9.4

7.521 Reviews

English

EN

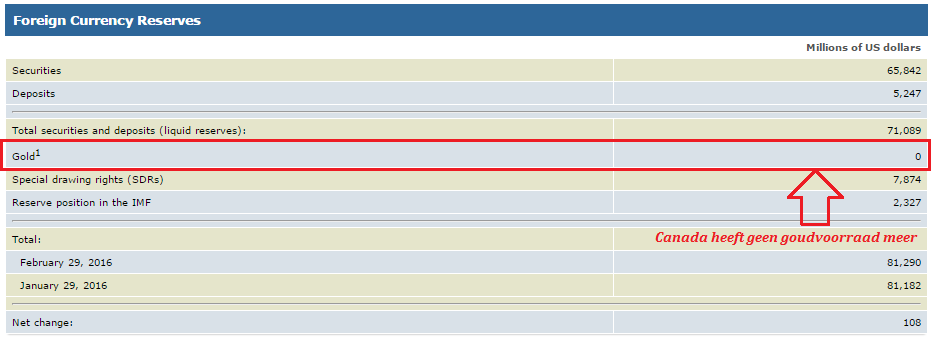

Canada sold the last part of its gold holdings in February, according to the latest overview of the Canadian Ministry of Finance. At the end of last year, there were only 3 tonnes of gold on the balance sheet and in January almost 80% of the items sold. In February, the last part of 21,851 troy ounces of Gold Coins also put on sale. This makes Canada the only G20 country without a gold reserve.

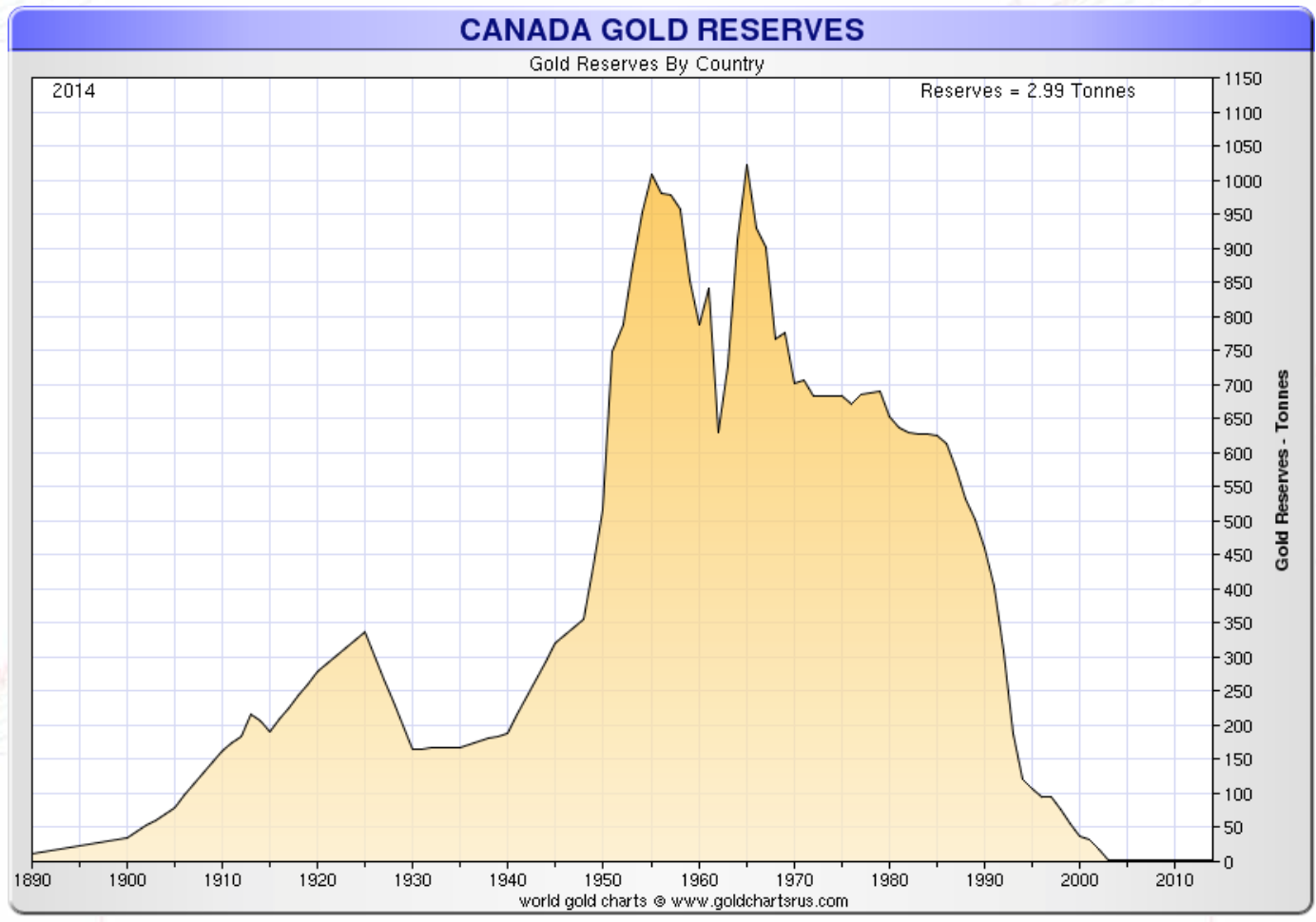

Most of Canada's gold has been marketed in the past. In 1965 there were still about 1,000 tons in the vault, but twenty years later half of that had already been sold. Between 1990 and 2002, the second half of the stock was also sold at a rapid pace.

"Canada's gold reserves belong to the government and are held by the Ministry of Finance. Decisions with regard to the gold stock are therefore taken by the Minister of Finance.", a ministry spokesman said. 'The decision to Selling gold was not taken because of a specific Gold price. The sale was carried out over a longer period of time and in a controlled manner."

According to economist Ian Lee of the Sprott School of Business at Carleton University in Ottawa, the government no longer has any reason to hold gold. "Under the old system, currencies were backed by gold. The U.S. dollar was pegged to gold at a rate of $35 per troy ounce. But in 1971, Nixon took the United States off the gold standard, for various reasons that I won't go into later."

Until August 1971, dollars and gold were convertible, but since then the precious metal has had no official function. "It's a precious metal, just like silver, and it can be sold just like any other asset," according to the Canadian economist.

The Canadian government's decision is noteworthy, given that central banks around the world have been buying net gold for eight years in a row. This is the longest continuous streak since the London Gold Pool in the 1960s. Central banks of emerging economies are still adding gold to their reserves, while in Europe more central banks are deciding to withdraw gold from the United States.

Since the outbreak of the financial crisis, confidence in central banks and in the dollar as the world's reserve currency has come under pressure. That's why more countries want to retrieve gold or further expand their reserves.

Canada no longer has any above-ground gold reserves, but in the extreme case it can always lay claim to the soil reserves. In 2014, the country was still the fifth largest gold producer in the world with a mine production of 160 tonnes.