9.3

8.064 reviews

English

EN

America has played a major role in blocking a gold-based monetary system after the Bretton Woods system collapsed. That's what Jan Nieuwenhuijs writes in his new blog Gainesvillecoins.com. Why did the Americans want to get rid of precious metals as the basis of the monetary system? And how did they get the Europeans to let go of gold as well?

Before the Second World War, the Gold Standard restored to its former glory for a while. However, the standard could not be maintained for long. The British pound had returned to pre-war parity, making the currency highly overvalued. Also, the strict rules of the Gold Standard were no longer observed after the First World War. For example, budget deficits were more easily covered by the developed capital market and wages could no longer be lowered. This is explained in a previous article on Holland Gold.

After World War II, America was the only world power. As a result, the country had a strong negotiating position when a new monetary system was decided. In the town of Bretton Woods, it was decided that henceforth only the dollar could be exchanged for gold. Other currencies, in turn, were pegged to the dollar. As a result, the world effectively transitioned to a dollar standard. The fixed price of $35 each troy ounce was maintained by the creation of a Gold Pool. A group of central banks would maintain the price by buy gold or sell in the free market.

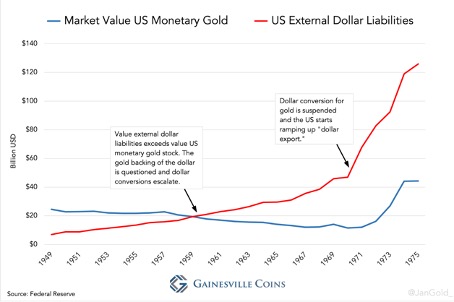

The system began to malfunction as the U.S. balance of payments deficit began to widen. In this way, foreign central banks gained more and more dollar reserves and increasingly wanted to exchange those dollars for gold. As a result, the U.S. gold supply continued to decline. Where the Gold Pool Initially, we had to buy gold to maintain the price, but now suddenly gold had to be sold in order not to let the price rise too fast.

In the 1960s, countries began to criticize the system, which was designed to hold more and more dollars. America was able to de facto finance the expensive war against Vietnam simply by printing dollars. The French president, Charles de Gaulle, agitated against this 'exorbitant privilege' in a speech and was in favor of the use of gold for international payments.

The U.S. balance of payments deficit is widening. (Source; Gainesvillecoins.com)

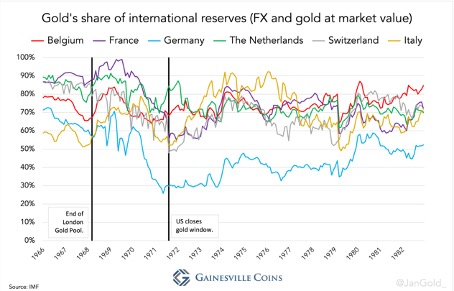

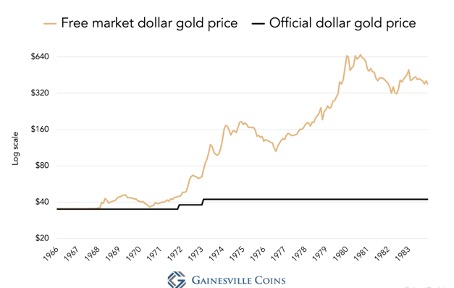

When the British pound had to devalue, the situation got further out of hand. Initially, the Gold Pool closed for two weeks. At a conference in Washington, it was decided that the Gold Pool was completely dissolved and that the market price of gold could therefore fluctuate. However, it was decided in favor of the Americans that no central bank would buy or sell gold at a price other than the official price. As a result, a two-part gold market was created: private individuals could trade gold at the free market price, central banks carried out transactions at the official price. This provision made the gold market less liquid, as no central bank was willing to sell at $35 per ounce, knowing that gold was worth much more. Gresham's Law was introduced, with central banks using dollars as a means of payment and gold as a reserve.

