9.4

7.521 Reviews

English

EN

The Chinese government is considering buying millions of homes that are struggling to sell in the Asian country, according to a report Bloomberg this week. China has been plagued by problems in the real estate sector for some time and government interventions must now solve the problems. What exactly is going on in China and can problems in the real estate sector be prevented by overhauling the system?

China's real estate sector has seen tremendous growth for years. Between 2005 and 2009 House prices tripled in China due to low interest rates. Also, the Chinese government invested in the construction of houses when the financial crisis broke out. When it became clear that the growth of the sector resembled a bubble, actions were taken to counter the rise in prices. When the bubble deflated, ghost towns arose full of houses that were unfinished or uninhabited.

In 2020, the government introduced stricter rules regarding the financing of real estate. These rules had a major impact on Evergrande, a major Chinese property developer. The company had accumulated a large debt and ran into financial problems from 2021 onwards. The Credit Rating of the company then went down and the company found it increasingly difficult to meet its obligations. Early 2024 Fell Evergrande and the company had to sell all its possessions.

The real estate sector in China is in crisis. The number of homes sold fell by 47% in the first four months of 2024, putting the number of homes on sale at its highest point in eight years. Add to that the fact that economic growth has been disappointing in recent years. In the first quarter of 2024, economic growth was 5.3 percent. In Western countries we dream of these percentages, but for developing countries this is a low growth. India, for example, grew in the last quarter of 2023 8.4 percent.

Economic growth in China could continue to disappoint in the coming years, For example, we wrote in February. This is partly due to the ageing of the population, which will also affect China. In addition, the biggest steps in migration have been made and fewer and fewer workers will move from the countryside to the city. On the other hand, companies in neighbouring countries benefit from lower labour costs than in China. China faces fierce competition from countries such as India and Bangladesh.

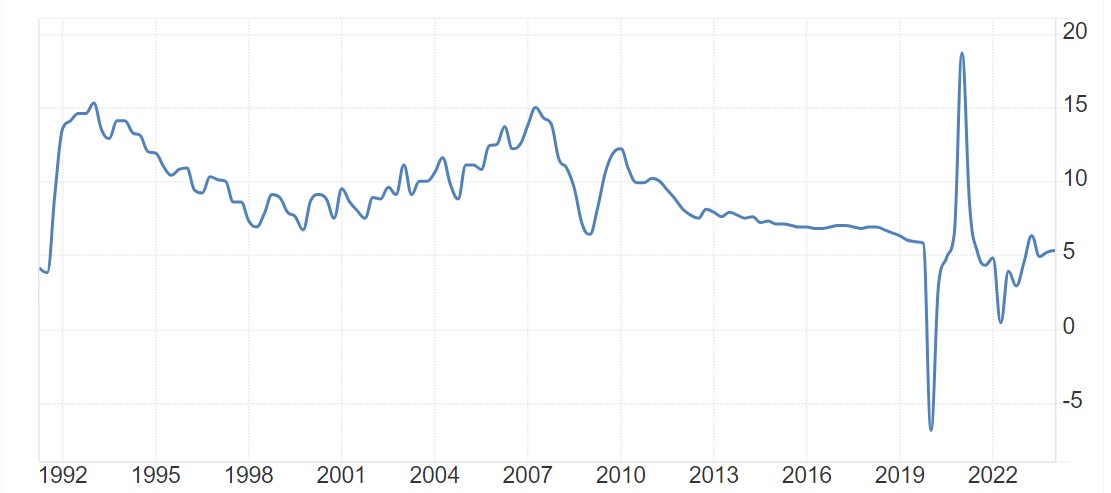

Growth in China continues to decline. (Source: Tradingeconomics)

Growth in China continues to decline. (Source: Tradingeconomics)

With the help of state-owned banks, local governments should start buying millions of unsold homes from property developers such as Evergrande at a discount, the proposal reads. Through the plan, project developers will be financially supported and the government hopes to prevent new cases like Evergrande. The homes are then converted into affordable housing, creating more affordable housing for lower-income families.

The plan is anything but cheap. Estimates of the cost of the plan vary. Raymond Cheng, head of China Property Research at CGS International Securities in Hong Kong, indicated that the plan will cost at least 1,000 billion yuan, or $140 billion. Shujin Chen, head of China Financial and Property Research at Jefferies Financial Group, assumed double that. In that case, the plan will cost the Chinese government about $280 billion.

The Chinese government's plan is mainly to treat the symptoms. A plan to prevent financial bubbles was discussed in 2022 in A podcast by Holland Gold with former chief economist of ING Teunis Brosens. In the podcast, the pros and cons of fractional reserve banking were discussed and an alternative system was discussed in which mortgage loans no longer go through banks. If, in the future, households no longer receive financing from banks, but instead turn to pension funds, for example, an exorbitant rise in house prices in times of scarcity could perhaps be avoided.

Here's the thing: at the moment, by far the largest part of financing in Europe goes through banks, including financing for a house. If a loan is taken out from a bank, the bank can create this money out of thin air. Money creation today is largely in the hands of commercial banks. Banks are required to hold certain reserves. If a bank meets the requirements, the bank creates money and a promise is made by two parties: on the one hand, the bank promises that the customer will get a loan that the bank cannot easily access, and on the other hand, the customer promises that he or she will repay the loan neatly. This process is known as mutual acceptance of guilt.

But since this process involves money creation, it encourages fluctuations in business cycles. In rising times, people are willing to borrow a lot and house prices rise very fast. In downturns, demand collapses and house prices fall. This could be remedied by not allowing money creation for existing assets, such as a house that has already been built. In this way, money growth is more in line with economic growth. In the event that people do need a loan, they have to rely on borrowing existing money, for example from a pension fund. In this case, a rise in house prices is less likely, as pension funds are likely to lend less money than the banks that can create the money out of thin air.

However, this plan is also encountering difficulties. This makes it more difficult for many people to apply for a loan. It could also lead to large losses for countries with an overheated housing market, as it leads to a fall in house prices. Teunis Brosens also pointed out disadvantages: 'Of course you can set up a system in this way and I'm not saying that this system can't work, but there are always advantages and disadvantages. In such a system, people will also be disappointed because they cannot get a mortgage or because they have run out of pension money, for example. You also oblige pension funds to invest heavily in Dutch mortgages, while they now also invest a large part of the money abroad. It would be nice if we came up with a system in which everyone benefits, but actually there are always winners and losers'.

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink and Joris Beemsterboer interview various economists and experts in the field of macroeconomics. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.