9.3

8.064 reviews

English

EN

This article has been automatically translated from Dutch. Click here to see the orginal article including all links to sources.

Readers sometimes ask whether the weekly selection ever focuses specifically on gold. This week, the answer is yes — we dive straight into gold. At the time of writing, the gold price trades around €116,500 per kilo. If that level holds through December, gold investors could be looking at an impressive annual return of well over 40 percent. What are the latest developments in the gold market, and what can we expect for 2026?

This week, the World Gold Council (WGC), the international industry body for the gold sector, released a new update on central bank gold purchases, along with an outlook for the gold market in 2026. Below, we outline the most noteworthy insights.

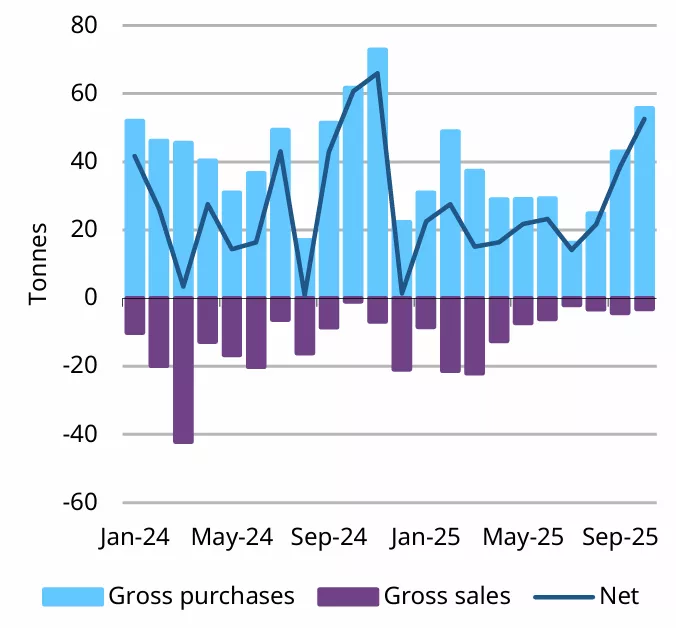

According to the WGC, central banks purchased a net 53 tonnes of gold in October, a 36 percent increase compared to September. The chart below shows that purchases have clearly picked up since the summer.

Development of central bank gold purchases (Source: World Gold Council)

Several important nuances apply here. First, these purchases are being made by a relatively small number of central banks. Second, total net purchases from January through October came to 254 tonnes, which—annualised—is a slower pace than in the previous three years. According to the WGC, this may reflect the steep rise in the gold price. That said, purchases remain well above long-term averages.

Volume of gold purchased by central banks this year slightly lower than previous years (Source: WGC)

