9.3

8.064 reviews

English

EN

In this week's selection, we take a look at Nvidia. How can the share price fall despite massive revenue growth? We also see that Berkshire, Warren Buffett's company, has reached a major milestone while still in the process of selling stakes in other companies. In addition, we look at newly published figures on the Dutch economy: the Netherlands is the 3rd largest exporter in the EU, producer confidence seems to be improving somewhat and inflation figures are in. Finally, an article was published in the Financial Times this week entitled: 'This gold rush has staying power'.

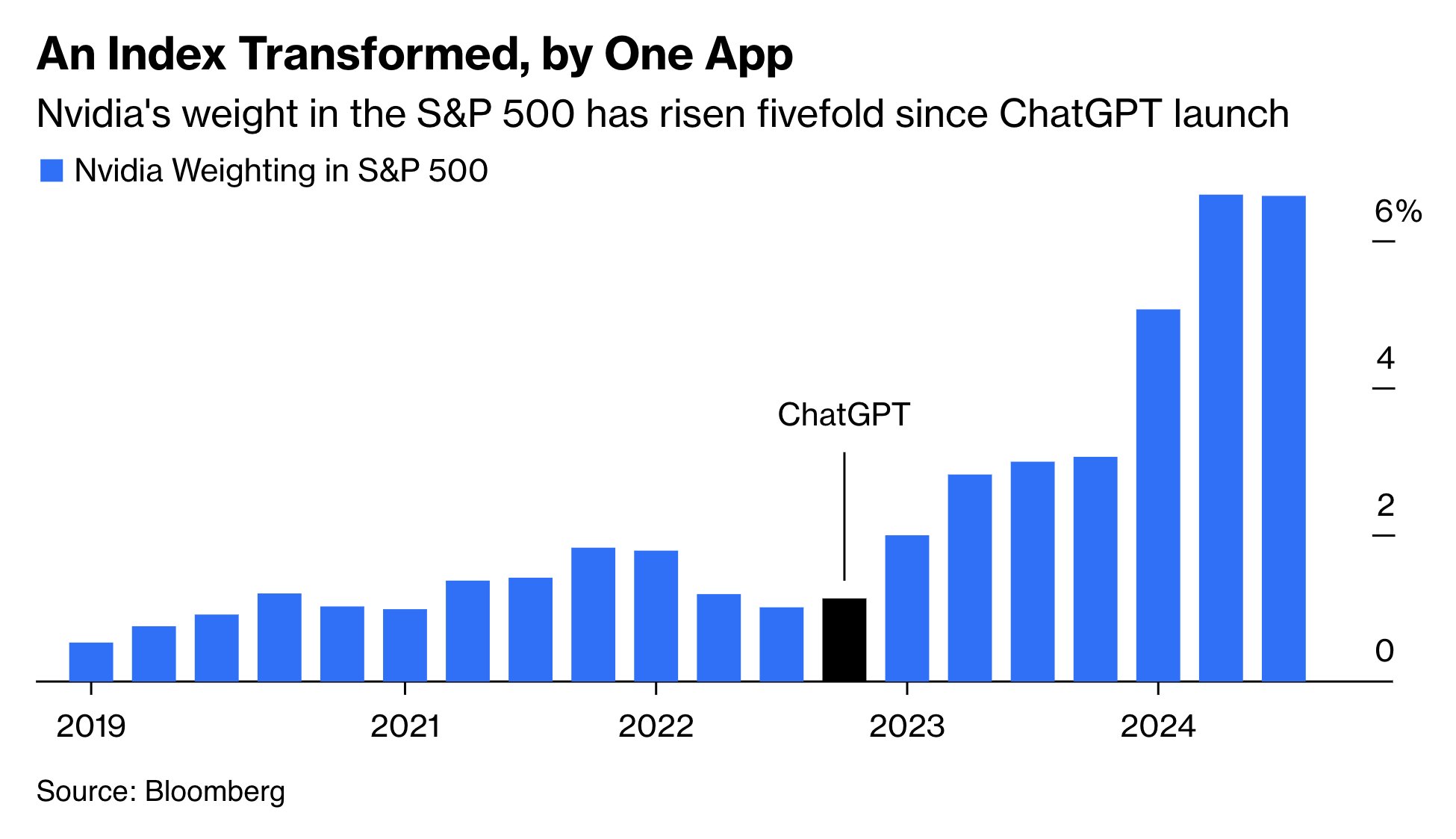

AI tech giant Nvidia published impressive new quarterly results this week. The Quarterly turnover increased by 122% from last year, to $30 billion. A whopping $16.6 billion of this was profit, which translates to 67 cents per share. This is more than double from the $6.18 billion, or 25 cents per share, in the same period last year. In addition, Nvidia announced a $50 billion share buyback program.

