9.3

8.064 reviews

English

EN

This article has been automatically translated from Dutch. Click here to see the orginal article including all links to sources.

It was hard to miss: Trump and Musk are publicly feuding. But what is the fight really about? Meanwhile, Bloomberg reports that central banks have every reason to continue buying gold. And in Switzerland, deflation has reappeared — alongside a possible return to negative interest rates.

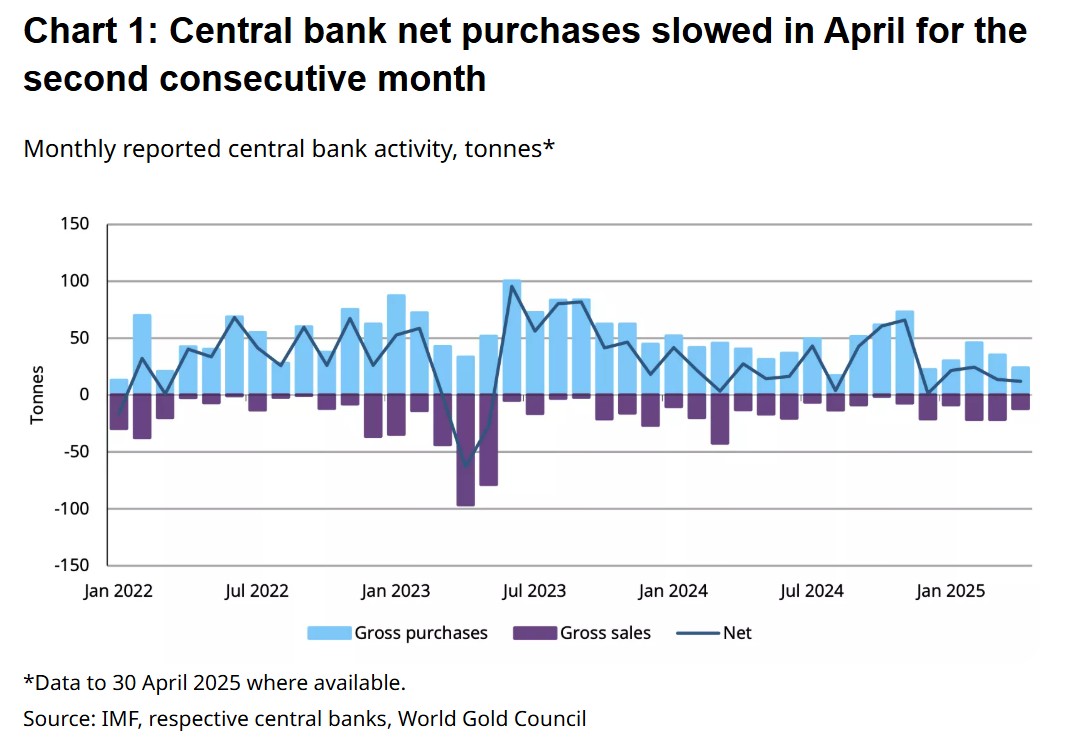

Central banks added a net 12 tonnes of gold to their reserves in April, according to new data from the World Gold Council. This marks the second consecutive month of slower accumulation, and it is well below the 12-month average of 28 tonnes. However, the World Gold Council stresses that this shouldn’t be interpreted as a break in the trend. As the chart below shows, the data is highly volatile, and a single month’s activity is not a reliable predictor for the months ahead. Furthermore, gold purchases are often reported with significant delay. Poland remains the largest buyer, and many African central banks have plans to boost their gold reserves.

Net gold purchases by central banks (source: gold.org)

