9.3

8.064 reviews

English

EN

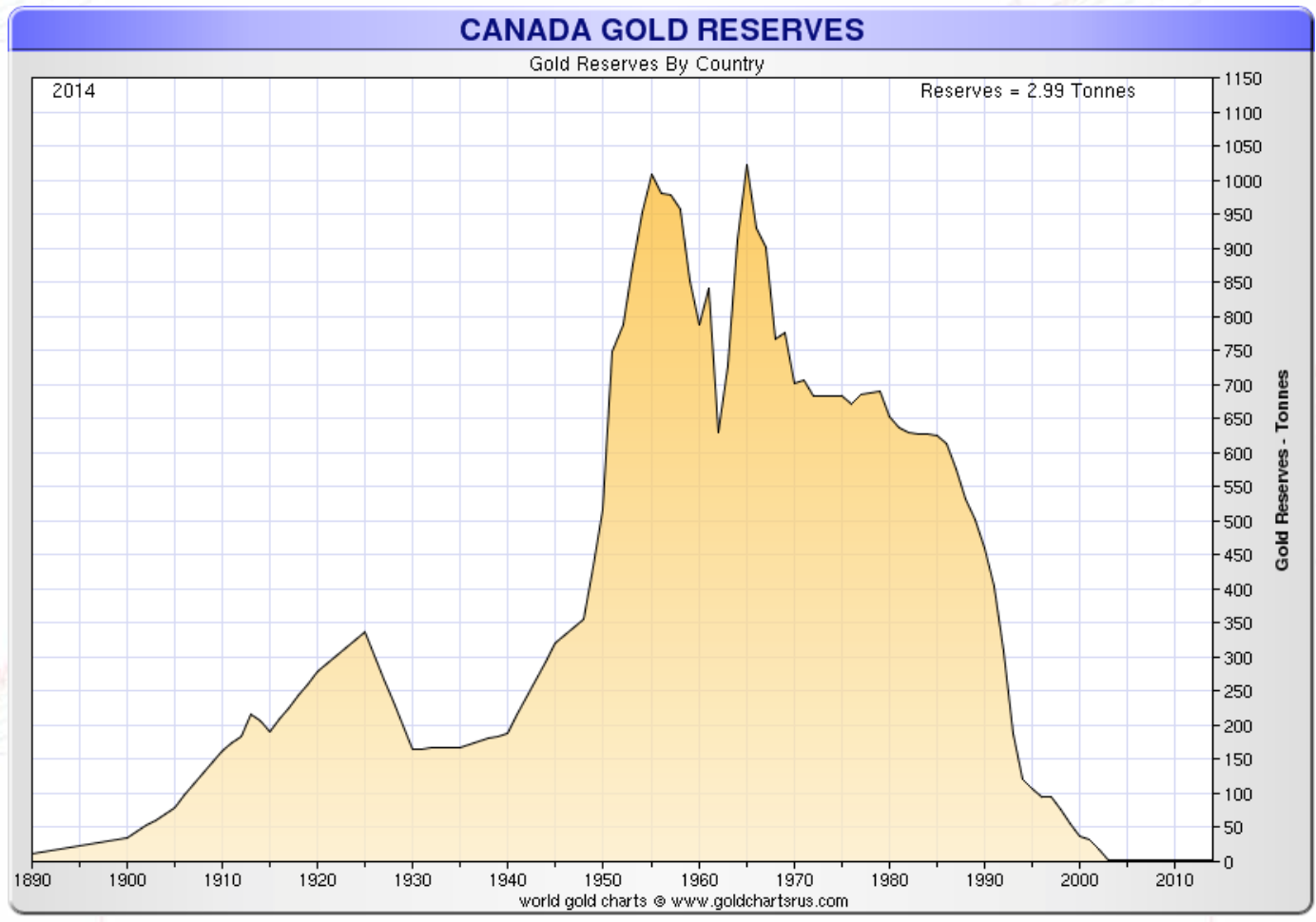

At the beginning of this year, Canada has a large part of its gold reserves Sold. At the end of last year, the country still had an official gold reserve of 3 tonnes, but the Latest figures of the Ministry of Finance show that there are now only 0.62 tonnes of the yellow metal left in the safe. That's a drop of almost 80%. The remaining gold stock of 620 kilograms is on the balance sheet at a value of 24 million US dollars. Relative to Canada's total reserves of $81.1 billion, that's less than 0.1%.

According to a spokesperson for the Canadian Ministry of Finance, the sale of gold is not related to the development of the Gold price. In Canada, the gold supply does not belong to the central bank, but to the government. According to economist Ian Lee, the government has no reason to hold a gold reserve, because the precious metal is less liquid than government debt.

Canada sold almost all of its gold between 1965 and 2005. Fifty years ago, the country still had a gold reserve of about a thousand tons, but almost all of it has disappeared from the Canadian vaults. About 300 tons were sold between 1965 and 1970, the era when central banks tried to defend the gold price of $35 per troy ounce in a coordinated manner. Even the dumping of 300 tons of gold on the market at a rock-bottom price could not prevent the United States from finally having to abandon the peg between the dollar and gold in 1971.

The second wave of sell-offs took place in the 1990s, when many central banks tried to push down the gold price with large-scale sales of hundreds of tons of gold. At the turn of the century, only a few percent of the thousand tons of gold remained. Yet the government remains that last bit Selling gold.

Canada has sold almost all of its gold holdings