9.3

8.064 reviews

English

EN

This article has been automatically translated from Dutch. Click here to see the orginal article including all links to sources.

Tensions in the Middle East have escalated once again: today, Israel launched a large-scale attack on Iran. Tehran is vowing retaliation, and investors are rushing to safe havens. Meanwhile, Switzerland is taking an unusual step this week: the country wants to enshrine the availability of cash in its Constitution. Read on!

Overnight, Israel carried out a series of airstrikes on Iran — an escalation that had long been anticipated. The targets included sites linked to ballistic missiles, Iran’s nuclear program, and the leadership of the Iranian armed forces. Among the casualties are prominent nuclear scientists and Hossein Salami, commander-in-chief of the Revolutionary Guard.

Overview of Iranian nuclear installations (Source: CNBC)

Overview of Iranian nuclear installations (Source: CNBC)

In a video address on X, Israeli Prime Minister Netanyahu explained that he views Iran’s nuclear program as an existential threat to Israel. According to his intelligence, Iran would have been capable of producing nuclear weapons within a few months. He referenced Iran’s past attacks on Israel over the last year and the ongoing fight against Iranian proxies such as Hezbollah. Clearly speaking also to an American audience, Netanyahu warned of the danger of nuclear terrorism:“We will not allow the most dangerous regime in the world to get its hands on the most dangerous weapons in the world. Iran plans to hand these weapons (nuclear weapons) to its terrorist proxies.” He added that Operation Rising Lion will continue until the threat has been fully eliminated.

Netanyahu’s Address (Source: Prime Minister of Israel)

Netanyahu’s Address (Source: Prime Minister of Israel)

Iran’s Supreme Leader, Ayatollah Ali Khamenei, has vowed retaliation: “That Zionist regime should anticipate a severe punishment. By God’s grace, the powerful arm of the Islamic Republic’s Armed Forces won’t let them go unpunished.”

Earlier today, Iran launched around 100 drones in direct response to the attack. Reportedly, all were intercepted, possibly with support from Jordan. A full-scale retaliation may be delayed due to the substantial damage inflicted by Israel on Iran’s missile capabilities and military leadership.

