9.3

8.064 reviews

English

EN

This article has been automatically translated from Dutch. Click here to see the orginal article including all links to sources.

A jam-packed weekly selection this Friday. In last week's selection, we hinted at it: the new French government has already collapsed after just three months. Additionally, data published this week shows that central banks are once again purchasing significant amounts of gold. October recorded the highest monthly net purchases of 2024. Furthermore, there's a remarkable German article about Milei's "chainsaw," and we are seeing increasing indications that the proverbial tide is turning in energy and climate policy.

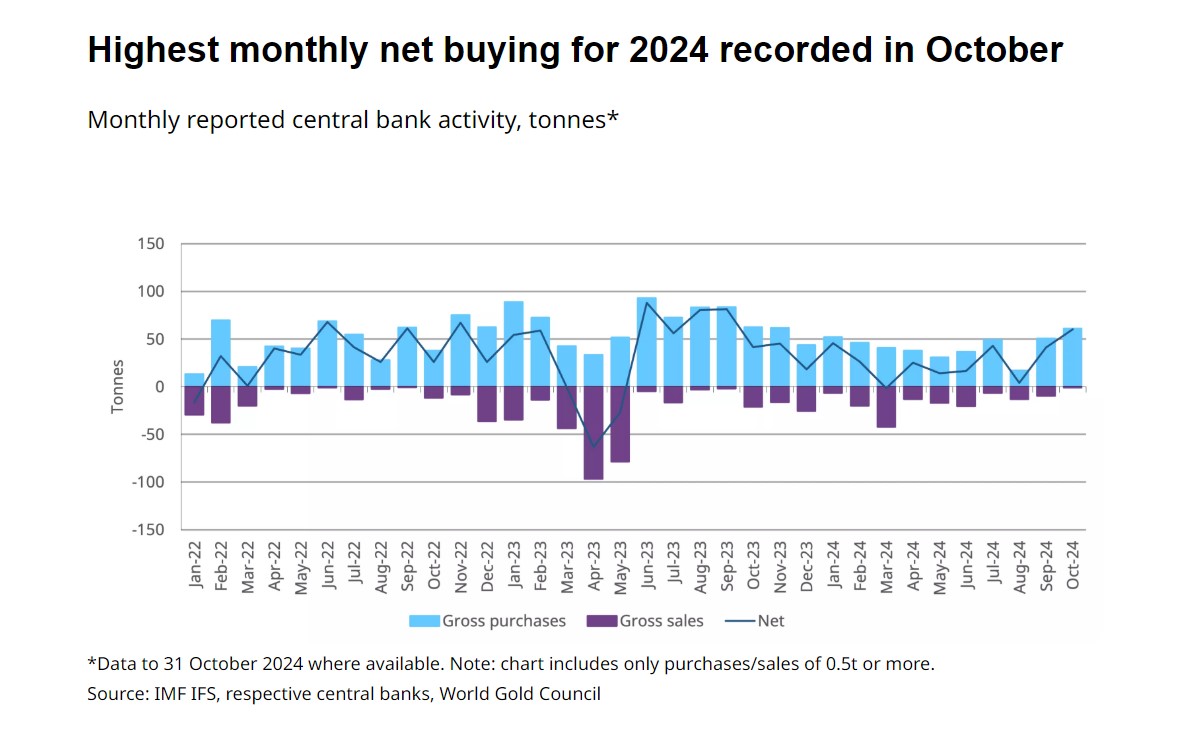

The World Gold Council released new figures this week, and the results are striking. October recorded the highest monthly net gold purchases by central banks in 2024. In total, central banks added a net 60 tons of gold to their reserves. The Reserve Bank of India was the largest gold buyer in October, acquiring 27 tons. The Turkish Central Bank ranked second with 17 tons, followed by the National Bank of Poland, which added 8 tons to its reserves. Poland had previously announced its goal of holding 20% of its reserves in gold.

Gold Purchases by Central Banks (Source: World Gold Council)

Jan Nieuwenhuijs published an article this week titled: “Repatriated Gold Reaches Historic Highs.” In 2024, 78% of the world’s official gold reserves are stored outside the Federal Reserve Bank in New York and the Bank of England in London. This marks a significant increase compared to 1972, when only 51% was stored elsewhere.

According to Jan, this trend reflects a decline in the West's financial dominance and a shift in geopolitical power balances. He estimates that the West currently holds 21,470 tons of gold, while the rest of the world holds 18,643 tons. This share has been rising rapidly in recent years, driven in part by substantial purchases by Asian central banks.

