9.3

8.064 reviews

English

EN

The Gold price has risen by almost 20% since the beginning of this year and has reached new record highs. In this article, we will explore the main factors that contribute to the rise in the price of gold. What (or who) is the driving force behind this impressive rally?

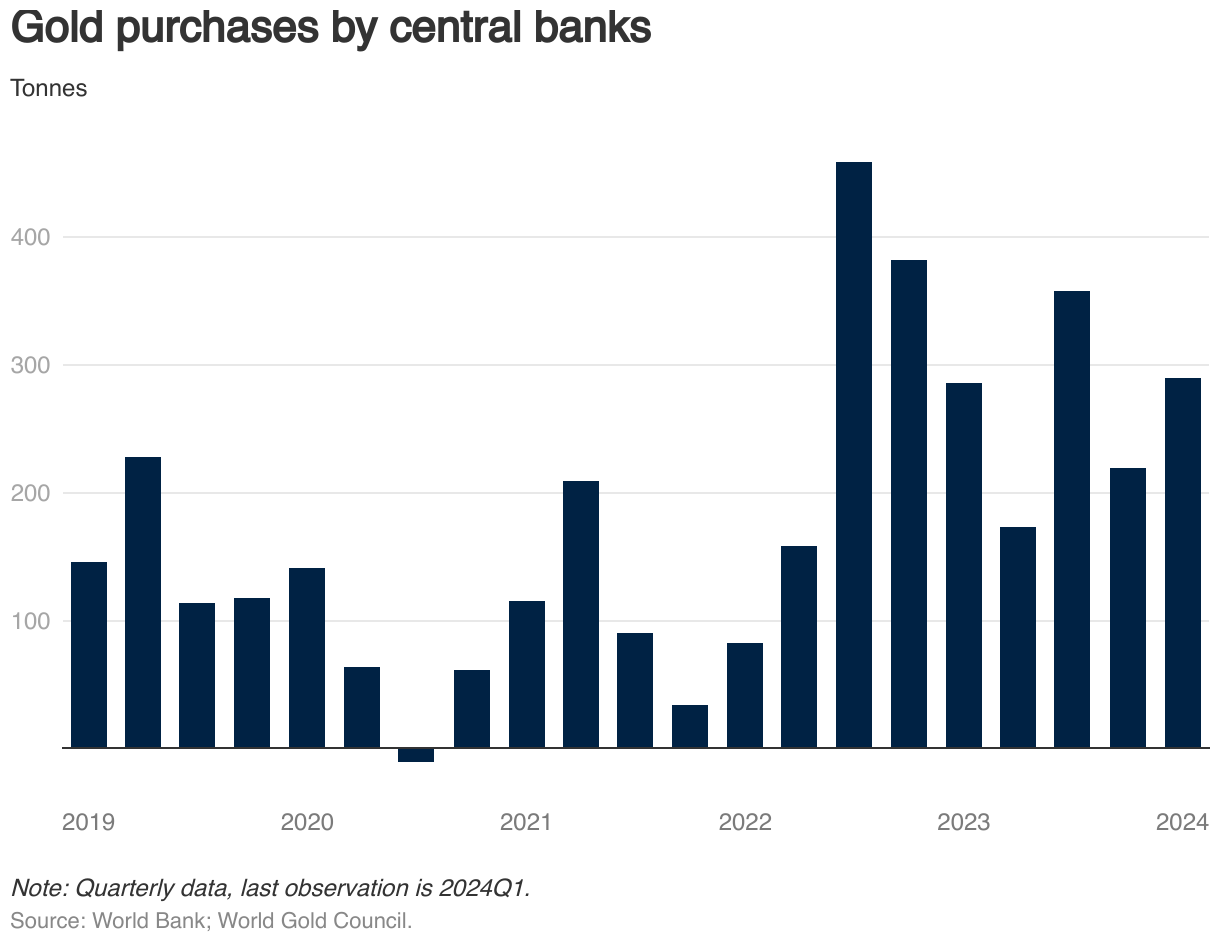

Central banks around the world have recently increased their gold reserves. This is a major factor in the price increase of gold. In the first quarter (Q1) of 2024, central banks' net demand for gold was 290 tonnes. This is it highest Q1 figure since the start of data recording in 2000 and 69% more than the five-year quarterly average of 171 tonnes. Countries such as China, India, and Turkey are the largest active buyers of gold. Even EU countries such as the Czech Republic and Poland have increased their gold reserves in the past year.

