9.4

7.521 Reviews

English

EN

Gold's outlook remains good, especially when various macroeconomic and geopolitical factors are taken into account. First, we take a look at the developments in the gold price in 2023, then we look at some factors that will influence the price of precious metals in the coming months. Finally, we will discuss the prospects. What can we expect from gold in the long run?

The Gold price has risen this year. For example, on January 1 of this year, the gold price stood at more than 54,000 euros per kilo of gold, while the price now fluctuates around 56,000 euros per kilo. In particular, the Turmoil in the banking sector created a Upward trend of the gold price. This makes sense, since gold is considered a safe haven. There were alsoCentral Bank Gold Purchases frequently in the news. In recent months, the gold price has fallen slightly. This was due to the fact that central banks' policy rates continued to rise. When interest rates rise, other assets become more attractive, since no interest is paid on gold.

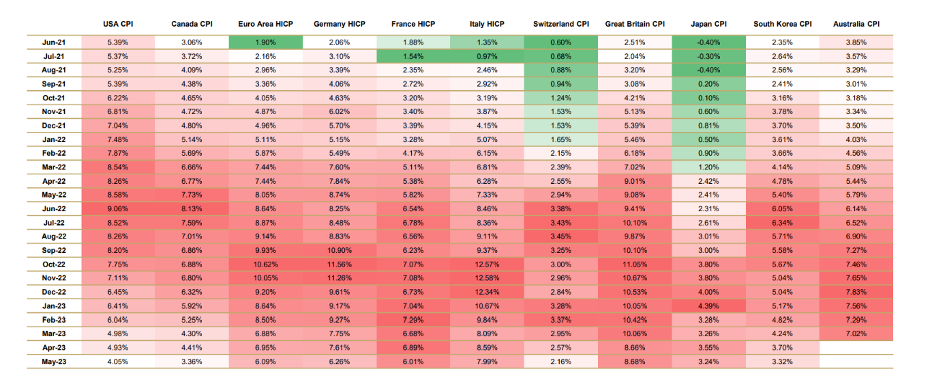

Of course, inflation is a very important factor for gold, as the precious metal is known as Hedge against price increases. We have seen very high inflation rates in recent months, culminating in an inflation rate for the Netherlands of more than 17 percent in September last year (calculated according to the European calculation method). The table below of IGWT shows that inflation has been in the red in every developed economy in recent months, i.e. the figure has been above the central bank's policy goal. For the European Central Bank (ECB), the target is an inflation rate of 2 percent.

A red box indicates that the inflation rate is above the central bank's policy goal. (Source: IGWT)

ABN Amro expects inflation to be even higher in 2024 and predicted an inflation rate of 3.3 percent for next year. Core inflation, inflation excluding strongly fluctuating prices of products such as energy, was still 7.1 percent in June. Although this is lower than the 8.2 percent in May, inflation still appears to be very persistent, according to the bank. Ironically, ABN Amro's former chief economist, Han de Jong, expects inflation to fall drastically in the coming months. On BNR wrote the house economist in a column that basic effects play a major role in this.

The base effect means that the inflation rate is still high due to price increases from a while ago. Inflation is the difference between the current price level and the previous year. The inflation rate may still be high, while prices have not even risen that much in previous months. For example, inflation was still 5.7 percent in June, mainly as a result of the explosive price increase in the summer of 2022. Between July and October 2022, the price level rose by 7.7 percent, de Jong writes. On the other hand, the price level rose by an average of just over 0.2 percent per month in 2023. If this trend continues, inflation will fall spectacularly in the coming months. "Of course, fuel prices have just risen again, but the chance that inflation will be close to 0 percent in October seems to me to be high," the economist writes in his column.

Another important factor for the price of gold is interest rates. Since the outbreak of the war in Ukraine, interest rates have risen worldwide. The ECB recently set the refinancing rate at 4 percent, while in June 2022 the rate was still at 0 percent. The ECB's next interest rate decision is scheduled for July. The expectation is that the ECB will hike again, but Klaas Knot Hint at a break after the upcoming increase. "For July, I think a rate hike is a necessity, for anything after July it would be at most a possibility, but by no means a certainty," Knot said recently.

For the gold market, however, the real interest rate is particularly important. That is the interest rate adjusted for inflation. Therefore, it is not only the level of nominal interest rates that is important, but also the level of inflation. Negative real interest rates are particularly attractive to gold owners. Although gold does not pay interest, it is considered a Stable valuetitle.

The last factor we discuss in this article is turmoil. This is also an important factor, whether it's geopolitical turmoil or financial turmoil; Gold is considered a type of refuge. Not only did gold hit record highs when the war in Ukraine erupted, the turmoil in the banking sector also caused a major upward movement that even boosted the gold priceto record high propelled it. The turmoil of recent times has not just disappeared either. The war in Ukraine is still going on and rising interest rates mean that people remain vigilant for new bankruptcies. In the event that unrest increases again, the gold price could just make a big jump up again. On us Event on 20 October we will take a closer look at money, geopolitics and green. The turmoil described above will therefore be discussed by various experts.

It is always difficult to say what the gold price will do in the short term. ABN Amro Expect the gold price to fall slightly in the coming months. According to the bank, central banks will not start cutting interest rates until later this year. The relatively high interest rates, in combination with possible lower inflation, could therefore lead to a slight decline in the gold price, although the bank does not expect a trend reversal.

Still, a rise in interest rates is not necessarily negative for the gold price. While precious metals often perform poorly in the run-up to a rate hike, once the rate hike has taken place, the outlook for the price of gold is actually positive. In the months following previous periods of interest rate hikes, the gold price rose by an average of 10 percent, as we wrote earlier Holland Gold. With the end of central bank rate hikes seemingly in sight, the outlook for precious metals seems positive.

That could also be true now. Although the price of gold may fall slightly, fears of a recession remain real. Economists such as Jeroen Blokland expect a crisis later this year. In such a scenario, central banks are likely to adopt a more accommodative monetary policy, which will benefit the price of gold. Earlier, we wrote an article about various asset titles during Different phases of a recession. Gold often performs particularly well in the run-up and early stages of a recession. Therefore, a price increase for gold later this year also seems very possible. Also, the turmoil we have seen over the past year and a half will continue. For example, the battle in Ukraine has still not subsided. Time will tell how these factors develop and how the gold price reacts to them, but the outlook for gold is certainly not bad.

Disclaimer: Holland Gold does not provide investment advice and this article should not be considered as such. Past performance is no guarantee of future results.

Do you want toBuy gold by means of Gold bars or Gold Coins? We are happy to help you with your order.

![]() Have a look at us YouTube channel

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink and Joris Beemsterboer interview various economists and experts in the field of macroeconomics. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.