The solution proposed by the then president of the Dutch Central Bank (DNB), Jelle Zijlstra, proposed the increase in the Gold price in all currencies. According to Zijlstra, it was strange that all prices had been three or four times higher since 1930, but that the gold price was still at the same level. Due to the large deficits of the US trade balance, the price of gold expressed in dollars would be increased even more. However, this would be in total contradiction with the American ideal of a hegemonic dollar. Zijlstra's plan therefore did not go ahead.

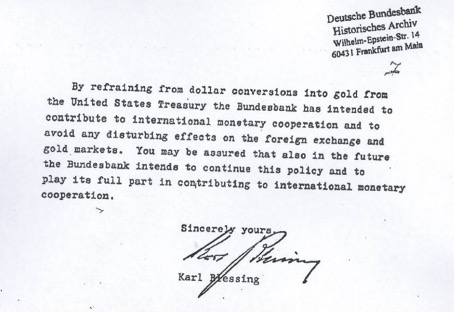

The American troops on German soil offered protection against the Soviet Union, but there were conditions attached. For example, the Germans were not allowed to exchange dollars for gold. The then president of the Bundesbank, Karl Blessing, even promised in a letter that Germany would not exchange dollars. Just before his death, Blessing also admitted that this letter was written when the Americans threatened to withdraw troops. Germany also pledged not to buy gold. This commitment also meant that Germany would not participate in a European Gold Pool, an initiative to regain the importance of gold. Without Germany, such an initiative would never have gotten off the ground. The Americans were successful in phasing out gold, but could not prevent gold from remaining important as a monetary reserve.

Blessing's letter. (Source; Gainesvillecoins.com)

The Dutch Jelle Zijlstra was stronger and did not go along with the American request not to exchange any more dollars. In 1971, the Americans even travelled to Amsterdam with a large delegation to convince Zijlstra not to exchange the loan. Paul Volcker, then undersecretary of the Ministry of Finance and later chairman of the FED, then said to Zijlstra 'You are rocking the boat', to which Zijlstra said; 'if that boat rocks too violently as a result of converting $250 million, that boat has already sunk'. In retrospect, this was a strong performance by Zijlstra, because in the same year President Nixon would break the link with gold. From then on, gold would increase sharply in value.

Germany held significantly less gold compared to GDP than other countries. (Source; Gainesvillecoins.com)

The oil crisis in 1973 was damaging to America, but it also presented an opportunity. Costs rose as a result of high oil prices, but the high oil prices that applied to many Western countries also increased the demand for dollars. In 1974, U.S. Secretary of the Treasury, William Simon, traveled to Saudi Arabia. There, Simon struck a deal with Saudi Arabia in which the country promised to supply oil to America and invest the dollars it earned in government bonds. In return, Saudi Arabia received military support from the Americans. The investment in bonds was made through a special construction to prevent market disruptions.

From the 1970s onwards, oil transactions were paid in dollars. In this way, the dollar retained its hegemony. Only in recent months has there been a shift in this development. Since the sanctions on Russia, countries have been thinking about an alternative to the dollar that can be used as a weapon. In December, Frank Knopers On the other hand, it is clear that oil-producing countries can play an important role in the discussion about a possible successor to the dollar.

It is therefore important to look at the currency in which oil transactions are traded. 'Russia now also pay with the renminbi, for example, but we also see that India wants to use its own currency. Oil-producing countries in the Middle East may have an ace up their sleeve in this discussion. But if the plans for a BRICS currency fail, gold is a good alternative,' Knopers thinks.

Gold has increased enormously in value since 1971. (Source; Gainesvillecoins.com)

The article by Jan Nieuwenhuijs gives a nice insight into the period around 1971. The role played by the Americans is particularly striking. It is difficult to say what gold will do in the future, but it is beyond the fact that central banks will continue to hold on to gold in the coming years.