9.3

8.064 reviews

English

EN

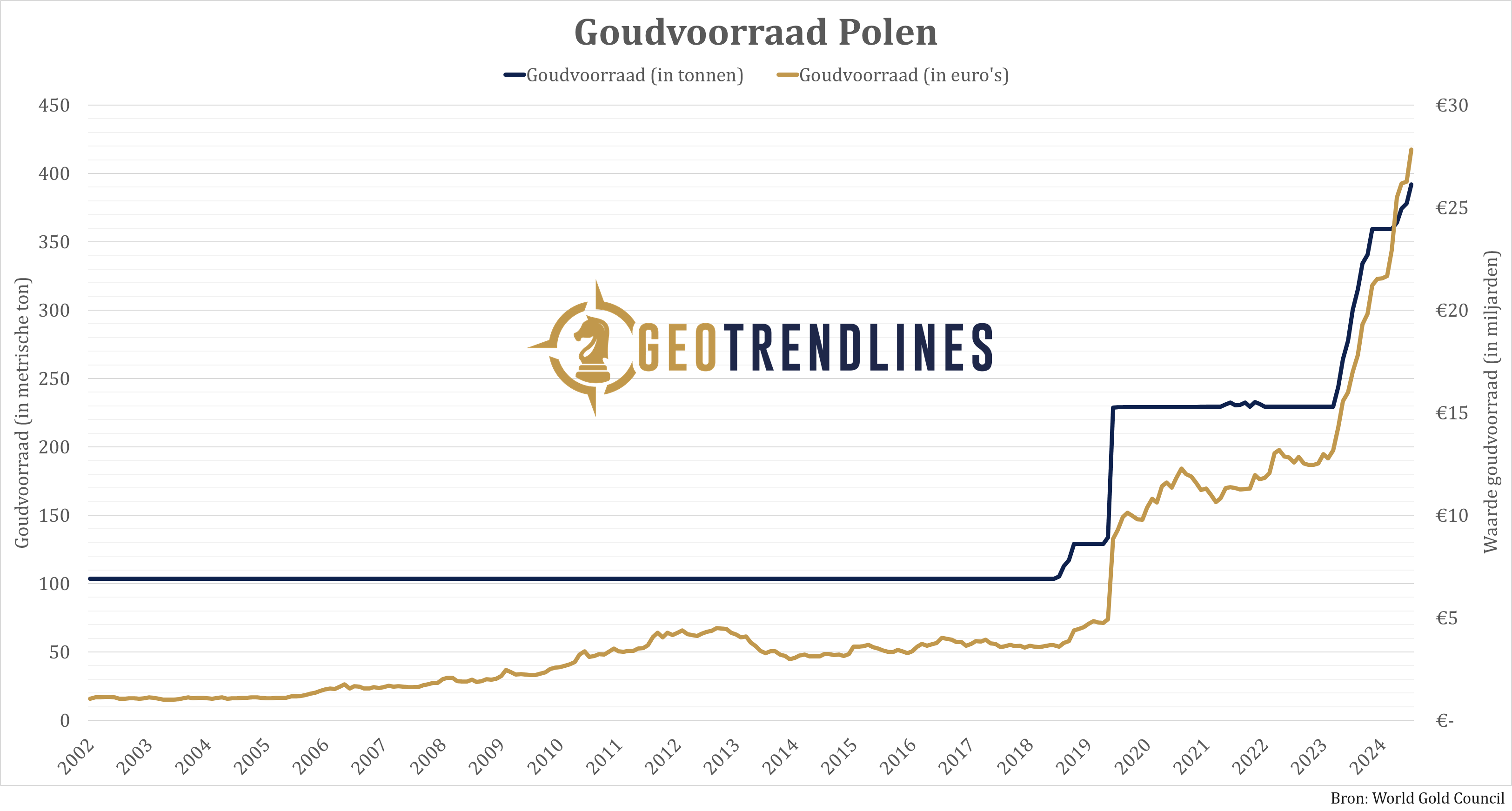

New figures from the World Gold Council show that the central banks of both Poland and the Czech Republic have bought gold again. The Polish central bank bought 14 tonnes in July and thus expanded its total gold reserve to 392 tonnes, almost four times the level of six years ago.

In 2019, Poland doubled its gold reserves to 228 tonnes and the central bank also repatriated more than 100 tonnes of gold from London. Since then, the Polish central bank has gradually replenished its gold holdings, as a hedge against financial and geopolitical risk. The Polish central bank called gold Have you ever seen the 'Ultimate reserve'which can always serve as an anchor of confidence, similar to what the Dutch Central Bank has about its gold stockSaid.