Gold purchases by central banks (source: World Bank)

According to Gita Gopinath of the IMF, countries are becoming increasingly critical of their dependence on the U.S. dollar for international transactions and reserves. This is due to the use of the dollar as a tool for economic sanctions and geopolitical pressure. She sees a shift from the dollar to gold as a politically neutral safe haven.

Despite the higher gold prices, we expect JPMorgan analysts that central banks will continue to buy gold. That means gold prices are likely to remain elevated this year.

The People's Bank of China (PBC) bought 225 tonnes of gold last year, making it the Largest Buyer of gold among the central banks. The PBC thus bought about a quarter of the 1,037 tonnes bought by all central banks worldwide in 2023.

Beijing fears that it has become too dependent on the dollar and is therefore pursuing more diversified reserves. China has accumulated huge foreign exchange reserves, mainly in dollars, as a result of its position as the world's largest exporter. This dependence on the dollar carries risks given geopolitical tensions and the use of the dollar as a tool for economic sanctions by the US.

This strategy is in line with that of other BRICS countries, which are also striving for Less reliance on the dollar. The group of countries is considering introducing a common currency that could challenge the dollar as the world's reserve currency.

Also Chinese Consumers buy a lot of gold in the form of coins, bars and jewelry as protection against the declining value of their real estate investments, the yuan, and the stock market. China's private sector's total gold purchases amounted to a whopping 543 tonnes in the first quarter.

Confidence in fiat money such as the dollar is under pressure due to high debt levels and persistent inflation. The United States is facing increasing fiscal deficits and interest payments. This increases concerns about the stability of the financial system. The possibility of Trump re-electing also fuels speculation about a possible devaluation of the dollar to disadvantage economic competitors and create jobs in the US.

Global debt levels have now reached an all-time high of $313 trillion (that's $313 billion). This comes down to 330% of the global economy. Ray Dalio has recently noted that creating inflation is the most effective and likely way out of debt. In this situation of increasing geopolitical tensions, distrust in the money system and persistent inflation, the preference is shifting to gold as scarce money without counterparty risk.

