9.3

8.064 reviews

English

EN

Since 1999, the financial world has seen a notable shift in the meaning of gold, which was considered "completely irrelevant" at the time. Today, we have a better understanding of what influences the price of gold. Gold responds favorably to low interest rates, high inflation, a rising money supply, and strong global demand. Remarkably, even with rising interest rates, gold seems unflappable and sends a clear message to investors.

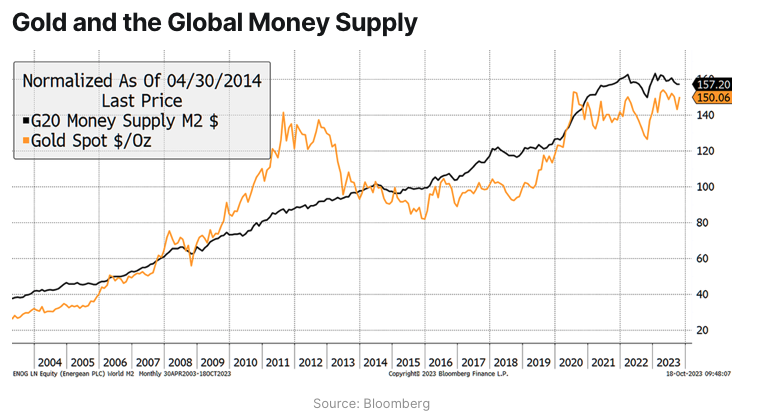

A study of the relationship between gold and the global money supply, particularly among G20 countries, shows a strong correlation. Over the past two decades, the global money supply has grown by 7.1% per year, closely aligned with the performance of gold. Although the Gold price fell in 2011, followed by a crash in 2013, the latter may have been due to rising real interest rates during the Taper Tantrum. This suggests that the crash of 2013 may have been a market correction rather than an intrinsic shift in the value of gold. Currently, gold appears to be about 5% undervalued relative to the global money supply.

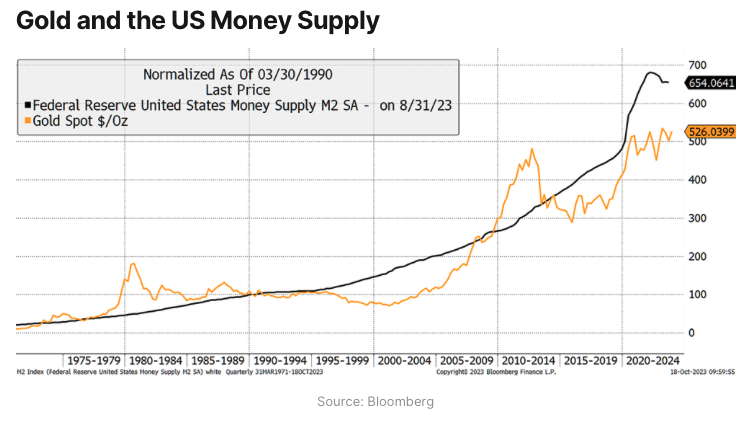

When analyzing the gold market, it is important that it is done on a global level and not just on the basis of the US data. While the historical correlation between gold and U.S. M2 money supply data has always been important, relying solely on U.S. data neglects the broader global economic context. Given the United States' declining share of global GDP (26% today compared to 40% in 1960), it is essential to consider the full global picture when analyzing gold's performance.

Despite concerns about rising interest rates and bond yields, the gold price is hardly affected by this. Normally, these conditions would be unfavorable for gold. Despite this, modeling against 20-year TIPS (Treasury Inflation-Protected Securities) shows a significant deviation, suggesting that gold is currently 58% overvalued.

This phenomenon can be attributed to a variety of factors, including geopolitics, central bank demand, and TIPS mispricing. It is suggested that gold is going through a transformative phase, in which its value is more closely linked to the global money supply than to inflation, with real interest rates continuing to act as a major influence over the medium term.

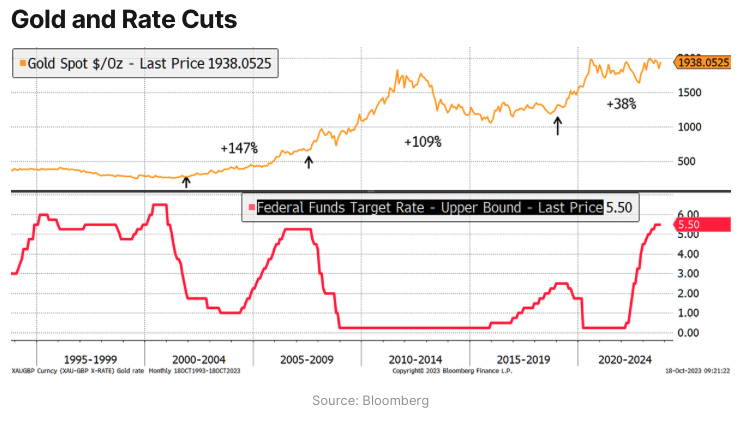

Another factor contributing to gold's performance is the anticipation of the end of interest rate hikes. Historically, the post-rate hike period has worked out well for gold, which has benefited from subsequent rate cuts. Given the economic challenges, the global decline in house prices and the upcoming elections in many developed countries in 2024, there is a strong possibility that politicians will revert to expansionary monetary policy. Gold seems to be signaling the end of monetary policy tightening.

Interestingly, institutional investors, particularly on Wall Street and in global asset management, have been reducing their positions in gold since late 2020, despite the increase in central bank reserves. This divergence suggests that when gold reaches a new all-time high, there will be significant demand from these institutional players.

The bullish case for gold is supported by three key indicators: gold, expressed in non-dollar terms, has just hit an all-time high, falling real interest rates, and recent Federal Reserve CPI data, which revealed inflation at 3.7%. Historically, gold has been in a bull market when real interest rates have fallen below 1.8%, indicating a positive outlook for gold in the current economic landscape. Lately, gold has also benefited from the geopolitical turmoil. It remains the most important safe haven worldwide.

Finally, the behavior of gold in today's markets sends a clear message to investors. It reflects a period of transformation in which it is more in line with the global money supply than with inflation. While real interest rates remain a significant factor over the medium term, there are other dynamics at play as well. The unusual reaction to rising interest rates, along with the anticipation of rate cuts and the contrarian actions of institutional investors, paints a picture of a strong bull market for gold. Gold isn't just a safe haven; It's a valuable part of investment portfolios, and it indicates that not everything is as it seems in the financial world.

Do you want toBuy gold by means of Gold bars or Gold Coins? We are happy to help you with your order.

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink and Joris Beemsterboer interview various economists and experts in the field of macroeconomics. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.

Source: Bytetree

Author: Charlie Morris