9.3

8.318 reviews

English

EN

Gold and silver dealers worldwide have faced unprecedented situations in recent weeks. From the United States to Hong Kong, customers queued in long lines outside stores, forcing dealers to limit access. During the surge in demand, investment-grade silver became scarce, while record volumes of silver were simultaneously sold back. A brief overview for the physical investor: what exactly was happening?

By now, we are all familiar with the gold and silver charts, showing a recent sharp surge followed by an extraordinary correction. Despite that correction, gold has already returned to the same level as January 27, and silver to the level of January 11. Since last August, the start of the rally, silver has still more than doubled in value. Gold is trading 50% higher than six months ago.

Meanwhile, BNP Paribas’ David Wilson expects a gold price of $6,000 per troy ounce by year-end (currently around $5,000). Yesterday, the silver price climbed another 4.3%, before easing somewhat today. Today’s decline was quickly explained. Unexpectedly positive U.S. jobs data reduced the likelihood of interest rate cuts by the Federal Reserve, which generally makes precious metals slightly less attractive.

Yesterday’s rapid rise was partly driven by a new forecast from the Global Silver Institute, projecting that silver deficits will persist into 2026. While demand for silver jewelry is declining slightly due to higher prices, this is being offset by rapidly increasing investor demand, the institute stated in a press release issued yesterday.

Gold price over the past week showing a brief spike from January 27 and the subsequent correction. Within a few days, the gold price recovered. Source: Holland Gold.

The unprecedentedly rapid rise in the silver price to €3,200 per kilo at the end of January significantly disrupted the physical precious metals trade, not only in the Netherlands. Old silver items emerged from drawers and cupboards everywhere, as high prices made melting increasingly attractive. “Everyone’s grandmother is selling the silver candlesticks, forks, knives—anything made of sterling silver—to capitalize on silver prices,” said Gene Furman of King Gold & Pawn and Empire Gold Buyers in New York. In recent weeks, it was mainly about silver. “It’s coming in droves and droves,” said Gary Tancer of Coin & Jewelry Gallery in Boca Raton, who bought ten times more silver in January than he would normally purchase in an entire year. Some U.S. dealers even stopped buying or turned customers away.

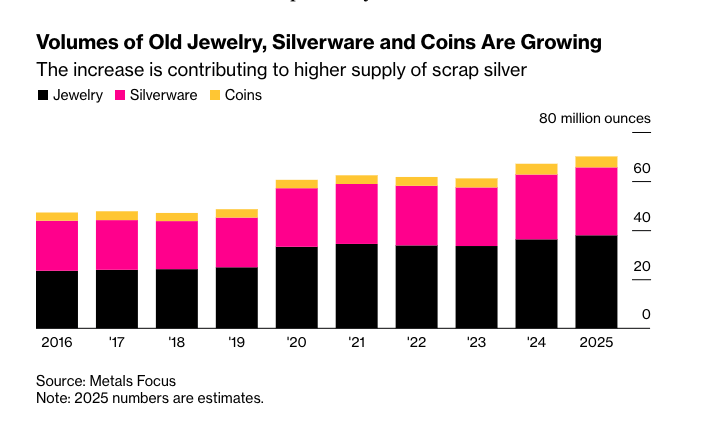

Share of scrap silver (including silver cutlery and jewelry that are melted down) in total recycled silver is increasing. Source: Bloomberg

Private individuals are mainly choosing to sell silver heirlooms, as many appear to expect gold to continue rising in value, Philip Newman of Metals Focus told Bloomberg. The share of scrap silver in annual silver supply (mining, industrial recycling and melt silver) increased rapidly in 2025.

Within the Holland Gold network, we also hear from jewelers and refineries that they are being flooded with silver. Old silver teapots and pitchers are purchased and this so-called scrap silver is then crushed and melted. It is subsequently sent to refineries such as Umicore, Argor Heraeus and C. Hafner, where it is refined into pure silver. Refining is a time-consuming process, and the enormous influx has overwhelmed many refineries. Argor Heraeus, Europe’s largest precious metals refinery, reports massive backlogs. “If you place a silver order today, it no longer takes a few weeks—we are now talking about months,” said Dominik Sperzel of Heraeus Precious Metals.

This has led to the unusual situation where there is plenty of silver throughout the market chain, but not yet in the right (pure) form or in the right place. Holland Gold also recognizes the remarks made by U.S. dealers, with January 2026 going down as an absolute record month in terms of activity. In busy periods such as a silver squeeze, logistics play a crucial role in the trade.

While refineries and dealers attempt to clear backlogs, a degree of calm appears to have cautiously returned to the markets. After several TACO moments (Trump Always Chickens Out), and following the recent correction and subsequent recovery in prices, activity is declining. Yet this may be deceptive. We still see significantly higher price volatility than before. In addition, Chinese demand for silver continues to dominate the markets. Demand from Chinese investors remains strong, alongside increased demand from Chinese industry, particularly solar panel manufacturers. This has resulted in historically low silver inventories at the Shanghai Gold Exchange (China’s main precious metals exchange). Currently, higher premiums are being paid for immediate delivery of metals. Although the important Lunar New Year holiday starting February 16 may temporarily ease Chinese markets, significant tightness remains in the Chinese silver market.

Silver inventories at the Shanghai exchange continue to decline, and China’s silver deficit is widening (source: Bloomberg)