9.4

7.630 Reviews

English

EN

This article has been automatically translated from Dutch. Click here to see the orginal article including all links to sources.

This week, we observe that the economic situation in Germany, heading into the elections, is far from improving—in fact, the crisis is deepening. On top of this, Brussels is putting Volkswagen in even more trouble. It is highly likely that due to EU climate policies, VW will have to give away hundreds of millions of euros to Chinese competitors in exchange for emissions credits. Additionally, the number of bankruptcies in the Netherlands has been increasing every year since 2021. Finally, we take a look at gold’s golden start to 2025.

Europe’s largest economy contracted by 0.2% in 2024, following a 0.3% contraction in 2023. According to Ruth Brand, President of Germany’s Federal Statistical Office, the German economy has been struggling with increased competition, high energy costs, persistently high interest rates, and uncertainty. Industrial production decreased, and gross value added fell by 3%, while the construction sector saw a decline of 3.8%.

Growth of the German Economy (Source: Holger Zschäpitz)

Germany has been in an existential crisis for some time, both economically and politically. Recently, Scandinavian ministers sharply criticized Germany for its failing energy policies, which have negatively impacted energy prices across Northern Europe. Now, the French newspaper Le Monde reports that Germany’s economic policies are dragging all of Europe down with it. An opinion piece in the prominent French paper—hailing from a country with a budget deficit of 6%—sees Germany’s fiscal conservatism as a significant problem.

Germany has been stagnating, with no growth since Q4 of 2019—just 0.3%, far behind France (3.8%) and even further behind the US (9.4%). German economist Isabella Weber has described the “Schuldenbremse” (debt brake) as a historic mistake. Without a stimulus plan, despite healthy public finances, Germany remains in stagnation. As the industrial base of Europe, Germany’s weakening will have repercussions for the entire continent.

In October, Nout Wellink noted in our podcast that Germany’s debt brake could serve as an example for countries like France. Implementing similar regulations could reduce debt burdens across European nations and enhance the stability of the monetary union.