Estimated Global Official Gold Reserves (Source: Money Metals)

Analysts from the Canadian Imperial Bank of Commerce (CIBC) suggest that Donald Trump’s presidency will favor the gold price. “We believe Trump’s imposition of tariffs could lead to retaliatory measures against U.S. exports, causing inflationary pressures that would support the gold price,” the analysts noted. “Historically, gold prices often rise alongside inflation.”

In addition, the Chicago Mercantile Exchange (CME) announced this week that they plan to launch 1-troy-ounce gold futures contracts in mid-January 2025. They noted a growing trend of retail investors seeking smaller gold-related products to diversify their investment portfolios. In their press release, they highlighted that gold is increasingly seen as an essential component of a well-diversified portfolio. According to Jin Hennig, CME’s global head of metals, the 1-ounce contract is “an excellent way to lower the barrier for market participation.”

Finally, for gold enthusiasts: Bloomberg released a 10-minute mini-documentary yesterday on the causes of the massive gold rally. It includes fascinating insights into the Chinese market. Watch the video here.

As a loyal reader of our weekly selection, you likely saw this coming: the French government led by Michel Barnier has collapsed. Last week, we wrote about how financial markets were already bracing for this, as the interest rate on French government debt surpassed that of Greece. Read last week’s article here for a detailed explanation of the situation.

A motion of no confidence against the three-month-old government was passed on Wednesday with support from Marine Le Pen's party. Barnier now goes down in history as the shortest-serving prime minister of the Fifth French Republic.

Michel Barnier (Source: European Parliament)

President Emmanuel Macron must now appoint a new prime minister, as new elections cannot be held until summer. The problems with France's budget are not expected to be resolved anytime soon. In this week’s podcast with Sander Boon, we discussed that neither the left-wing opposition nor Le Pen's right-wing camp is eager to significantly cut social security spending.

Le Pen, in particular, needs the pensioners' vote to win the presidential election. Public spending on French pensions currently accounts for 14.4% of France’s GDP. By comparison, the EU average is 11.9%, while in the Netherlands, it is just 6.1%. Total social security expenditures are also much higher in France, at 32.9%, compared to 23% in the Netherlands. An interesting article on Le Pen’s strategy can be read in the Financial Times here. Expect plenty of drama in the coming months. We’ll keep you updated!

A remarkable article in the leading German newspaper Die Zeit today titled “Die Kettensäge Wirkt” references Javier Milei's chainsaw, which he used as a symbol during his campaign to become president. The chainsaw symbolized his plan to radically downsize the government. He has since been busy implementing his agenda: closing half the ministries, laying off tens of thousands of civil servants, cutting salaries, halting public construction projects, and reducing various other government expenditures.

Argentine Inflation (Source: Die Zeit)

The results are slowly becoming evident: Argentina's rampant inflation has started to slow down. However, poverty levels in Argentina have risen, which Milei addressed. According to him, the statistics do not accurately reflect the situation. Despite criticism of his policies due to these figures, he insists that his reforms are necessary and that Argentina can achieve "living standards comparable to Italy and France" within 15 years.

In this week’s podcast, Sander Boon discusses two potential paths for reform in the West: the Milei-Trump approach or the EU-Draghi approach. The latter, Sander argues, represents a path of more bureaucracy, government intervention, and taxation. It is therefore notable that Milei is now on the radar in Germany, although the initial reception is not very positive. We regularly write about Germany’s problems, such as the 17% drop in industrial production since 2017.

