9.4

7.521 Reviews

English

EN

This article has been automatically translated from Dutch. Click here to see the orginal article including all links to sources.

This week’s selection can only focus on one thing: Donald Trump’s policies. Let’s pick up where he left off during his speech to the World Economic Forum (WEF) in Davos. He made it clear to the forum participants that America is embarking on a radically new course—leaving the audience visibly uneasy. Naturally, all the usual topics are on the table: climate policy, Ursula von der Leyen, the EU, Javier Milei, the CBDC, stocks, Ukraine, and inflation. Read on!

Yesterday, Donald Trump, inaugurated on Monday, addressed participants of the World Economic Forum (WEF) in Davos via video link. According to Sky News, the audience was visibly uncomfortable in their seats as the new U.S. president spoke after dominating the annual conference for three days without even being physically present.

Trump's speech at Davos 2025 (Image Source: The White House)

The unease in Davos was understandable and had nothing to do with the usual Trumpian bravado in his speech. Trump announced a policy direction diametrically opposed to the usual consensus there. In his speech, he blamed inflation and high government debt on radical left policies and promised to break away from them. He outlined radical measures aimed at reducing illegal immigration, regulations, bureaucracy, and diversity mandates. Trump also championed free speech and criticized efforts to combat misinformation, which he called censorship.

He declared the end of the Green New Deal, which he referred to as the "Green New Scam." Trump also confirmed the U.S. withdrawal from the Paris Climate Agreement, reaffirmed Americans' choice regarding fuel and electric vehicles, and proposed expanding oil and gas production. According to Trump, this would not only lower the cost of goods and services but also transform the U.S. into an industrial superpower and a global hub for artificial intelligence and crypto innovation.

Trump invited companies to relocate and manufacture in the U.S., employing a clear carrot-and-stick approach. The carrot: some of the lowest taxes in the world. The stick: import tariffs for companies that do not produce in the U.S. This stands in stark contrast to Ursula von der Leyen and the European Commission's stance, which views such policies as a “race to the bottom,” while calling the Paris Agreement “humanity’s best hope.” Trump claimed the EU treats the U.S. very unfairly in this regard.

Oil prices reacting to Trump’s statements (Image Source: Holger Zschäpitz)

Trump called on Saudi Arabia and other OPEC countries to lower oil prices, arguing that this would immediately end the war between Ukraine and Russia, as Russia heavily relies on oil sales. As seen in the chart above, the market reacted immediately. Trump also urged China’s President Xi Jinping to help end the war. On Wednesday, Trump announced that Russia could expect additional sanctions if the war continues. Dutch Prime Minister Mark Rutte welcomed this development, and it seems effective—Putin is reportedly ready to discuss the matter with Trump.

Trump also pressured Jerome Powell, the chairman of the U.S. Federal Reserve, to lower interest rates. Such interference is unusual and could undermine the Fed’s independence. Economist and stock market analyst Corné van Zeijl sees Trump’s demand as a threat to this independence and partially attributes rising U.S. government bond yields to it.

Earlier this week, the White House announced measures to protect Americans from the risks associated with Central Bank Digital Currencies (CBDCs). While this may have little practical benefit for citizens, the European Central Bank (ECB) continues its push for CBDCs. Analyst Jeroen Blokland suggests this adds an “extra tool to the endless toolkit aimed at fiscal dominance and debt sustainability.” Financial expert Arno Wellens questioned whether Trump even has the power to dismantle the CBDC project.

Christine Lagarde, ECB president, told CNBC that Europe should prepare for trade tariffs and expressed skepticism about Trump’s policies. In a podcast with Sander Boon, we discussed two potential paths for the West: the path of Von der Leyen and Lagarde, characterized by more regulations, taxes, and control, or the path of Trump and Milei, favoring fewer regulations, lower taxes, and greater freedoms.

