a basket of rivals, rose by 1.5 percent, the largest one-day increase since September 2022. The British pound fell 1.1 percent against the dollar to $1.29, while the euro dropped 1.7 percent on Wednesday to $1.074.

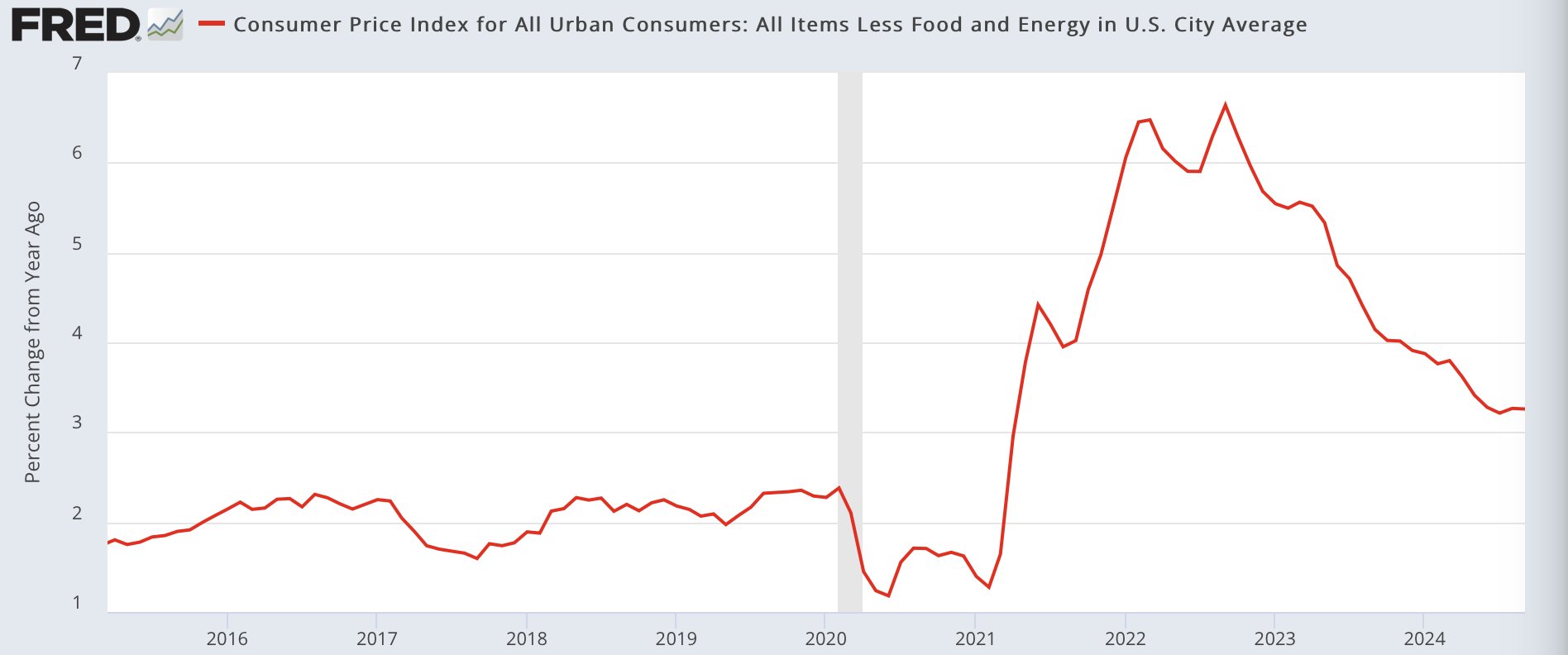

Mansoor Mohi-uddin, chief economist at the Bank of Singapore, wrote in the Financial Times, "With Donald Trump in power, the dollar will likely rise initially but weaken thereafter." He says the dollar is likely to rise in the short term due to four factors: high U.S. budget deficits, higher tariffs on foreign goods, reduced immigration, and strong U.S. stock markets. These factors will stimulate U.S. inflation and discourage the Fed from further rate cuts. However, in the longer term, he expects the dollar to weaken due to multiple risks, such as increasing deficits. Read his full analysis here.

