9.3

8.137 reviews

English

EN

This article has been automatically translated from Dutch. Click here to see the orginal article including all links to sources.

Rarely has a week in the precious-metals market been so turbulent. Within just a few days, the gold price surged to a new record before correcting sharply. What do experts make of this move, and does this pullback present a new entry opportunity?

It was an extraordinary week for the precious-metals market. Last Friday, 23 January, the gold price was still hovering around €135,000 per kilo. By Thursday, 29 January, gold had reached a new record of nearly €150,000 per kilo (more than $5,500 per ounce), only to fall back today to roughly last week’s levels.

Gold price development over the past week (source: Holland Gold)

In a podcast recorded on Wednesday with Paul Buitink, we discussed the impact of these price movements on Holland Gold’s operations. In the podcast, Paul described the precious-metals market as overheated and discussed the possibility of a pause in the rally and a potential correction.

On Friday morning, CNBC published an article asking whether this decline once again offers an attractive entry opportunity. Regarding the correction, they quoted economist Ed Yardeni:

“The surprise is that gold has gone from $3,000 to $5,500 without any meaningful correction,” Yardeni said. “A pullback toward $5,000, with some consolidation around that level, would be a normal pattern within a bull market.”

Yardeni said in an interview with Bloomberg on Thursday that he sees a global bull market across virtually all assets, driven by the enormous amount of liquidity that central banks have injected into the system.

The speed of Thursday’s correction was striking. Its abrupt nature suggests something other than orderly profit-taking alone. “When parties want to reduce large positions in gold or silver, they typically do so gradually in order to achieve the highest possible price,” a precious-metals trader told CNBC.

Gold–silver ratio at its lowest level since 2011 (source: Holland Gold)

Despite the correction, prices remain elevated; gold is still trading above last week’s level. The experts interviewed by CNBC agree that the rally unfolded at an exceptionally rapid pace and that a period of consolidation could follow in the short term. The gold–silver ratio is at its lowest level since 2011, which historically has often preceded a consolidation phase.

The structural drivers behind the precious-metals rally, however, appear to remain intact. Gold in particular continues to be supported by a combination of geopolitical tensions and fiscal and debt-related problems. The article argues that this could be a good moment to gradually build positions or add exposure, especially for investors with little or no gold in their portfolios who maintain a long-term perspective.

Two weeks ago we discussed the debt problem, and last week Ray Dalio’s remarks about the breakdown of the monetary order.

In the podcast, Paul Buitink already pointed to the flight out of fiat currencies such as the dollar. He is not alone in this view. Economist Daniel Lacalle published an article this week on Mises.org titled “De-dollarization? It’s really de-fiatization.” According to Lacalle, there is a broad loss of confidence in fiat currencies and government bonds of developed economies.

“In recent years, the main trend in global reserves has not been a shift away from the dollar, but a rotation away from government bonds of developed economies toward gold,” Lacalle wrote.

According to Lacalle, governments are running up against the limits of their ability to issue ever more debt. First, there is an economic limit: beyond a certain point, additional government debt no longer leads to growth, but instead to stagnation and declining productivity growth.

Second, there is a fiscal limit. This is reached when interest expenses and debt levels continue to rise even amid loose monetary policy and increasing tax revenues, placing structural pressure on public finances.

Finally, there is an inflationary limit. When governments and central banks finance debt through currency debasement, this structurally erodes purchasing power. High and persistent inflation ultimately undermines living standards and confidence in fiat money.

Lacalle notes that government debt is approaching record levels—especially for peacetime—while long-term spending commitments, unfunded liabilities such as pensions (France being a notable example), weak economic growth and aging populations make future fiscal improvements politically extremely difficult. At the same time, central banks are pursuing extremely loose monetary policies to facilitate government financing.