Javier Milei in Davos (source: World Economic Forum)

Argentine President Javier Milei also spoke in Davos, stating that his reformist approach is gaining traction. “What once seemed like a global hegemony of the ‘woke’ left in politics, educational institutions, the media, supranational organizations, or even forums like Davos, has begun to crumble,” he said.

Whether Europe will follow Trump and Milei’s lead depends on their success. Milei already sees allies in Europe, citing Giorgia Meloni and Viktor Orbán. This week, France called for a regulatory pause, focusing on ESG rules, following the EU’s declining competitiveness. Polish Prime Minister Donald Tusk also called for deregulation, announcing plans to cut into Frans Timmermans’ Green Deal: “If we go bankrupt, we cannot do anything for the environment.” Opposition to European climate policies has been growing, as highlighted last week when we reported on Volkswagen's financial losses to a Chinese competitor due to EU climate regulations.

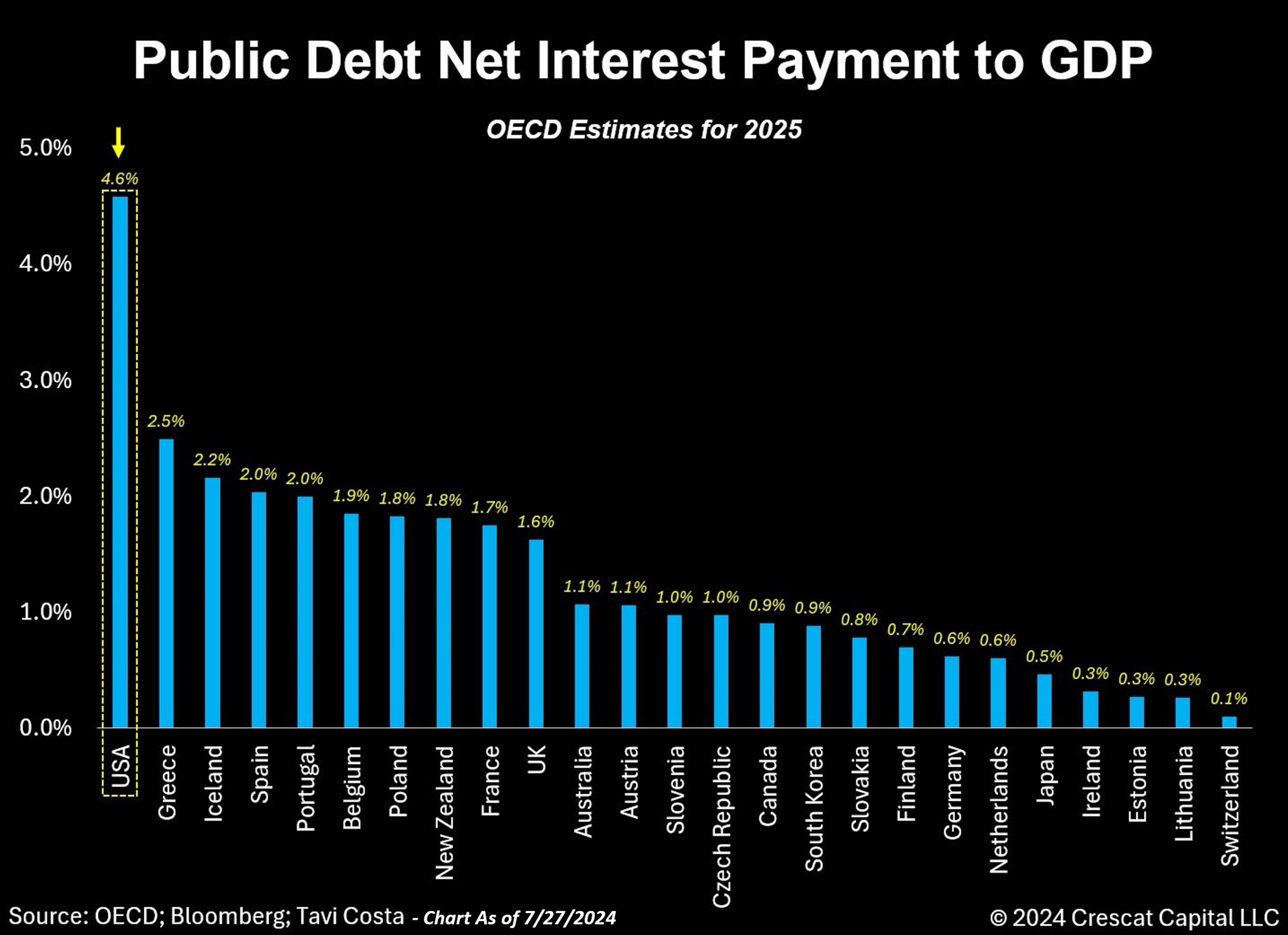

U.S. interest payments relative to GDP (Image Source: TaviCosta)

Time will tell if Trump can deliver on his promises. Challenges abound, with rising interest rates and inflation playing significant roles. BlackRock CEO Larry Fink cautioned investors against assuming high inflation is over, predicting further increases in bond yields. “The biggest risk we have worldwide today is the world believes we are past the high point of inflation,” Fink warned.

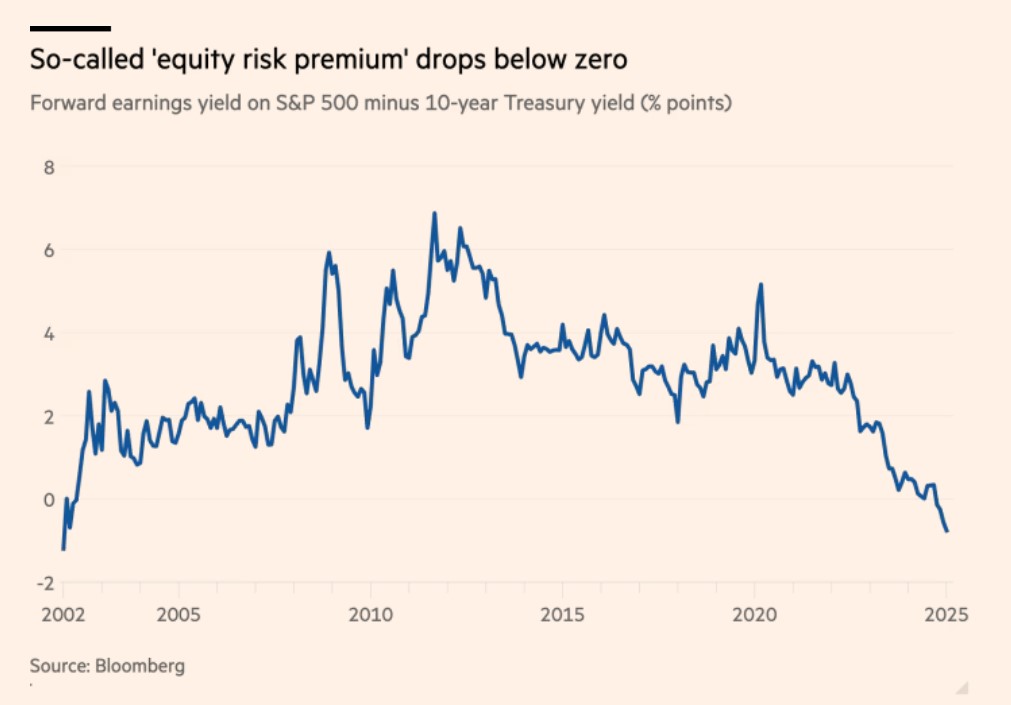

The risk premium on U.S. stocks compared to bonds (Image Source: FT)

The valuation of U.S. stocks is also at extreme levels. Relative to bonds, American stocks are the most expensive since the dot-com bubble. This week, we discussed the overvalued stock market in detail in a podcast with equities analyst Niels Koerts (see below). Stay tuned!