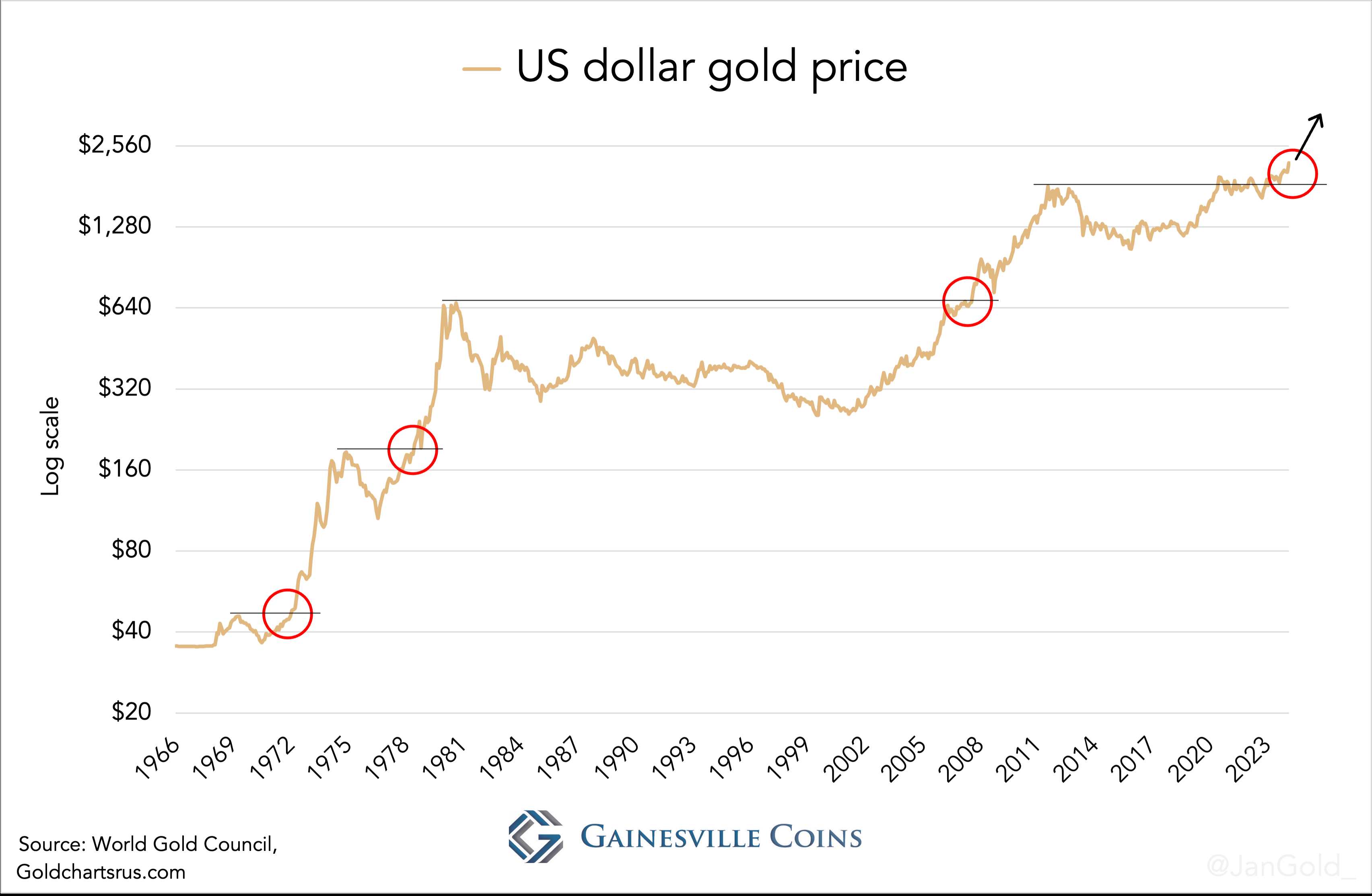

Investors therefore see gold as a safe haven in times of economic uncertainty and inflation. Historically, the Gold price during an (economic) crisis. After the financial crisis in 2008 and the outbreak of the pandemic, gold saw a significant increase in its price.

US Dollar gold price (source: Gainesville Coins)

Technical analysis point out that gold price has broken through a multi-year resistance zone. Long-term indicators also show that gold is undervalued. This suggests that we are at the beginning of a prolonged bull market for gold. The market value of gold could potentially be double.

