9.3

8.064 reviews

English

EN

This article has been automatically translated from Dutch. Click here to see the orginal article including all links to sources.

Was Germany’s economic downturn deliberately concealed? The revised data paints a stark picture: Germany is now the worst-performing economy in Europe. Meanwhile, rumors are once again swirling in the U.S. about a possible revaluation of the country’s gold reserves—and not without reason. Is gold regaining its monetary role?

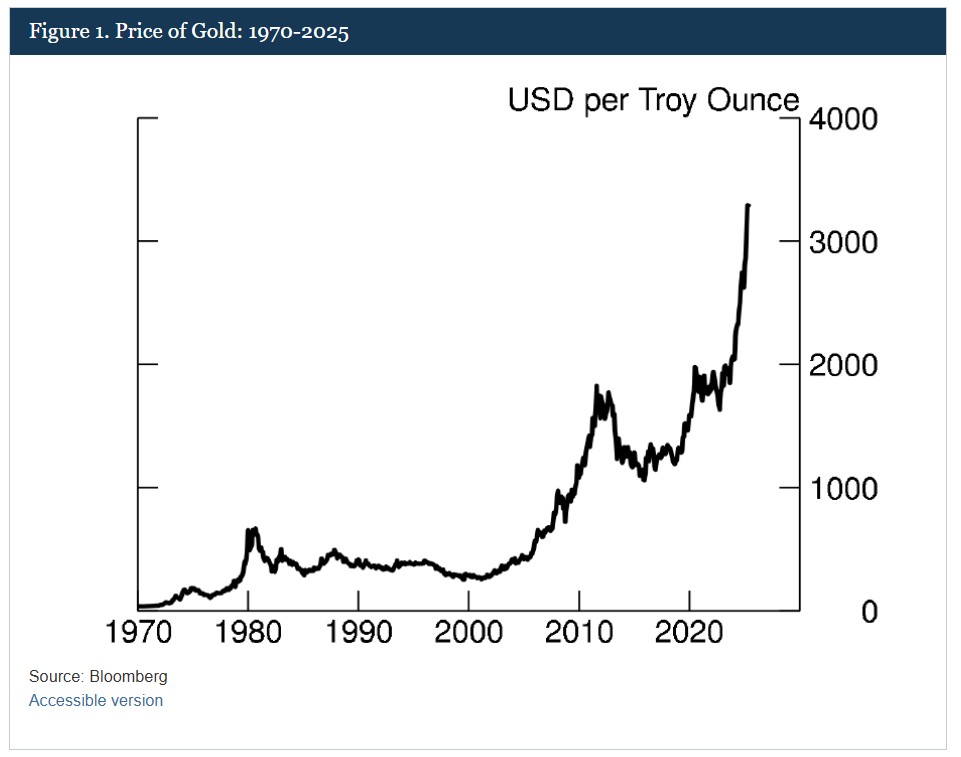

A few months ago, surging gold prices and a $37 trillion national debt reignited debate in the United States about revaluing its official gold reserves. We discussed this in February during our podcast with Jeroen Blokland. U.S. Treasury Secretary Scott Bessent stated shortly afterward that there were no plans to revalue the gold holdings. But now the rumors have resurfaced—this time following the publication of an article on the website of the Federal Reserve, the central bank of the United States.

Scott Bessent denied revaluation plans on February 20 (source: Bloomberg)

Since 1973, the U.S. Treasury has valued its gold at $42.22 per ounce. But as you know, the market price has increased dramatically since then. The United States holds 261.5 million ounces of gold, officially valued at around $11 billion. At current market prices, however, that gold would be worth over $750 billion. Those unrealized gains could, in theory, be used by either the central bank or the government.

In the Fed article, Principal Economist Colin Weiss explains the mechanics of a revaluation and the differences between scenarios in which the proceeds would benefit the government versus those in which they would go to the central bank itself. He also references several international examples of countries that have previously used gold revaluation gains in this way.