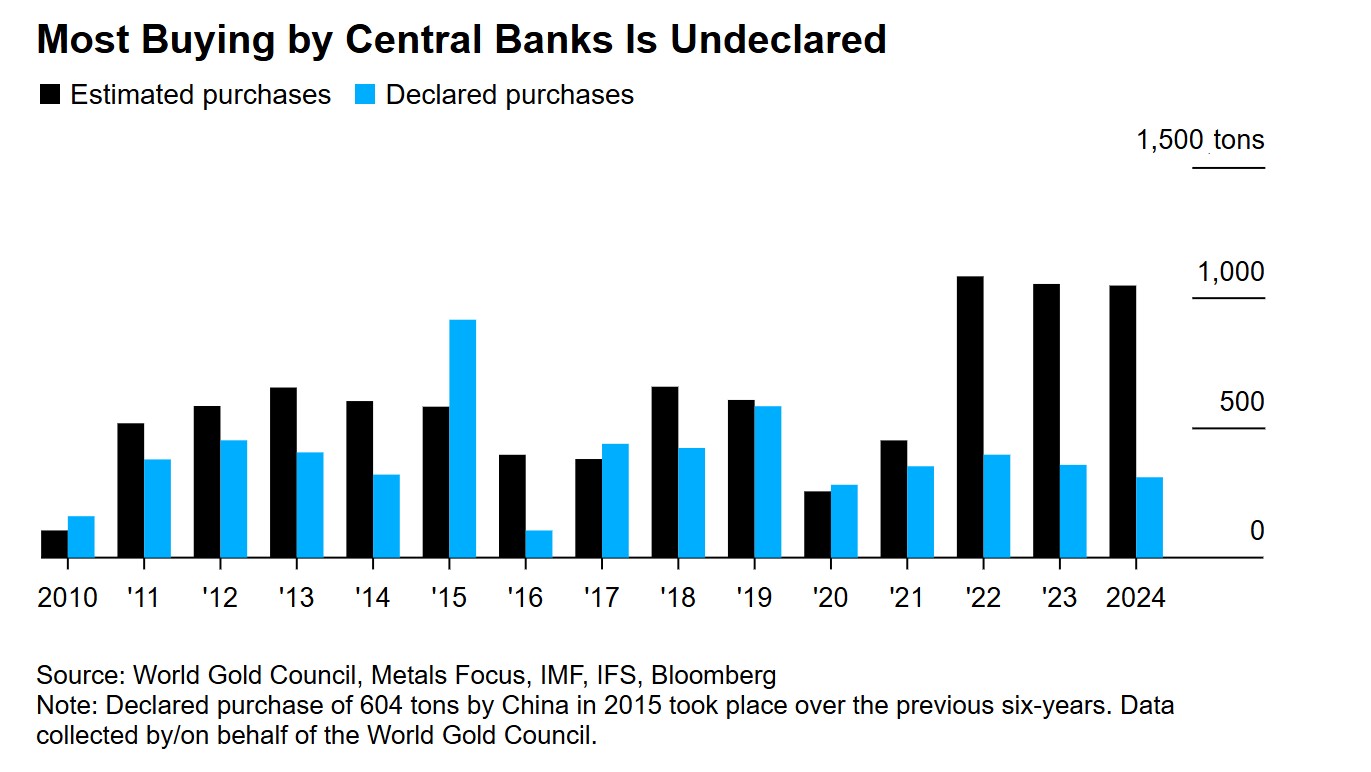

Bloomberg published an article this week stating that central banks have every reason to continue buying gold. These purchases are often not disclosed. In 2024, only about one-third of the acquisitions were publicly reported. According to an HSBC survey of 72 central banks conducted in January, more than one-third planned to increase their gold holdings in 2025. Not a single bank intended to sell.

During the 1990s, many Western central banks sold large quantities of gold, contributing to a prolonged bear market. But that trend reversed after the financial crisis, and gold demand has risen ever since — a process that accelerated following the sanctions against Russia. As Bloomberg notes, domestically held gold cannot be frozen. Additionally, concerns about the dollar — the world’s reserve currency — losing value have been a driving factor. “Gold is the safest reserve asset,” said Adam Glapiński, governor of the National Bank of Poland. “It is independent of any country’s policy, crisis-resistant, and preserves its real value over the long term.”

Many central bank gold purchases remain undisclosed (source: Bloomberg)

Globally, central banks are estimated to be buying around 80 tonnes of gold per month, according to Goldman Sachs. The bank estimates that China has bought an average of 40 tonnes per month since 2022, based on trade data — but without disclosing these purchases. Gold analyst Jan Nieuwenhuijs has written extensively about this. We interviewed him on the Holland Gold Podcast back in November. According to JPMorgan, reallocating just 0.5% of foreign dollar reserves into gold could drive the gold price to $6,000 per ounce by 2029.