Apparently, this wasn't impressive enough because the share price dropped by 8% after publication of the figures. Investors have become accustomed to Nvidia consistently exceeding expectations, which is why even impressive results sometimes lead to disappointment in the stock market. "It seems like the bar was set just a little too high this earnings season," said Ryan Detrick, chief market strategist at Carson Group. "Death, taxes, and Nvidia exceeding expectations are the three certainties in life... Even the Expectations for the future have been increased, but not to the same extent as in previous quarters," Detrick said.

Nvidia as a percentage of the S&P 500 (source: Bloomberg)

Nvidia as a percentage of the S&P 500 (source: Bloomberg)

The spectacular growth of recent times seems to be slowing down a bit. There are some concerns about Blackwell chip supply delays and the 122% revenue growth is a lot lower than the three consecutive periods of year-on-year growth of more than 200%. The Net Profit Margin decreased slightly from 57% in the first quarter to 55% in the second quarter. This is the first decline in profit margin since the second quarter of 2022. We Wrote rather, that achieving large earnings growth rates is crucial for stocks like Nvidia, but that there is ultimately a limit. A striking detail is that before the publication of the figures, the CEO of the company $128 million of shares.

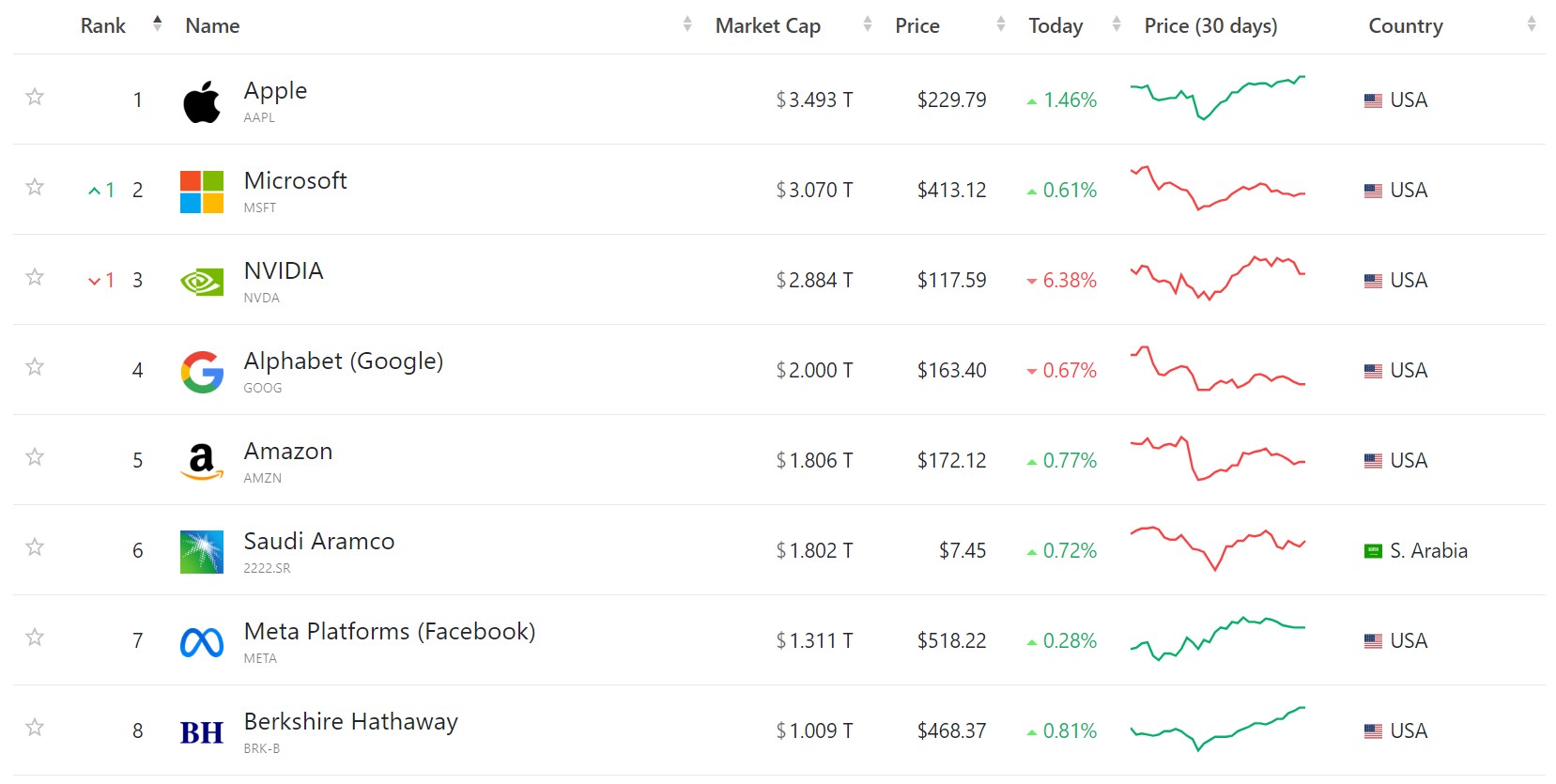