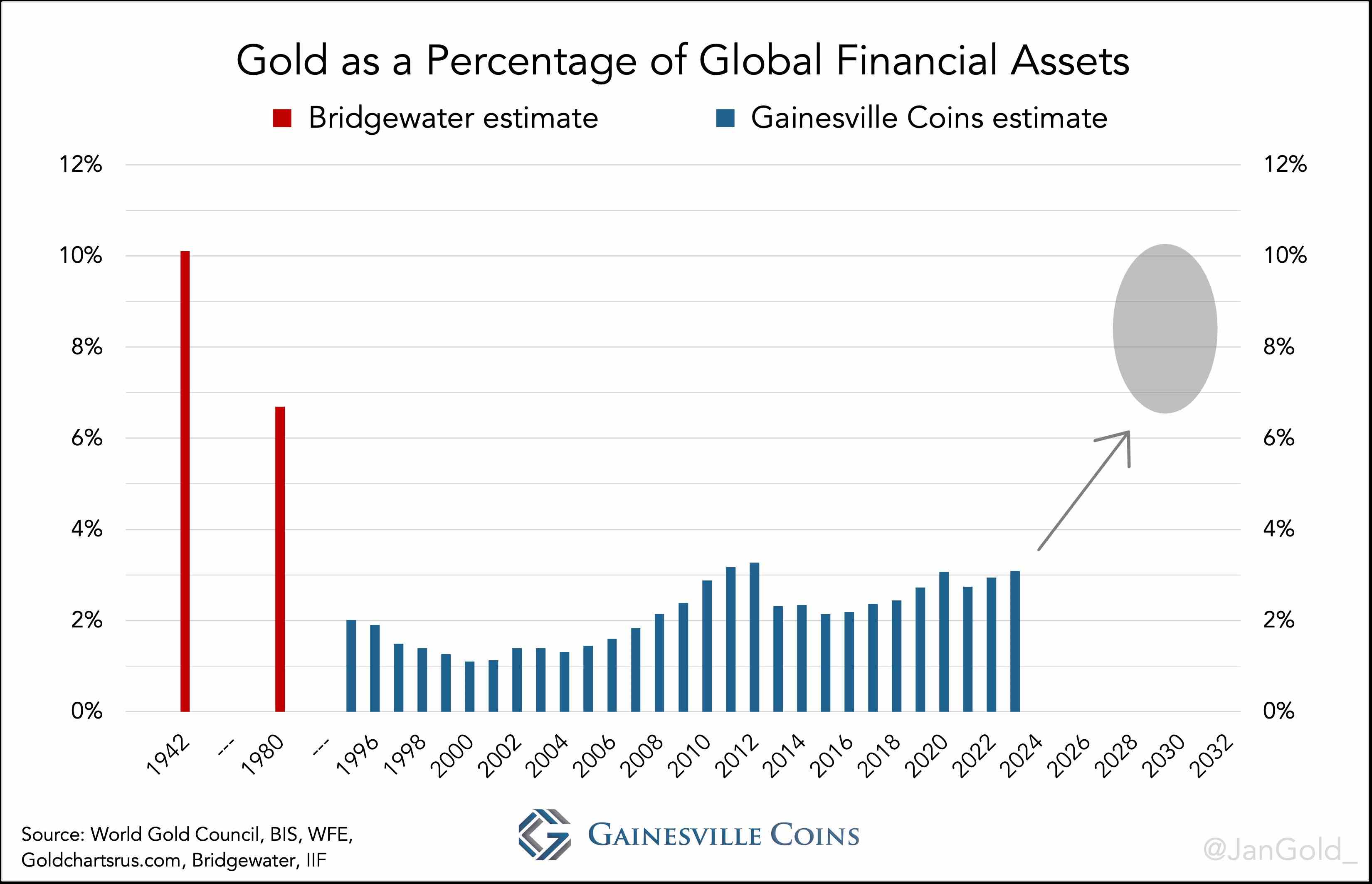

Gold as a percentage of financial assets (source: Gainesville Coins)

As we can see in the chart, the value of gold relative to financial assets was between 7% and 10% during periods of low confidence in credit. This was the case during World War II and at the end of the 1970s. Currently, gold is at 3%. This indicates that there is still plenty of room for further price increases during this bull market.

The impressive rise in the price of gold is the result of several factors that undermine confidence in the money system and geopolitical stability. Central banks, particularly in countries such as China and India, are increasing their gold reserves to reduce dependence on the US dollar.

The record-high global debt burden of $313 trillion and the expectation of persistent inflation are bolstering demand for gold. Investors and consumers see gold as a relatively stable investment in uncertain times. The experts' analyses and the combined demand from central banks, investors and consumers suggest that we are at the beginning of a prolonged bull market.

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink interviews various economists and experts in the macroeconomic field. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.