Gold price development since 1970 (source: Federal Reserve)

A central bank can use revaluation gains to cover losses. This occurred in Italy in 2003, and also within the Kingdom of the Netherlands: the central bank of Curaçao and Sint Maarten did so in both 2021 and 2022.

Governments, on the other hand, typically use revaluation proceeds to reduce public debt. In South Africa, a plan was introduced in 2024 to apply around 150 billion rand (2% of GDP) in revaluation gains to slow debt growth. Lebanon also used revaluation profits worth 11% of GDP to partially pay down its debt. The proceeds could, of course, also be allocated to investments. In a footnote, the article even refers to debates on using such profits to create a strategic bitcoin reserve or sovereign wealth fund.

Although the article does not take a position on whether the U.S. should revalue its gold reserves, its publication on the Fed’s official website signals that the issue is once again under serious consideration. Could this be a sign of gold’s return to monetary prominence? It is, at the very least, the first time in recent history that the Federal Reserve has officially addressed the topic.

Famed investor Ray Dalio stated this week that it’s not unthinkable for gold to regain a central role in the monetary system. Dalio sees a recurring pattern throughout history: when public trust in fiat currencies erodes, governments often resort to printing money to repay debt. Over time, however, no one wants to hold the devalued currency—forcing governments to re-peg it to gold.

Will this pattern repeat itself? Dalio believes it’s quite possible, though unlikely in the very near term. Gold analyst Jan Nieuwenhuijs echoed Dalio’s remarks and pointed to his own analysis, in which he argues that Europe may already be preparing for a return to a gold standard.

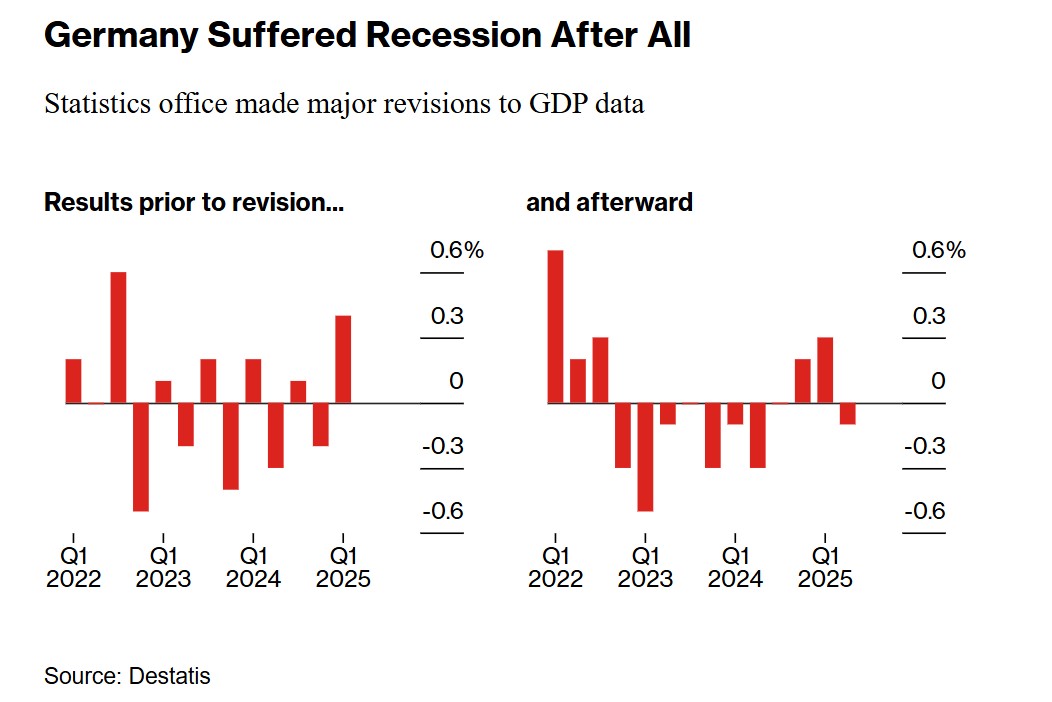

Last week, we briefly covered Germany’s economic contraction in Q2 2025. This week, we revisit the topic—not only because new data has emerged, but also because earlier figures have been revised. What previously appeared to be a ‘stop-and-go’ pattern—a hallmark of stagnation—now seems to indicate a prolonged recession.

