9.3

8.058 reviews

English

EN

This contribution comes from the Boon & Knopers Substack

The Hungarian National Bank has increased its gold reserves from 94.5 tonnes to 110 tonnes. This decision was made due to increasing economic, geopolitical and capital market trends worldwide, which have strengthened gold's role as a safe haven and stable asset. It is clear from the press release:

"In recent years, the global economic, geopolitical and capital market trends that have contributed to the appreciation of gold have intensified. Gold has played different roles in different financial systems throughout history. It is an effective replenishment to the reserves, even under normal market conditions.

In times of heightened financial and geopolitical uncertainty and under extreme market conditions, gold's role as a safe haven and store of value is of particular importance, as it can boost confidence in the country and support financial stability. Because of all these advantages, gold remains one of the most important reserves worldwide."

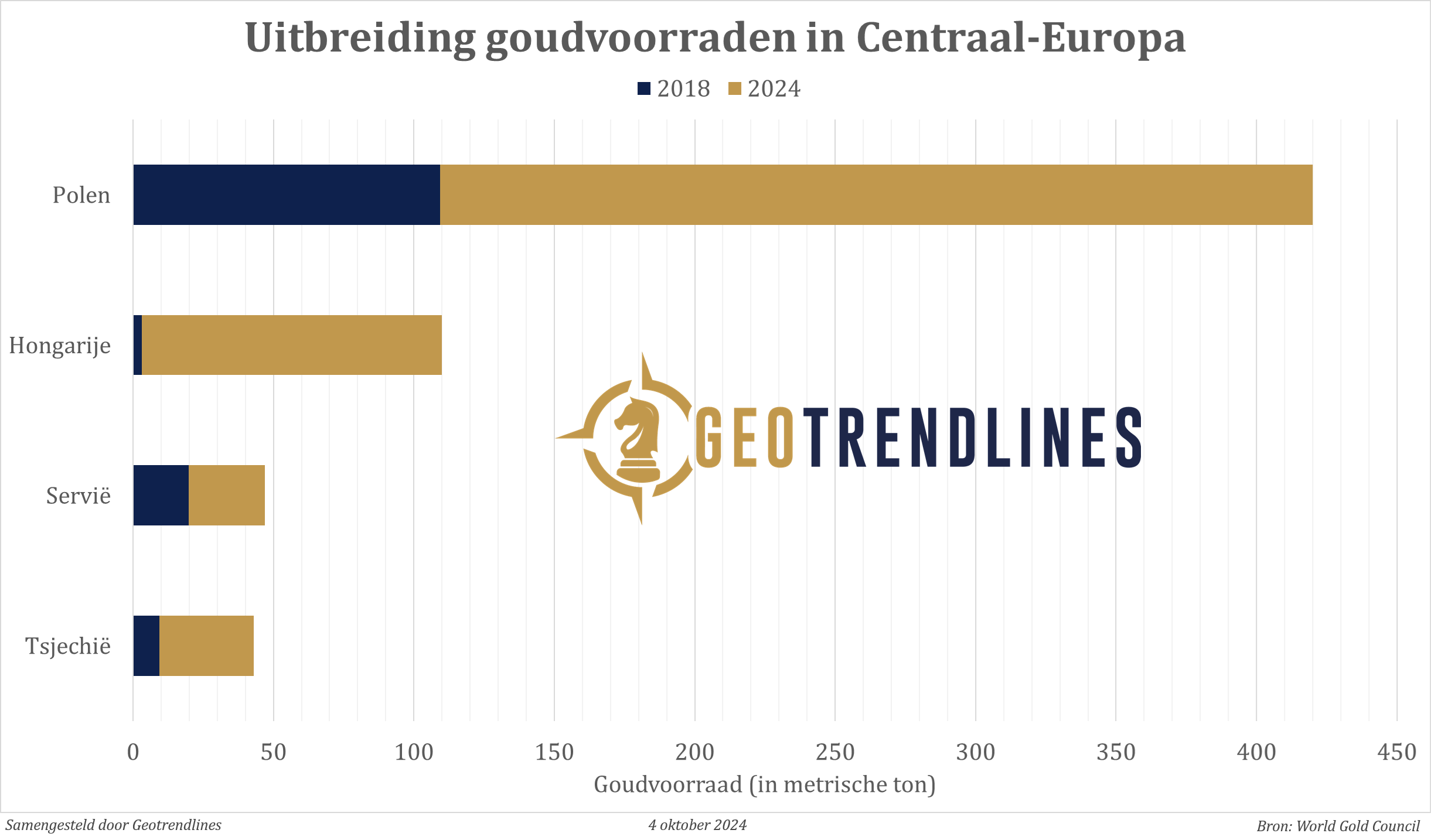

Hungary's central bank began a fundamental review of its monetary policy towards gold in 2018. The gold stock was first Recalled from London and then rapidly expanded from 3.1 to 31.5 tonnes. In 2021, the gold stock was Tripled up to 94.5 tonnes. With the most recent expansion to 110 tonnes, Hungary now has the highest gold reserves per capita in the Central and Eastern European region.

Gold stock of the Hungarian central bank

Poland has also recently added gold to its reserves, Polish central banker Adam Glapiński said this week well-known. Commenting on monetary policy, he said that the gold stock had been further increased from 400 tonnes to 420 tonnes of gold, which means that Poland now has more gold than the United Kingdom. Poland's central banker said that the gold reserve is a very important reserve that can play a stabilizing role, especially in extreme scenarios. He set a target of holding 20 percent of the reserves in gold, adding:

"We have joined the exclusive club of countries with the largest gold reserves. None of our trading partners and investors can doubt our credibility and solvency, even when a dramatic situation unfolds around us."

Polish central banker Adam Glapiński aims for 20 percent gold in international reserves

Global demand for gold has also increased sharply among central banks in recent years, with an all-time high of 1,082 tonnes of gold purchases in 2022 and an almost similar volume in 2023. Most of this is accounted for by non-Western central banks, which hold relatively little gold in relation to the size of their economies and their total reserves. This year, for example, 70 percent of all gold purchases by central banks on behalf of non-Western countries.

It is striking that countries in Central and Eastern Europe in particular have been buying a lot of gold in recent years. The threat of war is felt up close in those countries and history shows that having gold in wartime is essential. It is important to keep mentioning that countries such as Poland, Hungary, Serbia and the Czech Republic keep most or all of their gold reserves on their own soil. From this, we can deduce that these countries are not very worried about a Russian invasion.

Eastern European countries have bought a lot of gold in recent years

Read more

Hungary Gold Stocks back from London (April 8, 2018)

Central banks are preparing for Monetary Reset? (April 12, 2020)

Hungary expands gold reserves to 94.5 tonnes (April 7, 2021)

Poland further expands gold reserves to almost 300 tons (August 11, 2023)

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink interviews various economists and experts in the macroeconomic field. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.