9.3

8.064 reviews

English

EN

Inflation has risen to record highs due to the war in Ukraine. Savers are concerned about the purchasing power of their savings and therefore decide more often buy gold. In the long term, the precious metal has proven to retain its purchasing power. That's one of the main reasons to buy gold. But is it also a good hedge against inflation?

There are several reasons to buy gold. It is a tangible form of wealth, which you can keep outside the financial system. You don't have to rely on a bank, broker, or mutual fund to access your assets. It is therefore a form of capital that does not pose any counterparty risk. That is why the precious metal is especially popular in times of crisis.

Another reason to own gold is that it has a negative correlation with stocks. By this we mean that the price of the precious metal generally rises at times when stock prices fall sharply. This means that you can also use gold to reduce the downside risk of your investment portfolio. According to research of the World Gold Council, gold made a positive contribution to returns during several stock market crashes.

Negative correlation of gold in times of crisis (Source: World Gold Council)

It can also be interesting to buy gold for returns. Since 1971, the price of gold has risen by an average of Up 8.1% year-over-year. By comparison, during this period, the money supply in the United States increased by an average of 7.1% per year. The chart below shows that money growth and gold prices are moving in the same direction in the long run. And that seems like a logical connection, because if more money comes into circulation, you might expect the price of a scarce commodity like gold to increase as well.

Gold vs. money supply (Source: St. Louis Fed)

From a historical perspective, we can also substantiate that gold is able to maintain its purchasing power in the long term. A hundred years ago, one could buy a luxury tailor-made suit for a troy ounce of gold. Today, that is still possible. You can also buy oil with gold for decades at a price of between ten and thirty barrels of oil per troy ounce of gold. This is despite the fact that the major currencies have lost almost all their purchasing power over the past hundred years, as the graph below shows. In that respect, gold is a better means of preserving purchasing power than money.

Value of currency versus gold (Source: World Gold Council)

When you hear or read about inflation in the newspaper or on television, you usually mean the increase in the price of a basket of goods or services. Just like the price of gold, inflation also has a very erratic course, which depends on a large number of external factors. There are some examples from history where inflation and the price of gold do not move in the same direction.

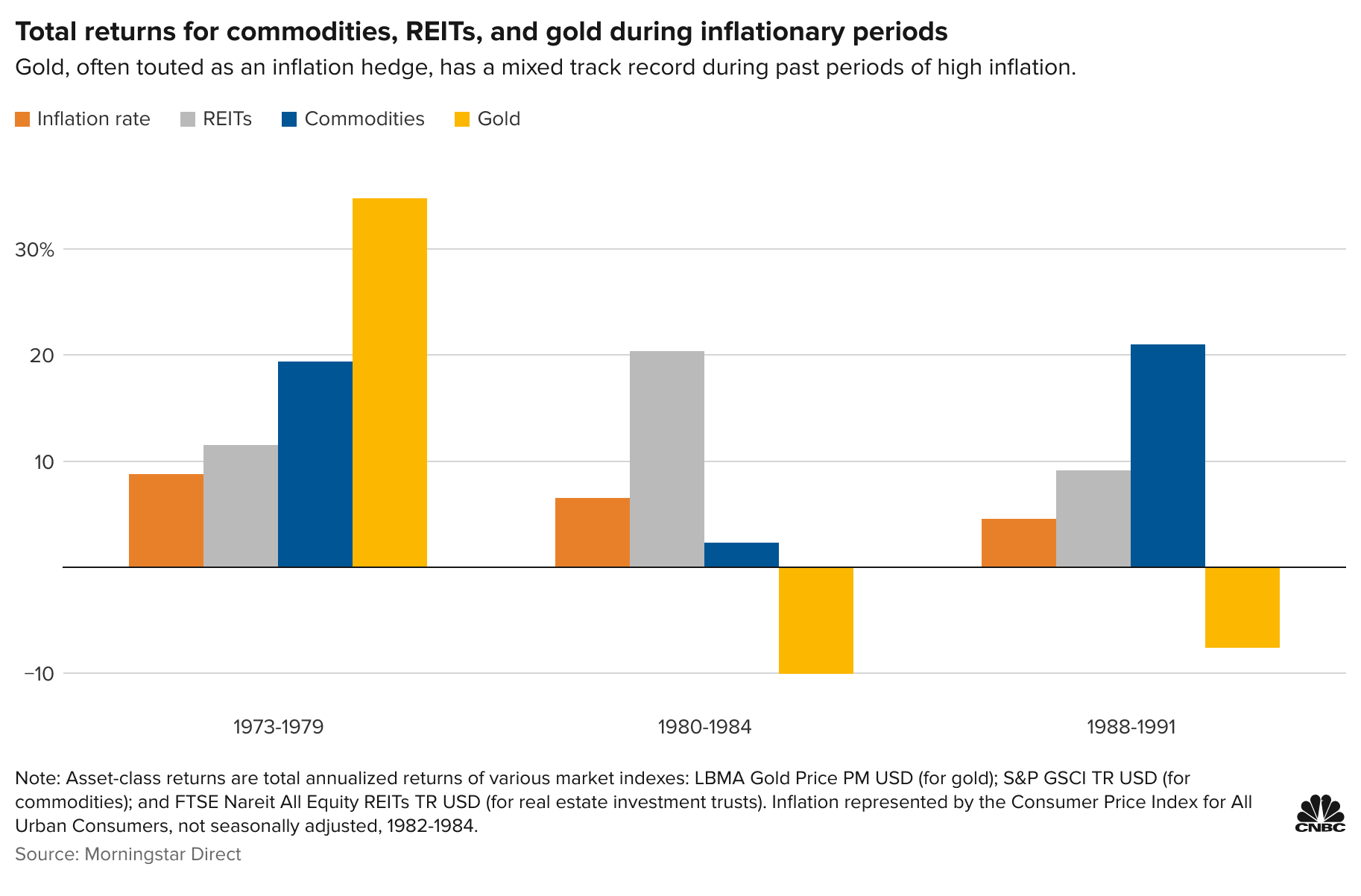

For example, the Gold price In the period from 1980 to 1984 it averaged ten percent, while inflation was about 6.5% annually. Between 1988 and 1991, the precious metal was also found to offer no protection against inflation. At the time, prices were rising by an average of 4.6% per year, while the price of gold was falling by 7.6% per year. The other extreme is the period from 1973 to 1979, when the price of gold rose by 35% per year with an average inflation rate of 6.5%. At that time, gold yielded even more returns than stocks, bonds and real estate.

Gold is not always a good hedge against inflation (Source: Morningstar)

The perfect correlation between the gold price and inflation may therefore diverge in the short term. Nevertheless, we can conclude that the precious metal will increase in value in the longer term and thus offer protection against the depreciation of currencies. As described earlier, a hundred years ago you could buy a luxury suit for a troy ounce of gold and now that is still possible. If you want to maintain your purchasing power in the long term and protect your savings against inflation, then gold is definitely worth considering.

![]() Have a look at us YouTube channel

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink and Joris Beemsterboer interview various economists and experts in the field of macroeconomics. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.