9.3

8.064 reviews

English

EN

Over the past few months, we have already different Articles about the upcoming economic recession. In our previous update in September, we took stock of five key macroeconomic indicators. We concluded that we will almost certainly have a recession, but that it will take some time before it is visible in all sectors. In this article, we will discuss the most important trends and leading indicators. What can we expect?

The main factors currently slowing down the economy are high energy prices and rising interest rates. The increased cost of energy is starting to nestle deeper and deeper into production processes, driving up the prices of many products. Food prices in particular have risen sharply, reducing the purchasing power of households. In addition, interest rates have risen sharply and seem to be stabilizing at a high level, causing our assets to decrease in value. Our savings pots, such as pensions and home equity, have both fallen in value over the past year.

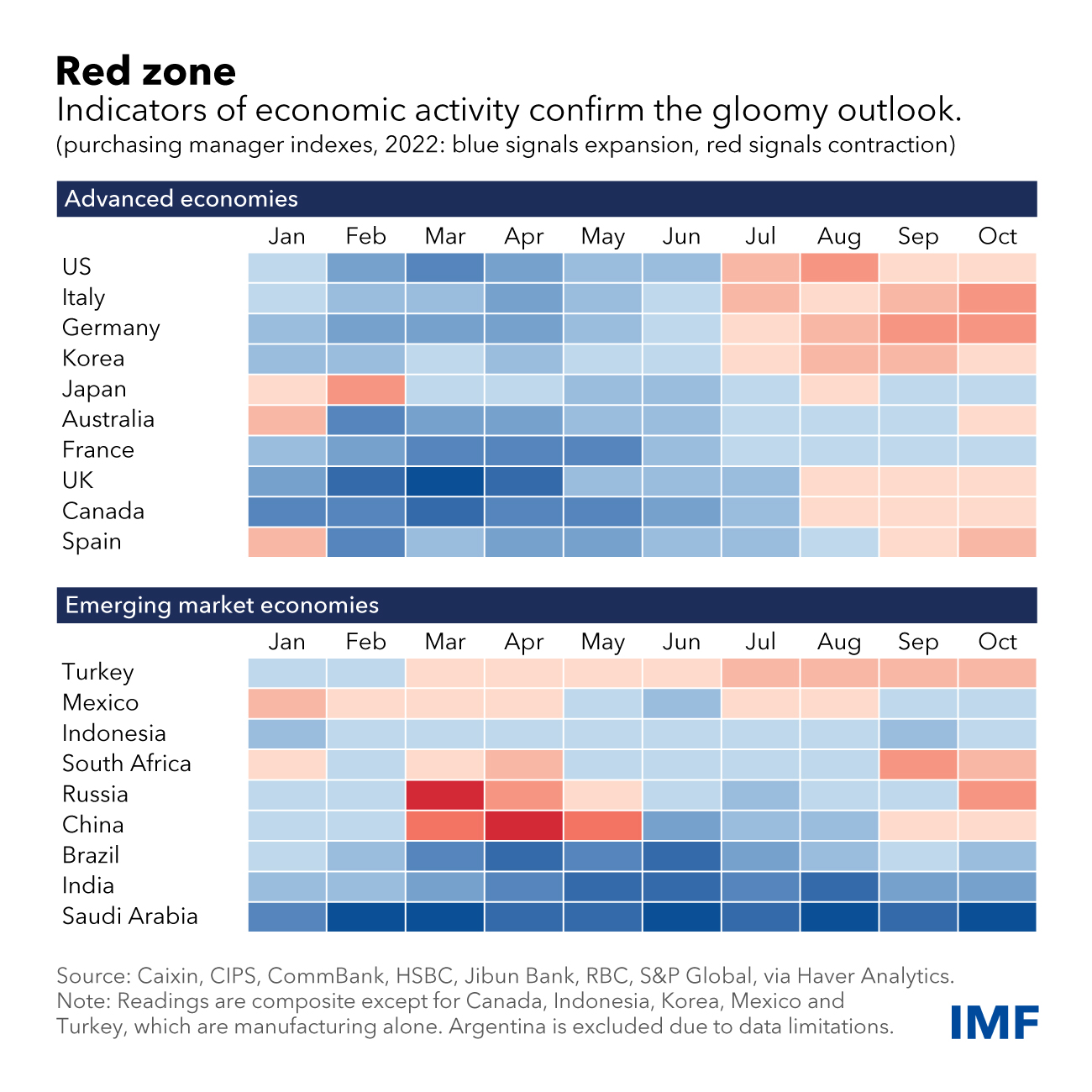

All in all, therefore, not a favourable prospect. In addition, central banks have put on the brakes this year by raising interest rates and ending asset purchase programs, causing the economy to slow down even faster. And that mainly affects the Western economies, as shown below overview of the purchasing managers' indices in different countries. Since July, the purchasing managers' index has been pointing to contraction in many countries, which means that companies are taking into account a deterioration in the economic climate and consumers who are more likely to tighten their purse strings. It is a logical response to the dramatic deterioration in consumer confidence. Not only in the Netherlands, but worldwide.

Purchasing managers' index turned from growth to contraction in many countries this year (Source: IMF)

This change is reflected in other economic data. In the United States, the big tech companies have recently cut thousands of jobs. Elon Musk announced shortly after his takeover of Twitter that 4,400 jobs will be created at the company. disappear. This week, Meta, the parent company of Facebook, followed by the news that the company wants 11,000 jobs scrape. Amazon, which normally hires extra staff in the run-up to Black Friday and the holiday season, announced this week a Major round of layoffs 10,000 jobs will be lost. Apple is in relatively better shape and does not expect any major rounds of layoffs yet, but it did announce last summer that it will hire fewer staff.

If we look at the technology sector worldwide from a slightly greater distance, we see that there are already many tens of thousands of jobs since the beginning of this year vanished. Of course, that's only a small share of the economy, but it does confirm the change in overall sentiment. The tech sector has performed by far the best of all sectors in recent years and has therefore been very popular with both large and small investors. The decline in the value of tech stocks since the beginning of this year and the chart below of the number of layoffs in the sector confirms that sentiment has completely reversed this year.

![]() Announced redundancies in the technology sector (Source: Trueup)