Interest Rates, the Fed, and Inflation

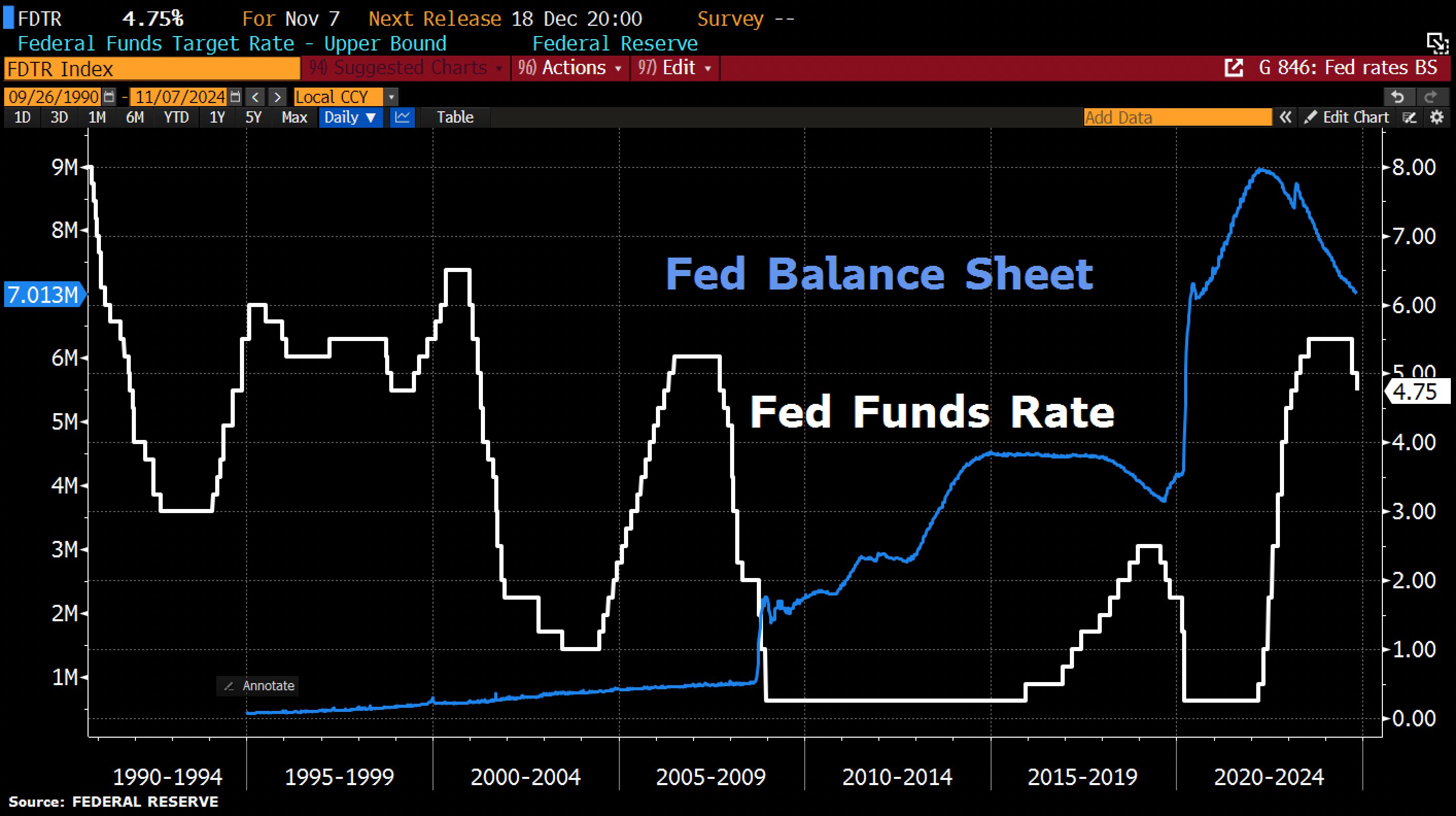

The interest rate the U.S. government has to pay on its debt increased. On Wednesday, the yield on the 10-year Treasury bond rose by 0.12 percentage points to 4.40 percent, the highest level since July. Despite Fed rate cuts, Treasury yields continue to rise, likely due to market expectations of higher inflation. More people are recognizing that the Fed doesn’t control longer-term interest rates. This rate also serves as a benchmark for mortgage rates, which have also risen. The interest rate on a 30-year U.S. mortgage has now climbed to 7.39 percent.

The U.S. central bank further reduced the rate this week, this time by 0.25 percentage points. Fed Chair Powell said that the Fed is aware that cutting too quickly could hinder progress in fighting inflation, while cutting too slowly could “unnecessarily weaken economic activity and employment.” He also stated, "Fiscal policy is on an unsustainable path; our debt-to-GDP level is not unsustainable — but the trajectory is unsustainable... It’s important that the debt is addressed, as it ultimately poses a threat to the economy."

