9.3

8.064 reviews

English

EN

Gold miners' production costs rose to an average of $1,123 per troy ounce in the third quarter, the highest level since 2013. According to the World Gold Council costs increased by 4% quarter-on-quarter. Compared to the same period last year, the cost of gold mining even increased by 16%. This increase is largely attributable to higher energy prices, because it takes a lot of energy to extract gold from the ground. In addition to higher energy bills, the gold mines also spent more money on personnel costs. Shortages in the labour market and corona restrictions are further pushing up wage costs.

The production costs of the gold mining sector are usually expressed as all in sustaining cash costs (AISC). This definition does not only include the cost of gold mining itself (cash costs), but also ancillary costs such as exploration and depreciation. This broader definition therefore also includes all the costs that gold mines incur in order to remain operational in the long term. These costs have been rising for five quarters in a row now, but despite this, it remains lucrative to win gold. One advantage for the sector is that the local currency has depreciated against the dollar in many gold-producing countries. As a result, the yield of the precious metal converted to the local currency is higher.

Gold mining production costs (AISC) to highest level since 2013 (Source: World Gold Council)

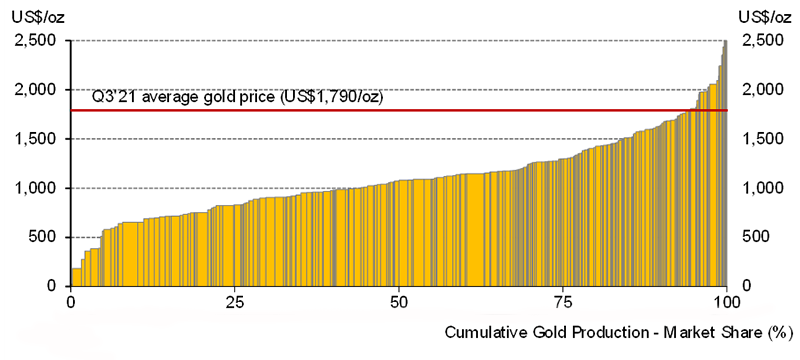

Due to higher production costs, the profit margin of the gold mining sector is lower, but it is still very profitable to extract gold. The graph below shows the net yield of the gold mines. This is the average Gold price in a quarter minus the average cost of production during the same period. This profit margin was the highest in the third quarter of 2020, when the gold price rose to a record high. The gold price is now somewhat lower, which lowered the net profit margin in the third quarter to $667 per troy ounce. That was a 9% decrease from the previous quarter and the lowest level since the first quarter of 2020.

If we look at the longer term, we see that the profit margin is still very healthy. At $667 per troy ounce, the margin is still twice as high as the average yield in 2014 and 2015. As the last graph shows, only 6% of the total global gold mine production is no longer profitable at the current cost of production. The costs of this small group of gold mines in the third quarter were higher than the average gold price of $1,790 per troy ounce.

The fact that the profitability of the gold mining sector has fallen somewhat is also evident from the share prices. The GDX, an index of major gold mining companies, is currently trading at $30.69 almost a third lower than the record of $42.94 set in early August last year. The index of junior gold mining stocks, GDXJ, are also down nearly a third from last year's peak of $60.95 at $40.92. In comparison, the price of gold has only fallen by 14% from its high in August last year, from $2,070 to $1,780 per troy ounce. The downside risk of physical gold was therefore half that of gold mining stocks.

Net profit margin gold mining sector decreasing, but is still at a high level (Source: World Gold Council)

Gold mining sector cost curve shows that most gold mines are still very profitable (Source: World Gold Council)

Gold mining sector cost curve shows that most gold mines are still very profitable (Source: World Gold Council)

This contribution comes from Geotrendlines