9.3

8.064 reviews

English

EN

Investors bought more gold in the first quarter of this year than in the same period last year, according to the World Gold Council in its new quarterly report on the gold market. In the first three months of this year, fewer gold coins and gold bars were traded, but this decline was more than compensated for by a resurgence in gold ETFs.

Demand for jewellery, on the other hand, fell slightly, while central banks bought almost as much gold in the first quarter of this year as a year earlier. The full report can be found on the website of the World Gold Council.

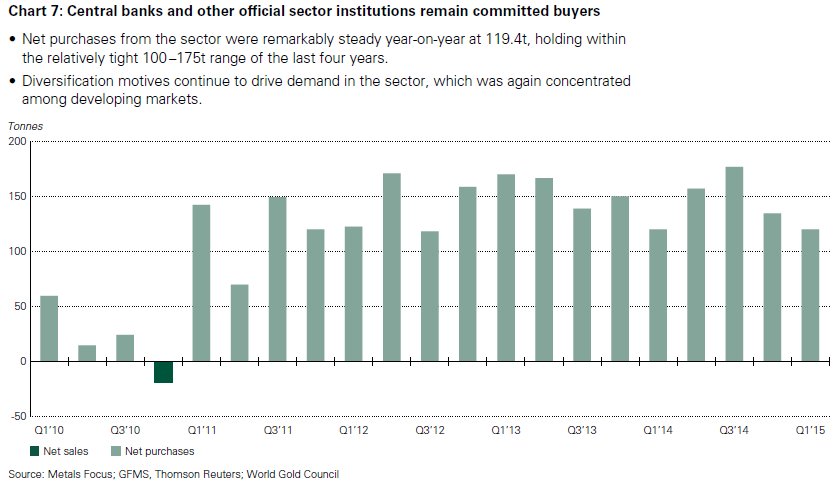

The World Gold Council's figures show that investors are slowly but surely getting back into gold ETFs. After eight quarters of sell-offs, these mutual funds finally added some gold back to their stocks. In the first three months of this year, 25.7 tonnes were added, compared to 13.5 tonnes removed from ETFs a year ago. Apparently, investors speculating on the development of the Gold price This is a good time to get in.

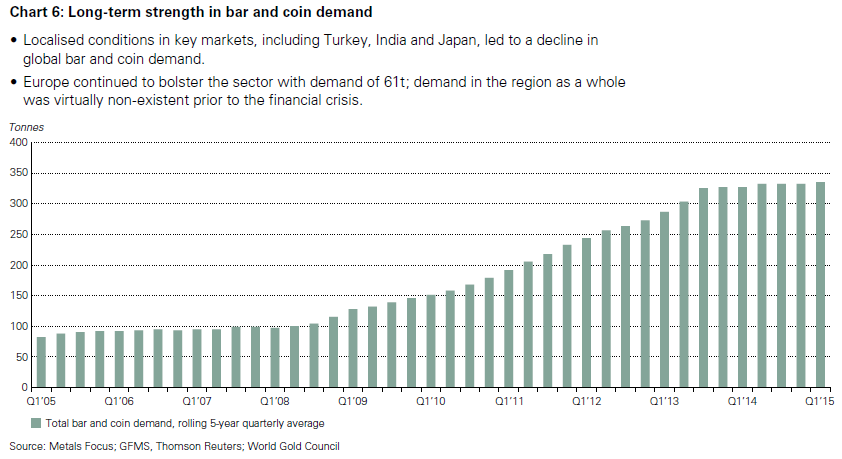

While the demand for shares of gold ETFs increased, fewer gold coins and gold bars were sold. Compared to the first quarter of last year, demand fell by 10% to 253.1 tonnes. That seems like a big drop, but if we look at the average over the past few years, total demand is still robust. The following chart from the World Gold Council shows that the market for physical investment gold is stabilizing at a level that is more than three times higher than before the crisis.