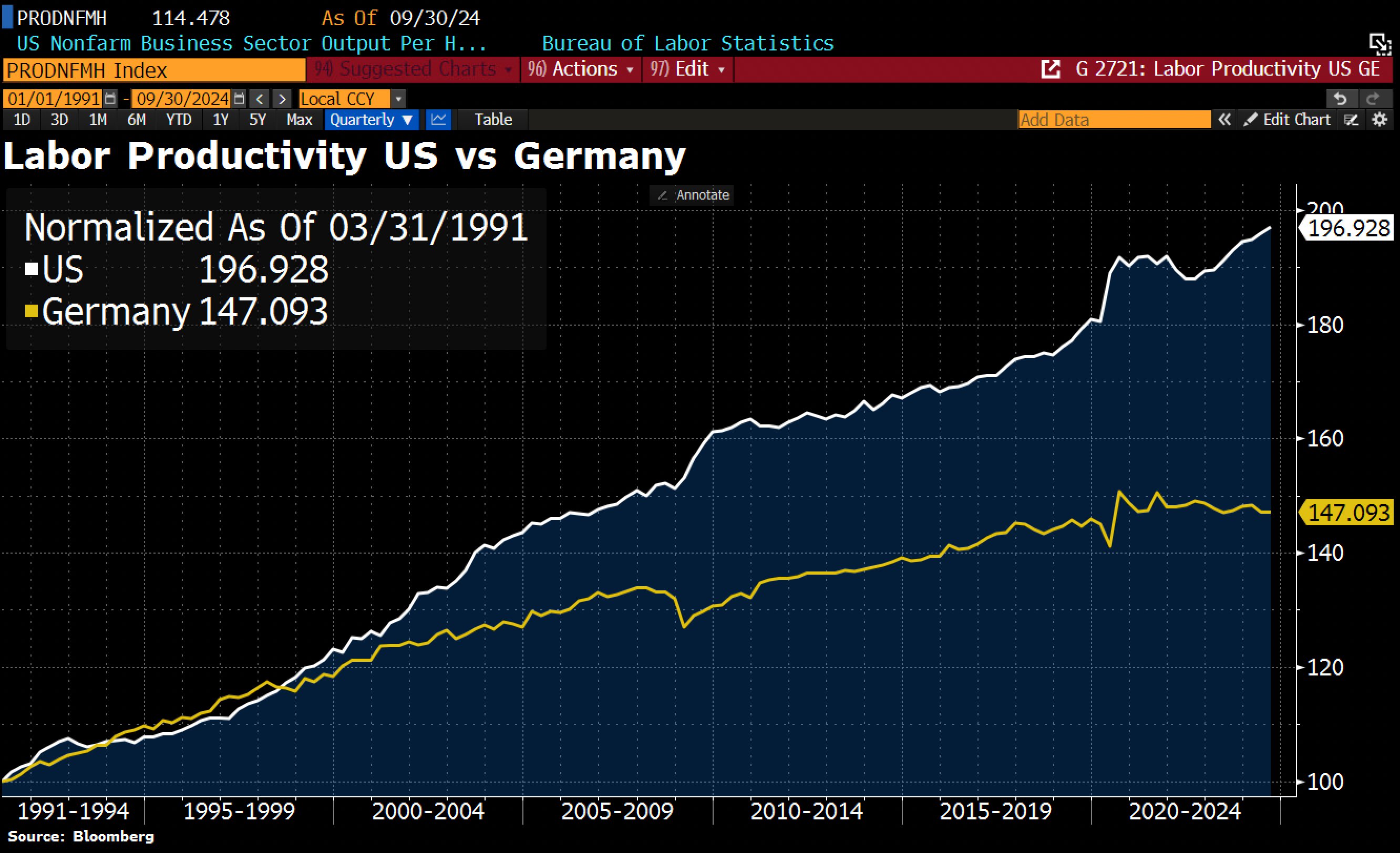

Development of Labor Productivity: Germany vs. America (Source: Holger Zschäpitz)

The French opinion piece highlights poor German productivity growth as a cause of stagnation. As seen in the graph, productivity growth started declining after the euro was introduced. According to German financial journalist and market analyst Holger Zschäpitz, this may be causally linked to the euro becoming undervalued for Germany. While an undervalued currency can boost exports in the short term, it might become a curse in the long run by reducing the pressure on German companies to innovate and improve productivity.

Meanwhile, yields on German government bonds have risen significantly, with the aforementioned uncertainties likely playing a key role. According to the IMF, no major economy has a weaker growth outlook than Germany. ING’s predictions for Germany’s economic situation in 2025 can be found here.

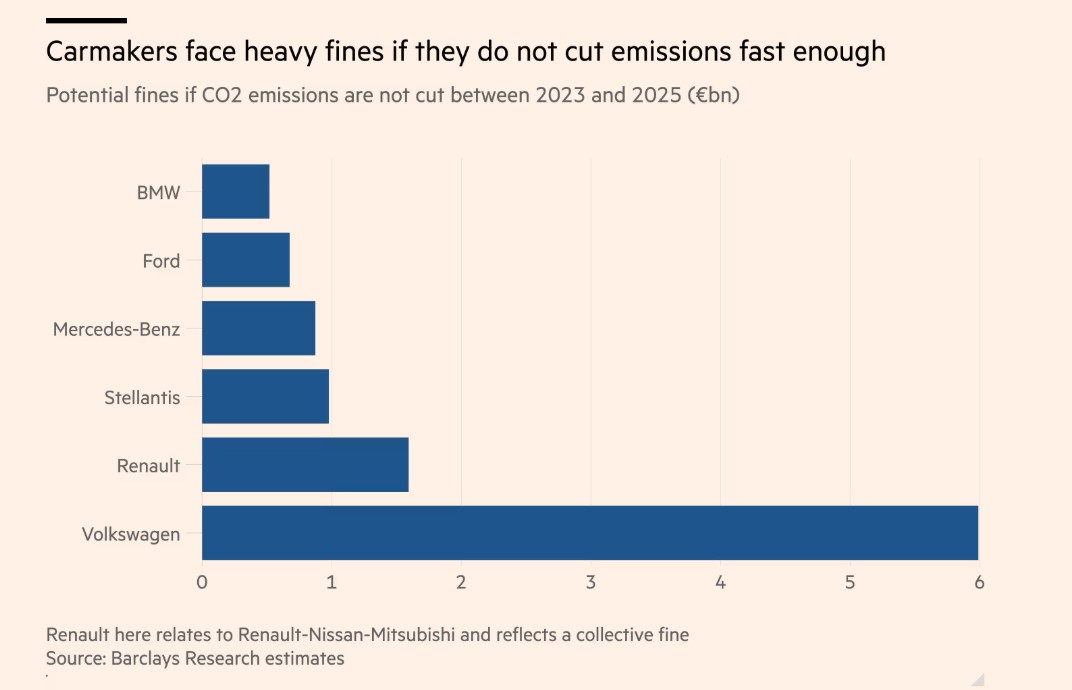

As if Germany didn’t have enough on its plate, the Financial Times reports that European automakers like Volkswagen may be forced to purchase carbon credits worth hundreds of millions of euros from Chinese competitors like BYD. This stems from EU emissions regulations.