Gold

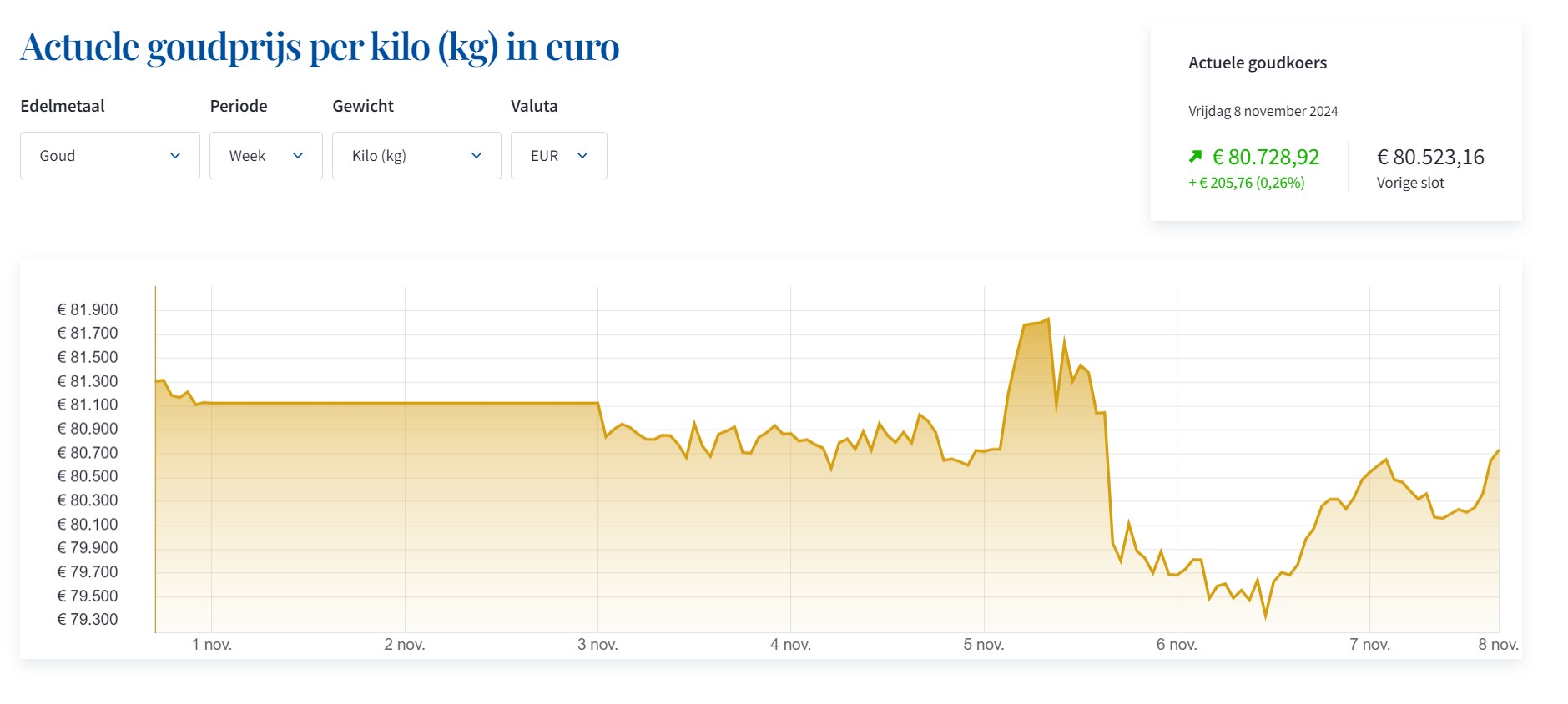

Finally, we come to gold. As seen on the graph, the gold price rose during the voting and then declined once the result became known. Otavio Costa of Crescat Capital called this a typical example of a "sell the news event." Jan Nieuwenhuijs suggested that the drop, once Trump’s win became clear, was due to expectations that geopolitical tensions will now ease. During his campaign, Trump made it clear that he wants to end the conflict in Ukraine as soon as possible. Russian President Vladimir Putin responded positively to this yesterday.

But as Jeroen Blokland noted during the drop, that won't be enough to create a permanent decline. Trump will, as mentioned above, create more debt with his policies, further driving inflation. Additionally, well-known author and investor Jim Rickards said in an interview, "Gold is driven by factors bigger than Trump." He cited central bank gold purchases, BRICS, de-dollarization, and sanctions, where he claims the West is seizing Russian assets. Watch the full interview where he explains why gold will continue to rise here. The analysts already seem to be proven correct, as the gold price is rising again. Just as during Trump's first term as president, when gold rose nearly 55 percent.