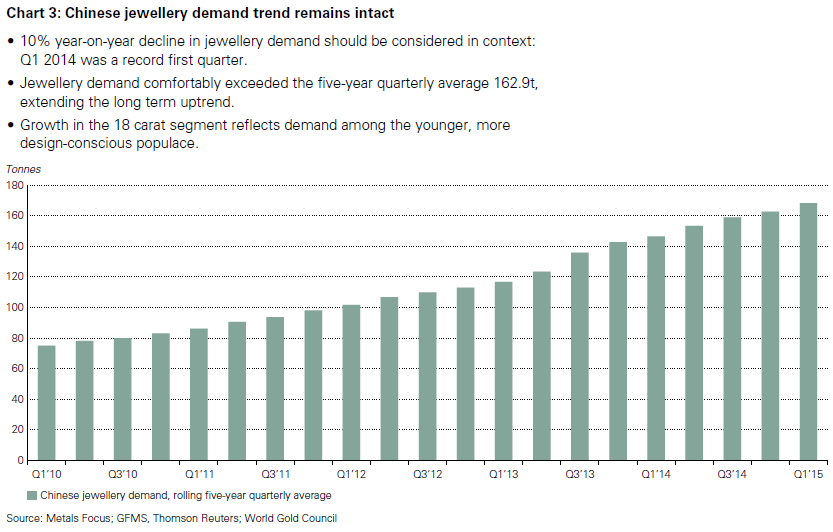

Global demand for jewellery failed to match the record volume of the first quarter of last year. At that time, 620.2 tonnes of gold jewellery were sold worldwide, compared to 600.8 tonnes in the first three months of this year. In China, demand fell from 236 to 213.2 tonnes (-10%), as the relatively flat gold price made it less inclined to Buy gold. Many Chinese were also lured by the stock market, as the Chinese stock market has risen sharply in the first months of this year.

This was different in India, where demand rose from 123.5 to 150.8 tonnes (+22%) due to less strict import restrictions. The demand for gold jewellery exceeded the average of the past five years, which is 570.3 tonnes.

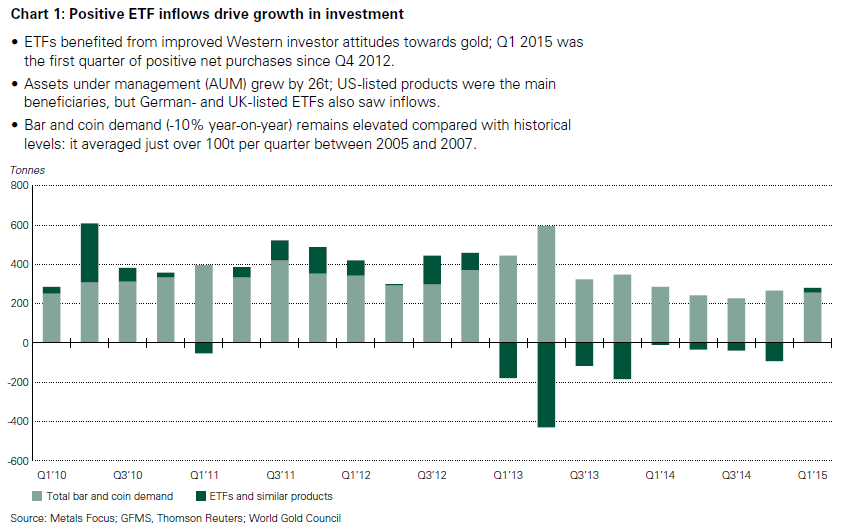

Since the outbreak of the financial crisis, central banks have been structurally buying gold, in volumes ranging from an average of 100 to 175 tonnes of gold per quarter. Central banks buy gold as a form of diversification, especially those of countries with relatively small gold reserves. Examples of this are Russia and China, two economic powers that still have relatively few gold reserves compared to the 'West'.

In the first quarter of this year, central banks bought a net 119.4 tonnes of gold. This was almost the same as the same level as one year previously. Russia added 30 tonnes of gold to its reserves, accounting for a quarter of all central bank gold purchases. Other countries that bought the precious metal included Kazakhstan, Belarus-Russia, Malaysia and Mauritius.