9.3

8.064 reviews

English

EN

This article has been automatically translated from Dutch. Click here to see the orginal article including all links to sources.

This week brought yet more clear signs that pressure on the eurozone continues to build. The ECB warns that the Dutch pension reform is putting additional strain on the sustainability of government debt across Europe — but what is the real underlying problem? And more importantly: what is the possible way out? Meanwhile, a sudden halt in COMEX trading today triggered a wave of speculation and rumors surrounding silver. Read on!

The ECB fears an imminent sell-off of government bonds by Dutch pension funds as a result of the pension reform. Dutch funds are among the most important buyers of European sovereign debt. Around 65 percent of all government bond positions held by pension funds in the eurozone are in Dutch hands.

Under the new system, pension contributions are fixed and the final pension depends on contributions and returns. Because funds no longer need to align their portfolios with fixed benefit obligations, they can invest in riskier assets, reducing their need for very long-dated bonds, the FD explains.

European governments, as loyal readers already know, are already struggling with substantial budget deficits — yet plan to spend even more in the coming years, including on defense and climate policy. According to the ECB, falling demand from Dutch pension funds for long-dated government bonds may lead investors to buy new issuances only if yields are higher or maturities shorter. This would push interest costs further up, which — combined with weak economic growth — puts the sustainability of government debt under additional pressure.

In our podcast with Han de Jong, we already discussed that the sale of French government bonds by Dutch pension funds could cause serious problems for France.

European yield curves are steepening, including in Germany (Source: Holger Zschaepitz)

The ECB notes that market expectations of higher government financing needs have already led to a steeper yield curve. The yield curve is a chart showing how interest rates on government bonds vary with maturity, from short-term to long-term.

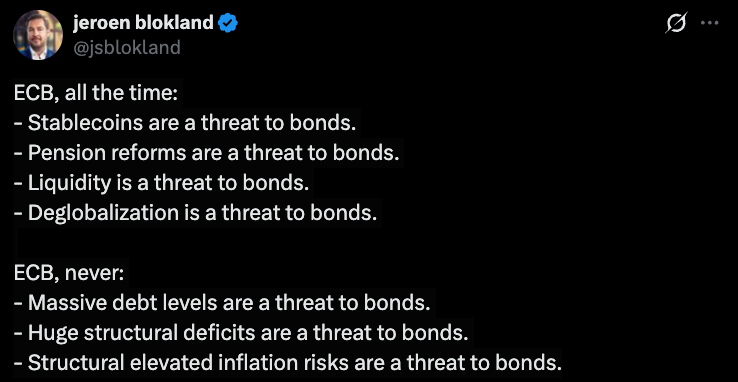

But what is truly the biggest threat to sovereign bonds? And does the pension reform not simply expose a much deeper underlying problem? According to Jeroen Blokland, the ECB is focusing far too much on the wrong factors. It warns about things like stablecoins and the Dutch pension reform — but far less about the real risks weighing on bond markets: massive debt levels, structurally high deficits, and persistent inflationary pressures.

This week, however, the European Commission did issue a warning on exactly these issues. According to Brussels, rising deficits and debt levels in the eurozone constitute “sustainability risks.”

The Commission states that the 2026 budgets of both the Netherlands and Malta do not comply with EU fiscal rules, including the 3 percent deficit ceiling. The Netherlands has a debt ratio of around 44 percent and Malta 46 percent — far lower than countries such as Spain, Italy, and France, all of which exceed 100 percent. Unsurprisingly, this conclusion did not go down well with many.

Finland is also being placed under the excessive deficit procedure, while Italy is allowed to exit it. Robin Brooks commented: “We’re now in the bizarre situation where Finland — which is spending heavily to support Ukraine — ends up in the excessive deficit procedure, while Italy — which barely contributes at all — gets to leave. This makes no sense…”

Support for Ukraine vs. Economy Size (Source: Robin Brooks)

The chart above shows that Finland, with a much smaller economy, contributes more support to Ukraine than Italy or Spain. Brooks argues that punishing countries that support Ukraine in what he considers an existential threat to Europe, while rewarding countries like Italy and Spain that contribute almost nothing, is entirely illogical.

The influential economist has previously called the end of the euro an economic necessity. He argued that Europe would be stronger without the euro and better able to face external threats. This week he went even further:

“The euro has become a defense mechanism for high-debt countries. The threat of a breakup would end this debt illusion and force countries to tax their abundant private wealth.”

Median Household Wealth in Europe (Source: Robin Brooks)

He refers to the fact that median household wealth in southern countries with high levels of government debt is actually higher than in Germany, where public finances are in order. Jort Kelder pointed this out earlier in our podcast, saying: “The Italians have more savings per capita than we do. Why exactly are we subsidizing them? Can someone explain this to me?” Kelder argued that Italians simply need to start paying taxes — there is more than enough private wealth.

According to Brooks, it is now clear that countries like Italy are unwilling to do this as long as they can lean on Germany and the Netherlands. That’s why he sticks to his solution: Germany must leave the eurozone, or at least credibly threaten to do so.

This could spell the end of the euro. Brooks acknowledges this would be painful, but says it would bring important advantages. It would force debt write-downs in Italy and Spain, creating the fiscal space needed to deal with external threats such as Russia and China. Southern European politicians would once again be held accountable by the markets — the only true judge of debt sustainability. And the frustrations surrounding the euro would finally disappear from the list of grievances of populists in both high- and low-debt countries.

Naturally, we will continue to follow developments in the eurozone for you. To be continued!

A remarkable message this morning: trading in futures and options on the Chicago Mercantile Exchange (CME) was halted. “Due to a cooling issue at the CyrusOne data centers, our markets are currently halted,” CME Group wrote on X. Exchanges under CME include the Chicago Board of Trade, the New York Mercantile Exchange, and the Commodity Exchange (COMEX). Unsurprisingly, COMEX was the main target of speculation on social media.

Historic Silver Breakout (Source: Otavio Costa)

COMEX is the U.S. exchange for metal futures and options, including gold and silver. Many accounts on X speculated that the real cause of the halt was tied to the rapidly rising silver price and a possible physical shortage. Yesterday we already noted that physical silver inventories at COMEX had fallen to their lowest level since March. That the outage occurred just as silver hit a new all-time high provided extra fuel for the rumor mill.

Willem Middelkoop questions the outage (Source: X)

Not everyone bought into the speculation. Ole Hansen of Saxo Bank wrote:

“The silver-conspiracy theorists are having the day of their lives. They claim CME, scared of a thin order book, shut down the entire platform to prevent a breakout. Needless to say: complete nonsense.”

Trading in silver futures resumed Friday afternoon. Silver broke another price record shortly thereafter and is now trading at around €1,516 per kilo at the time of writing. Who is right? That’s for you to decide.