9.3

8.064 reviews

English

EN

China's central bank spent 24.9 tonnes in Februaryof gold bought. This makes February the fourth month in which China's gold purchases increased. Over the past four months, China's central bank added a total of 102 tonnes of gold to its gold holdings. Due to the increasing demand for gold from central banks, but also due to recent turmoil in the US banking sector, the gold price has risen in recent weeks.

With its gold purchases, China is following the global trend of central banks Add more gold to their stocks. Also at the central banks of Singapore and Turkey found the precious metal in great demand. Due to geopolitical uncertainty and high inflation, central banks are buying more gold than in previous years. Last year, central banks even bought a record volume of 1136 tonnes. This could be the beginning of a trend of central banks looking for an alternative to the dollar, he wrote Kitco Last week.

Some analysts are therefore optimistic and expect this to lead to a further increase in the price of gold. Willem Middelkoop expects that China's central bank will continue to buy gold in the coming months, so that China can counterbalance the dollar. China's central bank indicates how much gold it bought in the past month, and according to Middelkoop, that is no coincidence. In doing so, they show that they have an alternative to the dollar up their sleeve.

It is not known exactly how much gold China owns, but it could well be that China owns more gold than official figures. When looking at the list of gold reserves of central banks, China is in sixth place, according to official figures, but analysts believe that China much more gold possession than it indicates.

According to gold market analyst Jan Nieuwenhuijs property China more than twice as much gold as official figures. Gold purchases by the Chinese central bank have not always been passed on to the IMF in recent decades. In the 1990s, for example, a lot of gold was bought from European central banks, but in order to prevent the gold price from rising sharply, this gold was traded outside the market.

