9.3

8.064 reviews

English

EN

After a poor stock market year in 2022, equities have gotten off to a positive start this year. The U.S. stock market is up about 5%, while European equities are up as much as 7%. Investors are looking to the future a little less gloomy, as interest rates seem to be stabilising and energy prices are falling again. But is this a good entry point for the stock market? Or are stocks still expensive?

In this article, we analyze the stock market using various indicators. We look at the Buffett indicator, a simple gauge named after the American master investor Warren Buffett. In addition, we look at the market from the perspective of the Case Shiller P/E ratio, a measure of how expensive stocks are relative to corporate earnings.

The Buffett indicator is a classic and proven method of valuing stocks. And this one sounds as simple as it makes sense, because it is nothing more or less than the ratio between the market value of American stocks and the gross domestic product of the United States.

To calculate this indicator, most analysts use the Wilshire 5000, an index that includes many American companies and is easy to convert to market value. One point in this index is equivalent to about $1 billion in market capitalization of companies included in this index.

Based on this index, the value of U.S. publicly traded companies was $42.8 trillion as of January 13, while GDP was $26.1 trillion. That means the Buffett indicator is 164% at the time of writing. By calculating this ratio over the past decades, we gain more insight into the value development of US shares. And it looks like this:

Buffett indicator from 1950 (Source: Currentmarketvaluation.com)

As the chart shows, there is an upward trend in the Buffett Indicator in the long term. It is also noticeable that the stock market can remain in undervalued or overvalued territory for a long period of time. The green trend lines indicate when stocks were cheap based on this indicator, the red lines indicate when stocks were expensive.

As we can see, we are coming from a very high level, in which US equities were proportionally as overvalued as they were at the peak of the internet bubble. That was the situation at the end of 2021. Last year, the S&P 500 lost nearly 20% of its value, while technology stocks fell even harder. This means that the extreme overvaluation has disappeared, but US equities can still not be called 'cheap'. Based on current prices, we are still 28% above the long-term trend line.

This suggests that equities may rise a bit further, but that the downside risk is always much higher. As a result, it seems too early to get in. Apparently, because historically this indicator appears to have only limited predictive value. In general, it is true that stocks perform better the following year if they come from an undervalued position, but not always. The graph below shows that there is a slightly positive correlation.

Slight correlation, but little predictive value in Buffett indicator (Source: Currentmarketvaluation.com)

The Buffett indicator is an easy rule of thumb for valuing stock prices, but the method is by no means perfect. For example, the indicator does not take interest rates into account, even though this is an important factor in the choice between shares and other investments. When interest rates are high, equities become less attractive compared to bonds. Based on the rise in interest rates over the past twelve months, we should expect a much larger correction in the stock market. In other words, the shares are currently more overvalued if you were to include the effect of interest in the calculation.

A second disadvantage of this indicator is that US GDP is national, while US corporate profits are increasingly international. This explains the upward trend in the Buffett indicator over the years and makes this indicator less accurate. It also only says something about the valuation of US equities and not about European equities.

Another popular valuation method for stocks is the Case Shiller PE ratio (CAPE). This method, developed by the American economist Robert Shiller, compares the value of the stock market with the profitability of underlying companies over the past ten years. This method filters out extreme outliers in corporate profits and thus provides a better reflection of the profitability of companies. It also includes the course of the economic cycle in the calculation.

The advantage of this valuation method is that it can be applied to all stock markets worldwide. Scientific studies have shown that the Case Shiller PE indicator has yielded reliable results at an international level. This means that it showed a positive correlation between the CAPE ratio and the return on shares over the next five to ten years in all the markets studied.

Based on this indicator, the US S&P 500 index currently has a ratio of 29.24. That is, stock prices are equal to more than 29 times average annual earnings. From a historical perspective, this is not extreme, but it is on the high side. Over a period of about 150 years, this ratio averaged 17 and the median was even below 16. According to this indicator, stocks were the most expensive in December 1999 and the cheapest in December 1920.

Based on this indicator, we would therefore also be reluctant to buy shares. But we must remember that this ratio is based on an index that is made up of about 20% technology stocks. Behind this average are different ratios for different market sectors. In certain sectors, equities can currently be much more attractively valued. It is more interesting to look specifically at those sectors than at an index such as the S&P 500.

Case Shiller PE ratio still suggests an overvaluation (Source: Multpl)

To date, we have only looked at the US stock market, but as mentioned, the Shiller P/E ratio is also applicable to stock markets elsewhere in the world. For example, Barclays has an extensive Historical data set of different countries, which allows us to compare the figures of European and Dutch stock markets with those of the United States. And that makes for an interesting graph.

For example, it appears that, on average, European equities have lagged behind U.S. equities for years and are therefore relatively much cheaper. It is also striking that Dutch shares have moved strongly in line with the US stock market in recent years. This is probably due to the large weighting of the energy sector in the index. Average contain European equity markets have been much more industrial, which has underperformed the energy and technology sectors in recent years.

