9.3

8.064 reviews

English

EN

This article has been automatically translated from Dutch. Click here to see the orginal article including all links to sources.

This week, speculation about the gold reserves in Fort Knox reached new heights, while gold emerged as the best-performing ‘Trump trade.’ At the same time, China appears to be offloading US Treasuries en masse, and European stocks have been significantly outperforming their American counterparts since Trump’s inauguration. Read on!

You may remember Fort Knox from the iconic Bond film Goldfinger. In this 1964 classic, Sean Connery as 007 is tasked with stopping the villain Auric Goldfinger, who plans to make the Fort Knox gold supply radioactive with an atomic bomb, drastically increasing the value of his own gold. According to the US Mint, Fort Knox holds 147.3 million ounces of gold—over 4,580 tons. This accounts for more than half of the U.S. gold reserves, currently valued at approximately $425 billion. But is the gold really there?

Distribution of U.S. Gold Reserves (source: US Mint)

Rumors and conspiracy theories have long circulated that the gold in Fort Knox may not be fully accounted for, as the vaults have been closed for decades. In 1974, a group of journalists visited after similar suspicions, and in 2017, Treasury Secretary Mnuchin toured the facility along with Senator Mitch McConnell. You can find photos from this visit here. However, these were not complete and reliable audits. As a result, ZeroHedge called on Elon Musk to check whether the 4,580 tons of gold are actually there. Musk responded with a tweet: "Surely it gets checked every year?" To which Senator Rand Paul replied, "Nope. Let’s do it."

Fort Knox in Kentucky (source: Michael Vadon)

Rand Paul has long supported such an audit, as has his father, Ron Paul. It now appears that this may finally happen, as Trump has also given his blessing. "We hope everything is in order at Fort Knox, but we are going to Fort Knox—the legendary Fort Knox—to make sure the gold is there," Trump told reporters aboard Air Force One on Wednesday. "If the gold isn’t there, we’re going to be very angry," he added. The rumors and conspiracy theories will not be easily dispelled. Critics on X argue that a visual inspection will not suffice; drill tests are needed to ensure the gold is real. Earlier this week, we reported that the U.S. is considering a revaluation of its gold reserves—read more here.

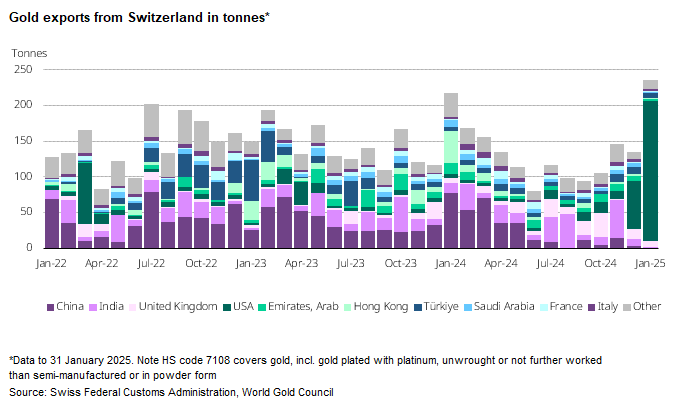

Swiss Gold Exports (source: Krishan Gopaul)

In recent weeks, we’ve seen massive shipments of gold to the U.S. We covered this extensively in a previous weekly selection—read it here. According to the CEO of StoneX, over 2,000 tons have been exported to the U.S. in the past two months. The above chart, for example, shows a sharp increase in Swiss gold exports to America. In January, Switzerland exported nearly 200 tons of gold to the U.S. Meanwhile, gold lending costs continue to rise.

According to the Financial Times, the threat of U.S. import tariffs is pushing gold prices to new records. In recent weeks, gold has become the best-performing ‘Trump trade,’ surpassing all major asset classes since Trump’s inauguration. "Gold serves as a geopolitical hedge, an inflation hedge, and a dollar hedge," said Trevor Greetham, head of multi-asset at Royal London Asset Management, in an interview with the British newspaper. This is why demand for gold is soaring among central banks and private investors.

