9.3

8.064 reviews

English

EN

Jack Hoogland started his career in banking, but has now been involved in investing for twenty years. He now writes a lot about all kinds of assets Topaandelen.nl, an investment information service provided by Investforprofit NV. We asked Hoogland about his views on the economy, precious metals and commodities. What are the best investments for 2024?

2023 was a good year for gold. Although interest rates were raised several times in 2023, the price of the precious metal rose. According to Jack Hoogland, it was mainly the gold purchases of central banks that put a floor under the Gold price. On the channel of Holland Gold we have already written several articles about central banks adding gold to their reserves. 'Various countries want to hold fewer dollars and are therefore buying more and more gold, which caused the gold price to rise,' says Hoogland.

The outlook for precious metals in 2024 is therefore very positive. Indeed, the year 2023 was mainly characterized by the absence of the expected recession. 'Contrary to expectations, it didn't happen,' says the investment expert. 'Actually, that has stopped the gold price. Normally, when a recession is imminent, the price of gold rises as central banks increase the money supply and lower interest rates. Now, the price of gold rose significantly, even without a recession coming. The price of gold could rise very fast if central bank interest rates go down and large institutional investors opt for gold."

According to Hoogland, the fact that the recession has not materialised is mainly due to the American Support package in response to the pandemic. About 85% of Americans initially received $1,200 per person under President Trump, plus $500 per child. Under Biden, individuals received an additional $1,400 and families received between $2,000 and $3,200 in additional child support. For a family with 2 children, the support in recent years amounted to an amount between $7600 and $8800. While economists had expected some of that money to be saved, Americans have actually consumed beyond expectations in 2023. That postponed the recession in America, but with defaults rising in America and several large companies tempering earnings expectations, it seems unlikely that the recession will not happen in 2024 either.

Jack Hoogland is also positive about silver, as silver is still far from its highest point. In doing so, he also looks at history; "When the Fed Chairman, Jerome Powell, intervened during the pandemic, the Silver price in a few months. That's how it can be now. I expect gold to do better than silver initially, but after that, silver can catch up,' says Hoogland.

