9.3

8.064 reviews

English

EN

This article has been automatically translated from Dutch. Click here to see the orginal article including all links to sources

It was a tough week for advocates of ambitious climate policies; the proverbial wind seems to be blowing from a different direction. Will the climate agreement survive leaders like Trump and Milei? Furthermore, we turn our attention to Germany, where the ruling coalition has collapsed, and it has become clear this week that the Schuldenbremse may be coming to an end. Finally, we discuss the pause in the bull market for gold and silver: what are the expectations for the near future?

The approach to combating climate change via the financial system is under pressure. While Europe remains ambitious, support in the U.S. and elsewhere appears to be crumbling. Bloomberg reported that the Fed refused to support the Basel Climate Plan this week. According to this plan by the Basel Committee on Banking Supervision, banks must report on climate risks.

Jerome Powell, chairman of the Fed, stated earlier this year that addressing climate change does not fall within the central bank’s mandate: “We are not policymakers on climate change ... We believe we should do our job as you have entrusted us to, namely achieving maximum employment and price stability.” According to Bloomberg, the Committee had already significantly weakened the climate plan for this reason. The committee is now preparing for a scenario in which work on integrating climate considerations into global reporting standards for banks may be suspended indefinitely.

Christine Lagarde, press conference ECB, September 12 (source: ©Felix Schmitt for the ECB)

Our own European Central Bank takes a completely different view, seeing climate policy as part of the central bank’s mandate. They support, among other things, the implementation of CO2 pricing, just like De Nederlandsche Bank (DNB). Dutchman Frank Elderson, formerly of DNB and now working for the Basel Committee and the ECB, is a staunch advocate for contributing to robust climate policy. Earlier this year, he caused controversy for comments about ‘reprogramming’ new employees concerning climate policy.

This week, Christine Lagarde, president of the European Central Bank, published an article in the Financial Times about the importance of climate policy and achieving the goals of the Paris Agreement. She writes: “We must urgently unlock all possible sources of capital, with speed and on a large scale, and create the regulatory conditions to finance our green future and preserve nature.”

However, even in Europe, a different wind now seems to be blowing. Unlike in the U.S., many European banks must disclose how their loan portfolios align with the Paris Agreement. But French President Macron stated this month that he believes the European Union should ‘synchronize’ its financial regulations with those of the U.S. to support competitiveness. Additionally, it is becoming increasingly clear that fossil fuels remain indispensable for now. Germany’s industry is deeply troubled due to its energy policies; more on that crisis later in this article.

Javier Milei

The election of Trump, who is openly pro-oil and is likely to withdraw from the Paris Agreement again, is bad news for proponents of robust climate policy. The stability of the agreement now seems uncertain. Argentine President Javier Milei withdrew his negotiators from the COP29 climate summit after just three days. He called the climate crisis a "socialist lie" and climate scientists "lazy socialists." Moreover, several government leaders canceled their trips to the summit.

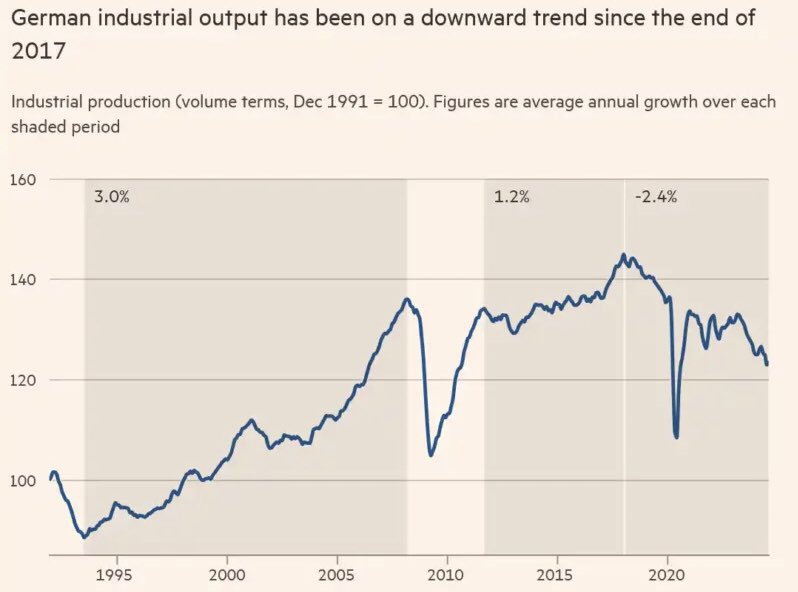

You may have missed it due to all the attention on the U.S. elections: Germans will likely have to return to the polls in early 2025 because the ruling coalition has collapsed. This happened last week after Chancellor Olaf Scholz dismissed his Finance Minister, Christian Lindner. There was disagreement between coalition partners over a €9 billion budget gap. Germany has been in decline for some time, with industrial production now 17 percent lower than in 2017.

