9.3

8.064 reviews

English

EN

This article has been automatically translated from Dutch. Click here to see the orginal article including all links to sources.

This was a week of hard numbers. The number of rental properties sold was almost twice as high as previously thought—unexpectedly due to government intervention. According to a professor, the Dutch rental market is gradually spiraling out of control. Meanwhile, both stocks and crypto took heavy hits this week. European stocks are also set to struggle as Trump mentioned a 25% import tariff. However, one Trump trade stood out: gold. Is the party over, and is the Trump trade coming to an end? Read on!

Hugo de Jonge’s Affordable Rent Act is a disaster for the rental market. Yesterday, new figures revealed that rental property sales are accelerating even faster than expected. Minister Mona Keijzer commissioned a deeper investigation by the Land Registry after reports indicated that affordable rental supply had nearly vanished. Last year, investors sold more than 38,000 rental properties—almost twice as many as initially estimated. This was somewhat expected, as even we, a precious metals company, wrote an extensive article on it last year when we noticed more real estate investors buying gold.

Surge in Private Landlord Sales (source: FD)

In our podcast last week, university professor Coen Teulings stated that Hugo de Jonge has wrecked the rental market and that people without wealthy parents will ultimately be unable to live in cities like Amsterdam. Last year, nearly 20% of purchased homes were former rental properties. Investors have been selling far more than they are buying since 2021. Government measures have made property rentals significantly less attractive, particularly for private real estate investors. The Affordable Rent Act is not the only culprit. Since last year, private landlords have faced higher wealth taxes on their properties and are no longer allowed to sign temporary rental contracts.

“These are huge numbers leaving the rental sector. It’s getting out of hand,” said Professor Peter Boelhouwer to De Telegraaf. At the current sales pace, more rental properties are being sold than built. The government claimed that while rental properties would be sold, new construction would compensate. Minister Keijzer finds the figures concerning and expects to inform Parliament about possible measures by the end of March.

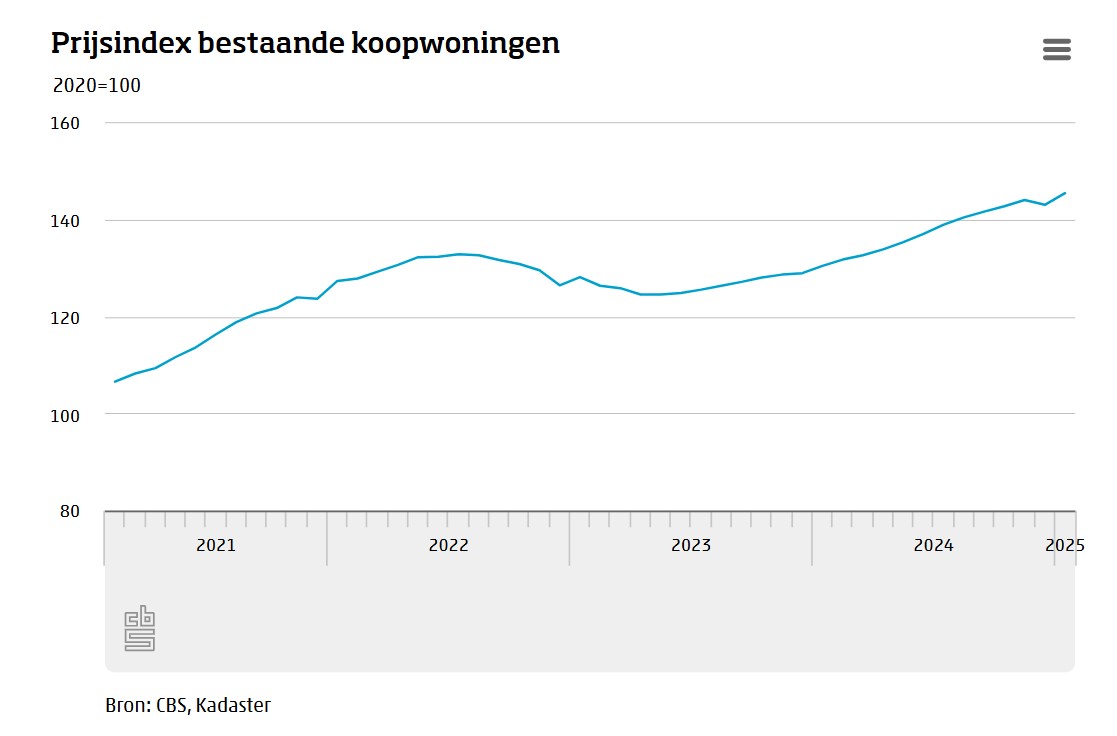

Price Index of Existing Homes (source: CBS)

Last Friday, the CBS released more interesting figures on the housing market. In January 2025, home prices were 11.5% higher than a year earlier. Compared to December 2024, prices rose by an average of 1.6%. The surge in former rental properties entering the market has not led to significantly cheaper home prices.