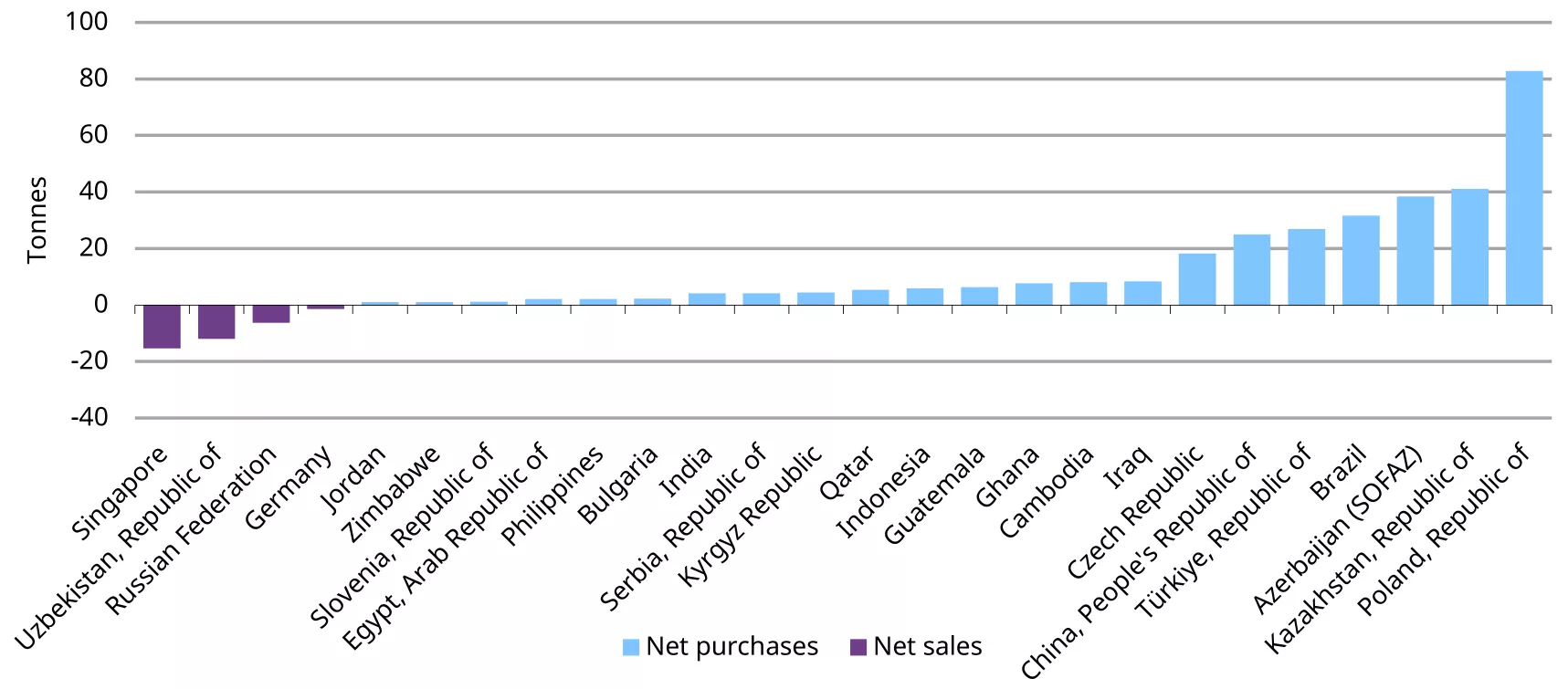

Poland remains the largest buyer of gold. The National Bank of Poland has already purchased 83 tonnes this year. This comes as no surprise: Poland has for years been among the most active buyers. In October last year we wrote that Adam Glapiński, president of the Polish central bank, is aiming for gold to represent 20 percent of Poland’s total reserves.

Overview of central bank purchases from January to end-October 2025 (Source: WGC)

Other notable buyers include Kazakhstan, Azerbaijan, Brazil and Turkey. However, a third and perhaps most important nuance is that WGC figures rely heavily on officially reported purchase data.

China appears in sixth place in the chart, but it is widely acknowledged that actual Chinese purchases are much higher. Gold analyst Jan Nieuwenhuijs—who joined us in our podcast last year—argues that China’s true gold purchases and reserves are significantly higher than officially reported.

That view now also seems to be gaining traction in mainstream media. In November, the Financial Times reported that China’s undisclosed purchases may be more than ten times higher than official figures, noting that China is strategically trying to distance itself from the US dollar. Based on trade flows, analysts at Société Générale estimate that China alone may have accumulated around 250 tonnes this year.

The WGC expects central banks to continue expanding their gold reserves throughout 2026.