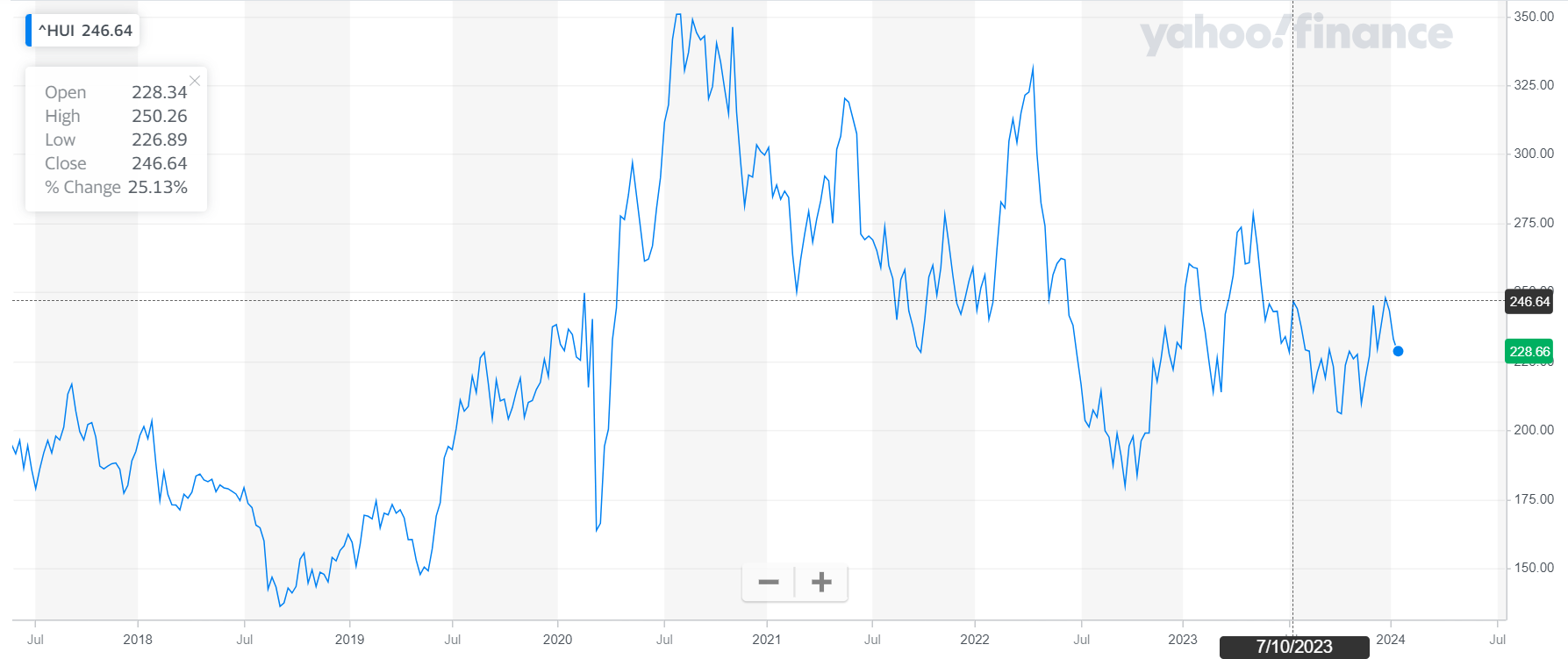

The higher prices of precious metals also mean that the profit margins of the Silver and gold producers. And Hoogland sees an opportunity there, because the shares of these producers are now undervalued. 'In my opinion, gold is undervalued in terms of the amount of money in circulation, but gold stocks are undervalued compared to gold. The cost of extracting gold from the ground has risen, but the price of gold has risen much faster. So the gold producers are much more profitable than they were a few years ago, but that is not reflected in the share prices, because they are still lagging behind,' says Hoogland.

The index of gold stocks. (Source; Yahoo)

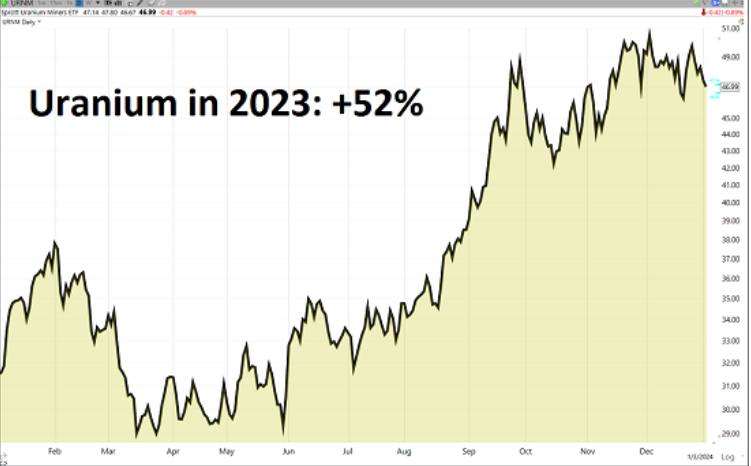

Finally, Hoogland discusses the energy transition. He expects the prices of certain commodities to rise sharply in the coming years. This applies, for example, to uranium, the raw material needed for the generation of nuclear energy. There are now 437 nuclear reactors in operation and 61 more are under construction. In his blog Hoogland writes that China, India and France, among others, are working to increase the number of nuclear reactors.

The plans for these nuclear reactors require large quantities of uranium and Hoogland sees a problem there. It takes a lot of time to build mines and scale up the production of uranium. There has also been hardly any investment in the production of uranium in recent years. The production of uranium will therefore find it difficult to keep up with demand, according to Hoogland; 'After the Fukushima nuclear disaster, it was financially unfeasible to invest in uranium mines for a long time, and now such an investment is less attractive due to high interest rates. In recent years, however, many plans have been made for new nuclear reactors and as a result, the demand for uranium will increase in the coming years. That demand is too high if you look at the amount of uranium that is produced.'

The price of uranium in 2023. (Source: Topaandelen.nl)

The price of uranium in 2023. (Source: Topaandelen.nl)

And so it applies to more raw materials needed for the energy transition. Only a small amount of copper is needed to build a gas-fired power plant, but the construction of wind or solar farms requires much larger quantities of copper. The production of an average petrol car involves about 20 kilos of copper, but for an electric car that quickly amounts to 70 kilos. 'If you realise that there are one and a half billion cars worldwide and that less than three percent are currently electric, then the demand for copper is likely to increase. And it also takes a long time to scale up copper production,' says Hoogland.

Hoogland sees major shortages of all kinds of raw materials, which means that their prices will rise. Europe therefore puts itself in a difficult situation, because there is hardly any production on the European continent, Hoogland observes. Later this year, we will ask Hoogland again for his view on the developments. Until then, it will be interesting to see how the economy develops and what central banks will do. Should central banks lower policy rates, a rise in the gold price is likely.

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink and Joris Beemsterboer interview various economists and experts in the field of macroeconomics. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.