9.3

8.064 reviews

English

EN

The new Affordable Rent Act promises lower rents, but at the same time causes a huge sell-off among landlords. The government wants to make rents more affordable, but investors fear for their returns and are considering selling their properties. At Holland Gold, we are conducting more and more consultations with real estate investors who want to convert their apartments into gold. What's wrong?

The Affordable Rent Act, the new rent law of outgoing minister Hugo de Jonge, was adopted at the end of April and can enter into force after approval by the Senate. With the new law, the government wants to make rents affordable again. They expect that this regulation of rents will reduce the rent of 300,000 homes by an average of 190 euros in the long term.

Economists agree that price controls such as a rent cap should be Counter-productive work. Prices are just a manifestation of reality. There are no shortages in the free market in the long term. When there is a high demand for something and a shortage occurs, prices rise, which then leads to an increase in supply. The higher rents result in more rental properties, which in turn brings rents down. However, a government can disrupt this process with permits, regulations, high requirements, and price controls.

Setting a maximum rent is therefore no more than symptom control and can even make the problem worse. It does not solve the cause of the problem, but it does bring all kinds of negative effects such as Inefficiencies and shortages. The well-known economist Milton Friedman criticized a price cap in a essay in 1946 and warned that they would lead to the "arbitrary and arbitrary allocation of space, inefficient use of space, and delay of new construction". The only sustainable way for tenants to get a better deal is for cities to issue more building permits and increase housing supply.

According to Fair Rent Foundation, an organization that represents landlords, more than 60 percent of rental homes in the four major cities would become unprofitable if the Affordable Rent Act comes into force. A house that currently costs 1500 euros per month would only be allowed to be rented out for 1100 euros due to the new points system. This leads to a situation where landlords have to commit money, which is obviously unsustainable. 83% of the members of this organization, who collectively own 6 billion euros worth of rental properties, are considering selling rental properties in the major cities. These homes will then be put on the owner-occupied market and will be withdrawn from the rental market.

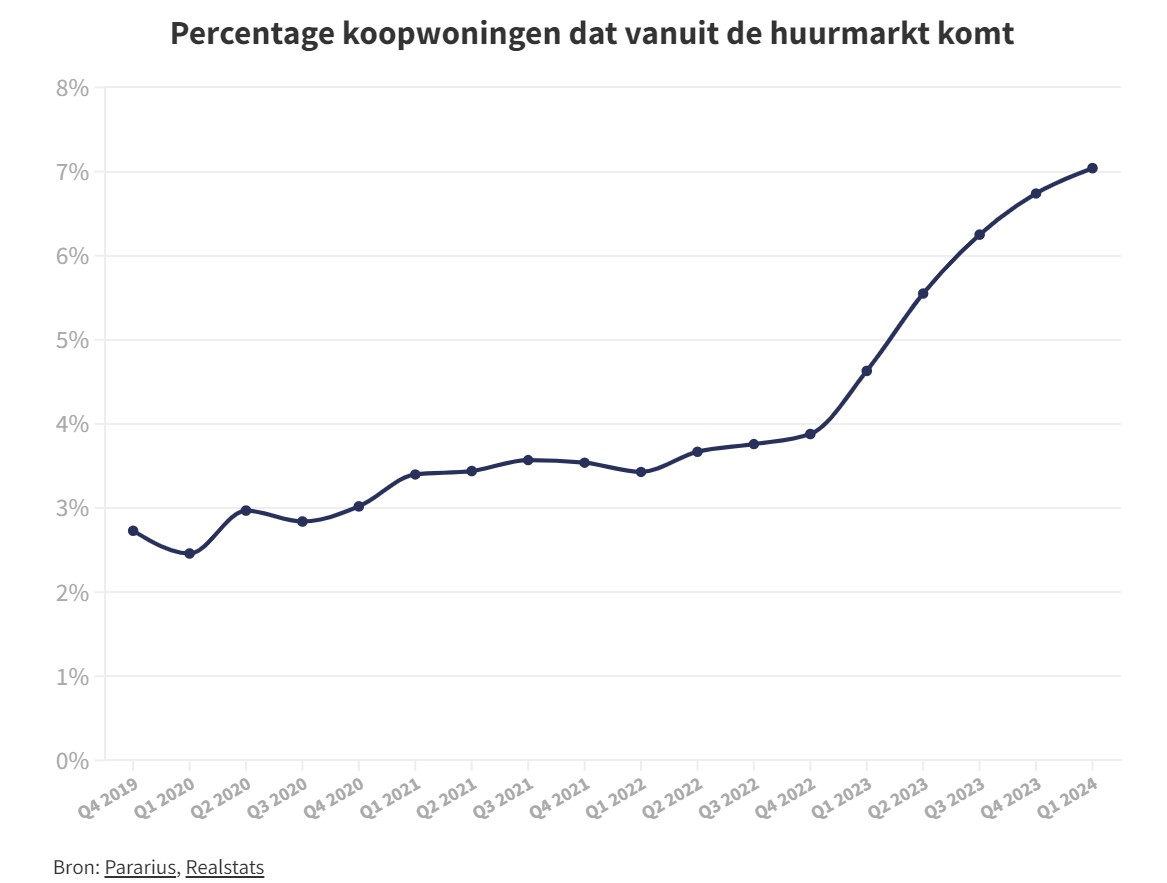

Percentage of owner-occupied homes coming from the rental market (source: Pararius)

Many landlords are not waiting for the new law. The shift from rental properties to the owner-occupied market is already clearly noticeable. According to Pararius the percentage of owner-occupied homes from the rental market rose to 7 percent in the first quarter of 2024. This means that 7 percent of all homes on the market in the first quarter were former rental homes.