Development of industrial production in Germany (Source: FT, via Philipp Heimberger)

According to the Financial Times, the conflict had a deeper ideological dimension regarding how to handle Germany’s economic downturn and the legal limits on public debt. Germany has a Schuldenbremse (debt brake) enshrined in its constitution. The Social Democrats and Greens have long wanted to relax it, but the liberal Lindner did not agree. Lindner previously called for tax cuts and reductions in climate policy spending to counteract the economic downturn in the country. The relaxation would have allowed Germany to take on more debt and, among other things, increase its support for Ukraine.

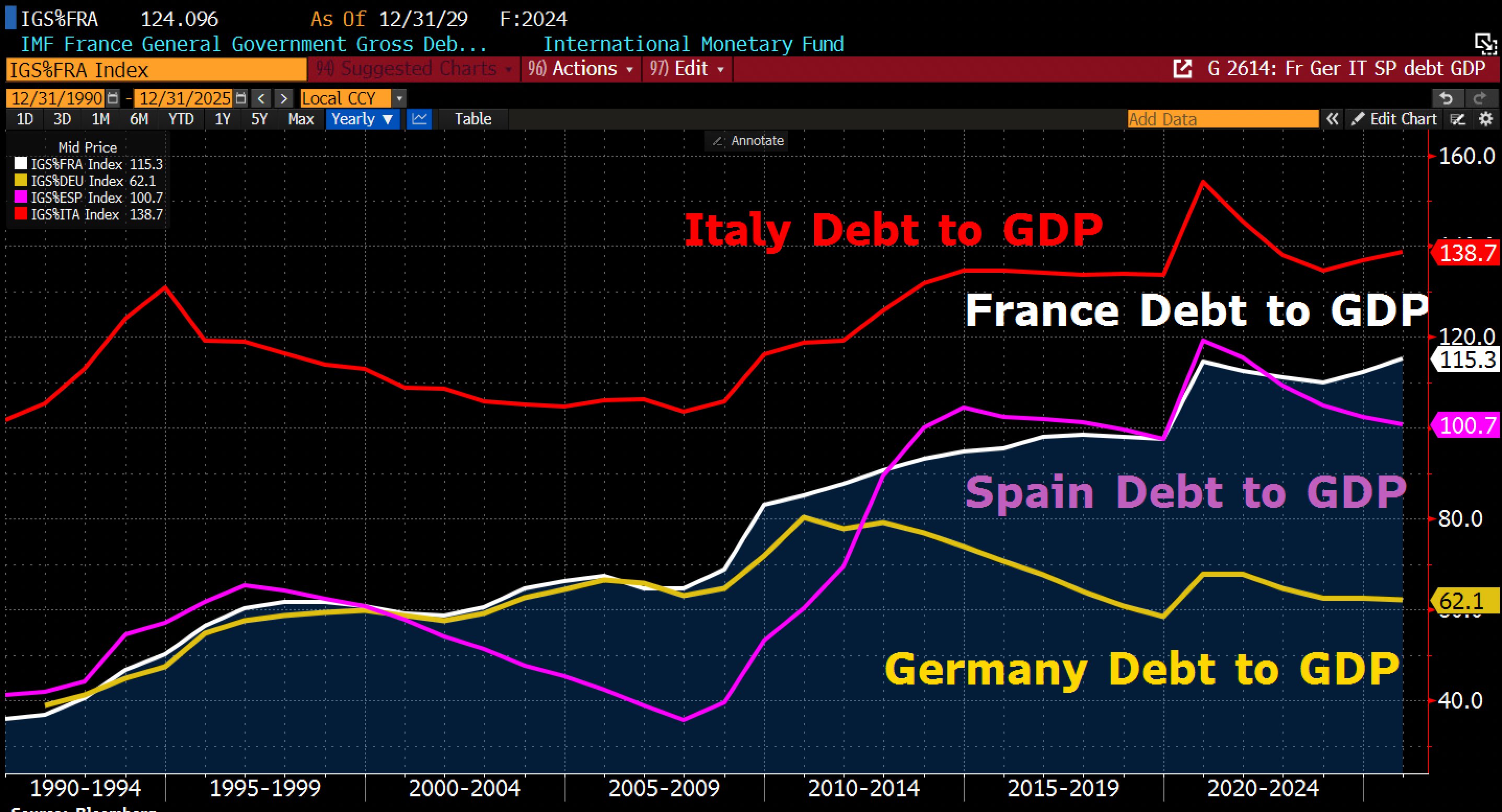

High European Debt Ratios (source: Holger Zschaepitz)

On Wednesday, opposition leader Merz (CDU) stated that he no longer rules out reforming the Schuldenbremse. He indicated that he is not open to reforming it to increase spending on consumption or social policies, but if additional loans were used to stimulate investments, “the answer could be different.”