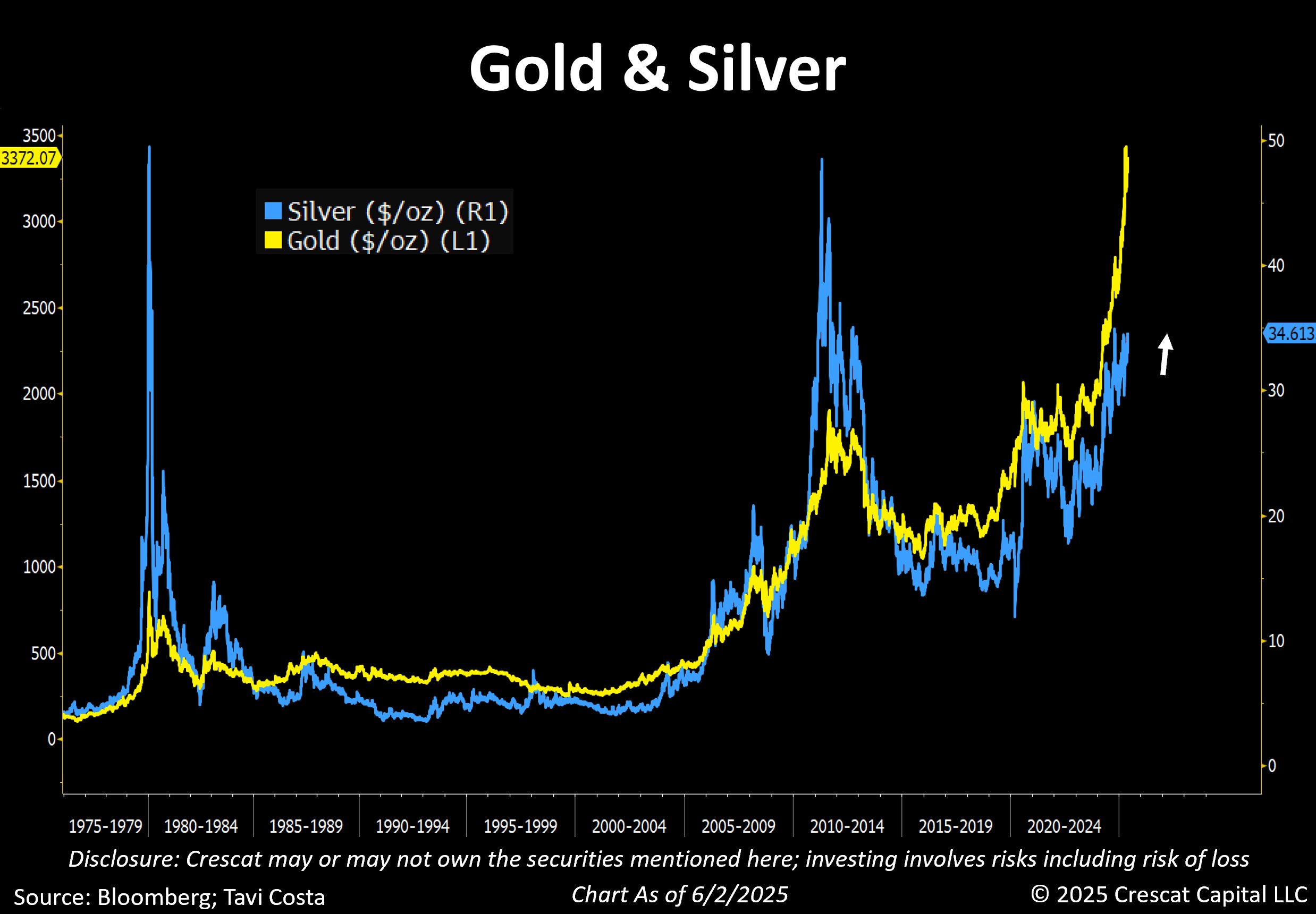

Silver & Platinum

Gold isn’t the only precious metal doing well — silver and platinum prices have also made strong moves recently, with both breaking out this week. Silver tends to follow gold. As Otavio Costa wrote on X earlier this week: “It’s time. Investors have short memories, but if history teaches us anything: gold moves first — then silver takes over. With the gold-silver ratio near 100, I believe today’s move is just the beginning.”

Gold and silver prices (source: Otavio Costa)

Peter Schiff draws a connection to Trump’s policies: “The realization that all the talk about spending cuts and controlling the federal deficit was nonsense was the catalyst for this breakout. Now that the floodgates are open, I expect a massive inflow into precious metals.”

A few weeks ago, Holland Gold published an article titled “Platinum Market at a Tipping Point Towards a Powerful Breakout.” You can read the piece by expert Jeroen Vandamme here.