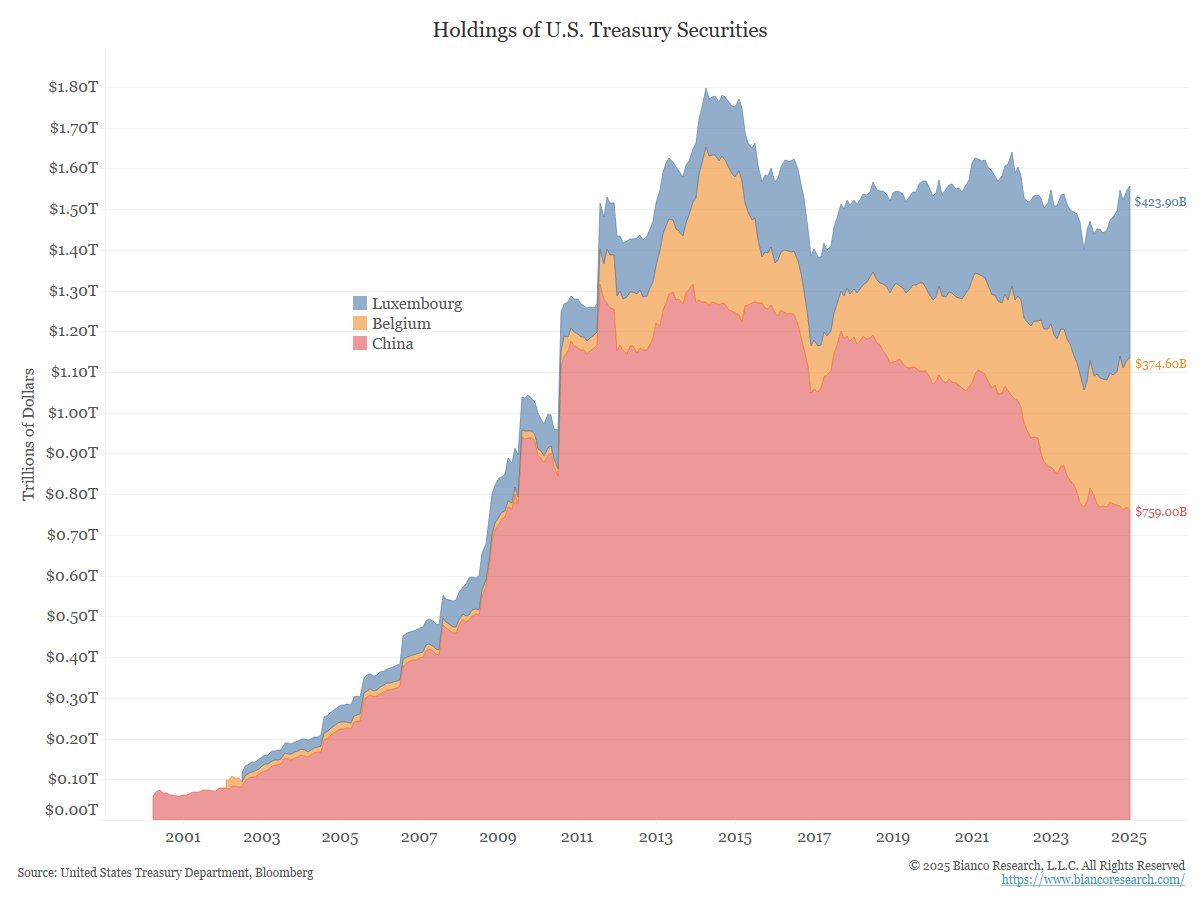

Andy Schectman observes that nations are turning away from U.S. debt and opting for gold instead, as gold carries no inflation, default, or counterparty risk. This week, it became clear that the value of U.S. Treasuries held by China fell by $57 billion to $759 billion in 2024—its lowest level since 2009. The Financial Times attributes this shift to China's desire to diversify its reserves by acquiring assets like gold. China’s reported Treasury holdings have declined by approximately $550 billion since their peak in 2011.

