9.3

8.064 reviews

English

EN

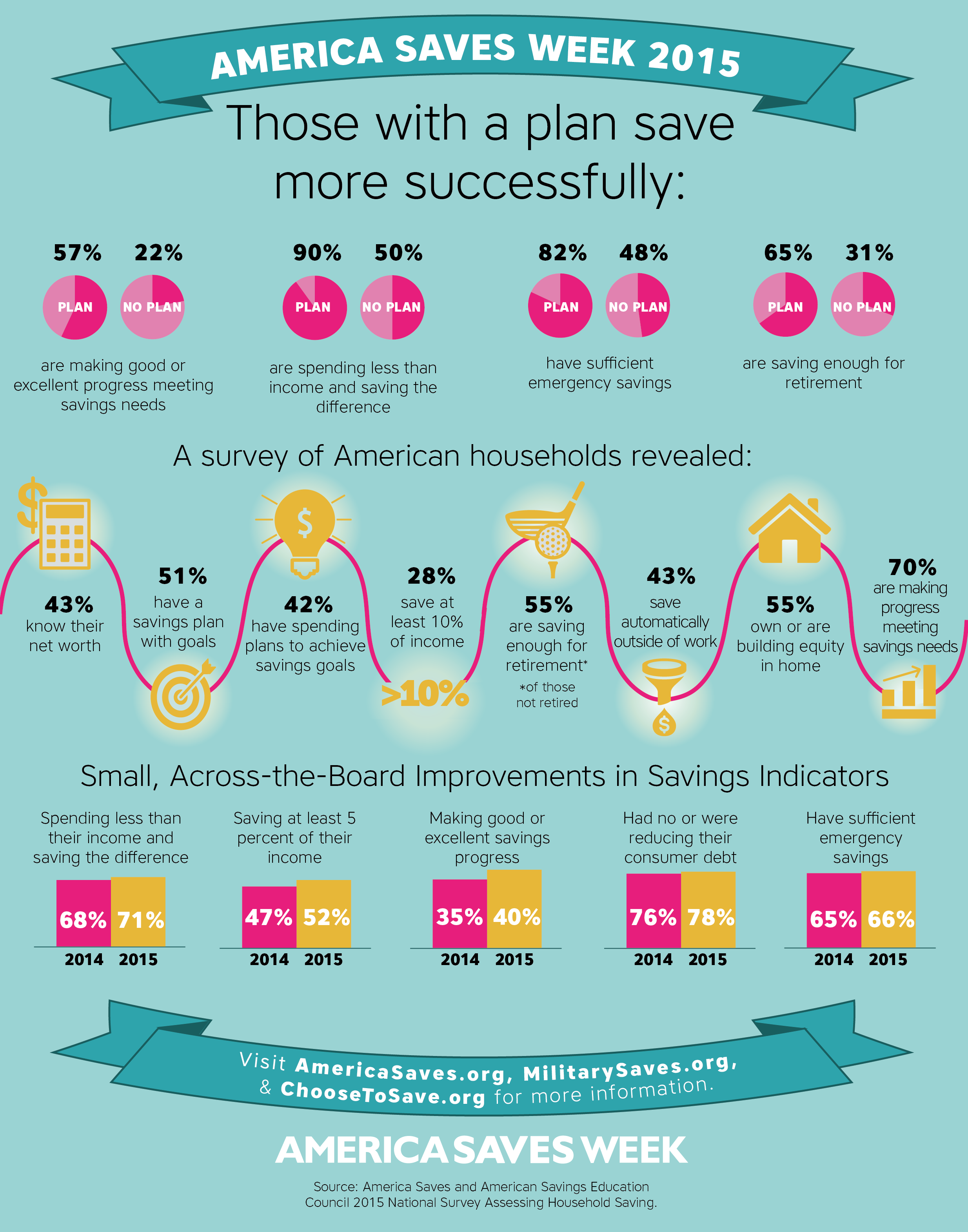

More Americans have managed to save money and reduce debt over the past year, according to the annual research of the Consumer Federation of America. Of all respondents aged 18 to 34, 56% managed to set aside at least five percent of their income. A year ago, it was only 50%. Only the age group of 45 to 54 years showed a larger increase, from 45% at the beginning of 2014 to 53% in the poll at the beginning of this month.

The study of Americans' saving behavior also shows that more young people are thinking about saving and that they are more likely to follow a savings program than last year. Last year, only 43% of millennials had a savings program, this year that had increased to 47%. The percentage who achieved their target rose from 34% in 2014 to 39% at the beginning of 2015. Young people are also more likely than last year to have set aside enough money for unforeseen large expenses, such as the purchase or repair of the car or a hospital bill. Last year, only 53% of American young people had set aside money for this, at the beginning of this year it was already 64%.

The crisis has made young people think more consciously about their finances and about saving. On the other hand, the increased need for savings suggests that confidence in the economy is still not particularly high. When young people have more job security, they are likely to be less inclined to put money aside. At the beginning of this year, 40% said they were making progress towards their savings target, which means that the majority are not getting much further.

Young people also want to have less debt, according to the survey. The latest poll from the beginning of this month showed that 78% of young people do not have consumer credit, compared to 76% a year earlier.

The research also shows that having a savings plan helps to keep the budget in order. Of all Americans with a savings plan, 90% spend less than they receive, while only 20% of people without a savings plan spend less. Not surprisingly, higher incomes are more likely to have money left over than lower incomes. For people earning less than $25,000 a year, it's 54%, for incomes between $25,000 and $50,000 it's 75%, and for incomes above $100,000 it's 87%.

Of all respondents, 43% knew roughly what their net asset position was, an increase of three percentage points compared to last year. Older people in particular have a clear picture of the total assets they own after deducting all debts. For young people, the picture is often less clear.

Also Read: