9.3

8.064 reviews

English

EN

The U.S. Mint said on Wednesday that its Silver Eagle Coins are not available for the time being, as a result of the explosive increase in demand for these investment coins. A spokesperson for the mint Confirmed that this news has not been communicated directly to the public, but only to the major distributors who market the coins.

The U.S. mint will increase production of the 2014 Silver Eagle, but it will take some time before the market sees any signs of it. The coins are already sold out here and there and the stocks are minimal. The mint will notify its business customers as soon as new stock is available.

The sharp drop in silver prices over the past week has caused a run on silver coins such as the Canadian Maple Leaf, the Austrian Philharmoniker and the American Silver Eagle. Reuters reported last Wednesday about shortages of silver Maple Leaf coins on the American and Asian markets. The Canadian mint decided in September to ration the supply of silver coins to various distributors, as there was not enough production capacity to adequately supply all suppliers.

The U.S. Mint sold 5.79 million Silver Eagle coins in the month of October, the largest volume in more than a year and a half. Compared to October last year, 87.5% more silver was sold by the mint. In September, sales of 4.14 million coins were also more than 37% higher than in the same month of 2013.

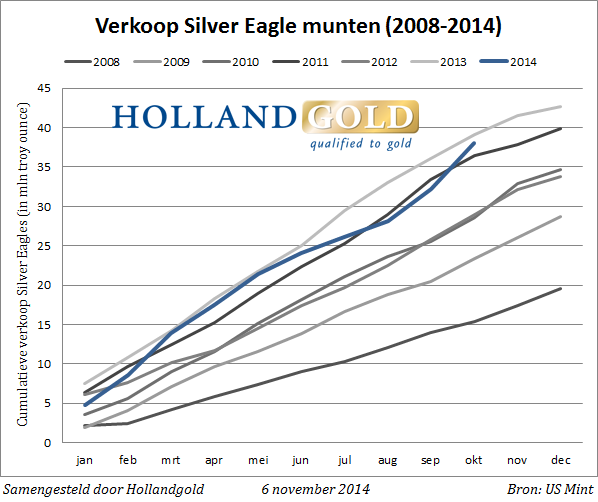

The following chart shows that cumulative sales of silver Eagle coins this year are almost as high as in 2013, the year in which a record 42.6 million Silver Eagles rolled off the production line.

Silver coin sales nearing 2013 record level

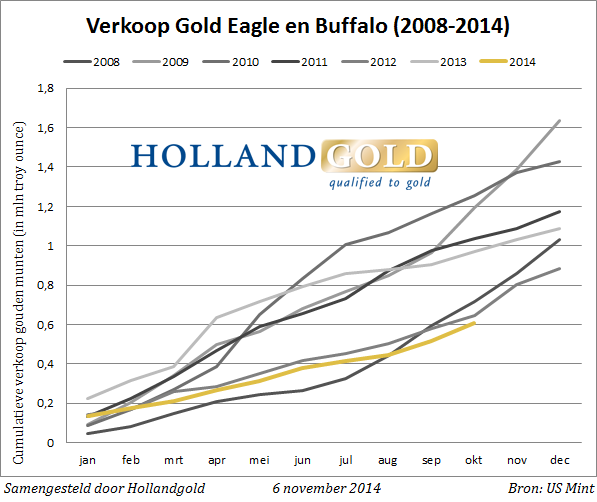

For the sake of completeness, we have also made an overview of the sales of gold investment coins from the US Mint. While silver sales are nearing last year's record levels, gold coin sales fell to their lowest level in years. The following graph clearly shows this.

Meanwhile, gold coin sales drop to lowest level in years

Due to the temporary scarcity of silver coins, delivery times in the trade have increased. It is expected that the premiums on the investment coins will also increase, as long as the scarcity continues. It takes some time before mints can increase their production and distributors have sufficient stock again.

The mints were taken by surprise by the sudden drop in the Silver Price, because towards the end of the year, they normally try to reduce the supply of coins to make way for the production of coins with the new year. Old stocks are then first disposed of, which means that there are often temporary shortages in the last weeks of the year. That will probably be the case again this year.