9.3

8.064 reviews

English

EN

In a month's time, a referendum will be held in Switzerland on the recovery and expansion of Switzerland's gold reserves. This means that the Swiss people will finally be able to express their voice on a subject that was previously only on the agenda of central bankers and politicians.

The initiators of the referendum want Switzerland to stop lending its gold reserves, for the central bank to return the entire gold reserve to its own country and for the central bank to no longer sell gold in the future. Finally, it also stipulates that the Swiss National Bank (SNB) must hold 20% of its total reserves in physical gold. To achieve that percentage, the central bank needs to use almost 1,650 tonnes Buy gold, so that the total stock increases to 2,700 tonnes.

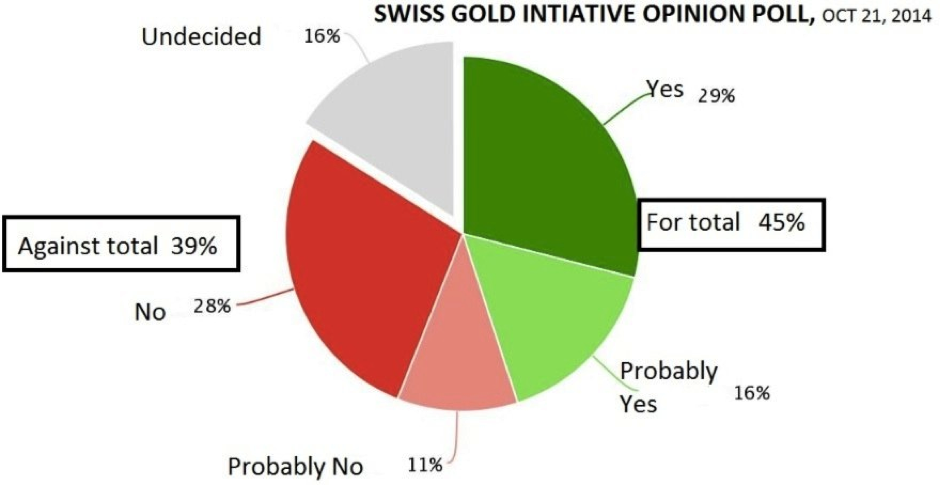

The official referendum is still about a month away, but the first polls are already in. From a survey Among 13,000 respondents, it emerged that a total of 45% are positive about the plans mentioned in the referendum. The number of opponents is not much smaller at 39%. Apparently, opinions on this subject are still very divided. About one in six respondents were not yet able to make a judgement on this issue.

The Swiss finance minister said that gold is a risky asset and that the central bank should therefore not have too much of it. A remarkable statement, when you consider that Switzerland has a relatively large gold reserve in relation to the size of its economy and population. Switzerland has also built up a reputation over the decades as a country where gold can be stored safely.

The referendum on gold follows a petition launched in 2013 by Luzi Stamm of the Swiss People's Party (SVP/UDC) and two other members of parliament. This petition reached the 100,000 signatures needed to start a nationwide referendum.

If the referendum is approved in a month's time, the provisions will be included in the constitution of Switzerland. That means the country will buy a lot of gold to achieve the required coverage ratio. If hundreds of tons of gold are indeed added to the reserves, this could have a very positive effect on the Gold price. We will continue to keep an eye on this development!