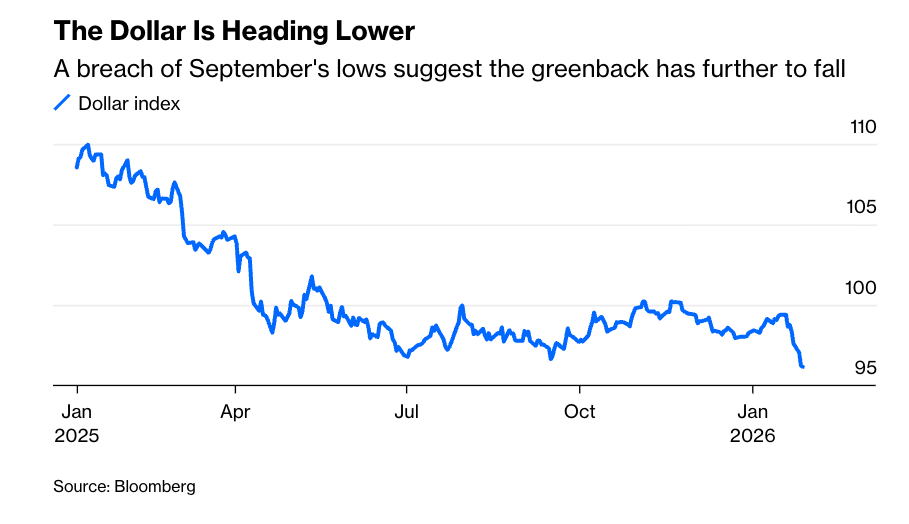

Dollar index since 2025 (source: Bloomberg)

According to Lacalle, this reinforces the conviction that fiat currencies will continue to lose purchasing power over time relative to assets such as gold. This is why, in his view, it is misleading to speak of de-dollarization; de-fiatization is the more accurate term. There is no better fiat currency capable of replacing the dollar. He expects gold to re-emerge as the ultimate reserve asset.

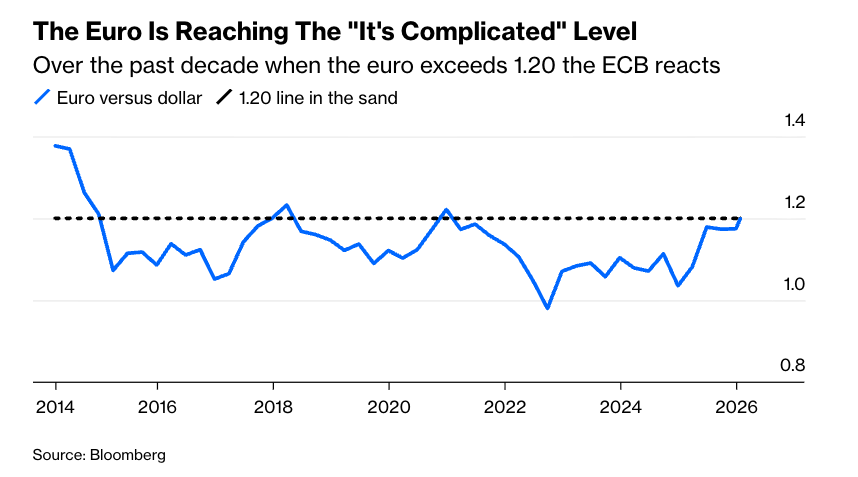

Following the recent decline, the dollar is trading at a multi-year low, but that does not mean the euro will remain structurally strong. A relatively expensive euro makes European products more expensive in the United States and American products relatively cheaper in Europe—an economic problem for the eurozone. Europe therefore also has a clear incentive to weaken the euro. Jeroen Blokland puts it as follows: “The eurozone can’t have a stronger euro. This is a race to the bottom, people, not to the top!”

The ECB intervenes whenever the euro becomes too strong against the dollar (source: Bloomberg)

The ECB intervenes whenever the euro becomes too strong against the dollar (source: Bloomberg)

A relatively strong euro not only negatively affects exports from eurozone companies. It can also depress inflation expectations by making imported goods cheaper. This helps explain why the United States urged China this week to allow its significantly undervalued yuan to appreciate.

Inflation in the eurozone is currently relatively low, partly due to countries such as France, while inflation in the Netherlands remains higher. At the same time, economic growth remains weak. Expectations are therefore that the ECB will intervene to weaken the euro once the exchange rate rises above $1.20, as it has done in the past. Earlier this week, we published an article explaining why central banks fear deflation and deliberately choose inflation.

The conclusion this week therefore appears to be that prices rose too quickly, but that gold and other precious metals will continue to strengthen their value over the long term relative to euros, dollars and other fiat currencies. Or, in the words of economist Robin Brooks—who sees the “Trump risk premium” on U.S. government bonds continuing to rise:

“The debasement trade is unstoppable.”