According to Jasper de Groot, director of Pararius, this development limits the options for people who fall outside the owner-occupied market and hinders their personal development. It is also not the case that owner-occupied homes will become much cheaper as a result. The owner-occupied market is no less than 8 times larger than the private sector rental market; A shift from rent to purchase has a much greater negative effect on the rental market than the marginal positive effect on the - much larger - owner-occupied market.

An important question that this raises is what residential investors do with the capital they would otherwise invest in real estate. At Holland Gold, we are conducting more and more consultations with real estate investors who want to rent their apartments. want to convert it into gold. "Professional investors like certainty. Unclear policy from the government means that investing in real estate no longer offers this certainty. As a result, we notice that more and more people are turning to precious metals," says Paul Buitink, director of Holland Gold.

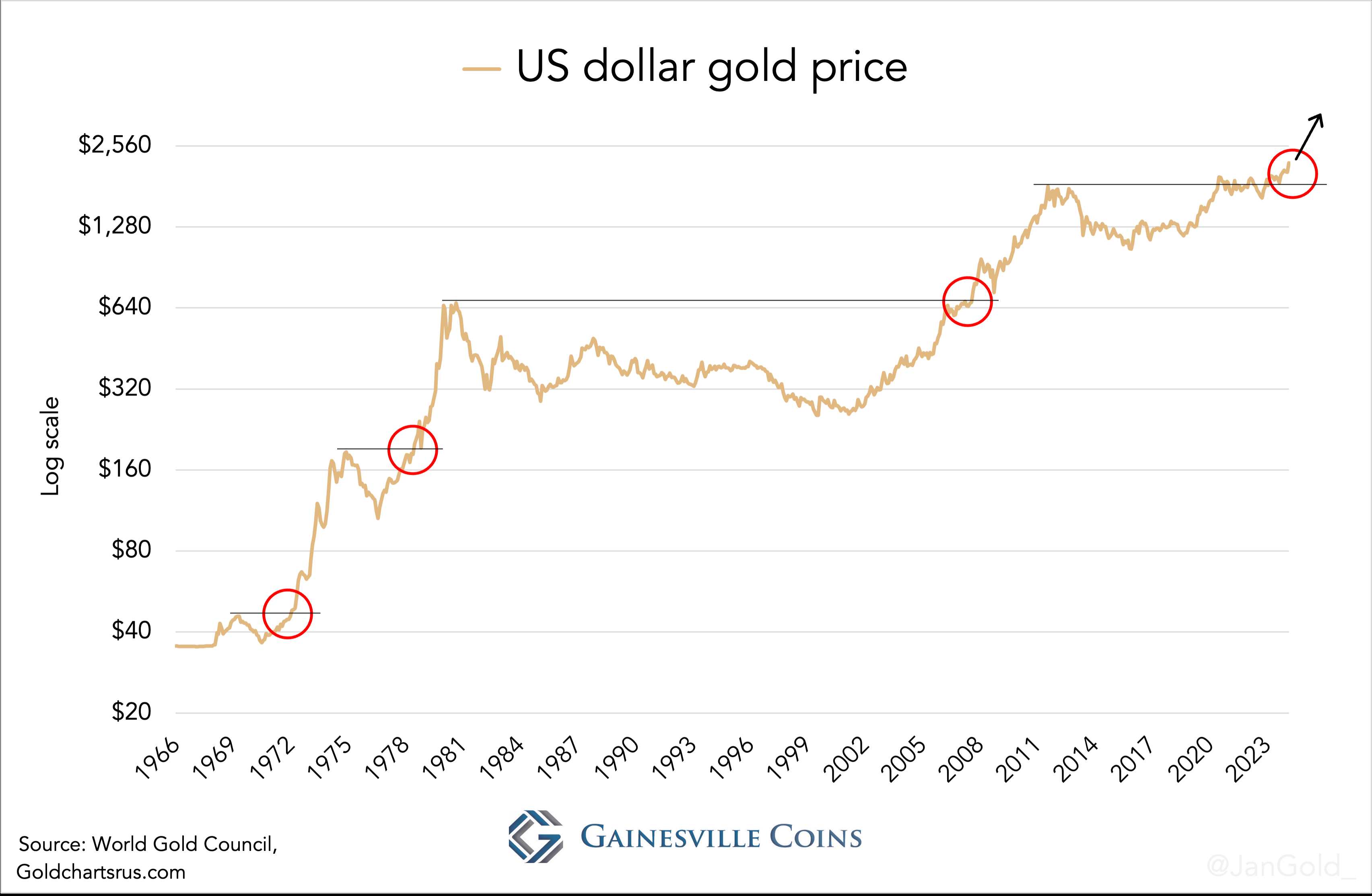

There is a good reason why these investors are looking at gold. The Gold price has risen by nearly 20 percent since the beginning of this year and has reached new record highs. This impressive increase is due to the Various factors that undermine confidence in the money system and geopolitical stability. Central banks, particularly in countries such as China and India, are increasing their gold reserves to reduce dependence on the US dollar, putting a floor under the price of gold. Also, well-known investors such as Ray Dalio Gold as a safe haven in times of high debt, economic uncertainty and inflation.

US Dollar Gold Price (source: Gainesville Coins)

US Dollar Gold Price (source: Gainesville Coins)

Technical analysis point out that gold price has broken through a multi-year resistance zone. In addition, long-term indicators show that gold is undervalued. This suggests that we are at the beginning of a prolonged bull market for gold. The market value of gold could potentially be double.

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink interviews various economists and experts in the macroeconomic field. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.