9.4

7.521 Reviews

English

EN

In recent years, China has claimed a conspicuous role in controlling the price of gold, a power shift that has long been in the hands of Western countries. This change, driven by unprecedented purchases by both the Chinese central bank and the private sector, marks a new era in the gold trade, writes Jan Nieuwenhuijs in his Last article.

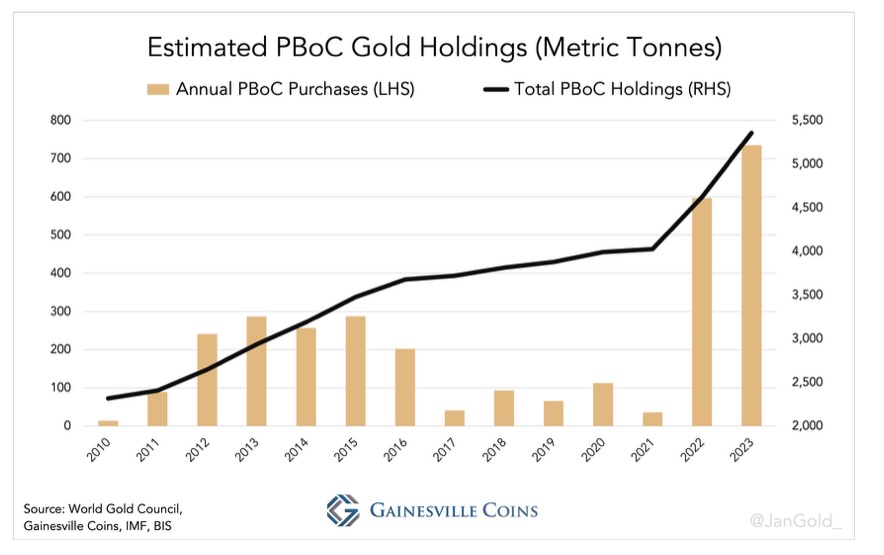

In 2023, the People's Bank of China (PBoC) a record amount of 735 tonnes of gold, about two-thirds of which were purchased surreptitiously. This strategy of the PBoC, together with a significant private sector import of 1,411 tonnes in the same year, illustrates a deliberate shift in gold market dynamics. With an additional 228 tonnes imported in January 2024 alone, China's impact on gold prices is undeniable.

The war in Ukraine and the subsequent freeze of Russian dollar assets by Western authorities have increased interest in gold as a safe haven. This scenario has Central Banks to increase their gold reserves. The PBoC's clandestine purchases, revealed by discrepancies in the reporting of the World Gold Council and official sources, emphasize a strategic shift to gold.

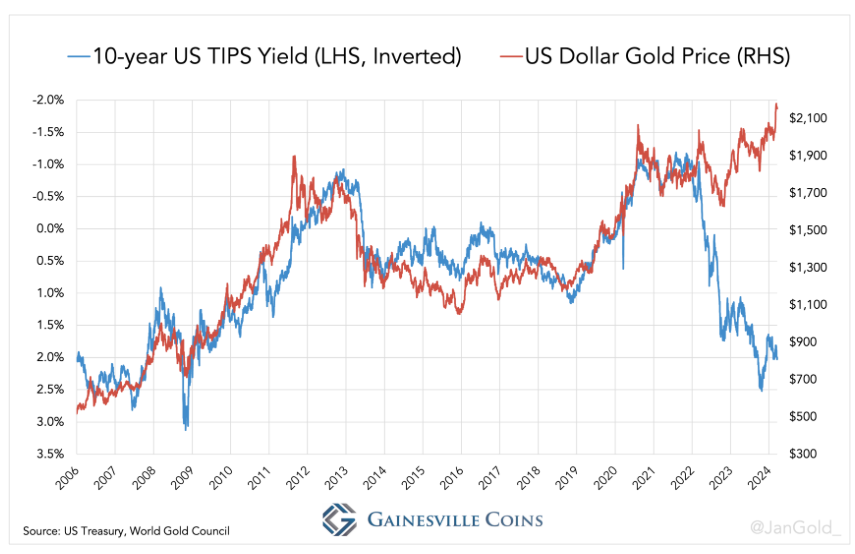

China's gold buying craze has fundamentally changed the traditional dynamics of the gold market, which was previously heavily influenced by Western institutional supply and demand. For 2022, the gold price mainly moved in line with the 'real yield' (10-year US TIPS interest rate) of U.S. Treasuries. However, since then, the price of gold has decoupled from this indicator, a change that can mainly be attributed to China's influence.

The increased gold flows from London directly to Asia, skipping traditional intermediate stations such as Switzerland, indicate a geographical shift of gold refining capacity to the East. This indicates not only a changing route of gold trading, but also a shift in global economic power.

While the Western world was a net seller, the Gold price an increase from $1,736 per ounce in July 2022 to $2,034 in January 2023. This trend reversal, in which the price increase was accompanied by increasing purchases rather than sales, illustrates the growing influence of China and Hong Kong on the gold market.

The instability of the Chinese real estate market And strict capital controls have led to an adjustment in investment behaviour towards gold. This shift signals a search for safer investment options outside of the local stock market and real estate sector, with gold an increasingly attractive alternative.

The PBoC's strategic purchases of gold reflect a move away from the U.S. dollar amid concerns about potential interest rate cuts and inflation. This trend, along with rising gold purchases by China's private sector, positions China as a defining force in the future direction of the gold market.

If Western investors, driven by fears of monetary devaluation, also flock to the gold market, this could lead to a "perfect storm" for the price of gold. This scenario shows an interesting development in the financial markets, challenging the traditional correlation between gold prices and real yields. This suggests a shift in investor behavior and the perception of gold as a safe haven asset during times of economic uncertainty. It is clear that the influence of the Chinese central bank and increasing demand from Asia play a crucial role in this dynamic, which could lead to new strategies for both institutional and retail investors worldwide.