European equities are much less overvalued than U.S. (Source: Barclays)

According to Goldman Sachs analyst David Kostin, investors can also learn from the development of companies' earnings expectations, the so-called earnings per share (EPS) estimates. Research firm Factset periodically publishes figures on the earnings expectations of companies in the S&P 500. These profit expectations have been revised significantly downwards this year. According to Kostin, that could be a warning sign of an upcoming recession because it usually follows a significant drop in earnings expectations.

Earnings expectations have fallen sharply this year (Source: Factset, Goldman Sachs, via Bloomberg)

The fact that stock prices are rising this year suggests that investors are currently placing more value on factors other than earnings growth, such as inflation rates, central bank interest rate policies and geopolitical developments in the world. Whether the current optimism on the stock market is justified, that remains to be seen.

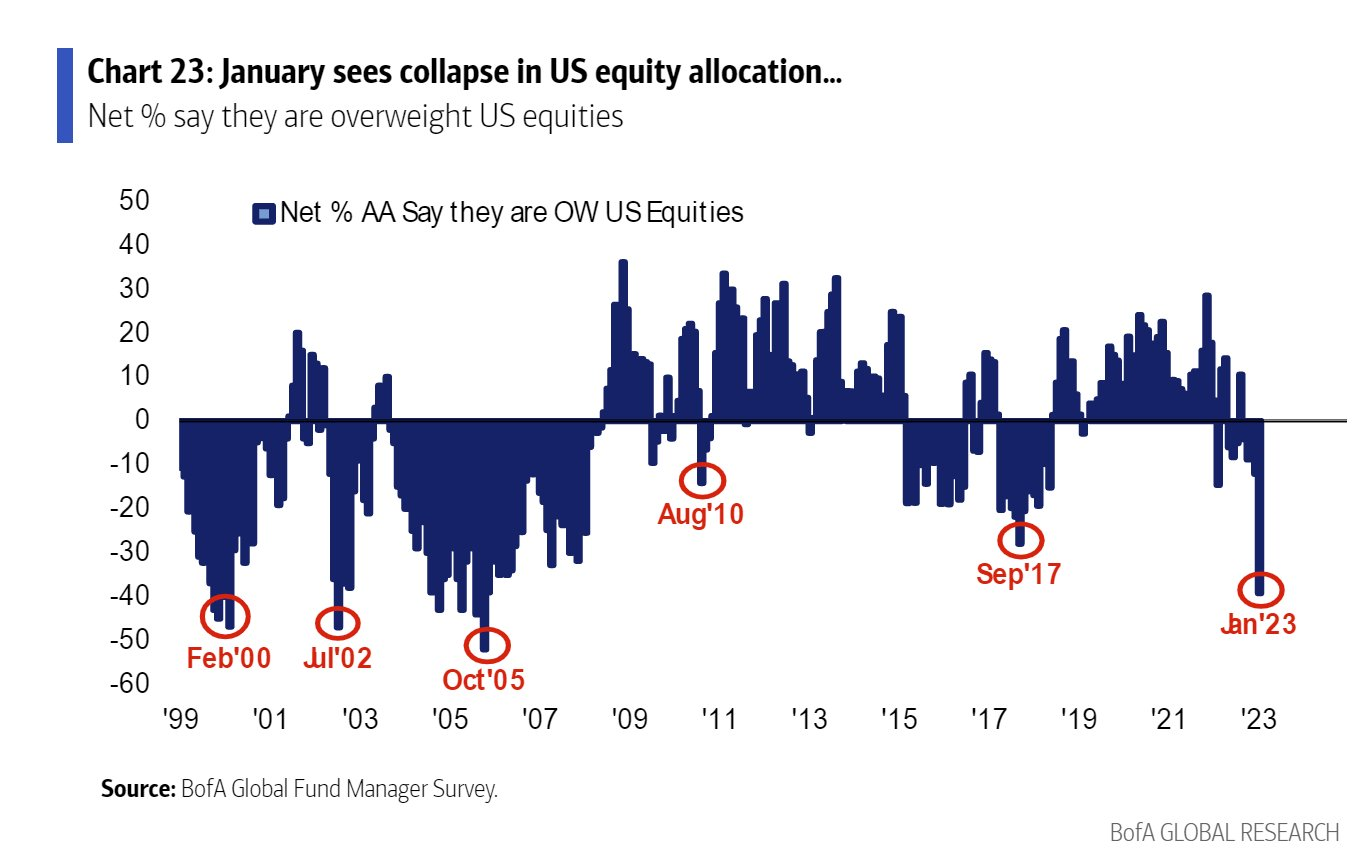

As the chart below shows, investors outside the United States are selling their US stocks this month. A smudge sign. Together with the still relatively high valuations, some caution is therefore in order.

Foreign investors sell U.S. stocks (Source: Bank of America)

![]() Have a look at us YouTube channel

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink and Joris Beemsterboer interview various economists and experts in the field of macroeconomics. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.