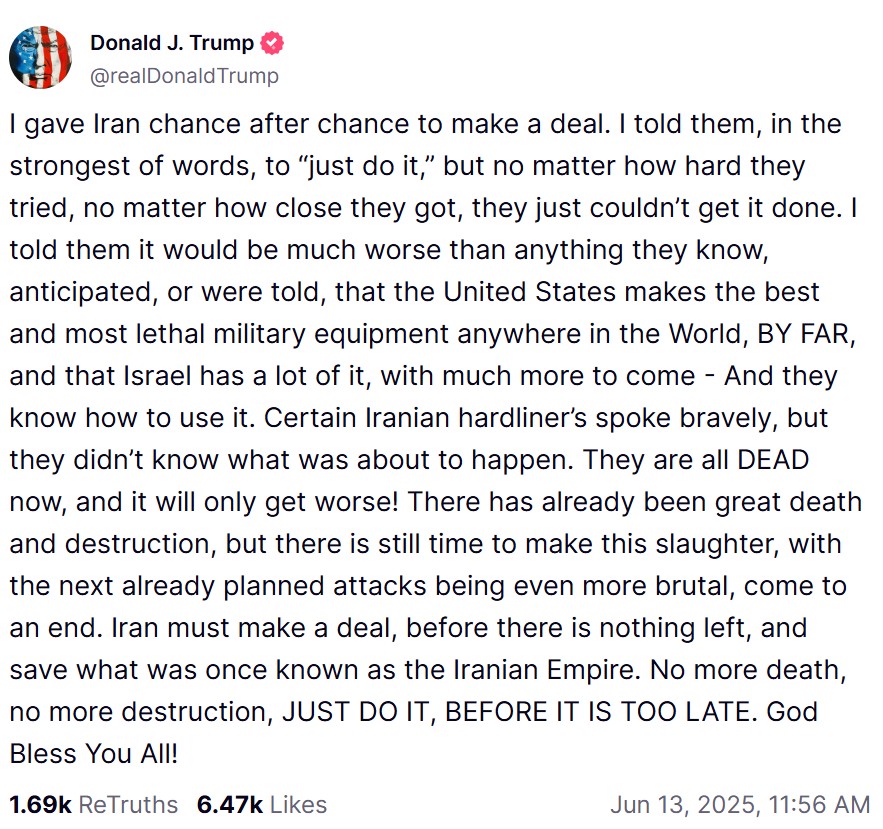

Trump’s reaction (Source: Truth Social)

Trump’s reaction (Source: Truth Social)

Trump responded moments ago on Truth Social, urging Iran to strike a deal before it’s too late. The key question now is whether the U.S. will become directly involved in the conflict. The State Department claimed the U.S. was not involved and called the attack unilateral. However, it seems unlikely the U.S. was unaware: America reportedly withdrew embassy staff from the region prior to the strike.

It’s worth rewatching Paul Buitink’s recent interview with Douglas Macgregor, a retired U.S. Army colonel, who warned of an Israeli strike on Iran and explained why Trump may not have full control over the situation.

Israel has not halted its airstrikes. According to reports, the operation may last at least two weeks.