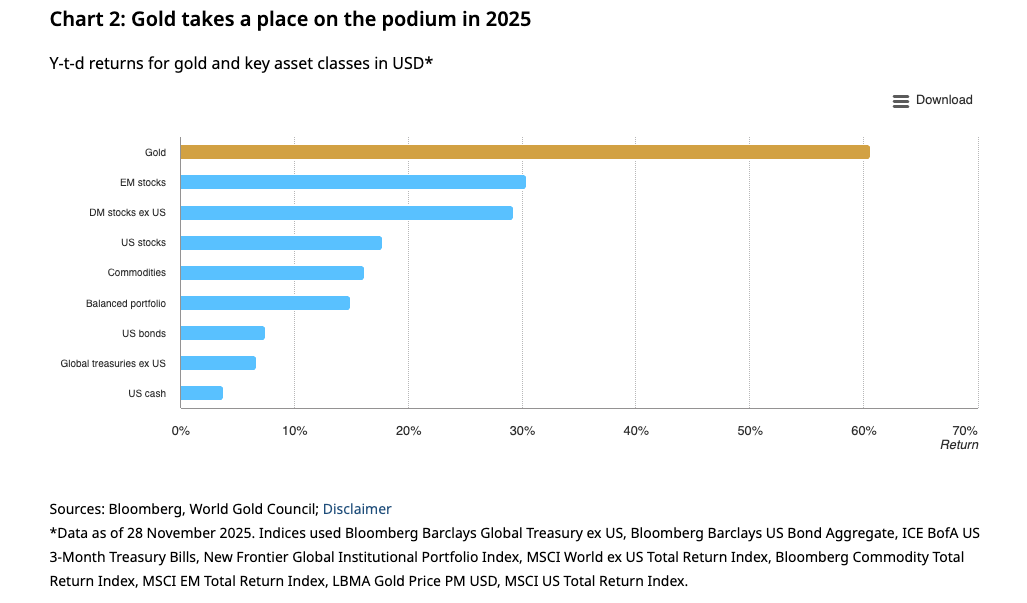

In its outlook, the WGC highlights that gold has delivered a return of more than 60 percent in US dollars, marking the fourth strongest annual performance since 1971. It identifies two macro factors as key drivers: an exceptionally tense geopolitical and geoeconomic environment, and a weaker US dollar combined with slightly lower interest rates. Together with weak government bond performance and high valuations in US equities, this has increased the need for portfolio diversification.

Year-to-date returns across gold and other major asset classes (Source: WGC)

According to the WGC, markets largely expect current conditions to persist into 2026. Meanwhile, uncertainty remains high both economically and geopolitically, including ongoing debates about whether inflation will remain sticky or even reaccelerate.