The EU has mandated that automakers reduce emissions by 2025. The European Commission plans to fine automakers €95 per vehicle for every gram of CO₂ per kilometer above the limit of 93.6 grams, based on the average emissions of the vehicles sold in 2025. Companies lagging in the shift to electric vehicles must choose between paying billions in fines, boosting EV sales through price cuts, or buying credits from less polluting competitors.

Tesla, for instance, plans to sell its credits to companies like Stellantis, Ford, and Toyota. Tesla has already earned over $2 billion in the first nine months of last year by selling CO₂ credits. In another pooling arrangement, Mercedes-Benz collaborates with Polestar and Volvo, both owned by China’s Geely. Analysts predict that Volkswagen and Renault will struggle to meet targets, leaving them with few alternatives to pooling and likely forcing them to "collaborate" with Chinese manufacturers such as MG-SAIC and BYD. Volkswagen would need to nearly double its EV sales in 2025 to meet EU targets.According to the Financial Times, Dutch EU Commissioner Wopke Hoekstra is in talks with the sector, as Brussels plans to engage in a "strategic dialogue" with automakers later this month.

Potential EU fines (source: FT)

Earlier this week, reports emerged that Chinese automakers are eyeing European Volkswagen factories for acquisition. This could allow them to bypass EU tariffs on imported electric cars. It all serves as a stark symbol of the current situation—a stagnating European economy burdened by ever-increasing regulations from Brussels. Europe continues to disadvantage itself with its ambitious climate policies, while the rest of the world moves away from such an approach. In China, hundreds of coal plants are planned to power all those electric Chinese cars.

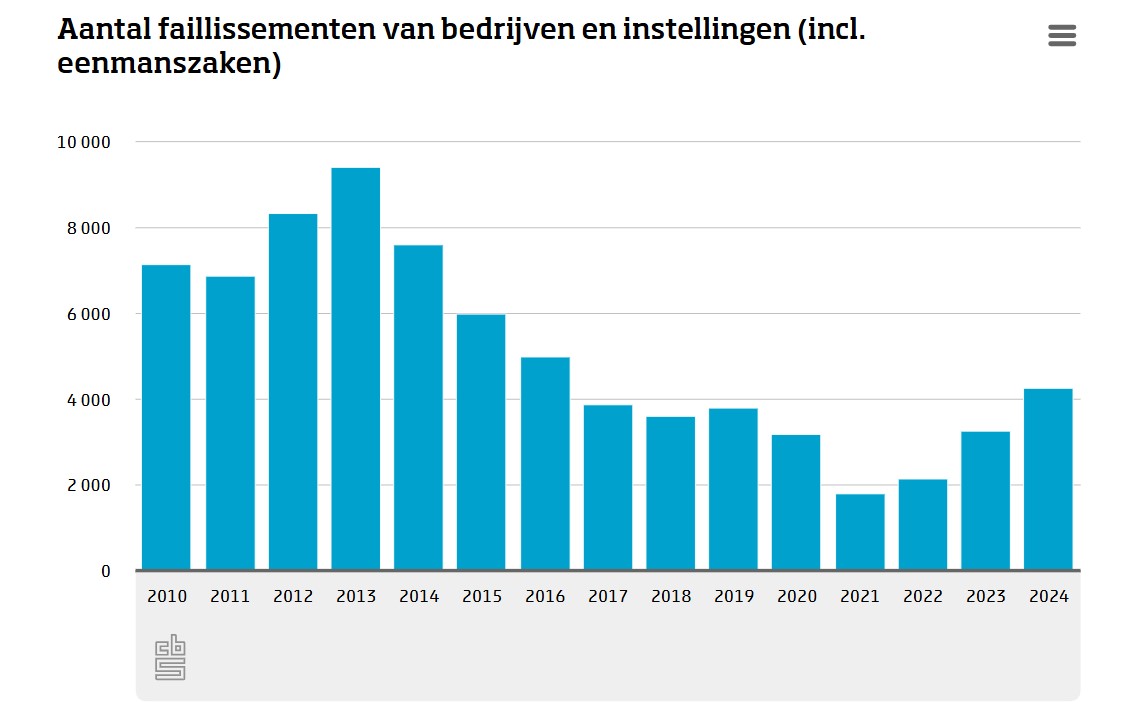

According to figures published this week by Statistics Netherlands (CBS), the number of bankruptcies increased by over 30% in 2024 compared to 2023. A total of 4,270 businesses (including sole proprietorships) and institutions went bankrupt in the Netherlands last year, up from 3,272 in 2023. Nearly all industries saw more bankruptcies than in 2023, with the highest numbers occurring in trade (811), construction (618), and specialized services (509). The latter sector experienced the strongest growth.