Gold stock Poland

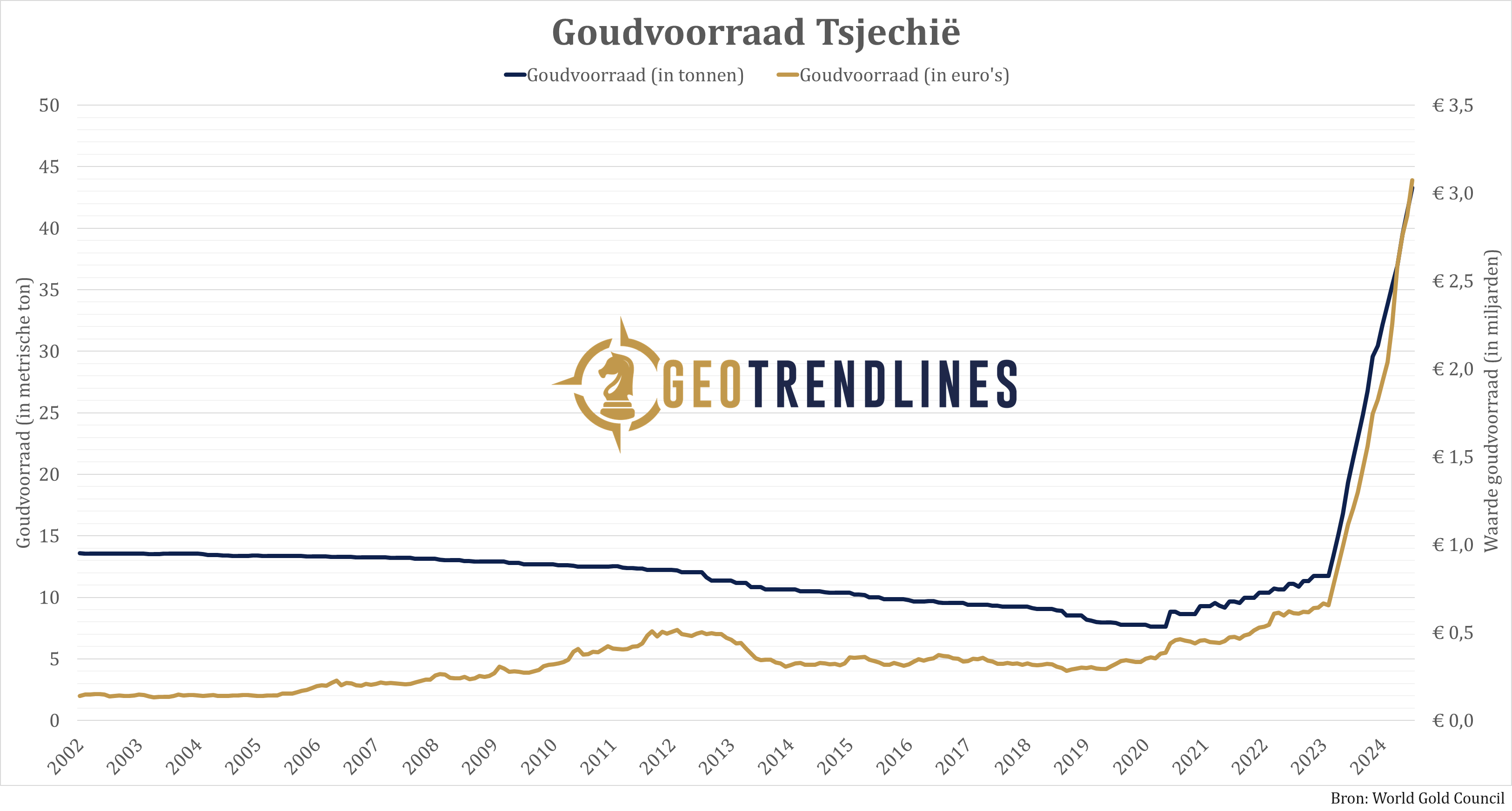

The central bank of the Czech Republicbought 2 tons of gold in July and has now added gold to its reserves for 22 months in a row. In this period, the country's gold reserves rose from 10.9 tonnes to 43.5 tonnes, more than four times as much.

The Czech Republic has had a new central bank governor for two years, namely 46-year-old Aleš Michl. In a interview With the Czech financial news site Ekonom in May 2022, he said prior to taking office that his ambition was to make more returns from the central bank's reserves. "It's better to have assets than a mountain of debt', said the central banker.

Michl has been with the central bank of the Czech Republic since December 2018 and has seen several countries in the region add gold to their reserves in recent years, including Austria, Hungary, Poland and Serbia. All these countries are expanding their gold reserves for geopolitical and economic reasons.

Gold stock Czech Republic

These gold purchases by Eastern European countries show that the significance of having a gold supply is increasing by the day. In a world of increasing geopolitical tensions, gold is a reserve with no political affiliation and no credit risk.

It is also striking that many of these countries repatriate their gold, and thus move it from London to their own country. As we have said before, this is noteworthy, because it contradicts the narrative that Russia would advance further after conquering Ukraine and attack more countries.

If that was really the intention of Russia, then Eastern European countries would be wise to take their gold to safety and move it to London or New York, for example. The fact that they are doing exactly the opposite is a confirmation to us that the central banks of Eastern European countries do not see this as a risk.

How can you, as an individual, respond to this development? Follow the policies of central banks and make sure you have some physical gold in your possession, spread over different locations if desired. You never know when it will come in handy, but better a few years early than a day too late.

Would you like to read more analyses by Frank Knopers and Sander Boon? Through their Substack they publish regular updates. Frank Knopers and Sander Boon write A weekly market commentary with their views on the most important trends and events in the field of money, gold and geopolitics.