Berkshire Hathaway has a Milestone reached. Berkshire, which has been led by Warren Buffett since 1965, is the first U.S. non-technology company to be worth more than $1 trillion. The company's stock price has already risen by more than 29 percent in 2024.

List of largest companies by market capitalization (source: CompaniesMarketCap)

Over the past few months, Buffett has been billion dollars of Bank of America shares. Despite this, he still owns 12% of the bank's shares, making him the largest shareholder. Buffett never discusses why he is buying or selling certain stocks while doing so, and he has not provided any explanation for the sale of the Bank of America stock. Buffett followers suspect that the recent selling points to his belief that the market is overvalued, and that he is preparing for a downward move. At the beginning of August, we already wrote that he would take half of his stake in Apple has sold and now owns $277 billion in cash and T-bills. There was one share that Berkshire continued to buy. In the recent quarter, Buffett approved the repurchase of $345 million of treasury shares.

Buffett isn't the only one with a lot of 'dry powder'. Recently we read that the largest private equity firms $722 billion ready to invest. These companies don't seem to expect an immediate downward movement, if you can go by their comments in the article. They are preparing for a wave of new deals, partly due to the expectation that central banks will cut interest rates. This renewed enthusiasm comes after a period in which dealmaking came to a halt due to higher interest rates and a cautious market.

Dry Powder PE (source: Bloomberg)