U.S. Treasury Holdings (source: Jim Bianco)

However, the apparent drop in China’s holdings may be overstated, as Beijing is increasingly managing its U.S. Treasuries through less visible accounts, registered in countries such as Belgium and Luxembourg. Japan has also reduced its holdings of U.S. Treasuries.

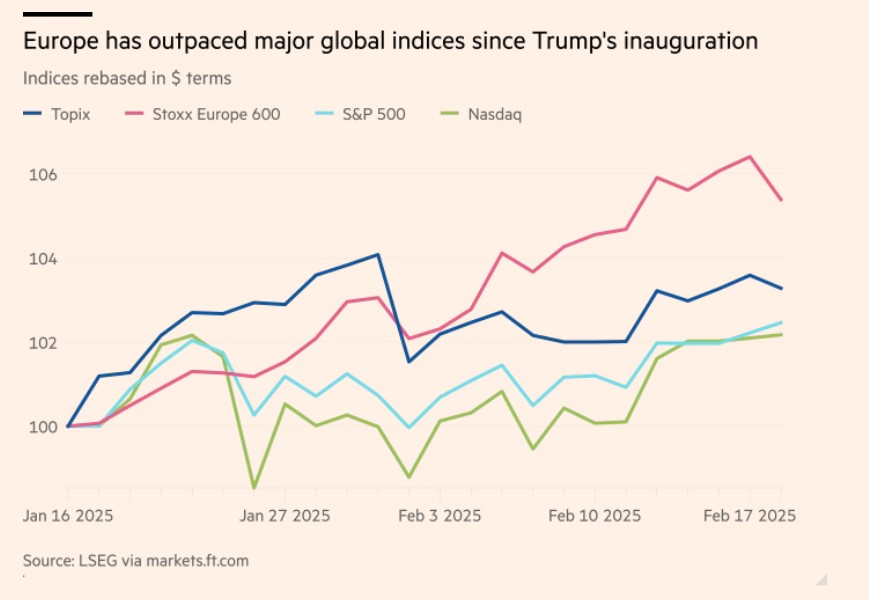

European stocks have outperformed the U.S. market in the month since President Donald Trump’s inauguration. The European Stoxx 600 index has risen by 5.6% since January 17, while the S&P 500 has gained only 2.5%. Regular listeners of the Holland Gold Podcast will not be surprised. On the day of the inauguration, we discussed the relative opportunities for investors in Europe with stock analyst Niels Koerts.

European Stoxx 600 Performs Well (source: Financial Times)

According to the Financial Times, European stocks have benefited from the fact that Trump has (so far) not imposed import tariffs on the EU and from the possibility of a swift resolution to the war in Ukraine. Some analysts, however, doubt whether Europe can maintain this lead throughout the year, especially if U.S. tariffs are only postponed rather than canceled.

Analysts at Bank of America say European stocks are experiencing their best start to a year since the late 1980s, despite economic stagnation and security concerns now that the U.S. is threatening to scale back military aid. Expectations are that European governments will now increase defense spending. As a result, one of the best-performing sectors has been the European defense sector. The stock price of Rheinmetall, known for the Leopard tank and Europe’s largest ammunition manufacturer, has surged by 34% in the past month.

Rheinmetall Stock Price (source: Holger Zschaepitz)

To significantly boost defense investments, European governments will need to take on more debt. Borrowing costs for major economies like Germany and the UK have already risen in recent months. The yield on German 10-year bonds has increased to 2.5%, up from just over 2% in December. One option under consideration is a joint debt issuance by European governments, potentially including the UK and Norway. However, a motion to reject European defense bonds has just secured a majority in the Dutch Parliament. Of course, this does not mean it won’t happen—after all, the Dutch Parliament also opposed the European digital identity initiative. "Europe solves every crisis with more debt; it’s like a disease," writes Martin Visser in De Telegraaf. He sees the EU gradually transforming into a debt union. Read his column here!