9.3

8.064 reviews

English

EN

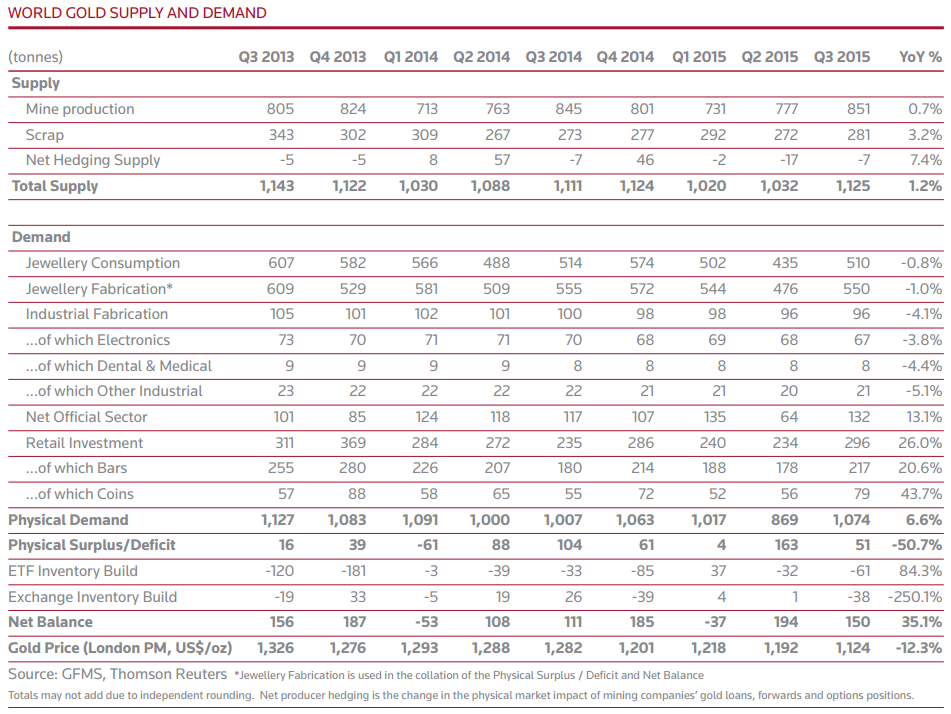

Demand for physical gold was 7% higher in the third quarter of this year than a year ago, according to research firm Thomson Reuters GFMS in its latest quarterly report. The increase can be fully explained by an increased demand for gold bars and gold coins, as demand for the precious metal for jewellery making fell by 1% globally compared to a year ago. Central banks also continued to Buy gold, they added a net 132 tonnes to their reserves in the third quarter.

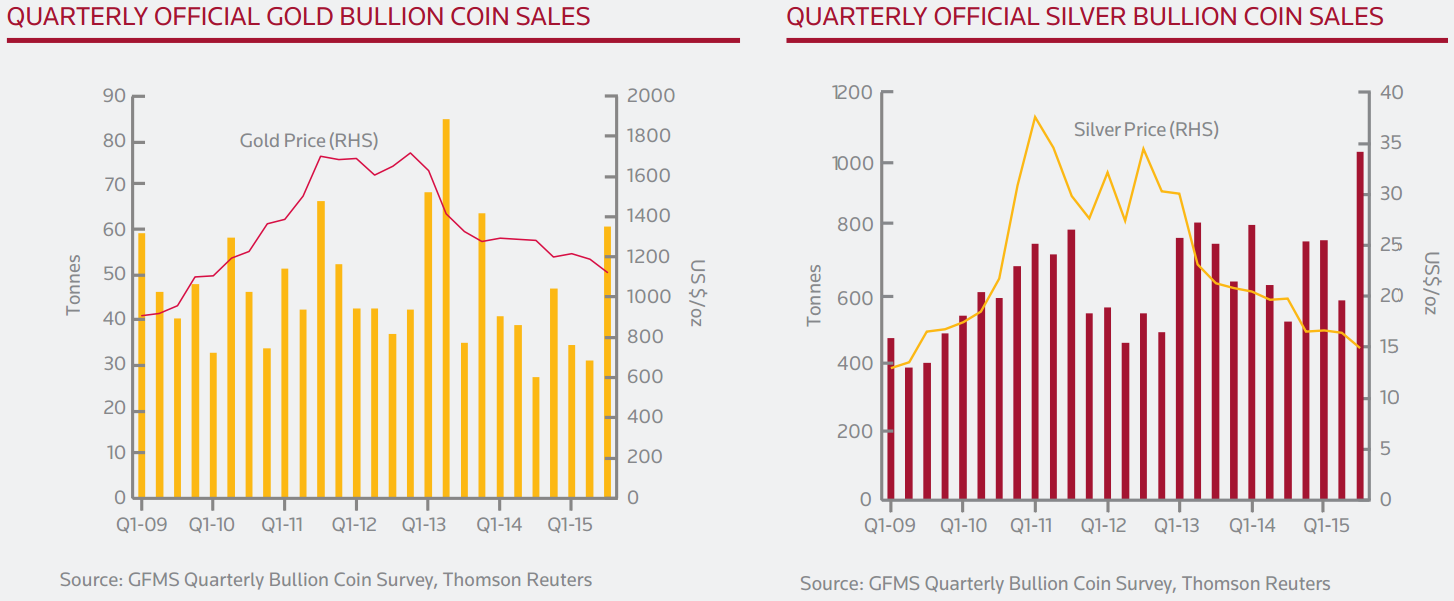

The demand for gold bars and gold coins amounted to 296 tonnes in the third quarter of this year. That is 26% compared to both a year ago and more than 25% more than in the previous quarter. Demand for investment gold increased in the third quarter due to the decline in the Gold price and by the correction in the Chinese stock market.

In China and India, demand for investment gold rose by 30 and 26 percent respectively. These developments also led to an increase in demand for gold on the European market. According to Thomson Reuters GFMS, 19% more investment gold was sold in Germany in the third quarter.

Demand for gold and silver coins picks up again (Source: GFMS)

Central banks also continue to buy gold, especially in emerging economies. In the third quarter, they collectively added 132 tonnes to their reserves, up 13% from the same period last year and more than double from a relatively weak second quarter.

Russia and China account for by far the largest gold purchases. China's central bank bought a lot of gold in July (19 tons), August (16 tons) and September (15 tonnes). Russia also added a lot of gold to the reserves. They bought plenty of gold in July (12.5 tonnes), August (31 tonnes) and September (34 tonnes). These two countries alone accounted for a total of 127 tonnes of gold purchases in the third quarter.

According to Thomson Reuters GFMS 2015 will be the sixth year in a row in which central banks add net gold to their reserves. Since the outbreak of the financial crisis, central banks with large foreign exchange reserves have been trying to diversify their portfolios by holding more gold.

Global Gold Demand 7% Up in Third Quarter (Source: GFMS)

About half of the demand for physical gold is destined for the production of jewellery. According to figures from Thomson Reuters GFMS, this market was about the same size in the third quarter as it was a year ago. Due to the fall in the gold price, demand from India (+5%) and China (+0.5%) increased, but this increase was offset by a weak European market (-25%).

According to Thomson Reuters GFMS figures, India regained the lead from China as the world's largest gold market in the third quarter. In the first three quarters, the Indian gold market accounted for a total demand of 642 tonnes, compared to 579 tonnes for the Chinese gold market.

Demand for gold 7% higher due to increased sales of coins and bars