In most Dutch municipalities, home prices increased in the last quarter of 2024. The highest rises were in Edam-Volendam (+20.8%), Heemskerk (+16.9%), and Utrecht (+16.4%). However, some municipalities saw price drops. In Nederweert, Dinkelland, Vught, and Noord-Beveland, home prices fell by 0.2%, 1.6%, 4.3%, and 5.0%, respectively. There are opportunities for those not tied to the Randstad!

Gold prices dipped slightly this week, returning to mid-February levels. Ole Hansen of Saxo Bank views this as a healthy correction before gold resumes its climb toward $3,000 (per troy ounce) and beyond. Last week, The Financial Times called gold the best-performing Trump trade, and it continues to stand strong while other Trump trades struggle.

Performance of 'Trump Trade' Tesla (source: Holger Zschaepitz)

Holger Zschaepitz notes that trades that performed well since Trump’s election are now gradually declining. “Tesla, crypto, tech, oil, and banks saw strong rallies. But since Trump took office on January 20—and especially over the past week—these positions have been unwinding.”

Tesla has fallen so much that it has now dropped out of the exclusive trillion-dollar club (stocks with a market cap over $1 trillion). The stock might be suffering due to Elon Musk’s close ties with Trump. This goes beyond Musk’s growing unpopularity among Tesla customers and the damage it causes to the brand. According to CNN, the Chinese government is considering withholding approval for Tesla’s Full Self-Driving technology as a bargaining chip in trade negotiations with the U.S. China has various means to pressure Tesla, including restricting data exports and imposing regulatory hurdles. This would be a financial setback for Tesla, which faces stiff competition from Chinese EV makers like BYD.

The S&P 500 Drops Below 6000 Points (source: CNBC)

The broader U.S. stock market is also struggling. The S&P 500 closed way below 6000 points for the first time since the inauguration. Even Nvidia's stock declined despite surpassing earnings expectations. The Financial Times attributes this to poor economic data on consumer confidence and home sales.

Short-term consumer confidence in the economy has fallen below the recession-warning threshold for the first time since June 2024. Meanwhile, the average 12-month inflation expectation rose from 5.2% to 6%, partly due to anticipated Trump tariffs. The British newspaper describes a defensive rotation away from tech stocks and bitcoin toward market segments that typically perform well in economic slowdowns, such as consumer staples. Warren Buffett’s Berkshire Hathaway has even sold all of its S&P 500 ETFs, now holding a record cash position of at least $334 billion.

Is the Party Over? Will the Trump Trade End? (source: Gage Skidmore)

Last week, we noted that European stocks were outperforming American ones, mainly because Trump had not yet imposed tariffs. European stocks began declining this week when Trump threatened import tariffs. Auto manufacturers were particularly affected. “We’ve made a decision and will announce it very soon,” Trump said when asked about EU tariffs. “It will generally be 25%, and that applies to cars and everything else.”

EU and U.S. Trade Tariffs (source: Daniel Lacalle)

Interestingly, the EU itself is no stranger to trade restrictions. Economist Daniel Lacalle notes on X that while the EU presents itself as a free market, it taxes U.S. goods more heavily than vice versa. According to him, the EU also creates indirect trade barriers through fiscal, regulatory, and environmental policies. Trump’s new tariffs—or the mere threat of them—could be leveraged to push the EU into lowering its own trade barriers.

Bitcoin’s drop has been so extreme that we won’t even waste too many words on it—a glance at the chart says it all. And bitcoin has actually held up better than most altcoins. Investor sentiment took a hit after Bybit, a major crypto exchange, suffered a $1.5 billion hack—the largest crypto theft in history.

Finally, a listening tip on the best-performing Trump trade. This week, Luke Gromen appeared on Tucker Carlson’s popular podcast for an episode entirely dedicated to gold. The episode has already been viewed over 700,000 times on YouTube. No time for an hour-and-a-half listen? Check out this summarized thread with the key points.