9.3

8.064 reviews

English

EN

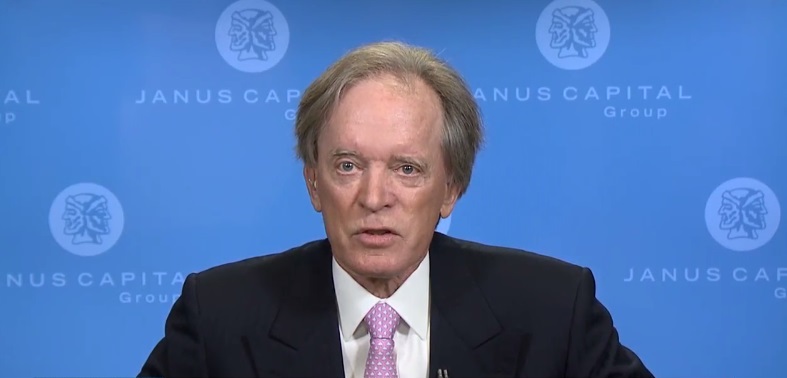

Central banks try to support the value of financial assets such as stocks and bonds at all costs and therefore it is very unlikely that they will one day reverse their stimulus programs. That's what asset manager Bill Gross of Janus Capital writes in his latest column on the state of the global economy.

Since 2003, the balance sheets of all the world's major central banks combined have increased from about $2 trillion to $12 trillion, meaning they have already withdrawn $10 trillion worth of investments from the market. They did this not only to lower interest rates, but also to artificially support the face value of all debt securities. By structurally buying government bonds, corporate bonds and even shares, central banks have become an important pillar of our economy. So important that, according to Bill Gross, it has become impossible for central banks to reverse this policy.

Central banks' balance sheet total exploded (Chart via Janus Capital)

Central banks managed to prevent a total collapse of the financial system with their interventions, but the undesirable side effects are becoming increasingly visible. Janus Capital's asset manager writes the following about this:

"As I've written before, capitalism has become distorted. Savings and investment are discouraged by returns that are too low relative to historical productivity growth. Zombie companies were kept alive, contrary to Schumpeter's "creative destruction" theory.

Debt has only continued to increase relative to GDP. The financial system has not been cleaned up and restored to a balance sheet where risk and return are once again proportionate. This equilibrium has been replaced by an imbalance, but it is difficult to see this economic illusion as long as volatility remains low."

The Federal Reserve tapered its stimulus program in 2014, but it didn't take long for other central banks to pick up the baton. It seems as if the tapering of monetary stimulus by one central bank has to be absorbed by another central bank. The U.S. Federal Reserve, which has formally stopped buying government bonds and mortgage loans, continues to roll over the debts it has on its balance sheet.

"The U.S. 10-year yield remains at 2.45%, as the ECB and the Bank of Japan jointly buy $150 billion worth of their own debt every month. Much of the money flows into U.S. Treasuries that yield 2.45%. Without this financial doping, both the bond market and the stock market worldwide would collapse and produce a vale of tears of significant proportions. I dare say that without the bond-buying programs of the ECB and the Bank of Japan, the interest rate on US 10-year bonds would rise rapidly to 3.5% and the US economy would fall into recession."

At first glance, the monetary policy of central banks does not appear to be harmful. They have managed to prevent a collapse of the global financial system, while the value of stocks and bonds has risen sharply in recent years. However, there is reason to be worried, because with all these asset purchase programmes, fiscal and monetary policy have become intertwined. In many cases, the interest that central banks receive on their government bonds flows directly back to the government, which means that in a certain sense you can already speak of monetary financing. Central banks are increasingly financing government debt.

Another problem with low interest rates is that pension funds and insurers can no longer make a return in this world of extremely low interest rates, which will put pressure on the solvency of these institutions. And then we haven't even mentioned the savers who receive virtually no interest on their savings.

Financial markets have become accustomed to monetary stimulus and do not offer central banks an easy way out. Interest rates are expected to rise further, especially if central banks elsewhere in the world start tapering their stimulus programs. And they will automatically be forced to do so with rising inflation worldwide. A catch 22?

Bill Gross sees no way back for central banks