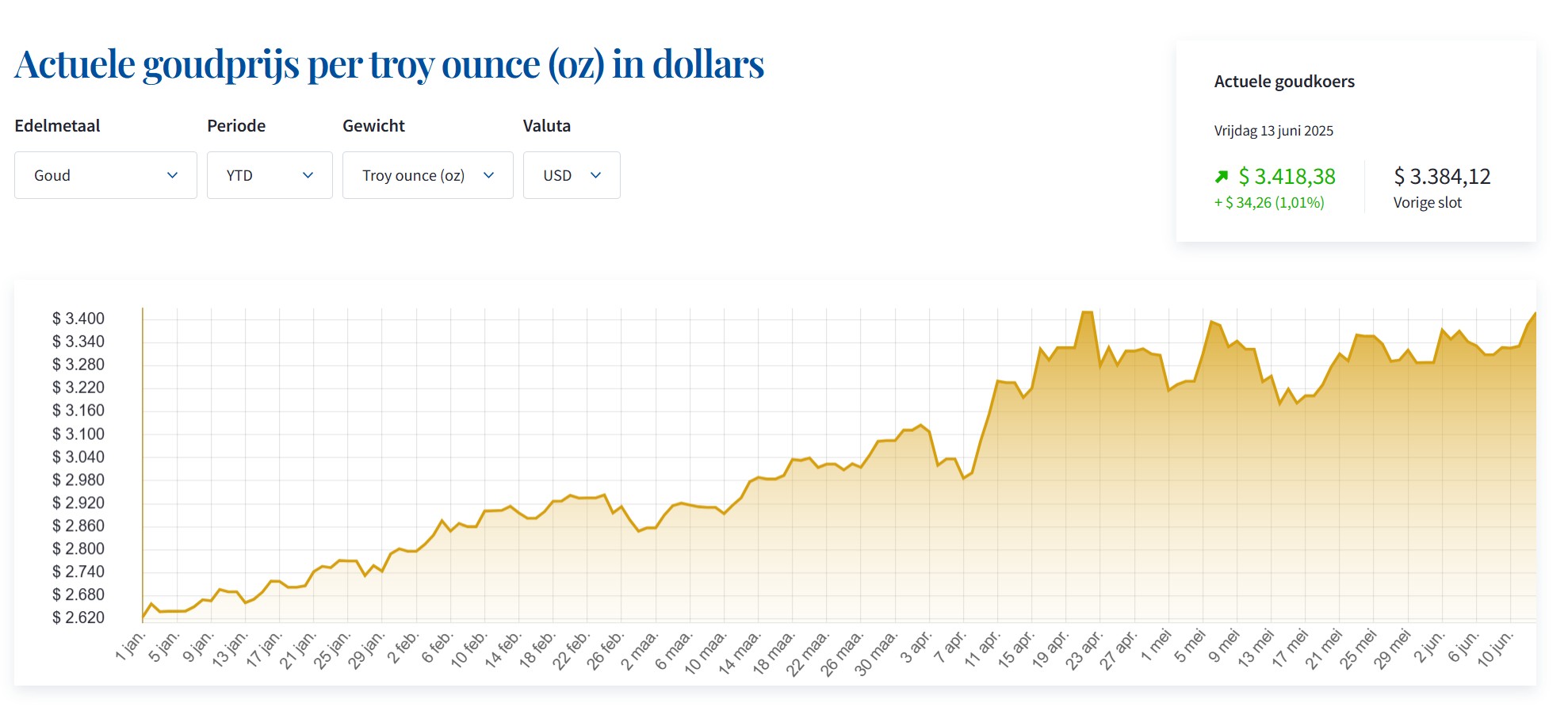

In response to the attack and fears of further escalation, investors are flocking to safe-haven assets. At the time of writing, the gold price exceeds €95,600 per kilogram — the highest level in two months. In U.S. dollar terms, the gold price appears to be breaking through its previous April record.

Gold price in USD, Friday afternoon, June 13 (Source: Holland Gold)

Gold price in USD, Friday afternoon, June 13 (Source: Holland Gold)

As during the previous round of Israeli-Iranian tensions, Bitcoin — the so-called “digital gold” — dropped in value, while physical gold rose. Bitcoin once again behaved more like a risk asset than a true safe haven, similar to equities, which also saw losses. The U.S. dollar, traditionally seen as a safe haven, performed relatively well and gained against other currencies.

Oil prices surged even more sharply, rising by up to 13% following the attack. This comes as no surprise given the conflict’s location. Jack Hoogland noted on X that OPEC+ has sufficient spare capacity to compensate for lost Iranian oil output, but that a potential blockade of the Strait of Hormuz by Iran could severely disrupt the use of that capacity.

With oil prices up roughly 40% since April 9, this surge poses a serious challenge for Trump, who relies on low energy prices as a key tool to suppress inflation. To be continued.

On Tuesday, the Swiss Council of States approved a constitutional amendment to safeguard access to cash. The proposal enjoys broad support across the political spectrum and had already been passed by the National Council. It is the government’s counterproposal to a 2023 citizens’ initiative titled: “Yes to a Free and Independent Swiss Currency in the Form of Coins and Banknotes.”

The Swiss Movement for Liberty (MSL), the initiator, wants to ensure that coins and banknotes remain available in sufficient quantities and that any plan to replace the Swiss franc must be subject to a vote by the people and the cantons. In Switzerland, referendums can be triggered if more than 100,000 signatures are collected.

Swiss Franc Banknotes (Source: Shutterstock)

Swiss Franc Banknotes (Source: Shutterstock)

Initially opposed to the initiative, the Swiss government offered a counterproposal. It now wants to enshrine in the Constitution that access to cash must be guaranteed, as well as the use of the franc as the national currency.

Interestingly, the government opts to use the term numéraire (cash) instead of explicitly stating “coins and banknotes.” This wording has raised concerns among MSL supporters. After all, what exactly qualifies as “cash”? Those following the CBDC debate will know that the digital euro is often portrayed as a form of digital cash.

According to Le Temps, there is no hidden agenda, at least according to Sidney Kamerzin, a politician and rapporteur on the Economic Affairs Committee of the National Council. The term numéraire was deliberately chosen to allow for alternative forms of cash.

Since MSL has not withdrawn its original initiative, the Swiss people will likely vote in a referendum to choose between: the initiative, the counterproposal, or rejecting both.