This could mean the end of Germany’s Schuldenbremse. In October, we hosted Nout Wellink, former president of De Nederlandsche Bank, on our podcast. In the interview, he spoke highly of the German Schuldenbremse, seeing it as a solution to excessive budget deficits and debts of European governments.

Bonus reading tip: Not only Germany but the entire EU is falling further behind the U.S. economically. This week, an interesting Twitter thread about it went viral. Read it here.

The gold price continued its correction this week, returning to October levels. In last week’s selection, we already discussed the decline in the gold price following Trump’s election victory. At the time, we wrote that this was likely due to expectations of reduced geopolitical tensions and that various experts expect the gold price to rise again in the long term due to other factors.

Gold price on Friday morning, November 15 (source: Holland Gold)

According to Maximilian Layton, head of commodities research at Citi, the pause in the bull market for gold and silver could last several weeks. The underlying drivers of the gold market remain intact, Layton said. Ole Hansen, head of commodity strategy at Saxobank, stated on X that his optimistic outlook for gold in the medium to long term has not changed. JPMorgan Chase also indicates that it expects the gold price to rise further in 2025. Kitco echoes this sentiment, viewing the lower gold price as an opportunity to buy gold at a discount.

In the Financial Times, we read that shares of Australian gold mining company Resolute Mining fell by more than 30 percent this week. This happened after it was revealed that CEO Terence Holohan and two employees were arrested in Mali. The company operates the Syama mine in Mali through a subsidiary. They were in the capital, Bamako, to meet with mining and tax authorities. Recently, the Malian government has increased pressure on mining companies to renegotiate their contracts. In September, Barrick Gold and the Malian government reached a settlement after the country’s military government detained four employees and claimed the company owed more than $500 million in back taxes. We also recently saw Tanzania put pressure on gold mining companies. Frank Knopers wrote an article on our website about the risks of gold mining companies compared to physical gold. Read it here (Dutch).

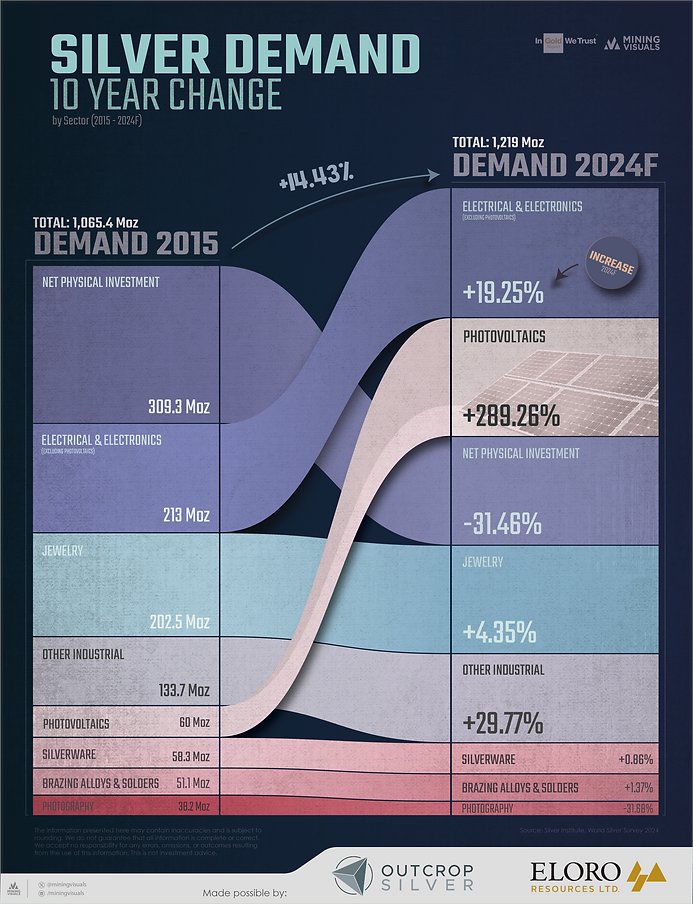

Meanwhile, silver demand is reaching record highs this year, driven primarily by industrial use, which has grown by 7 percent. This increase is largely due to the use of silver in solar panels and electric vehicles. However, silver mine production is struggling to keep up with growing demand, increasing by just 1 percent. This provides a plausible explanation for the significant rise in silver prices. In our monthly update, we delved deeper into this topic; check it out here (Dutch).

Where does the demand for silver come from compared to 10 years ago? (source: Peter Krauth)