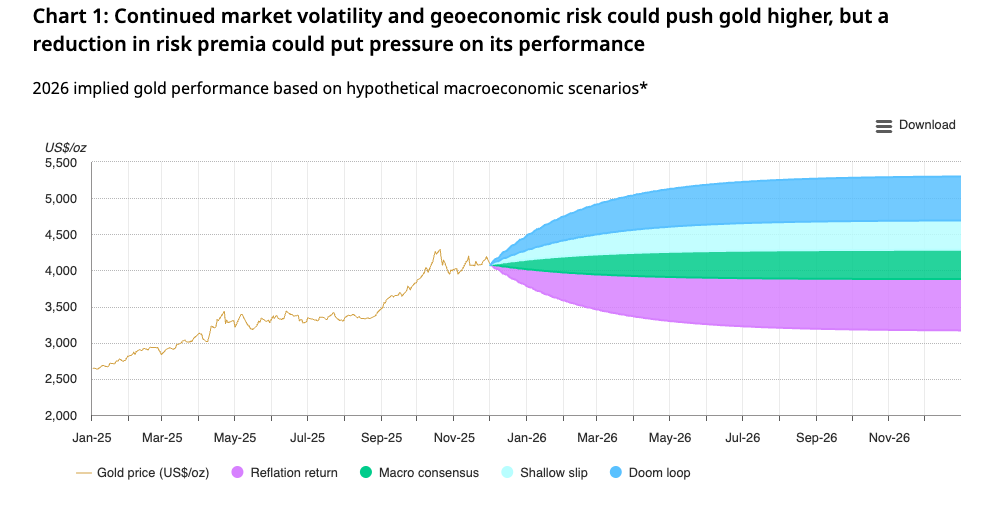

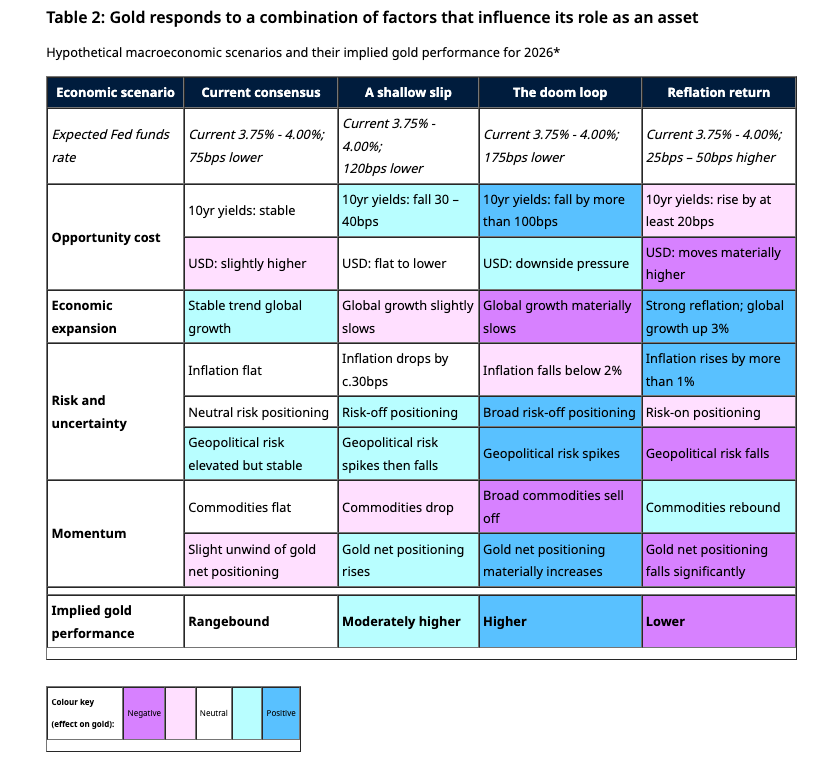

The WGC outlines three possible macro scenarios for gold, in addition to the consensus outlook for growth, inflation and monetary policy. The current gold price already reflects that consensus to a large degree, meaning that little movement is expected if those assumptions materialise. However, as the WGC emphasises, macro-economic developments rarely follow the baseline path markets anticipate.

Overview of scenario outcomes (Source: WGC)

In this scenario, economic growth weakens moderately. Risk appetite declines, and a downward reassessment of AI-related expectations may further weigh on stock markets. Employment softens and consumption weakens. In response, the Federal Reserve would likely cut interest rates more aggressively than currently projected.

The combination of lower rates, a weaker dollar and heightened risk aversion would be favourable for gold. Under this scenario, the gold price could rise by approximately 5–15 percent from current levels.

This scenario is far more bullish for gold, but clearly negative for the global economy. Growth falls sharply due to geopolitical shocks and declining investment. Businesses and consumers hold back spending, creating a downward spiral that reinforces itself.

In this situation, the Fed would likely resort to aggressive rate cuts, pushing bond yields lower and weakening the dollar. Safe-haven demand strengthens considerably, meaning gold could rise by 15–30 percent in 2026.

This is the only scenario in which the WGC expects a decline in gold. Here, growth exceeds expectations, prompting the Fed to keep rates unchanged or even raise them. Long-term yields rise and the dollar strengthens. The opportunity cost of holding gold increases, capital flows out of gold-related assets, and sentiment shifts toward riskier investments.

Under this scenario, the gold price could fall by approximately 5–20 percent from current levels.

Comparison of scenario impacts (Source: WGC)

Overall, the WGC maintains a constructive view on gold and concludes that “factors such as weakening growth, accommodative monetary policy and persistent geopolitical risks are more likely to support gold than undermine it. Furthermore, investment demand—which played a crucial role this year—has not yet been exhausted.” Additional demand from central banks, combined with developments in recycling, could further support the market. According to the WGC, gold’s role as a diversifier and protection against downside risks is more relevant than ever in today’s uncertain world.