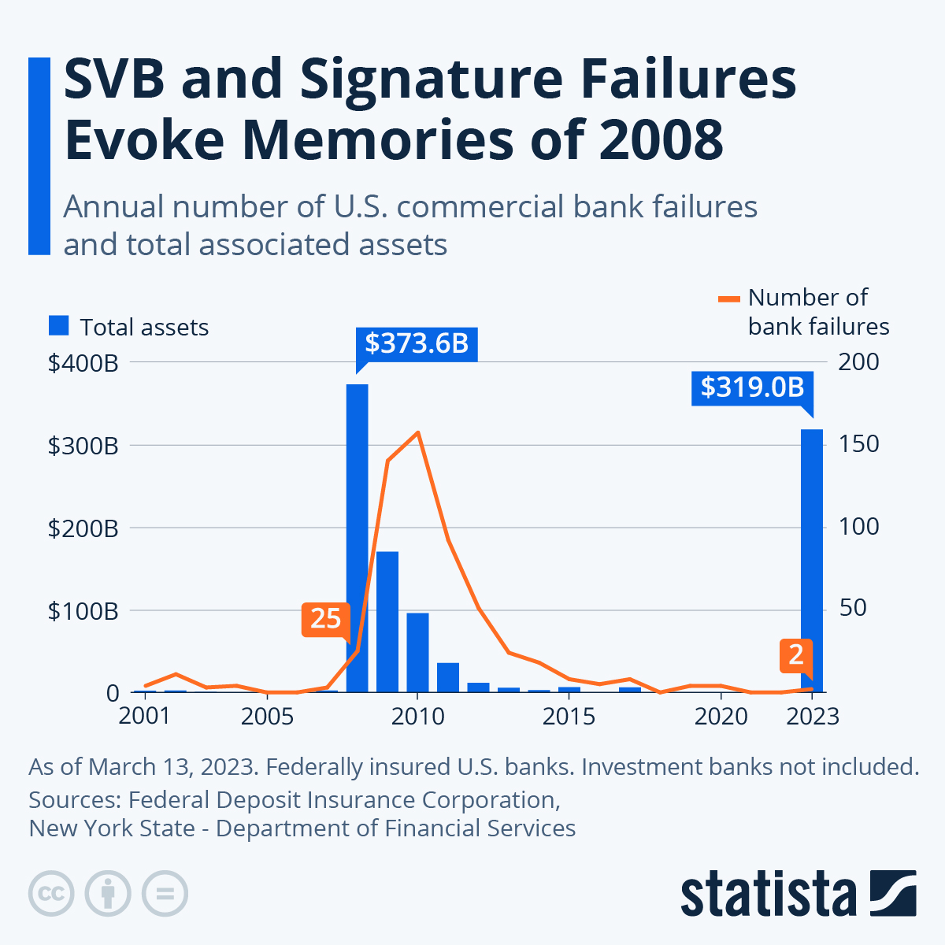

Turmoil in the banking sector is also affecting the gold market. On Friday, it was announced that the Silicon Valley Bank(SVB) had fallen over. In addition, the Signature Bank, a bank that mainly focused on crypto companies, now in the hands of regulators. This bank was also no longer able to meet its obligations and is thus following the path of Silvergate, another crypto bank that collapsed last week. Smaller banks have also run into problems as confidence in the banking sector has been damaged and people want to safeguard their savings by withdrawing their savings and transferring them to other banks.

SVB and Silvergate are considered important for the stability of the financial system. Therefore Guarantees the U.S. government now restricts all deposits, including deposits above $250,000 that are not covered by the deposit guarantee scheme. It is hoped that this will restore some confidence in the market. Almost 90% of all assets at SVB were outside the deposit guarantee scheme, because the bank had many startups and employees of technology companies as customers. To prevent these companies from getting into trouble as well, the government and the central bank decided to guarantee all assets.

Total number and magnitude of bankruptcies in the banking sector. (Source; Statista)

The turmoil at SVB is mainly a result of rising interest rates. Since high inflation, central banks have been forced to raise policy rates. This increases the pressure on banks to raise savings rates, while they often have money parked in bonds with lower interest rates. These bonds have fallen sharply in value in recent months, weakening the bank's balance sheet position. In recent months, there has already been downward pressure on stock and crypto markets, among others. It is therefore no coincidence that the most vulnerable parties are now in difficulty.

A new increase in the Fed's policy rate has been called into question by the turmoil in the banking sector. Analysts at Goldman Sachs expect U.S. interest rates to rise at the next interest rate decision on March 22doesn't go up. Analysts at Nomura expect the Fed to cut interest rates and stop reducing its balance sheet.

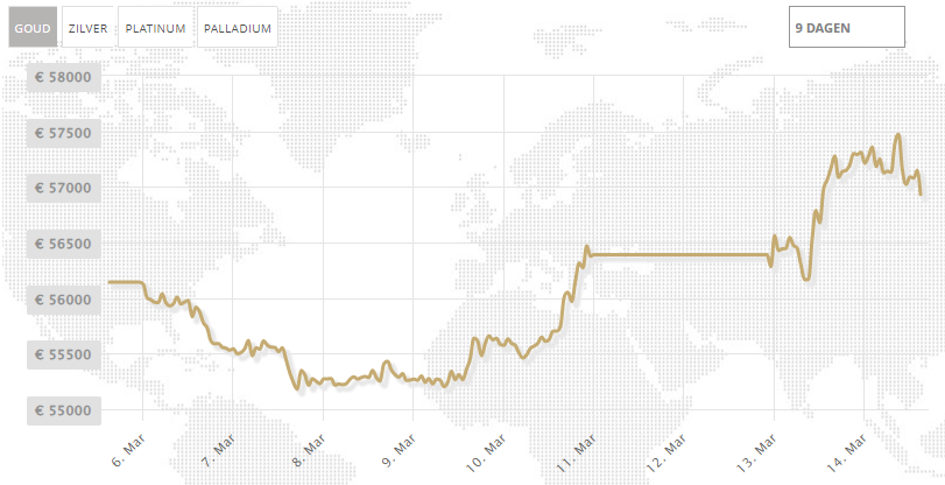

The uncertainty in the markets is causing rising prices of gold and Bitcoin. Gold prices hit their highest point in the past five weeks on Monday. Bitcoin rose to just under $25,000, while the price hovered around just above $20,000 last Friday. The growing unrest could lead to rising prices in the future .Safe Havens such as gold and Bitcoin can provide, although there is a need to be careful about that. It is difficult to estimate the effect of this banking crisis on the rest of the financial sector.

Do you want toBuy gold by means of Gold bars or Gold Coins? We are happy to help you with your order.

Development of the gold price last week. (Source; Holland Gold)

![]() Have a look at us YouTube channel

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink and Joris Beemsterboer interview various economists and experts in the field of macroeconomics. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.