Announced redundancies in the technology sector (Source: Trueup)

We are also seeing the effect of declining consumer spending and an upcoming recession in logistics chains. Large retail chains replenished their stocks during the corona period due to the high demand, but are now continuing to unsold stock. And the tariffs for container ships that bring the goods from China to Europe and the United States have completely collapsed from the record levels of the end of last year. A year ago, people paid an average of $10,000 for a container, now it's only $3,000.

Rates for container transport have completely collapsed this year (Source: Freightos)

This trend is confirmed by anecdotal evidence. At the Port of Los Angeles, by far the largest port in the United States, the volume of containers fell by October by 25% compared to the same period last year. And that with the holidays just around the corner, in which Americans traditionally buy more stuff. This is in stark contrast to the end of last year, when the port Extreme crowds and dozens of container ships had to wait to unload their cargo. From this, too, we can conclude that market sentiment has fundamentally deteriorated.

The International Energy Agency (IEA) expected that economic activity will decline in the near future. In its latest report, the agency predicted a decline in demand for fuels, particularly diesel. Last year, demand for this fuel increased by 1.5 million barrels per day, but this year that growth is estimated to level off further to just 400,000 barrels per day. For next year, the IEA even predicts a contraction, due to the combination of high fuel prices and a global decline in economic activity. Diesel is mainly used for transport and logistics and in industry.

In this article, we've looked at a number of leading indicators, such as purchasing managers' expectations, the state of the technology sector, and logistics trends. If these indicators point to a significant economic correction, but the effects of this will not be immediately visible. Unlike in the credit crisis of 2008, for example, there is no acute crisis this time. It is now gradual, as bubbles in financial assets are slowly deflating and households have less money left over and are drawing on their assets due to high energy prices. The latter will gradually have an increasing effect on spending, which means that the demand for goods and services, and therefore also employment, will decrease.

As we wrote in our previous update, we come from an exceptionally good starting point with low unemployment and a large number of vacancies. But it was to be expected that the trend would change. This week it was confirmed by figures from Statistics Netherlands, which showed that the labour market in the Netherlands had become less tight for the first time in seven quarters. There were fewer vacancies and fewer jobs. Also Shrank economy in the third quarter, by 0.2%. This contraction is likely to be even more pronounced in the fourth quarter.

![]() Have a look at us YouTube channel

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink and Joris Beemsterboer interview various economists and experts in the field of macroeconomics. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.