9.3

8.064 reviews

English

EN

Russia added 21.77 tonnes of gold to its reserves in the month of November, according to the latest data from the IMF. It is the ninth month in a row that the Russians have bought gold. November's purchase brings the country's total gold holdings to just over 1,390 tonnes.

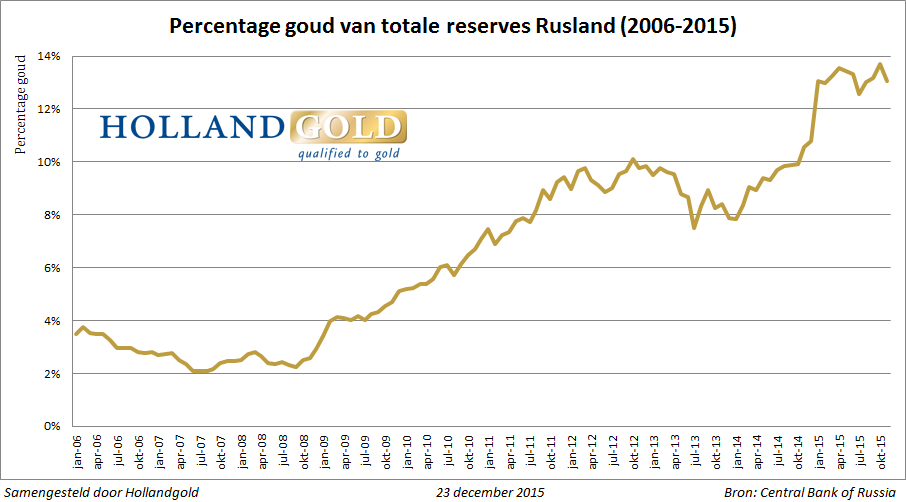

The central bank of Russia remains in full force Buy gold diversification of reserves. Relative to the size of the economy and in relation to currency reserves, the country still has a relatively small gold reserve, especially compared to many Western countries. The Central Bank of Russia has already added 197 tonnes to its gold holdings this year, up from 172 tonnes in the whole of 2014.

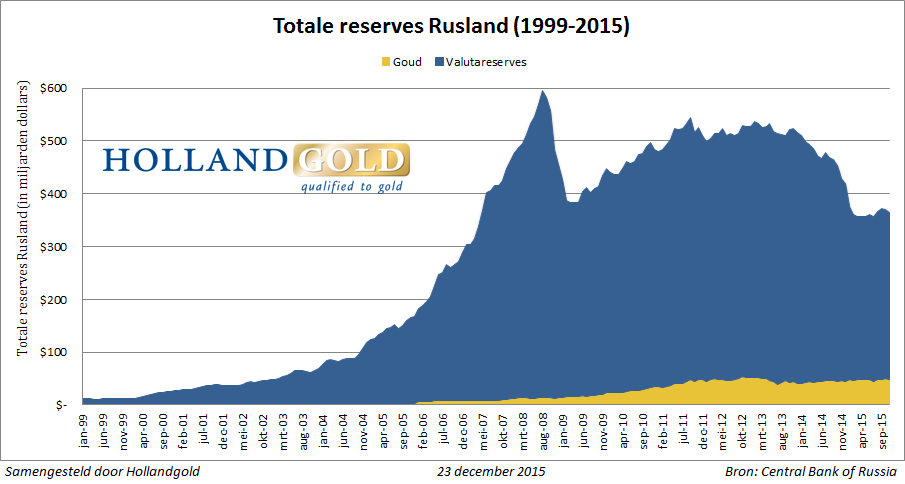

Russia the end of November, it had $364 billion of reserves, of which $47.68 billion in the form of gold bars and coins. That's about 13%. The central bank sees gold as a form of diversification and as a '100% guarantee against political risk'.

Since 2005, the country has been able to expand its gold reserve from less than 300 tonnes to almost 1,400 tonnes, more than four times as much. The central bank extracts a lot of gold from Russian gold mines. The country's gold mining sector is the third largest in the world with a production of over 266 tonnes in 2014. Only in China and Australia did more precious metal come out of the mines in 2014.

Total foreign exchange reserve and gold reserve Russia

Gold reserve as a percentage of total reserves

Not only Russia continues to buy gold, Kazakhstan also adds something to its reserves every month. Its gold holdings grew by 70,000 troy ounces to 218.66 tonnes in November, accounting for 27% of the country's total reserves.

Central banks added a net 175 tonnes of gold to their reserves in the third quarter of this year, according to figures from the World Gold Council. That was less than the same quarter last year, but much more than the 126 tonnes bought on average in a quarter over the past five years.

"The trend of buying gold will continue. Emerging economies such as China, Russia and Kazakhstan need to replenish their gold reserves from the point of view of diversification," Barclays analyst Feifei Li told Bloomberg.