9.3

8.064 reviews

English

EN

A further opening of the capital market in China could be unfavorable for gold, according to Reuters. China's gold market is the largest in the world, but that may change if Chinese investors gain access to global financial markets in the future.

The latest five-year plan states that China wants to open up its capital market further, which means that Chinese people will be able to buy foreign stocks and bonds more easily in the future than they do now. Investors will therefore have many more opportunities to invest their money and that may mean that they will buy less gold in the future than they do now.

At the moment, retail investors in China are still facing capital restrictions, which prevent them from investing directly in foreign stock and bond markets. However, they can be Buy gold, as long as they do not export the precious metal abroad.

"One of the arguments you often hear about why Chinese people buy a relatively large amount of gold is that they have almost no access to alternatives to invest in. That's because they don't have access to the international capital market."ICBC Standard Bank strategist Tom Kendall told Reuters.

"A relaxation of capital restrictions could result in a lot of gold flowing out of the country. It could have a very detrimental effect on domestic demand for the precious metal", he added. According to him, the large import of gold in relation to exports is also largely attributable to the capital restrictions.

China is the world's largest market for physical gold and accounted for one-fifth of global demand for gold in 2014, according to the World Gold Council. Gold bars and gold coins. The demand for the precious metal is so high that Chinese gold mines continue to increase their production year after year. With a gold mine production of 420 tons last year, China is also the largest gold producer in the world.

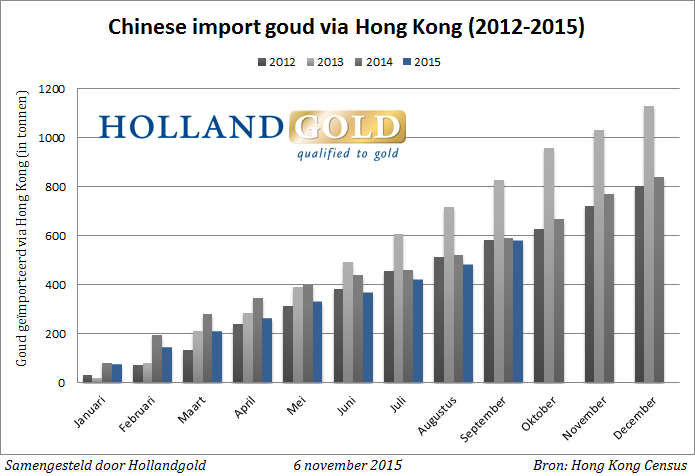

China imported a record volume of 1,158.16 tonnes of gold via Hong Kong in 2013. In 2014, a further 813.13 tonnes of gold were imported and it is expected that a similar amount of gold will be brought to mainland China via Hong Kong this year.

"Gold currently has a very unique position in the investment opportunities of Chinese citizens. That's going to change, but we don't know how soon that will happen. In the long run, these are not favorable conditions for gold," Philip Klapwijk, an analyst at Precious Metals Insights, told Reuters.

Chinese gold imports via Hong Kong