9.3

8.064 reviews

English

EN

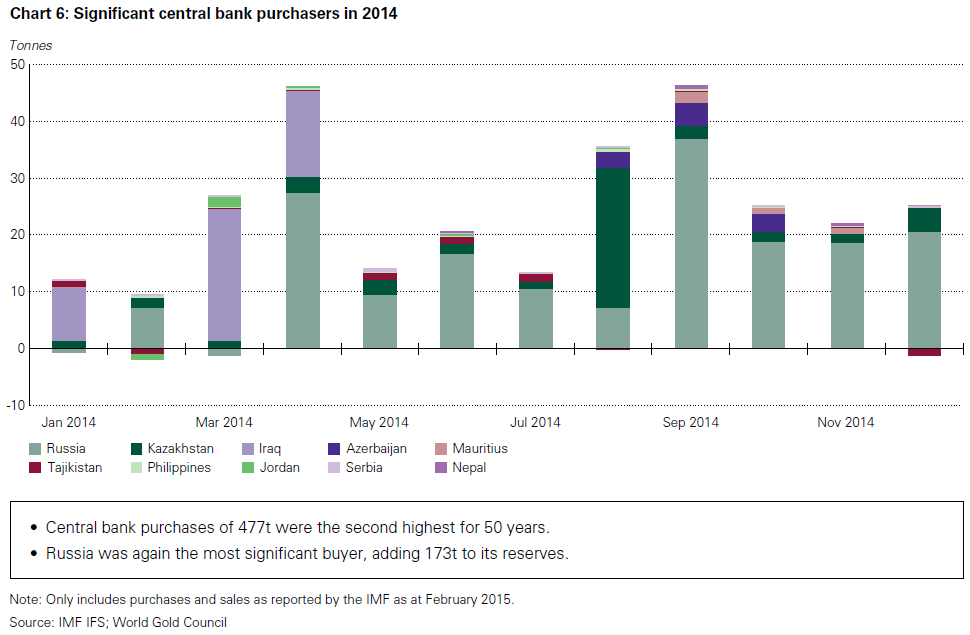

Central banks haven't stopped Buy gold, the report shows that the World Gold Council (WGC) recently released a week. In 2014, central banks bought a net 477 tonnes of the yellow metal, a 17% increase from the 409 tonnes of gold they added to their vaults last year. In the past fifty years, central banks only bought more gold in 2012, when they added 544 tons to their reserves.

Due to the outbreak of the financial crisis in 2008, Western central banks stopped selling gold, while central banks of emerging economies in particular increased their purchases. The list was headed last year by Russia, which added 173 tonnes to its reserves. Other major buyers of the yellow precious metal were Kazakhstan (48 tonnes), Iraq (48 tonnes) and Azerbaijan (10 tonnes). Strengthening the balance sheet and diversifying foreign exchange reserves was the main reason for buying gold. The gold reserves of Russia have returned to the level of 1993 and now account for 12% of total reserves.

The only central bank that sold a substantial amount of gold was that of Ukraine. It reduced its gold reserves by 44% to 24 tonnes to replenish its foreign exchange reserves. The country is in complete chaos and is struggling to pay its bills.

Central banks sold large amounts of gold between 1980 and 2008. European countries, in particular, have sold hundreds of tons of the precious metal under the Central Bank Gold Agreement. Partly because of this, the Gold price between 1980 and 2000.

Now that central banks are net buyers of gold, there has been more upward price pressure. Alistair Hewitt of the WGC told Bloomberg that emerging economies will continue to buy gold in the coming years, because they still have relatively little metal. "Demand from this segment of the market will remain robust", that's how Hewitt summed up the situation. According to estimates by the WGC, central banks will also buy at least 400 tonnes of gold this year.

Central banks bought 477 tonnes of gold last year (Source: WGC)