Revised German growth figures (source: Bloomberg)

Germany’s federal statistics office, Destatis, released revised figures based on “newly available statistical data.” It was already clear that the German economy had contracted in both 2023 and 2024, but the earlier numbers did not meet the technical definition of a recession: two consecutive quarters of negative growth. What business confidence indicators had long suggested is now confirmed by the revised data.

Willem Middelkoop suspects the revisions were deliberate and argues that such statistical “adjustments” are not uncommon. He wrote: “Germany concealed the 2023/2024 recession using the time-tested trick: ‘Oops, we revised our data.’”

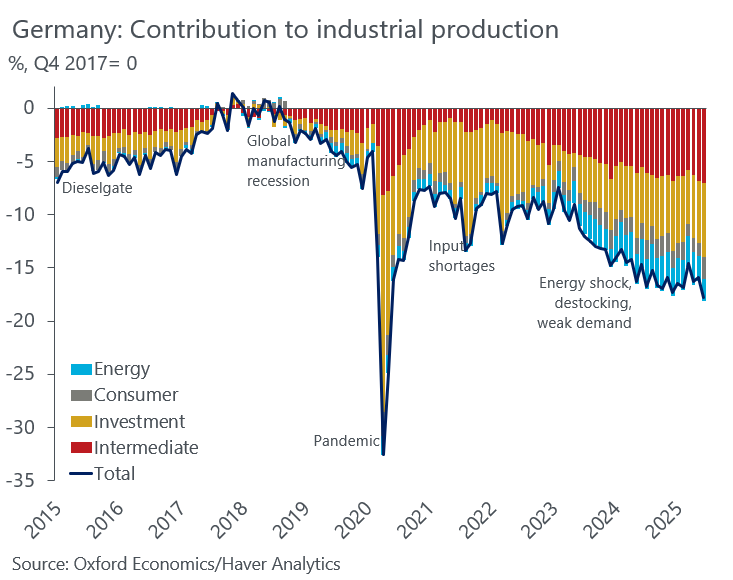

German industrial production at lowest level since the pandemic (source: Daniel Kral).

More bad news came in for the German economy. Industrial production in Germany fell to its lowest point since the COVID-19 pandemic. According to Destatis, industrial output dropped 1.9% in June compared to the previous month—far worse than the 0.5% decline economists had forecast in a Reuters poll.

On a quarterly basis, output declined 1.0% in Q2. Compared to June 2024, production was down 3.6%. On Wednesday, it was also revealed that new industrial orders unexpectedly fell by 1% in June—the second consecutive monthly drop, mainly due to weakening foreign demand.

Germany is the worst-performing European economy since Q4 2019 (source: Daniel Kral)

Daniel Kral, Lead Economist at Oxford Economics, noted: “One step forward, two steps back for German industry. With the front-loading of U.S. tariffs now behind us, production in June fell to its lowest post-pandemic level. Government support can’t come soon enough.” He also concluded that, after the revisions, Germany has been the worst-performing economy in Europe since the pandemic.

“Our business model, which carried us for decades, no longer works in its current form. Business conditions have deteriorated dramatically in a short time,” Porsche’s CEO recently wrote to employees. What applies to Porsche can, in many ways, be said of the entire German industrial sector—and thus of the broader German economy.

Yield spread between Italian and German 10-year government bonds (source: Holger Zschaepitz)

Germany’s old growth model—based on cheap Russian gas, an undervalued euro, and strong exports to countries like the U.S. and China—is no longer viable. And a new path to sustainable growth remains elusive. The German government is now attempting to stimulate the economy through increased borrowing. But that risks undermining the country’s last major advantage: its strong creditworthiness and low borrowing costs. Italian government bonds are now trading at just 83 basis points above German bonds, indicating that Germany’s relative funding advantage is slipping away.