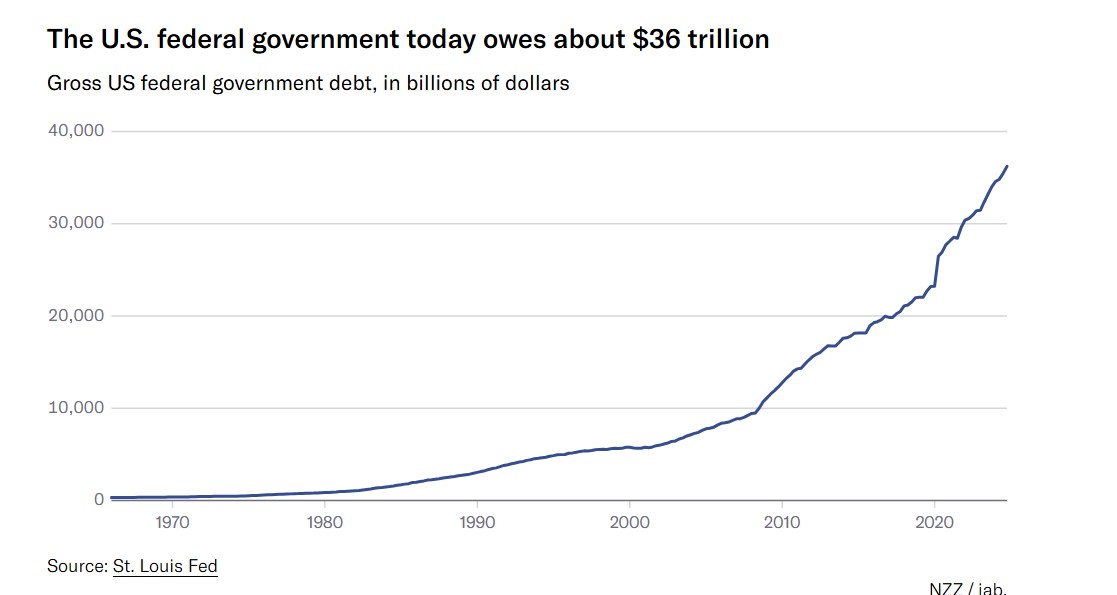

You’ve undoubtedly seen it: Trump and Musk are at odds. But what’s really at stake? Let’s summarize as briefly as possible. The most powerful man on earth is clashing with the richest man on earth — over the U.S. national debt and federal budget. Musk has voiced concern over the deficit and rising interest payments on America’s colossal $36 trillion national debt.

Interest payments have now surpassed defense spending, and Musk fears that if this continues, the entire federal budget could be consumed. The U.S. currently spends $1.2 trillion a year on interest — roughly the size of the entire Dutch economy — while interest rates continue to rise. The budget deficit stands at 7% of U.S. GDP, even though unemployment is just 4.2%. Such deficits are usually only seen during deep recessions.

U.S. National Debt Development (source: NZZ)

All major credit rating agencies have downgraded U.S. creditworthiness — Musk is not alone in his concerns. Trump, however, appears to be doing little to address the issue. On the contrary, he wants his “big, beautiful bill,” a new tax cut package, passed before Independence Day. Projections suggest this plan could add $2.4 trillion to the debt by 2034. A brief summary of the plan can be found here. Trump also wants to abolish or massively raise the debt ceiling — without corresponding spending cuts.

Musk responded by posting old Trump quotes about fiscal responsibility and argued that Trump should be removed. He predicted a recession under Trump’s policies and even alleged that Trump had ties to the late sex offender Jeffrey Epstein. Trump in turn called Musk “crazy” and threatened to cancel his government contracts. Tesla shares closed 14% lower yesterday.

We’ll continue monitoring these developments closely. Mounting debt and uncertainty could bode well for gold. Inflation seems like the most likely policy response. A compelling video by Lyn Alden on the topic can be viewed here.

Last month, Switzerland experienced deflation for the first time in four years. Since the peak of 3.5% in August 2022, inflation has steadily declined and is now negative. Prices fell by 0.1% in May compared to a year earlier. According to ING, the recent drop is largely driven by external factors. The relatively strong Swiss franc (CHF) has sharply reduced the cost of imported goods, which make up nearly a quarter of the CPI basket. Global energy prices have also declined.

CHF vs USD since January (source: XE.com)

According to the Financial Times, investors are now betting on a return to negative interest rates, as the Swiss National Bank (SNB) tries to slow the franc’s appreciation. In today’s climate of trade wars and Trump-induced chaos, the CHF is seen as a safe haven. It has risen more than 10% against the dollar this year, outperforming many major currencies, including the euro.

Further appreciation of the CHF could worsen deflation. Mike Riddell, a fund manager at Fidelity, notes that deflationary signals will make the SNB “allergic” to further CHF strengthening. He expects the SNB to intervene in the currency market if upward pressure continues. The SNB targets inflation between 0% and 2%. ING economist Charlotte de Montpellier expects two 25-basis-point cuts — in June and September — bringing the policy rate to -0.25%. So, is gold now the better safe haven compared to the CHF, as the SNB openly intends to prevent further franc appreciation?

On Tuesday, the yield on Swiss two-year government bonds fell to -0.24%, the lowest level in three years. All government bonds up to six years now yield below zero. For comparison: Dutch two-year bonds currently yield 1.93%. A common currency requires some sacrifice!