Number of Bankruptcies in the Netherlands (Source: CBS)

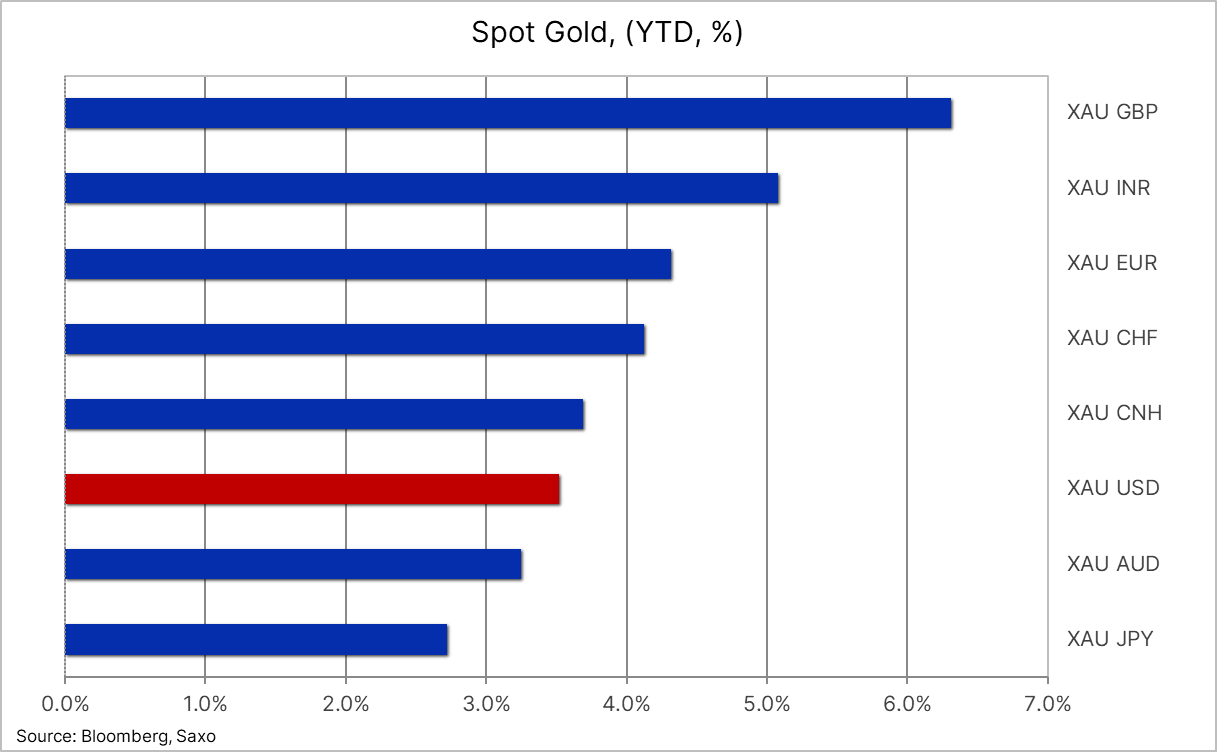

It’s hard to miss the remarkable start for gold this year. The gold price briefly surpassed €85,000 per kilogram this week and is also above $2,700 per ounce. Last week, we delved into the causes in two articles, highlighting factors such as Donald Trump’s inflammatory statements ahead of his inauguration next week.

Gold Performance YTD in Various Currencies (Source: Ole S Hansen)

As seen in the graph, we’re rapidly approaching Frank Knopers’ predicted €100,000 per kilogram. Gold has already gained over 4% since the start of this year. The World Gold Council published an update this week on the Chinese market, forecasting increased short-term demand for gold from both consumers and investors. Next week, Trump’s inauguration and his initial policy decisions as the 47th President of the United States will likely dominate the markets. We will continue to monitor developments with great interest.

Until next week’s selection!