9.3

8.064 reviews

English

EN

Gold and silver are outperforming crypto king Bitcoin this year, despite the recent correction in the precious metals market. J.P. Morgan stated on Monday that gold could surpass $5,000 per troy ounce in 2026. This suggests significant further upside, as gold was trading at $4,131 per ounce on Wednesday morning. One major driver behind this trend is the so-called “debasement trade.” What does it mean, and how could it push gold even higher in 2026?

Total market value of cryptocurrencies over the past 12 months, source: Bloomberg

Last Friday, Bitcoin stood 20% below its all-time high of $126,000 reached just a month earlier, hitting a low of $99,367. Bitcoin is struggling to regain momentum and, despite rising earlier this year, continues to lag behind gold and tech stocks, according to Bloomberg. With a year-to-date return of 10.67%, Bitcoin is also underperforming silver, which has gained 58% in dollar terms.

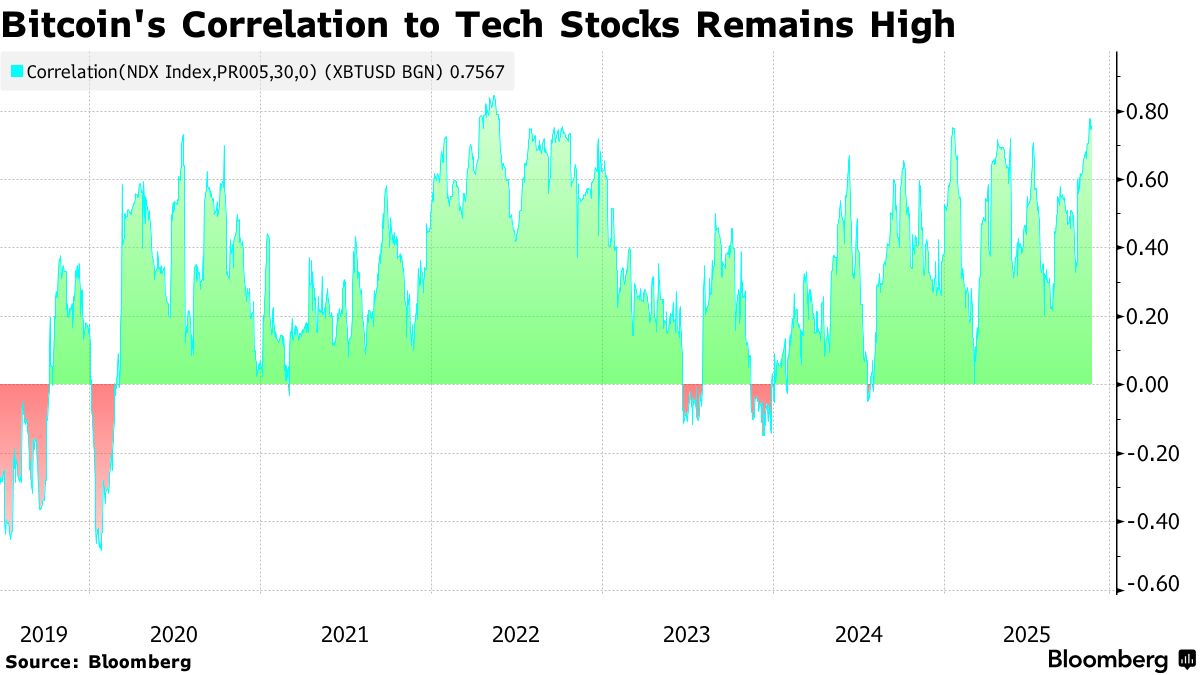

The immediate trigger for Friday’s crypto decline came from a warning by President Trump that China aims to challenge the U.S. as the “crypto capital” of the world. Longer-term concerns include fears of overvaluation in AI and tech stocks. A sudden sell-off in tech equities could push Bitcoin below the $100,000 level, said Jeff Mei of BTSE in an interview with Bloomberg.

Correlation between tech-stock movements and Bitcoin, source: Bloomberg

The debasement trade refers to investors allocating capital into assets that protect against inflation—such as gold and silver—because they are concerned about weakening fiat currencies, reduced central bank independence, and rising government deficits. The term refers to historic practices in which rulers like King Henry VIII and the Roman Emperor Nero reduced the silver and gold content of their coins, replacing it with cheaper metals such as copper. In essence, the debasement trade is driven by fear of inflation and eroding confidence in fiat money.

In earlier articles published in September and October, we discussed the debasement trade in the context of gold and Bitcoin as safe havens. But as Bitcoin now faces pressure from a potential AI-driven tech bubble, the latest analysis from the Sprott Precious Metals Report shows the trade broadening into other metals such as silver, platinum and palladium.

The recent short-lived silver squeeze made silver one of the best-performing metals this year. The squeeze was caused by a market disruption that pushed inventories at major exchanges to critically low levels. Three factors converged: fears over import tariffs increased transport between London and New York exchanges; rising prices drove ETF demand; and India’s Diwali festival boosted physical silver consumption.

The correction that followed is now being erased. Silver is up nearly 60% in euros since the start of the year and almost 80% in dollars (Wednesday morning 11:15).

Silver kilobar price—correction after recent squeeze is recovering quickly, source: Holland Gold

Long-time investors in gold and silver may wonder what is truly “new” about the debasement trade. Concerns about fiat currencies, government debt and the stability of the financial system have always been reasons to own precious metals.

What is new today is that the debasement trade is now widely discussed within the established Wall Street community, due to a structural shift in global fiscal conditions and the expectation that persistent inflation will become the norm. The concern extends far beyond U.S., Japanese or French debt levels—it is rooted in the limited number of policy tools available to governments, especially the United States, to manage their soaring debts.

“The forces driving deficits and currency debasement are structural rather than cyclical. U.S. policy is effectively built on a ‘run-it-hot’ principle—aiming to grow the economy faster than the debt,” argues Paul Wong of Sprott. Stimulating the economy requires loose fiscal policy, low interest rates and stimulus programs that pump liquidity into the system, fuelling inflation. “This implies ongoing fiscal and monetary friction. From this perspective, the debasement trade is still in the early stages of a much longer structural cycle.”

Many clients ask whether it is still a good time to buy gold now that prices are so high. Yet major institutional players expect gold to climb further into 2026. Prices could reach $5,200 to $5,300 by the end of 2026, says Alex Wolf of J.P. Morgan Private Bank. He bases his view not only on continued central-bank purchases but also on private-investor behaviour. Investment portfolios are increasingly allocating to gold out of concern for fiat currency. “If a growing number of investors merely raise their gold allocation to 5% of their portfolios, that alone would represent additional demand and likely higher prices.”

Also check out our YouTube channel.

On behalf of Holland Gold, Paul Buitink and Yael Potjer interview economists and experts in the macro-economic field. The goal of the podcast is to give viewers context and guidance in an increasingly fast-changing macro-economic and monetary landscape. Click here to subscribe.