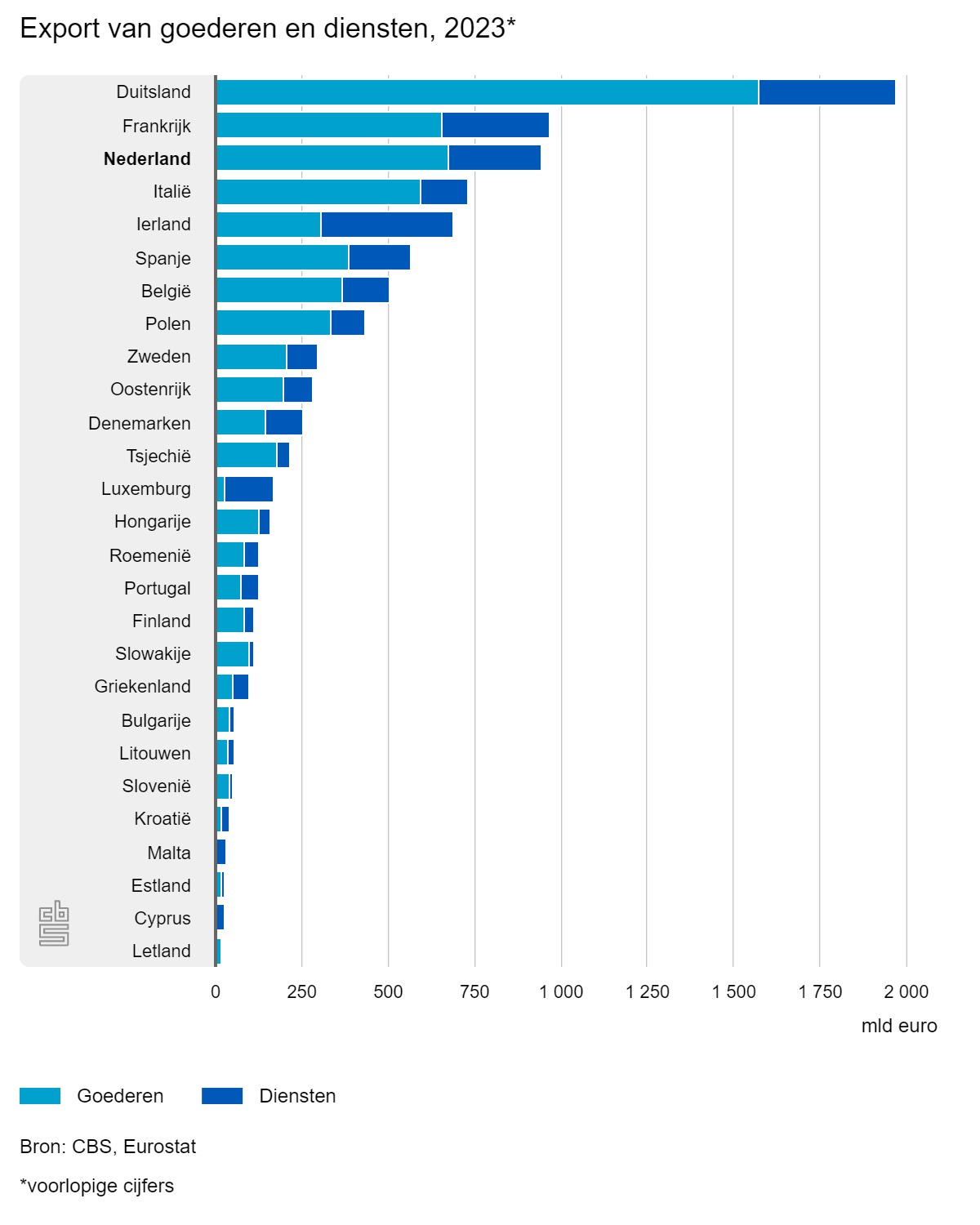

It CBS published the Dutch export figures this week. In 2023, the Netherlands was the third-largest exporter in the EU. Last year, the Netherlands exported €945 billion worth of goods and services, only €22 billion less than France. After Germany, the Netherlands is the EU's largest exporter of goods.

The Netherlands exports more than it imports, which makes a positive contribution to GDP. Important pillars of exports are business services, chemical and pharmaceutical products, food, beverages and tobacco, and machinery and electrical equipment. Transit accounts for more than 37 percent of total exports of goods and services. Exports of services have risen from nearly 15 percent since 2000 to more than 25 percent of GDP in 2023.

EU export figures (source: CBS)

The Dutch Producer confidence improved in August compared to July. The figure went from -2.7 in July to -1.9 in August. This is still below the 20-year average of -1.3. In August, Dutch manufacturers were less negative about their order position and more positive about their expected output in the next three months. Earlier this month, we wrote that the production of the Dutch manufacturing industry has already year due to the deteriorating competitive position since the war in Ukraine.

Producer confidence in the Dutch manufacturing industry (source: CBS)