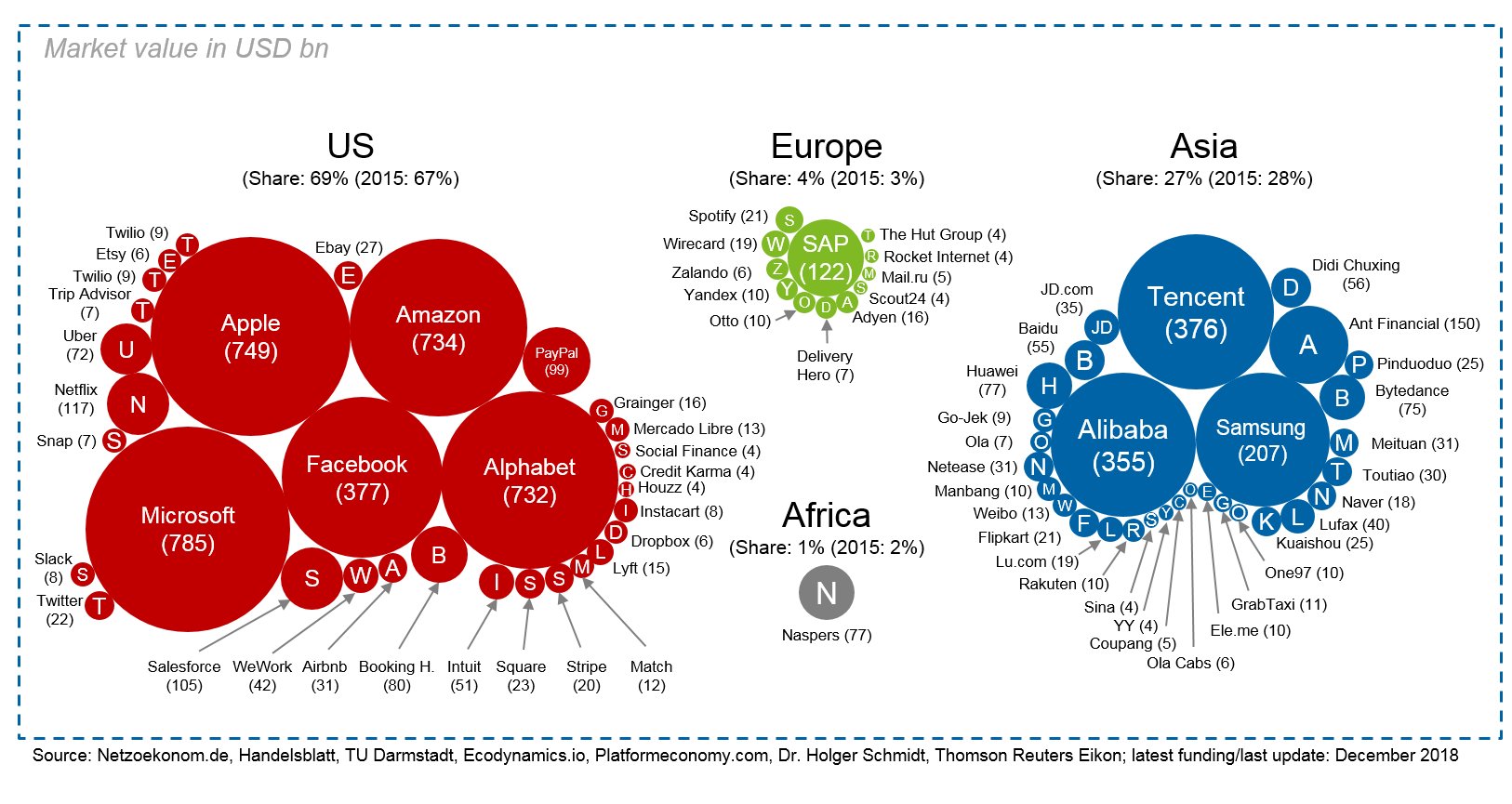

Market Value of Tech Companies in Europe (Source: Alessandro Palombo)

The Argentine example might inspire Germans—and by extension, the rest of Europe—to take a different approach in the coming years. It is becoming increasingly clear that Europe is falling behind.

Overregulation is not the only cause of Europe’s issues. High energy prices are also a growing problem, driven by both the conflict with Russia and self-imposed climate policies. Previously, we noted a possible turning point in climate policy. It is expected that Trump will withdraw from the Paris Climate Agreement. Similarly, the Federal Reserve is not aligning with the ECB on the Basel Climate Plan. Meanwhile, Macron has called for the EU to synchronize its financial regulations with those of the U.S. to support competitiveness.

Advocates of strong climate policies are facing increasing headwinds. This week, the wind shifted even further in the opposite direction. Denmark announced yesterday that it had received no bids in its latest tender for a North Sea wind farm. In April, Denmark launched its largest-ever tender for offshore wind energy, offering no subsidies. Danish offshore wind turbine developer Ørsted stated that it refrained from bidding due to an unfavorable risk-reward balance. Wind energy is a key component of Europe’s ambitious climate plans.

Shell also announced this week that it would halt new investments in offshore wind farms. Reuters cited rising costs, supply chain issues, and higher interest rates as reasons. Dutch MP Suzanne Kröger from GroenLinks responded on X with a tweet: “Shell is the climate problem.” Meanwhile, the Dutch government revealed plans to significantly scale back its climate project.

The tide appears to be turning. In August, we wrote that Dutch manufacturing had already been contracting for a year, partly due to high energy prices. Economists from ESB now argue that energy costs in the Netherlands are becoming too high for steel production. Unsurprisingly, the industry is scaling back its climate initiatives. This week, De Volkskrant reported that the Dutch industry has significantly reduced its plans to go green over the past two years. Perhaps it’s time to take the French solution more seriously?

Saxo Bank: Trump dismantles the dollar system. According to the bank, Trump’s policies could drive the BRICS countries to seek alternatives to the dollar. A recent statement from the Kremlin appears to confirm this.