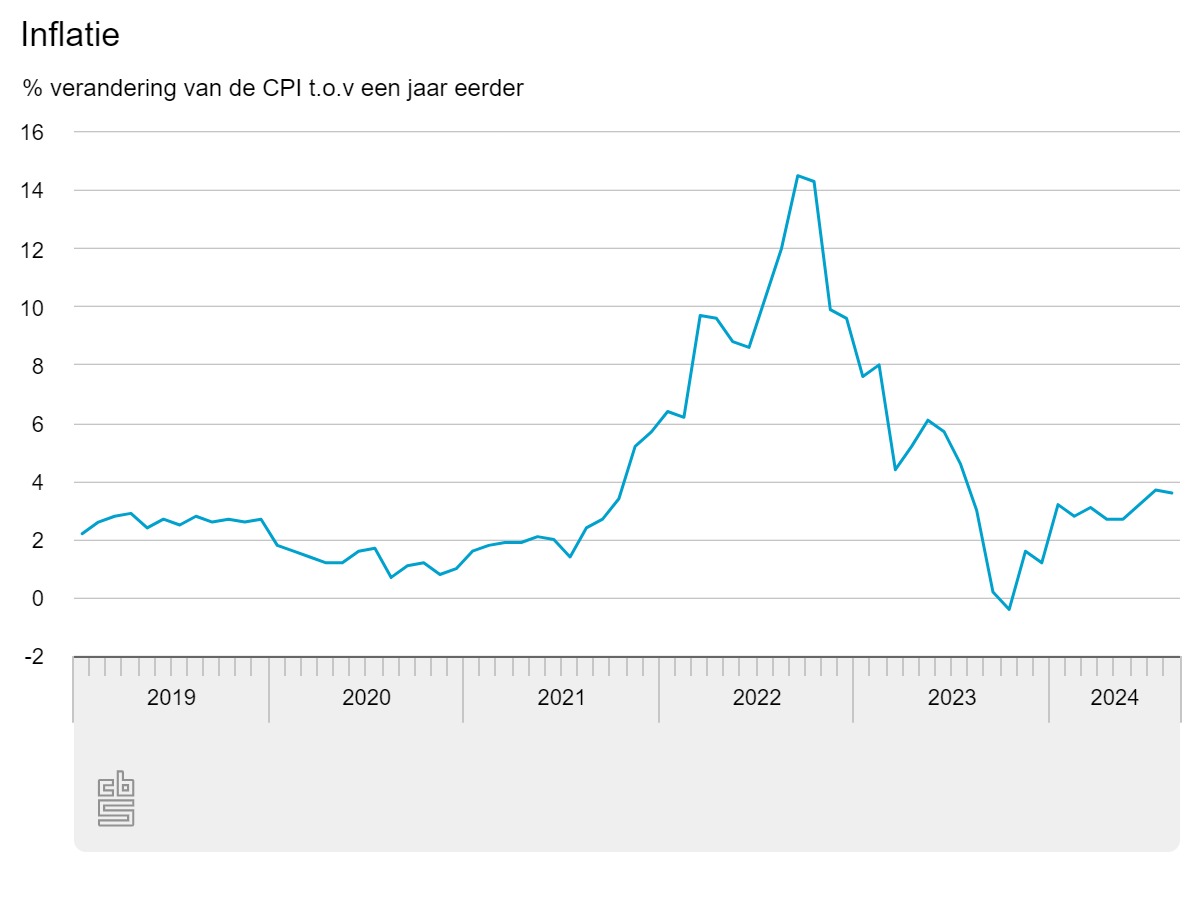

It is clear from the today Published flash estimate shows that inflation was 3.6 percent in August compared to August 2023, down from 3.7 percent in July. Prices in the categories services and food, beverages and tobacco rose the most, by more than 5.5 percent. The Dutch inflation rate is higher than that of the eurozone, possibly due to the relatively large services sector.

It inflation rate in the euro area fell to a three-year low of 2.2% in August and the German numeral surprisingly dropped to 2%. With these figures, the market now expects that the ECB cut rates by 25 basis points in September and again before the end of the year. This is despite the fact that core inflation does not want to fall below 2.5%. Eurozone inflation in the services sector has reached its highest level since October at 4.2%.

Inflation in the Netherlands (source: CBS)

Last week we saw a New record for the price of gold. This week, the Financial Times that there is a structural tailwind to the demand for gold that is independent of everything else that happens in the financial system. They point to the freezing of Russia's central bank reserves in 2022 as a crucial factor. This has strengthened the drive in major emerging economies to detach dependence on the dollar. In addition, they mention the fact that Central Banks bought 483 tonnes of gold in the first half of this year, the historic Positive effect lower interest rates on the price of gold and the rotation to gold and Rising demand investors. As a regular reader of Holland Gold, you were of course already aware of this!

(Photo: Stuart Isett/Fortune Live Media)

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink interviews various economists and experts in the macroeconomic field. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.